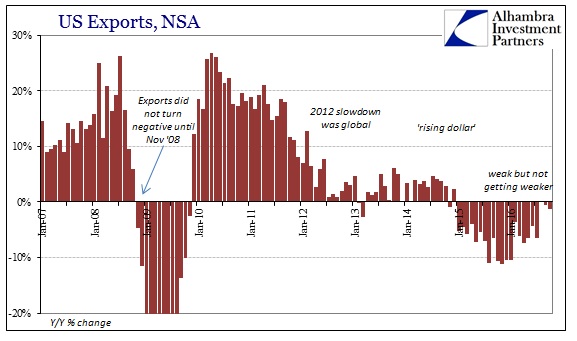

When US exports were reported a few months ago to have risen (slightly) in August 2016, it was widely expected that that increase was the start of many to follow. It was, after all, the first positive number on the export side since the end of 2014 after more than a year and a half of nothing but contraction. In the two months since, however, exports have taken back to the negative sign again. The Census Bureau last week released the update for October 2016, calculating that exports fell by 1.2% year-over-year (unadjusted).

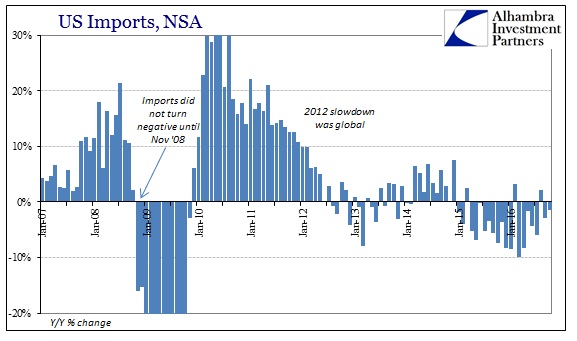

That was certainly better than what the export sector had been experiencing to start the year, but better is, again, a relative term. Going from serious contraction to just contraction isn’t anything at all like reflation. The import side has followed in similar fashion, where imports rose 2.2% year-over-year likewise in August, but have taken to contraction all over again in the two months since, including -1.5% in October.

Those numbers don’t tell the whole negative story, especially since this is the second straight year of mostly negative numbers. What changes is the month-to-month variation, but the economic trend is clearly the same. Compared to October 2014, exports are down almost 12%; a cost of not just that 12% but more so the lost two years that with still negative numbers this late into 2016 suggests only more of the same to come. Imports are nearly 9% less in this latest month than the same month two years ago.

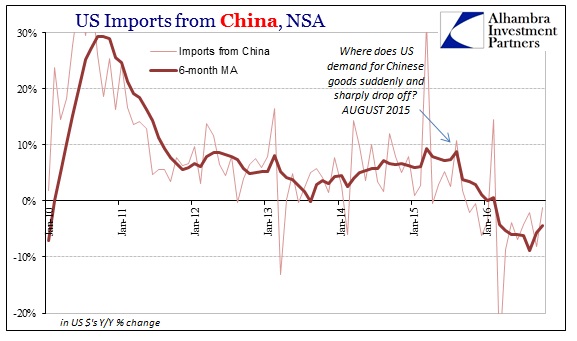

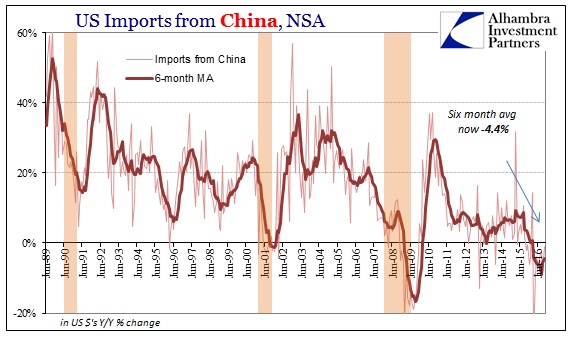

Given the continued contraction in US “demand” for global goods, in terms of China it might propose that statistics like China IP might actually have been manipulated. As noted earlier, Chinese industrial production has been steady at around 6% for more than 20 months. In terms of US imports from China, there has been an appreciable difference this year even compared to last year. Starting around August 2015, US import activity dramatically fell off and has yet to rebound.

Imports from China fell 1.2% in October after dropping more than 8% in September. With October’s negative, that was the eighth consecutive decline and twelve out of the last thirteen months going back to last October.

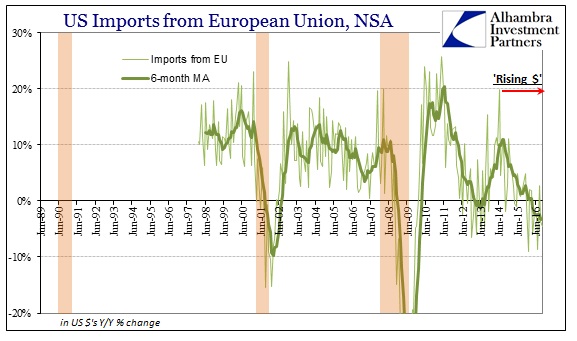

Even imports from Europe declined again, this latest month rather sharply by 4.6% Y/Y. Like overall US imports, the trade in goods from the other side of the Atlantic appeared to be recovering with a positive number in August. That would have been consistent with the traditional interpretation of how exchange rates work with regard to global trade in goods; stronger dollar is supposed to mean cheaper foreign imports, and therefore relatively more of them at the expense of domestic production.

Instead, as the euro has weakened against the dollar, US imports from Europe have contracted. In 2016, imports have declined in seven out of the ten reported months so far. The 6-month average, covering the six months immediately after the euro peaked for this year in early May at above 1.15 to the dollar, is now -3.1%. As we see with JPY, CNY, and any other currencies, there is no “stimulus” indicated by “weaker” exchange rates. There are instead just the remnants of disturbed monetary conditions which are highly negative and disruptive for all trade on all terms.

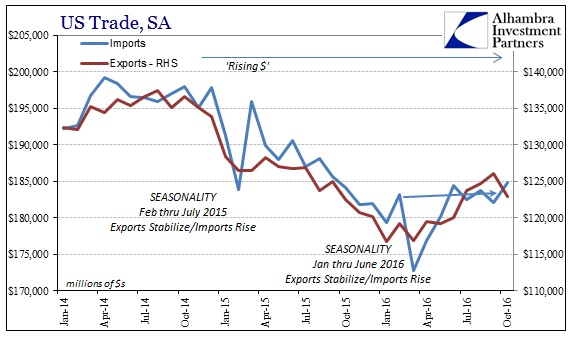

Seasonally-adjusted, US exports fell sharply in October reflecting, perhaps, the belated effects after two straight months of contraction in the unadjusted series. On the other side, imports after staging a rebound during spring have flattened out again rather than, as was extrapolated, persisting upward toward what was supposed to have been better growth especially in US “demand.”

At just $184.8 billion, US imports were barely above the estimated total for May, remain more than 7% below the peak from two and a half years ago, and are actually less than what was estimated for May 2011 almost five and a half years ago. The global economy is awful because US consumers, despite all the talk about the unemployment rate, just aren’t buying foreign goods. It really is that simple.

Because they aren’t buying domestic goods, at the margins, either, the whole world is stuck in the same smaller and slower economy as has been indicated for more than two years now. The occasional “good” month, as August 2016, has proven time and again nothing more than the same monthly variation and unevenness that visibly displays the difference of this economic trend as compared to more cyclical behavior like recession. In recession, economic accounts register a quick, sharp contraction followed by an equally quick and equally sharp recovery – the full swing of the cycle, both the down and the up, typically completed within two years at most.

Here we have ongoing weakness already for more than two years and still no end in sight. Instead of relatively sharp contractions earlier in the year, particularly on the export side, they have been replaced not by sharp acceleration into significant growth but by uneven and occasionally smaller contraction. It’s nothing like the birth of reflation, as it indicates for yet another month the same economy as the past few years, really going back to 2011. Something this intractable and persistent will not be cured overnight.

Stay In Touch