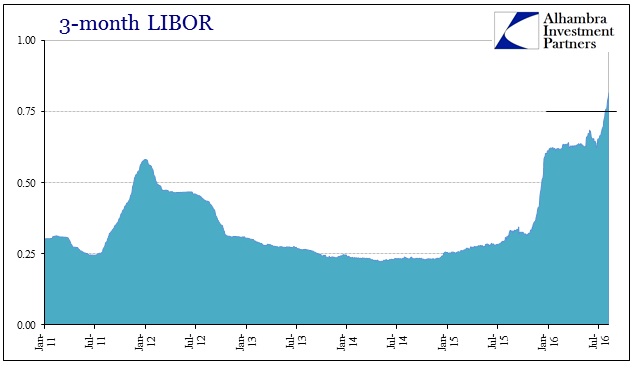

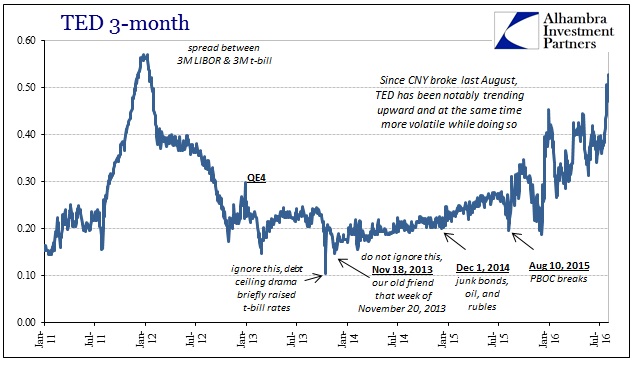

Though the media rushes to defend it as benign but prudent regulatory changes, there is going to be fallout from rising LIBOR “tightness.” And it will likely start where it can be least afforded, especially after last year’s rout.

Payments on floating rate loans issued by dozens of companies are set to increase as US dollar Libor for a period of three months has risen above 0.75 per cent.

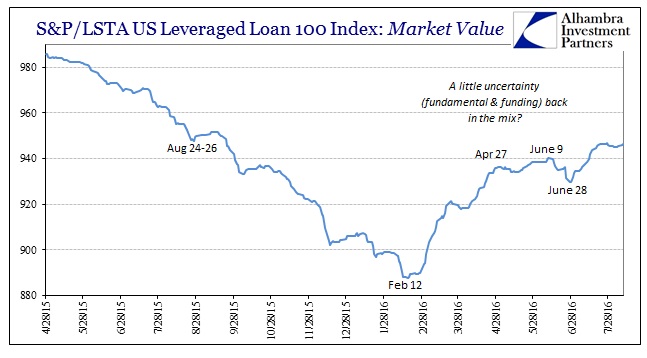

This level, alongside interest rate floors set at 1 per cent, is used on more than nine-in-ten of the loans that comprise the $880bn S&P/LSTA Leveraged Loan Index.

This could spill into CLO’s, leveraged loans’ related companion.

“[Rates] will start floating after a very long time and it will be interesting to see how it shakes out,” said Neha Khoda, a credit strategist with Bank of America Merrill Lynch. “For some companies it won’t matter, it will be a drop in the ocean. But for some with limited cash flows, it will be significant.”

The rise will also affect the vast universe of collateralised loan obligations — bonds backed by leveraged loans. For CLO investors in the lowest tranches, known as the “equity” slice of such deals, the impact can be significant.

After rapacious buying in all manner of corporate junk after February 11, the appetite has clearly settled since the end of April and even more recently. There is good reason for the caution, though that reason hasn’t actually changed since February.

Stay In Touch