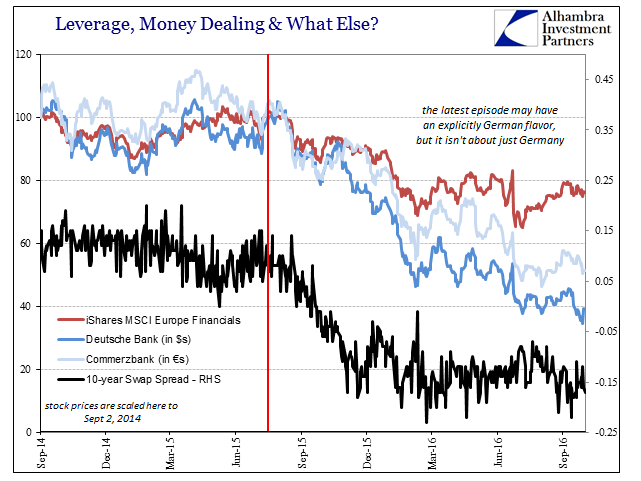

If we objectively analyze what is taking place with global banks, it is that they are facing new constraints due to volatility and conditions across different capacities that are much different than modeled expectations. This was supposed to be the Hollywood ending but instead there is only “global turmoil.” This difference isn’t new; it has been ongoing at various speeds and intensities since 2011.

As I wrote on Tuesday relative to ING’s sudden participation in reversal:

This is the legacy of the post-2011 global money era where responses to eurodollar decay have been progressively more drastic and real. The immediate aftermath (tied to 2008 as well as PIIGS) especially in Europe was mostly accounting fiction; banks rewrote their RWA models and calculations to boost capital ratios, making themselves appear to have become healthier. No bank was as aggressive in this phantom capacity as Deutsche Bank.

That was the first, most pain-free response to a forced (by renewed liquidity crisis) realistic view of conditions – to use math, models, and predictable hedging capacity as a means to shrink. It was in most cases perfectly acceptable, especially when it was mainstream consensus that global “stimulus” would lead to low and perhaps historically low volatility. Volatility and the ability to influence it (in the models) is paramount in RWA “management.”

That of course raises the only question truly worth asking about global banks especially in 2016:

That was all well and good under conditions of predictable volatility as well as hedging capacity (systemically). What would happen to all that math should volatility “unexpectedly” break out while hedges both performed far outside modeled expectations while replacing them was increasingly not an option? The only functional answer to that hypothetical situation is to shrink – not changing some numbers to alter appearances to satisfy regulatory views on the idea of “safe”, but to actually shrink in operation as well as scope for any future business trajectory.

The reason that some banks may be forced to shrink in real operations is because first they know they are vulnerable to RWA expansion through nothing more than the reverse process of what they undertook in 2012. As volatility rises without a realistic ability to hedge against it, RWA’s will be under pressure to be re-evaluated far less favorably.

To wit (h/t and thanks to M. Simmons):

Bank of Montreal, Canada’s fourth-biggest lender by assets, said on Tuesday it had amended its regulatory capital ratios for the first three quarters of 2016, a move that left the bank holding more risky assets than it had reported.

There were no changes to the BMO’s income statement or balance sheet apart from the level of its RWA, thus confirming something off in its models. It had reported CDN$260 billion of risk-weighted assets but was forced to review “procedures” about some of its portfolio holdings that were then reclassified to a higher risk “bucket.” The difference was an increase in RWA of about CDN$12 billion.

“This adjustment is tantamount to wiping out $1.3 billion of excess capital for the bank,” said Gabriel Dechaine, an analyst at Canaccord Genuity Group, adding that this amount of capital could have been used to buy back up to 15 million shares.

In a note to clients, the analyst said he believes the adjustments relate to the reclassification of certain loans and securities portfolios into higher risk categories, and said the situation at BMO is likely to raise concerns about the use of internal models by all the banks. [emphasis added]

As I have been writing over the past year and a half or so, those concerns have already been raised – nobody noticed because they were too invested in trying to ignore how QE wasn’t what they all thought it was. When math starts to go bad, banks often face only stark and confusing (to the outside) decisions: let RWA’s rise and be forced to raise more capital at a time when questions about banks “having” to raise capital may make it more difficult and perhaps dangerous (Deutsche), or try to “earn” your way out by drastically shrinking operations and cutting back marginal resources before the auditors and regulators start questioning why your math doesn’t conform.

Both scenarios end up systemically with the same result; reduced balance sheet capacity in the aggregate that only aggravates the problem that much more. BMO is just one more anecdote, but I think it represents well and more openly what has been going on this year underneath, maybe even more intensely since July.

Stay In Touch