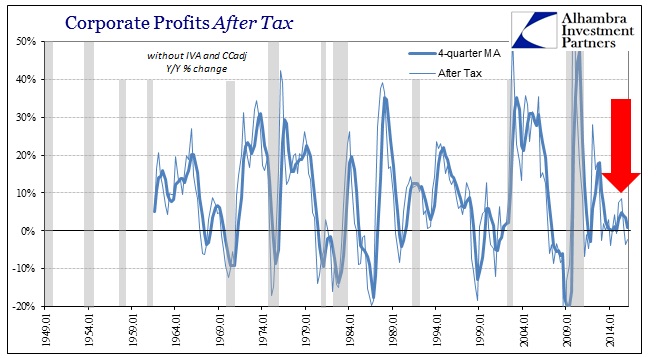

Accompanying the final estimate for Q1 GDP is the first estimate for the corporate profits and cash flow components. Profits rebounded from a dismal Q4, but that actually means much less than it sounds especially in the more important segments. Corporate profits before tax (without IVA and CCadj) were an estimated $1.86 trillion in Q1, better than the $1.77 trillion in Q4 but still below the $1.94 trillion of Q3 2015. Corporate profits After Tax accelerated from $1.64 trillion in Q4 to $1.69 trillion in Q1, but that was again less than Q3 and 2.3% below Q1 2015. The same pattern is found in all the subcomponents.

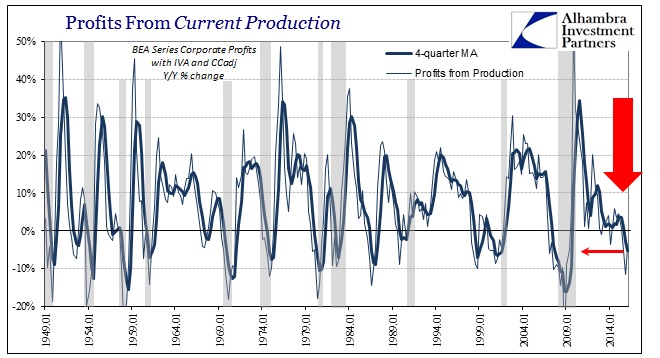

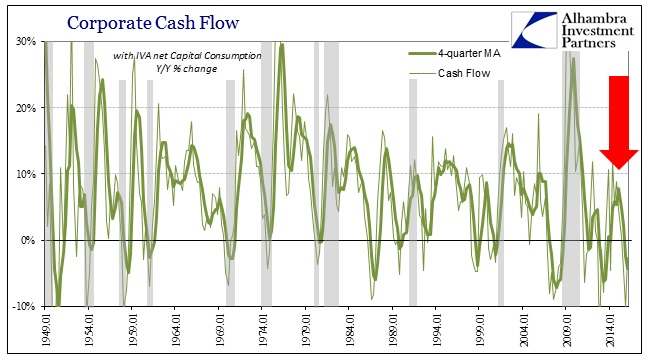

Corporate profits with IVA and CCadj (the BEA’s version of profit from current production) actually improved by much less than the others. Year-over-year, profits fell 4.3% after declining a large 11.5% in Q4. It was the third consecutive Y/Y contraction, the first time that has happened since Q2 2009. Corporate cash flow also fell 2.6% in Q1, and also the third consecutive decline.

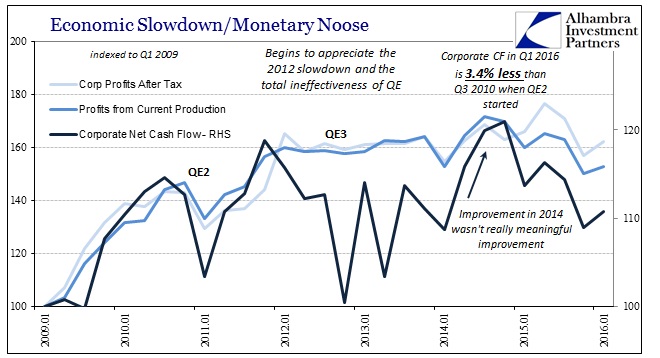

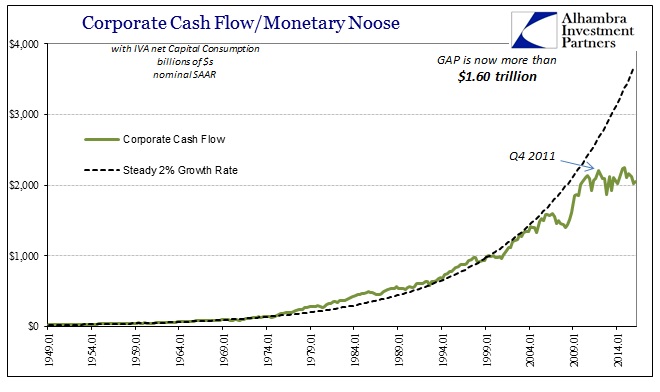

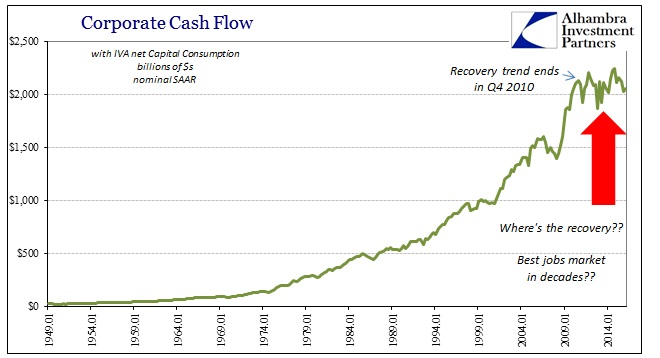

What we find in this part of the GDP report is simply more refutation of anything like “full employment.” It does, however, blend perfectly within the idea of monetary strangulation. Corporate cash flow, for example, stopped recovering as early as Q4 2010, and began to tread sideways from the familiar 2011 crisis window. Despite three additional QE’s, corporate cash flow in Q1 was 3.4% less than Q3 2010 just prior to the start of QE2, and 6.7% below the end of 2011. Profits from current production are only 6% above Q3 2010 and 2.4% below Q4 2011.

These are not business conditions that would suggest a robust hiring environment; quite the opposite. And once again we find that it isn’t recession, either, rather four years of a condition that defies cyclical categorization. This sideways trend does, however, align perfectly with other economic accounts particularly those dealing with consumer spending and “demand.”

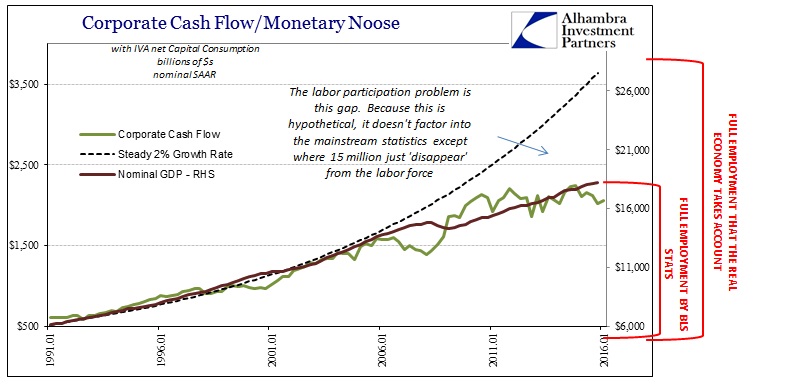

Because it isn’t recession, the actual weakness and destructiveness is understated especially on the time axis. Any healthy economy is one that grows in relatively steady fashion, so nominal factors that don’t decline but don’t expand are actually indicative of a serious problem – worse than recession that is a temporary deviation from trend. This four plus years of going nowhere can no longer be classified as anything like temporary or “transitory.” In comparison to actual growth, we find the familiar paradigm shift where, in terms of corporate cash flows, the baseline gap is now in the trillions.

It’s another piece that advances the idea that the Great Recession needs a new name since it wasn’t a recession at all. It also resolves the apparent contradiction between “full employment” and what can only be a depression (small “d”). The low employment rate only applies to the economy that is measured, rather than the full economy as it “should” have been had it actually been a normal cycle. It is (at best) full employment of the shrunken economy not full employment of the full economy.

That context leads to drastically different conclusions in both explaining what has happened (nothing but weakness no matter what QE) and what to expect (only more weakness to an increasing and unstable degree). Because we find the same depression all over the world and synchronized in time, that only can only mean global “money” as the likely cause.

Stay In Touch