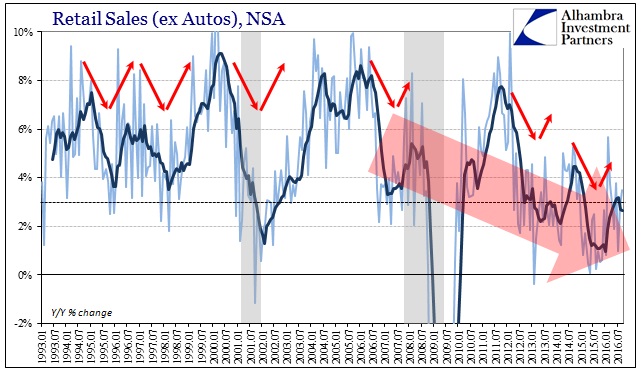

Retail sales in September 2016 were mixed, though what I mean by that is importantly different than what it used to suggest. Before 2012, “mixed” results in accounts like retail sales indicated that there was some good, some concerning. After last year where retail sales were uniformly atrocious, “mixed” now means some components still that way, with some others just merely bad. Overall, retail sales have been better this year than last year, but in many ways like the description that isn’t actually meaningful.

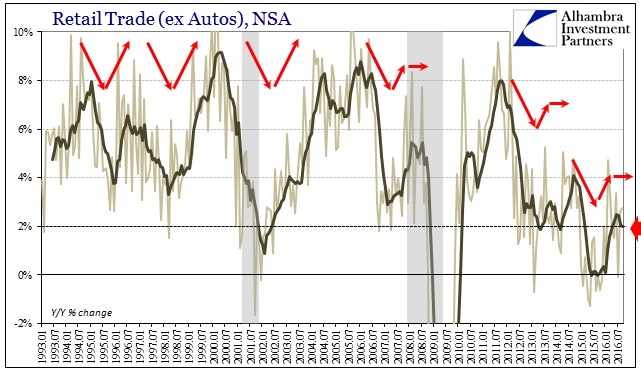

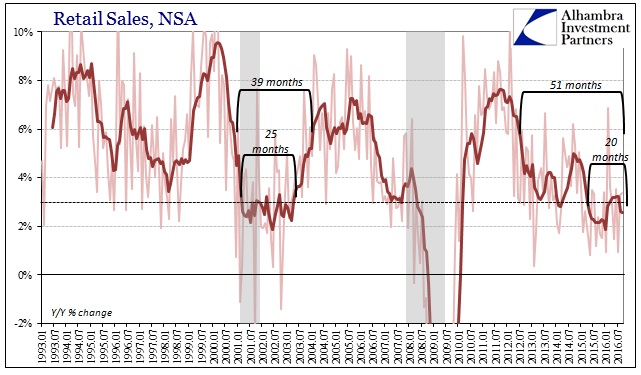

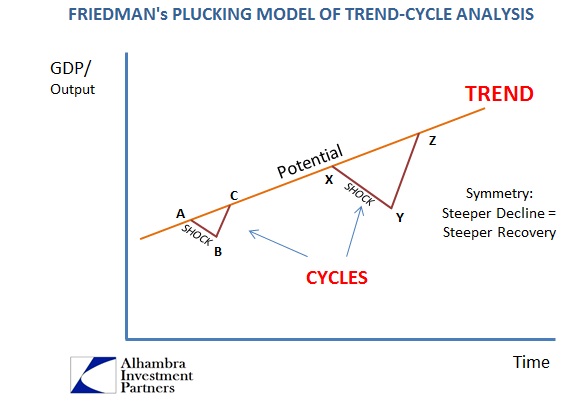

The US economy or any economy regularly undergoes periods of deceleration and acceleration. Some of these downswings manifest into full recession, while others come perhaps close but aren’t broad or deep enough to push the full economy off its track. In just the retail trade series, we can see these periods quite clearly; two in the later 1990’s, the first tied to the “maestro’s” rate hikes after 1994; the second, more serious slowdown in 1997 and 1998 due to the Asian flu and all its global elements. The next one was coincident to the dot-com bust in later 2000 that was sufficient to form a full but mild recession (and in the background of all these was the growing eurodollar system and its bubbles).

After each slowdown or pause, the economy would pick right back up and accelerate to its prior levels. The result of near-recession as well as full recession was the same, the “V” shape representing the symmetry of a growing economy and trend. The “V”, however, disappeared starting with the housing bust and has yet to return outside of the initial “recovery” period through the middle of 2011.

With the initial housing downturn in 2006, retail sales slowed very sharply, as did other accounts, only to start to rebound in early 2007. It was only a partial one, however, where the “V” was stunted on the upturn side. In other words, the economy slowed severely but only partially recovered from it, leaving it in a weaker state in this case heading into the Great “Recession.” As is usual, economists and especially central bankers misidentified this upturn as if it meant the worst was behind.

Rather than being a one-time anomaly, this asymmetry or stunted “V” has curiously recurred. As 2006, in 2012 the economy slowed sharply toward what in many ways looked like recession (I believe the FOMC agreed, which is why there was QE3 that September), only to remain weak for over a year before again the partial rebound in 2014. Like 2007, the FOMC mistook that for actual and normal acceleration even though it was so evidently inhibited (confirmation bias in action). Instead, also like 2007, the weaker economy was left for the “rising dollar” which pushed it into the next downturn.

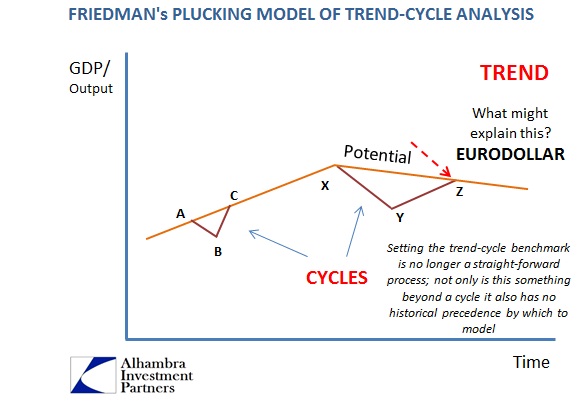

What we find in 2016 is only more evidence for this stunted “V.” This is the true context for “mixed” retail sales. At each of these downturns or slowdowns or shocks, the economy gets weaker and slower without ever recovering from it as it would under normal circumstances; as it had in all periods prior to the housing collapse – the eurodollar peak. We find instead this ratchet effect where after each episode the economy is worse off for having been forced into it; this is cannot be some usual business cycle mechanism.

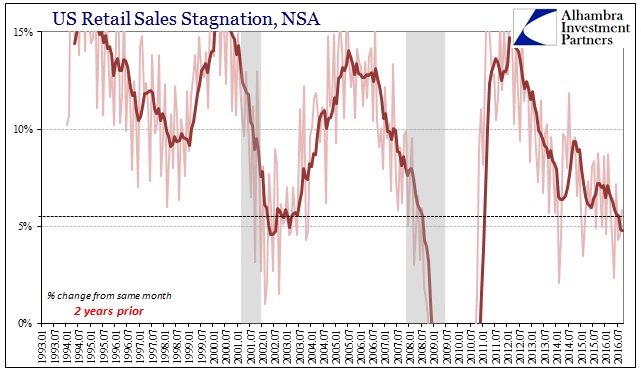

The 2-year comparison of retail sales demonstrates this point very well. Retail sales overall (including autos) grew 3.37% year-over-year in September 2016 following August’s gain of 3.30%. These results are merely bad, as 3% is more consistent with recession conditions or even near-recession conditions. Retail sales in September 1998 near the tail end of the Asian flu, for example, were 3.79% higher than September 1997. The difference, however, is that September 1997 retail sales were up year-over-year 6.15%, for a 2-year change of 10.5%. That was slightly less than what was typical for that time but not overly so.

Retail sales growth in September 2015, by contrast, was just 2.39% year-over-year, meaning that the 2-year growth through September 2016 was just 5.8%. Sales are slightly higher this year than last, but when last year’s numbers were downright awful marginal improvement is really no improvement at all. It leaves the economy vulnerable to all the negative forces of that downturn by never erasing it as is expected of normal, cyclical behavior.

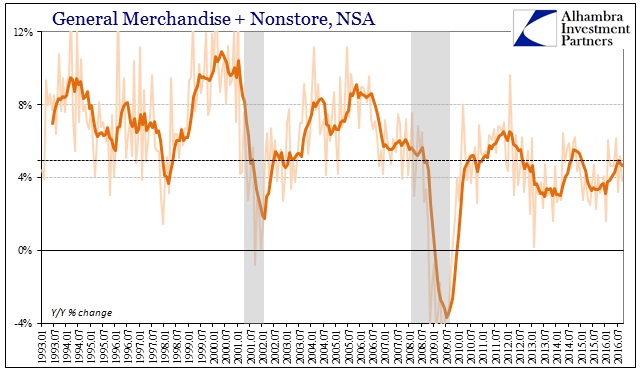

This protracted weakness does seem to be accumulating in various ways. In terms of retail sales and consumer spending, auto sales have slowed while at the same time consumers are ditching bricks and mortar for online. Taking the latter first, sales of General Merchandise stores fell 1.5% in September after falling 3.1% in August at peak back-to-school. Sales in this segment have contracted in four out of the past five months, twice at more than 3%. The 6-month average is now also negative at -1%.

Against that, Nonstore retail sales jumped by more than 10% yet again, not coincidentally, I believe, also the fourth time in the past five months. Combined, General Merchandise plus Nonstore grew just 3.8% year-over-year, strongly suggesting that consumers are switching by necessity rather than structural retail changes in an otherwise healthy economy.

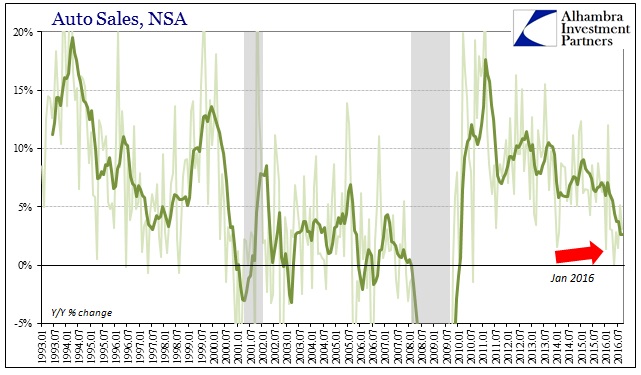

Auto sales seem to corroborate that view, with sales again weak in September, up just 3.1%. That is merely the same low level as has been the case all year. Sales in the past six months are only 2.6% more than the same six months of 2015. Ford’s sales “plateau” does seem to be indicated by the Census Bureau estimates.

It used to be that the economy would from time to time get hit and get knocked off stride only to recover and regain that stride no matter how serious the blow; that is what the business cycle had always meant, even where the downside didn’t turn into recession. Since the middle 2000’s, importantly, that has all changed. Now, the economy gets hit, falls off pace and never regains it; only to get hit again and falling even further behind. Given that these “hits” all coincide very neatly with eurodollar events, there really isn’t any mystery about what is going on. No matter how many years have already passed, and what has been done to remedy this situation, because of money the trend still remains as stubborn (and dangerous) as ever.

Stay In Touch