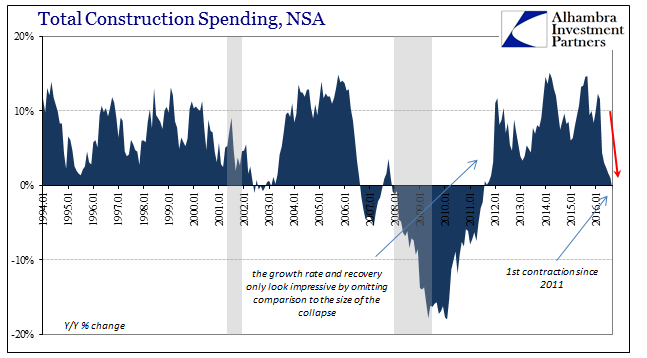

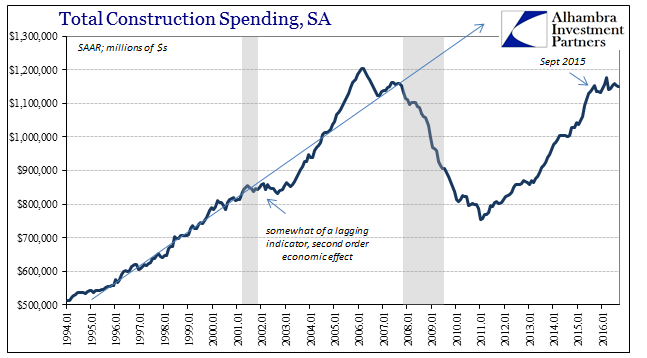

For the second consecutive month I can write that construction spending overall contracted for the first time since 2011. It hasn’t been quite as severe as Personal Income and Spending typically have been, but there has been some noise of revisions in the construction series. The original estimates come out a bit too pessimistic so that by the next month of data they are revised upward. But this only has the effect of changing the sign, not the interpretation.

As of this moment, Total Construction Spending fell 0.6% year-over-year in September. Though that might be a positive number next month when we revisit the series, like the past two months it, again, isn’t likely to be appreciably different. August was also slightly negative at first report, where upward revisions still leave the growth rate at just 1.0% after rising but 1.6% in July. No matter the revision, growth in construction spending has been unusually weak most of this year, less than 5% every month going back to March.

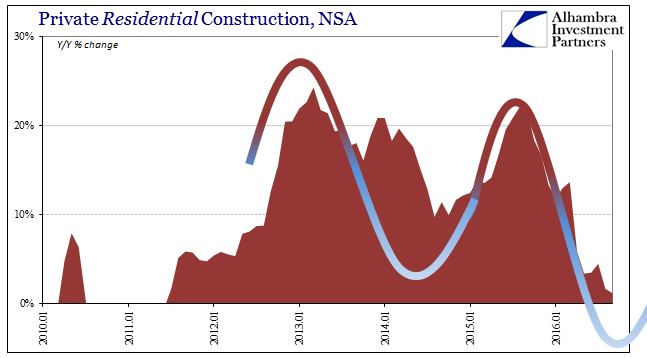

In 2015 when the world appeared to be headed for a much darker place, construction had remained relatively robust, averaging 10.3% for the year. The average so far this year is half that, 5.1%, and just 2.0% these past past six months. Spending on construction just stopped growing, abruptly turning cautious at the end of last summer.

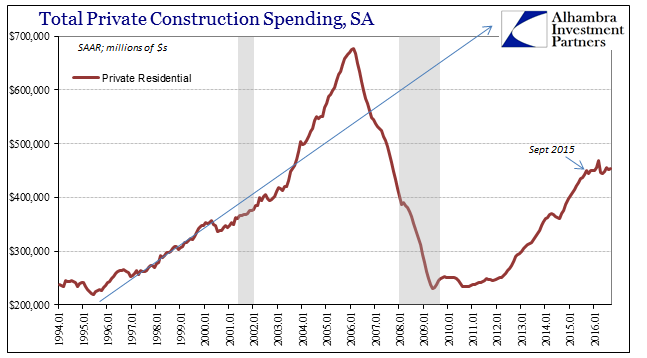

Though government and public activity gets most of the blame, as public construction is down 10% (in seasonally adjusted terms) from the peak last June, it has been unusually weak in private formats, too.

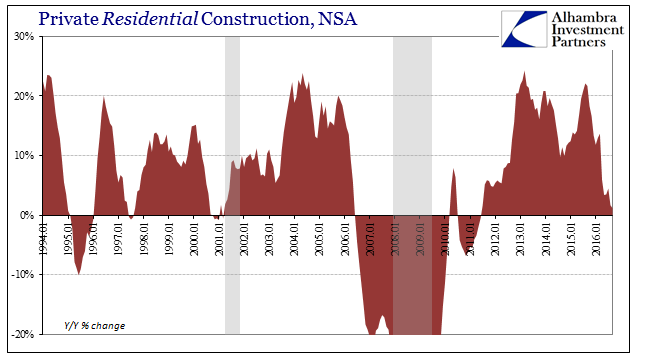

In fact, it is residential activity that is of the greatest interest given both the unemployment rate and purported recovery that in at least narrative form just won’t be given up. Residential construction is up just 1.2% in September, following growth of only 1.7% in August. In seasonally-adjusted terms, growth just stopped last September, confirming separately the housing conundrum (where are all the new houses?).

It is all more ongoing evidence that the US economy was dealt a serious but not quite recessionary blow in 2015, one that has left it appreciably weaker for the experience. It even follows the contours of the depression cycles I laid out earlier – if offset by about a year as a laggard reaction to those prior economic hits. It is thus not recession that we seek confirmation for, and quite consistently find.

Stay In Touch