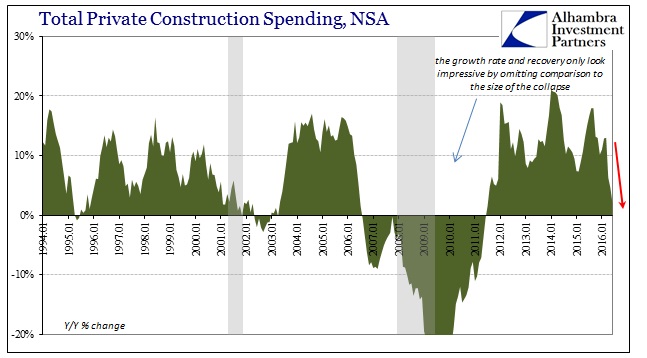

Construction spending had been increasing steadily since the start of 2011. Factoring both the size of the decline due to the housing bust and the timing of the turnaround in sales and prices, the mere fact that construction activity had been recovering was not really economically significant. As with most economic sectors, positive growth even to a substantial degree did not by itself indicate recovery. In other words, construction contributed a great deal to the cyclical confusion of the underwhelming “recovery.”

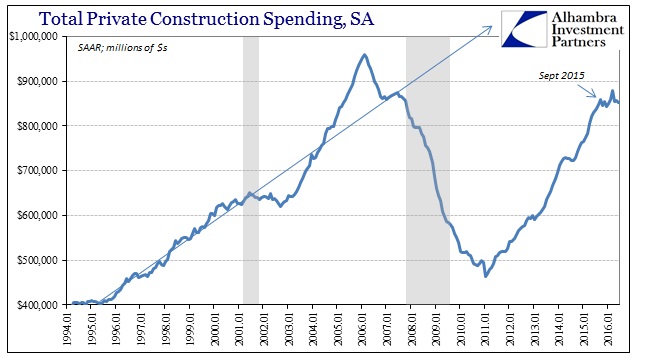

What is notable, then, is that since last September spending activity has suddenly flattened. The seasonally-adjusted annual rate (SAAR) of total construction spending was $762 billion at the end of 2014, growing to $859 billion in the nine months to last September. In the nine months since, however, spending has abruptly stagnated. The latest estimate for June 2016 was just $851 billion.

Unadjusted, the year-over-year growth slowed to the lowest rate since July 2011 at the start of the turnaround.

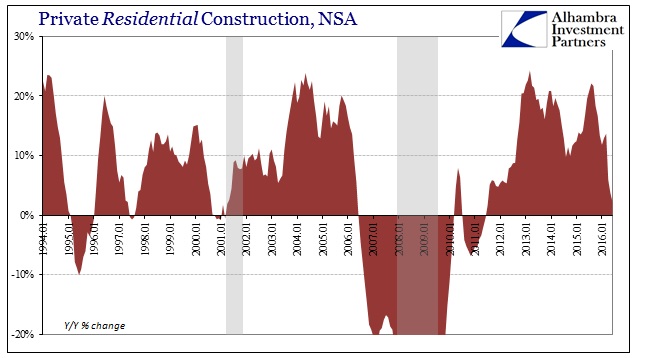

Residential construction spending, reflecting housing market and analysis from other data points, has slackened significantly since September but really in the past few months. Residential spending was just 2.2% more than June 2015, also the lowest since summer 2011.

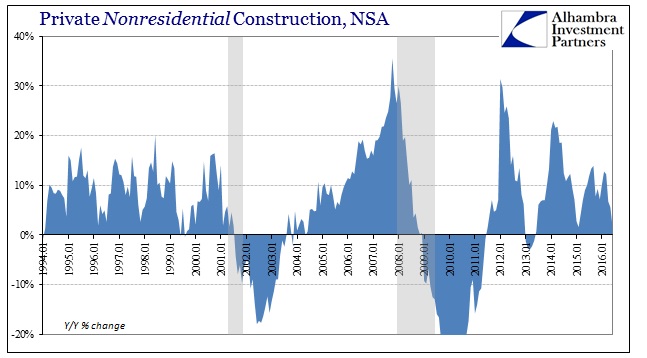

What really suggests a meaningful change, however, is that non-residential construction has also dipped; meaning that for the first time both sectors of the construction industry are experiencing sharp deceleration at the same time and to the same significant degree.

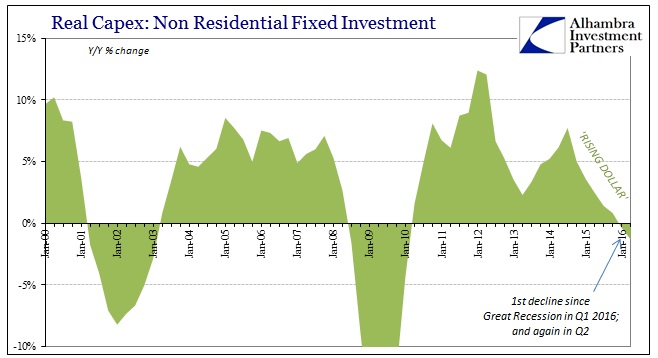

These estimates flow into the GDP figures in the Non-residential Fixed Investment segment, which already suggested unusual weakness in overall productive investment and capex.

That means there are three important elements exhibited in construction spending that make it noteworthy where it had not been, in my view, before. The first is the connection of non-residential construction spending with the GDP non-residential FI as further confirmation of erosion and serious weakness in business investment. The second is the sudden synchronization of residential construction with non-residential, pulling overall activity lower in combined fashion that might alter real economic outlooks beyond the construction industry (higher risk of spillover). The third is that these trends unify around September 2015, once more suggesting that “something” really changed in the middle of last year concurrent to the eruption of “global turmoil” that was and is the most acute outbreak of “dollar” strangulation since 2011.

It might propose either a financial explanation for the serious deceleration in the US and global economy, as construction is highly susceptible to financing conditions. Or it might simply be the sudden appearance of economic caution as a result of both markets and the economy being forced to confront monetary policy failure, and the state of the world where the myth is so exposed. In reality, it is likely some of both in perhaps reinforcing fashion, which might account for the combination of weakness across the residential/non-residential divide.

Whatever the case, it is yet more confirmation that weakness in 2016 far from being “unexpected” is no longer even the “usual” weakness.

Stay In Touch