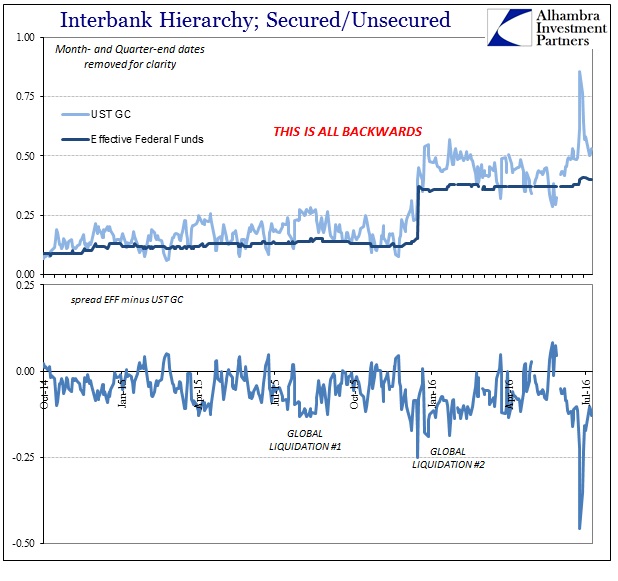

As an apparent consequence of post-Brexit uncertainty, the effective federal funds (EFF) rate moved up from 38 bps in “yield” to 40 bps, and then even 41 bps on June 27. That rather tame reaction is due to the fact that there is nobody aside from primarily GSE leftovers trading in federal funds. That the market rate moved even 3 bps may be significant in terms of projecting systemic liquidity given its long ago descent into irrelevance.

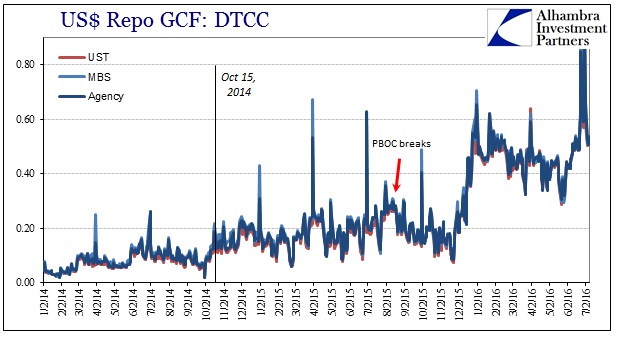

The repo market, by contrast, was much more moved by conditions surrounding the UK vote. I still don’t believe that Brexit itself matters all that much, and from the perspective of global liquidity it seems more like an excuse or trigger than an actual factor. Whatever the case, repo rates shot up in sharp contrast to federal funds. The UST GC rate hit 86 bps the day of the vote, a rather shocking positive 46 bps spread to EFF. As I pointed out before, this is already an abomination given the hierarchy of risk that is supposed to dominate money markets where there is something like normal money trading.

In the weeks since then, repo rates have settled but only partially. The UST rate in GC today was fixed at 53 bps, still above the federal funds “ceiling” and still a positive 13 bps spread to EFF. These are indications that global liquidity and dollar money markets are not alright, even more so than they had become up and through the past liquidations.

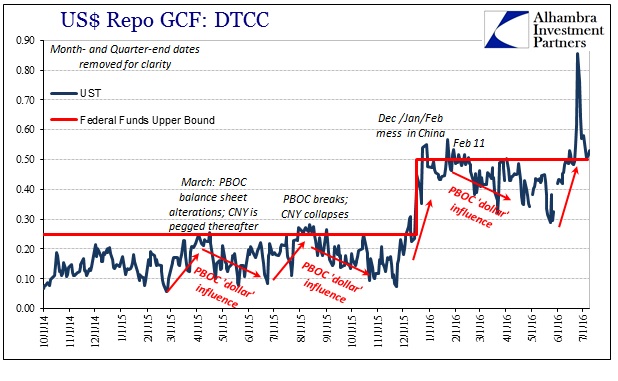

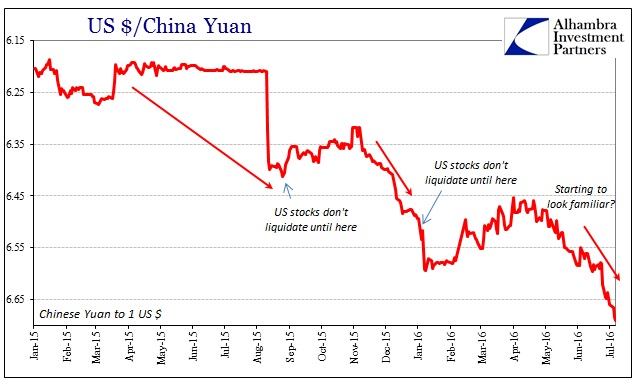

The behavior of repo rates especially since early 2015 traces out the familiar CNY outline. Undoubtedly dollar liquidity pertaining to the Asian “dollar” and its Chinese access plays a primary role in setting global dollar (il)liquidity as represented in the published DTCC GC repo rate (we can only assume it is a representative indication for the fuller repo markets that remain continuously over the horizon). It is not, however, the only repo indication of illiquidity. Other dimensions of the repo markets, primarily collateral, also exhibit the same tendencies staked out to the same moments in time.

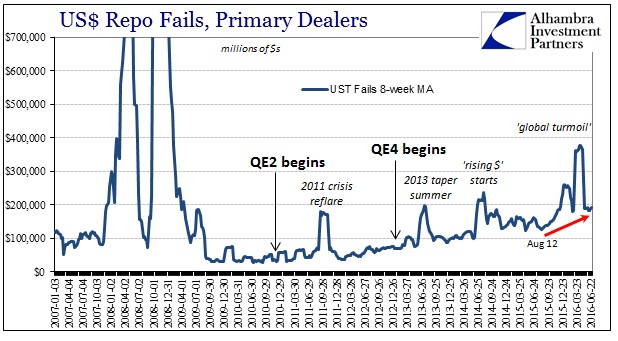

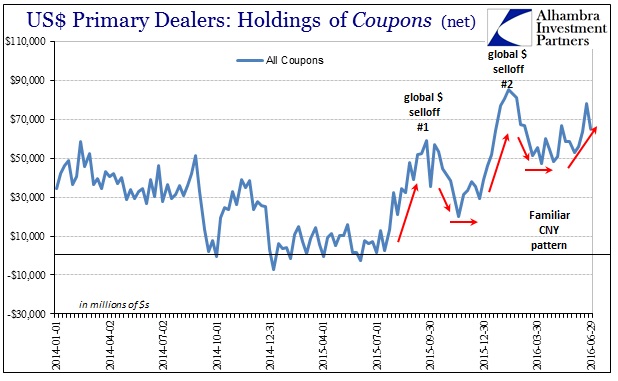

Repo fails, for example, had been rising slowly but steadily since the 2011 crisis, then suddenly flared up at the beginning of the “rising dollar” period, and then much more so starting the week the PBOC was forced to “devalue” by “dollar” disorder. As you can see above, repo fails remain, as GC rates, quite elevated even compared to their prior trend. Though officially and on record Wall Street banks seem content to stick to their absurd explanations as to why this is all benign nothing, the rise in fails correlates all-too-well with reported dealer holdings.

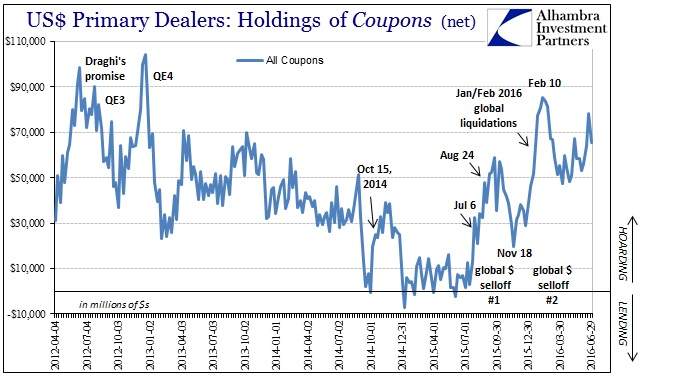

In wholesale terms, net “long” means hoarding of collateral, not holding UST’s as some kind of investment. Net “short”, or really second derivative intensity in moving in that direction, is the more familiar lending of collateral by dealers into the repo and derivatives markets. Thus, it isn’t surprising to see a larger net “long” position spring up in coupons (or coupons plus bills) coincident to the global liquidations, spike in GC rates, as well as again the conversant pattern and timing of CNY movements.

The mid-year appearance of these extra dimensions tied up in collateral conditions represent only an intensification of an existing illiquidity trend, as repo rates have been signaling increasing as much dating back to 2014 – particularly surrounding the very important events of October 15 that year. If there is a market indication of the appearance and sustaining of the “rising dollar”, repo might be as good as it gets. The full measure of illiquidity breaks out further from just rising rates into full collateral issues at exactly the moment when not only the global liquidations began but also how that has seemingly altered so many economic and financial indications (and myths) from that point on.

In other words, the repo market marks both the “rising dollar” and its amplification into “global turmoil”; giving us a sense of increasing monetary tightness as distinct (though related) from economic money “tightness” that had prevailed up until the middle of 2014.

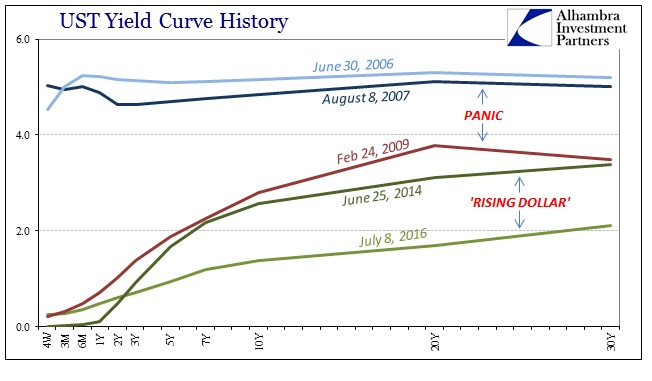

Though it should be pointed out that short run liquidity and the real economy “money supply” (such that it exists under the eurodollar standard) are distinct concepts, they are also still related especially within the wholesale framework. That means the repo market provides another element to this ongoing and intensified monetary strangulation of the real economy as characterized by collapsing yield curves further into the interest rate fallacy.

Rarely do you ever find such a clean, tidy package especially with regard to such esoteric and difficult concepts. In this case, however, you don’t really need to know that much about repo and wholesale technicalities to appreciate the connections in timing and spread across these further dimensions. Persisting low bond rates indicate monetary tightness in the real economy; persisting repo rates and collateral irregularities do as well but for internal “dollar” liquidity. Both are outcomes that are supposed to be near impossible as delivered by QE’s.

It would not be inconsistent to find sufficient or even plentiful financial liquidity set against “tightening” real economy money supply, as may have been the case off and on up until mid-2014. However, the fact that, as viewed from at least repo, financial liquidity has also tightened so dramatically and consistently gives us a more detailed view as to why the summer of 2015 may have been such a serious moment of perhaps changing paradigms across so many facets – from economy to money markets to even broad perceptions of what central banks actually do and can (not) do. “Something” clearly changed in the middle of last year, and it was monetary and financial in nature.

The bond market is still telling us of heightened monetary tightening for the real economy; the repo market only concurs.

Stay In Touch