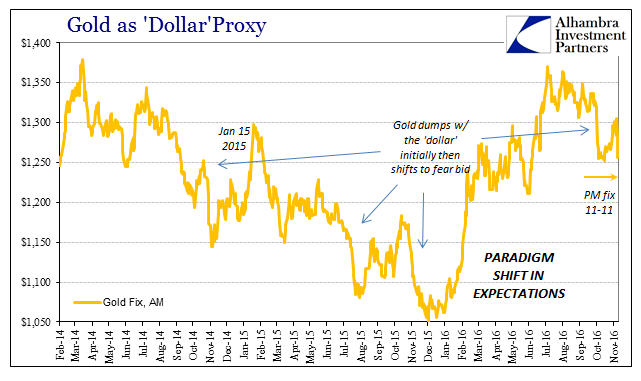

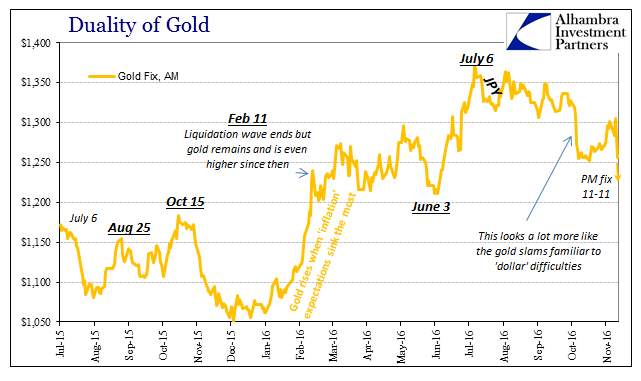

There are many facets to gold, which is as it should be. In trying to discern what ones are moving prices at any given moment, the complexities and really its duality can cloud the matter, often greatly. From the post-1971 traditional perspective, it is believed the preeminent inflation hedge. In financial terms, it is sensitive to shifts in relative interest rates. From the wholesale perspective, it is that often paradoxical tug-of-war between collateral of last resort and ultimate safety hedge, which in this context is where central banks are all wrong.

Gold prices have displayed by turn some of each of these views. There does seem to be at least an irregular bid perhaps tied to rising inflation. Market measures of future inflation here and elsewhere around the world have jumped of late, though still very subdued in context, and gold prices did seem to be moving in that direction. From a low of $1,252 (AM LBMA fix) on October 17, it jumped back over $1,300 again by Election Day.

In a broader view, however, gold prices don’t really fit market inflation expectations. First, to start the year, gold was surging when the market saw the least amount of future inflation since the Great “Recession.” Expectations have been rising all summer, and yet gold prices have been sideways to lower at the same time, continuing an intermediate inverse trend.

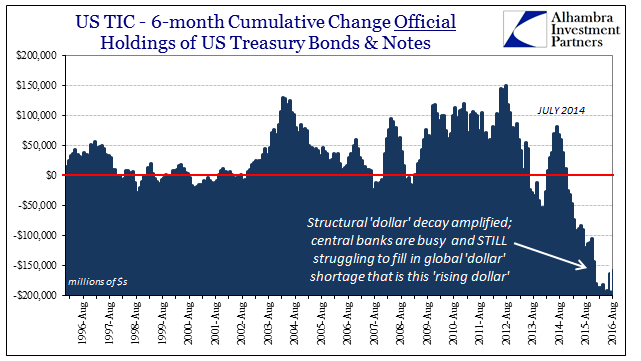

That might suggest, then, that gold is being moved by perceptions of interest rates and US monetary policy. As for the latter, gold prices are not limited in response to just the US jurisdiction. Money rates, on the other hand, have been rising though there seems to be still some debate as to why (it really isn’t a debate as much as an intentional blindspot, all that 2a7 talk). LIBOR as well as money rates elsewhere, especially China, jumped over the summer which would have the effect of making gold less valuable as a non-interest investment for those who view gold in that way.

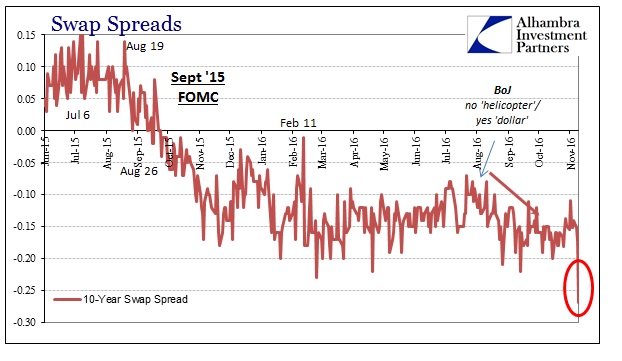

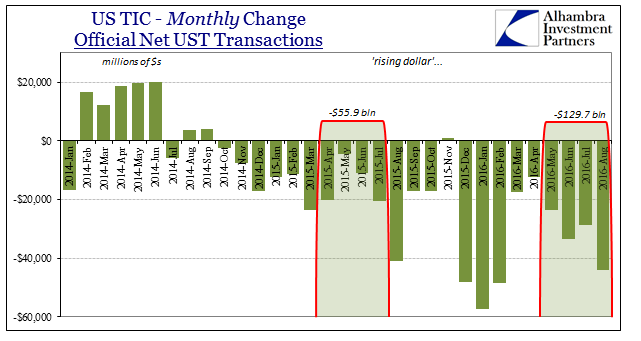

I think that gets closer to what has transpired in the gold market, related as it is in my view to more and more “dollar” issues. The defining variable for me is what gold did right at the end of September and to start October (as China was in holiday) and then again the past few days. Gold “slams” are a very good sign of “dollar” problems not necessarily related specifically to money market interest rates, but more so the wider functions of money markets themselves including collateral flow.

Just as gold had risen recently, it was smacked down again the past few days; from $1,304 Tuesday to $1,255 at the AM fix today, and down big again to $1,236 at the PM. That’s almost $70 in just two sessions.

I have to believe that the resulting action across these two trading days is linked to the disorderly selling in bonds, especially the massive irregularities for interest rate swap trading. What the UST market did was show very large margin calls that were likely good for more than just the UST market. If we are talking about derivatives, that would mean UST’s as collateral, and therefore a good bet that gold was in play as a last-resort funding method (highly negative for gold prices).

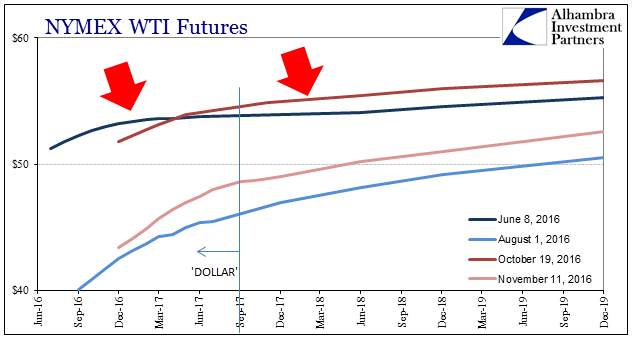

It’s not just money markets, however, where the “dollar’s” negative influence is felt. Oil prices have been down again as they have on and off these past few months. And like the last major downturn for WTI, this one bears the scars of negative “dollar” conditions, too. From relative high to low, the futures curve starts quite flat, closer to its natural instincts for backwardation rather than contango, and as the selloff gathers the unmistakable “hook” at the front end shows the financing part that is setting all marginal price action.

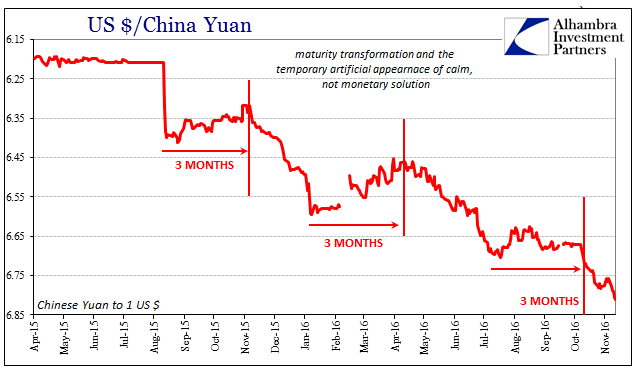

Put simply, more contango means less “dollars.” And that, of course, brings in the Chinese where last year’s most troubling correlation was where it both CNY and WTI dropped down at the same time. Going back to mid-October, that’s what we find for both (and right on schedule, too).

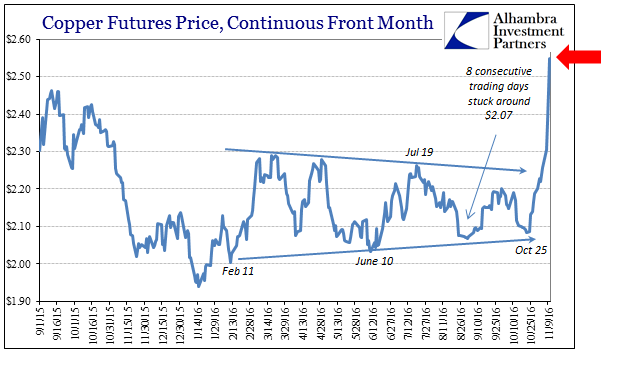

We aren’t without contradictions, obviously, and in this case the opposite “dollar” condition is being argued by copper. That metal, unlike gold, has been remarkably resurgent condensed into just a few weeks. Copper had until recently been delivering, like gold, a forewarning about finance and economy globally, though for most of this year that meant sideways in a strangely narrow range. For it to just explode higher as it has would seem to suggest that the bond market inflation impulse isn’t alone.

Reconciling copper to gold, however, isn’t that difficult. As noted prior, there is much more Chinese influence in the former than the latter. And though conditions in China itself are being driven by the “dollar”, it has responded only recently with what I am sure is a wash of RMB. In that way, perverse as it might seem, surging copper would indirectly agree with a gold slam by the very difference of likely PBOC action – gold suggests an increase in “dollar” pressure, causing a more forceful PBOC internal response, having great positive effect on copper prices.

The difference is the central bank response, which is a factor that I have written about quite a bit these past few months. We have seen all this before, including to where these kinds of seemingly opposed moves are actually complementary once you solve the key. That key had been in the past, as today, central bank reactions that markets were unsure as to how they would work out – they only saw them as different, and therefore enough to be positive about.

I am talking about 2007, though I want to be clear that this comparison is of a limited nature. It is quite natural that when you see some similarities to that time you extrapolate to everything about 2007, including and especially what followed. I don’t think that is the case now, as 2008 will never repeat. Instead, I am on record more times than I can count that what we have now is much, much worse than all that, insidious as it is because it is drawn out and stubbornly lingers no matter what. But because it is this way, the mainstream can’t even identify, unlike 2008, that there is “something” very wrong here, let alone identify what it actually is.

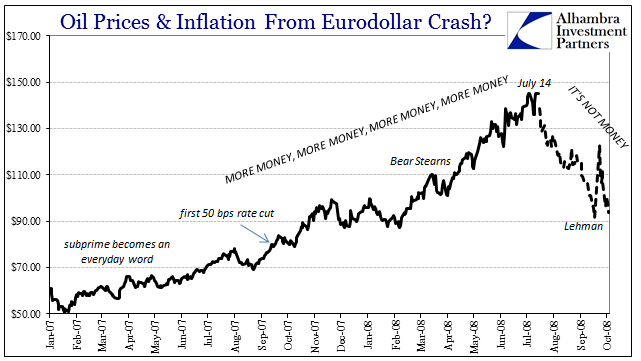

A good part of that has to do with just this kind of contradiction, as we see now as in 2007. In both cases, there were growing indications of “dollar” problems that broke out into the open in several ways. Yet, for all that in 2007, it wasn’t just inflation expectations but inflation itself began to skyrocket. Even stocks registered another record high as late as October that year.

What many people saw in 2007 was that though there might be some growing danger nobody could readily understand, it was also being met by a very different and equally growing Fed response to it. For many, that was all they needed to see, as they expected such forceful monetary policy would at some point in the intermediate future be revealed as effective to really, really effective. It was the last stage to where the full myth of the “Greenspan put” was displayed; it effectively meant that a great many investors and observers had improperly skewed perceptions where monetary policy always wins no matter how bad it may seem even in money markets. They just believed that Ben Bernanke was more than capable of fixing it, and quite likely he would overdo it in doing so.

That was the scenario that played out in especially oil prices. Whatever might happen in the supposedly far-removed subprime regions, and even as it spilled out, more and different monetary policies were believed, even after Bear Stearns, the winning play. In fact, by that point it had become self-feeding in the way copper seems to be right now; the worse it got in MBS, the more “money” the Fed would have to “print” in order to set it all right eventually. It wasn’t until July 2008 that these investors began to see their error; and it was a big one.

Again, the contours of this dichotomy are visible in what we have witnessed over the summer going back to the BoJ helicopter rumors. At this stage, “markets” don’t have any idea what central banks have been doing, might have been doing, and might conceivably still do, but they don’t care as much because whatever all that was or is it was or will be different. And if it follows the PBOC model from late October, it could very well be forceful, as well. The more the “dollar” strikes in these places, the more certain investors seem to dream of that much more different monetary reply as a result. The worse the “dollar” got in later 2007, the more inflation was predicted that would result! To my mind, where we are now is parallel if still nascent to that projected path.

Now that central banks have moved on from QE that clearly isn’t money printing (it only took nine years for most people, including central bankers, to figure it out), some parts of these markets seem to believe that will mean central banks might now undertake actual money printing instead. In the case of the PBOC and what is surely moving copper, that is closer to the truth than it would be anywhere else. But even with other central banks there is that possibility; it was, after all, rumors of an actual, Milton Friedman-style money helicopter in Japan that got all this going. Thus, if you believed that central bankers would now in this post-QE situation do it if pushed to, then the more the “dollar” pushes the closer you are to actual money printing.

As usual, some perspective is demanded. The difference between now and 2007 is obvious, as both “dollars” and inflation were at far, far more extreme opposites then. In this case, oil prices aren’t even following with the “wrong” direction, and it is instead the bond market where inflation expectations are being fomented. But even there, it isn’t truly a massive surge, more that it is a relative shift to less direct pessimism. In other words, the more disruptive the “dollar” gets the greater the potential chance that a central bank might convene a committee that would offer several possible policies that at some point might be initiated which could hopefully for once deliver the intended results.

The “dollar” is right there, and you can bet that despite the falling out in 2015 and the beginning part of 2016 a great many people desperately want to be back in love with central banks again. It certainly is way more fun, and most people are just tired, as I am, though for different reasons, of the constant negativity.

Stay In Touch