It has to be a sign of the times as well as human nature where we are compelled to either forget the (recent) past or to convince ourselves that we have moved far enough beyond the mistakes of them. There were two stories reported today that are seemingly unrelated except by how they contradict each other in principle. The first, reported by Bloomberg, writes that UBS as well as other banks are hiring mathematicians again.

UBS Group AG doubled the number of quants working for Chief Investment Officer Mark Haefele in the past two years. He wants to hire even more.

Haefele recommends customers use investment strategies that apply techniques designed by quantitative analysts, such as complex data visualization, rather than rely on their instincts.

Mr. Haefele says that “in many cases” machines can do a better job than a person, but what the article only implies is why he is saying that right now. People are expensive but algorithms are cheap; they are finance in mass production. With very little revenue in finance especially Wall Street’s formerly juggernaut models, banks are looking in every direction to cut costs. If math works as well as advice, so much better for the thin margins.

In the UK, incoming new board member for the government’s Office for Budget Responsibility is more cautious. His comments to the Telegraph sound quite a bit different than the direction UBS wants to take.

Economic forecasts should be taken with “a pinch of salt” and should not be relied on too heavily when taking big decisions, according to Sir Charlie Bean, the incoming board member of the Office for Budget Responsibility – the body which analyses the state of the economy and public finances.

Predictions can only be made with “a wide range of uncertainty” and should not be viewed as precise forecasts, he said.

Small upgrades to the economic outlook have encouraged governments to go on spending splurges in the past, only to find that growth is not as strong as was hoped, the senior official warned.

Almost every forecast made today, whether it be for GDP, the harmonized temperature of the Earth, or by the local meteorologist are all made by quants and quant models. In economics they have had a very checkered past right up to the current time. We all know well just how every central bank and orthodox economic model has been consistently over-optimistic, and in many cases to the point of earned disqualification (yet they remain).

In finance, however, the introduction of quants is not anything new. On the contrary, they were in heavy use going back as far as the 1980’s and mostly in the places you had never heard of until the words “shadow” and “banking” were put together by the events of 2008. Whereas quant models in economics were and are more of a nuisance, the quants of finance were a legitimate disaster. That was not just the case of the Panic of 2008; far from it, there were “mathematical” warnings all throughout the rise of the quant-based eurodollar. Math-as-money ran several rehearsals for 2007 in the years before it:

The mathematicians had entered the Wall Street realm en masse in the 1980’s, so by the time John Meriwether, a giant himself as the chief of Salomon Brothers bond-arb group, wanted to start a hedge fund in 1993 it was perfectly reasonable that Robert Merton could easily come aboard, along with another Nobel Laureate and mathematical luminary, Myron Scholes. Meriwether’s firm was named Long-Term Capital Management (LTCM, or LTCP as it was sometimes referred), quite a deceptive misnomer.

If the price of a security today has nothing to do with yesterday, then what matters are correlations – what everything else is doing today. The role of historical data, then, is to define correlations and patterns to reject stale “information” in favor of a dynamic re-arrangement of what explicitly is supposed to be a “market.” That was what JP Morgan was doing in the late 1980’s and what came to be the foundation for RiskMetrics, a service that launched in October 1994 and was widely (and wildly) subscribed in relatively short order.

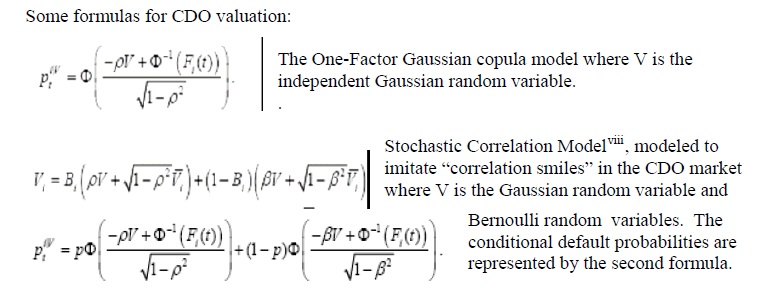

It was math that would take the eurodollar system to unthinkable levels (think AIG and the explosion in credit default swaps not for hedging but for “regulatory capital relief”, a distinction where math literally became money), a fact from which we have yet to escape even though it unraveled more than nine years ago. If the Great Financial Crisis were an airplane crash, the NTSB report would identify the chief point of failure as correlation math. The reliance upon quants in deep “bond” trading gave us the Gaussian copula, a formula for imputing correlation that anyone outside of Ivy League mathematics classes (or even economics) could see was bunk. As I did and wrote about on August 1, 2007.

The point of this part of the discussion (and this is a very basic view of very sophisticated calculations) is that these valuation models are dependent on an intense understanding of the mathematics and statistics of the model assumptions. There are assumptions that need to be made in order for the math to be meaningful – often assumptions that do not match the real world. The complexity of the interaction of so many meaningful, real-world variables and the degree to which each variable holds power over the result is hard to boil down into a single, yet complex, formula. Perhaps the biggest shortfall is the maturity of the CDS market, or lack of it. The models and assumptions are based on a very short history, there has not been a really good test of many of the assumptions and variable correlations. They have never been tested in a down period – there has been steady-to-good economic and income growth since 2004 when the credit derivative market blossomed.

In other words, it doesn’t matter how elegant the formulas and the detailed internal linguistics that are used to justify its “significance”, statistics are always prone to failure in any dynamic system because they right at the start have to assume that the near future will look like the recent past. Even the best models fail time and again upon this concept of “tail risk.” It was, in fact, the Gaussian copula that convinced me in 2007 that there was no escaping what was to come.

Then the wheels fell off, exactly where the models cannot predict. Despite the falling valuation of subprime CDO’s the ABX index stabilized. It seemed that the subprime loans made before the middle of 2006 were performing within constraints – it was the loans made in the third and fourth quarters that were the trouble (more on this in Part 4). This distinction was the reason for the “all clear” signal that Wall Street and the Fed sent shortly after the New Century and Countrywide troubles were made public. They signaled the subprime mess was contained to a limited segment and would not spread throughout the credit markets. But that distinction could not be modeled, how could it? Default rate and recovery rate assumptions were based on historic information that did not include a period of borrower distress.

So losses on the CDO’s mounted without any effective hedge, the ABX was no longer falling (it tracks subprime loans across the entire market place, not just those from late 2006). By the end of April the BSHGSCSELH [one of the Bear Stearns funds] was down 23%, and falling. Margin calls came and by early June the funds were out of cash, unable to make the calls. There were headlines, nervousness and strange behavior on the part of participants that indicate the extent of damage across the entire CDO spectrum.

This is exactly why Sir Charlie is right about forecasts; economic models continue to view the economy globally as if it in 2016 was operating by the same constraints and conditions as 2006. It is the assumption cast directly into the math that the current “recovery” will act as all others had in the past, with only the degree to which it might being variable. By the behavior of those periods we should expect “stimulus” to work and growth to eventually become bold again. It hasn’t worked out that way because the last decade has been one prolonged “tail risk.”

If Wall Street or economics truly wants to turn to math, they would all do well to start over with Benoit Mandelbrot rather than Louis Bachelier. It is chaos theory that teaches, nay proves, the unpredictability of complex systems whereas the random walk is, as the Gaussian copula was, a dingy, unsuited shortcut. The term itself is derived from what should be a more well-known paper written in 1975 by Tien-Yien Li and James Yorke. In Period Three Implies Chaos, Li and Yorke show that even a one-dimensional system that exhibits a regular cycle (in other words, one that should be predictable) of just three periods degenerates to display regular cycles of all lengths as well as those that appear to be simple and unpredictable chaos.

But it is always easier to take the short cuts while just hoping that kurtosis is for once a meaningful limitation for that hope.

Stay In Touch