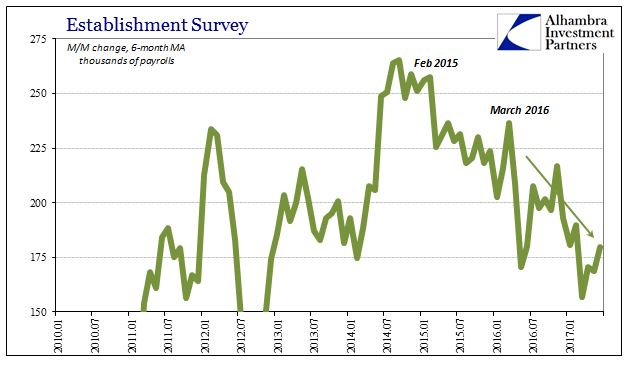

The payroll report for June 2017 was the first “good” one in some time. There are now a few indications that the “reflation” in the economy may be finally having positive effects on the labor market. The headline Establishment Survey gain was relatively solid at 222k, though it was above 200k for just the fourth time in the last nine months. The 6-month average, however, is still just 180k, much closer to 2012 levels than 2014.

Maybe the best sign of delayed improvement was in average weekly hours. The estimate was revised higher for April to 34.5 per week, with hours in June matching that level. Those were the best figures since the beginning of 2016.

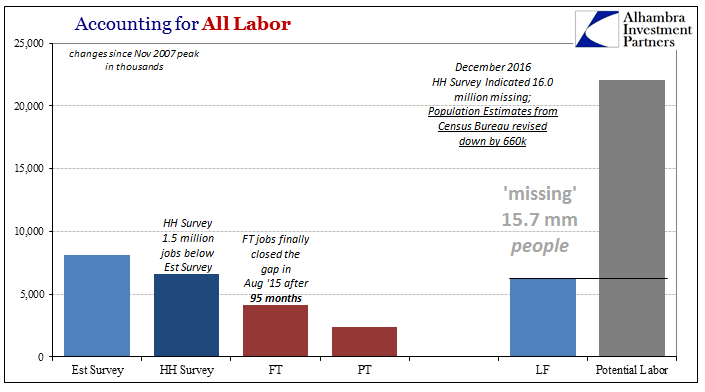

If there is actual improvement in labor utilization, it is proceeding at a painfully slow pace. At least in that way it is consistent with general economic conditions over the past few years. Whatever has occurred in either direction, other than the work requirements re-imposed via SNAP the US labor force has proved itself unflinchingly apathetic.

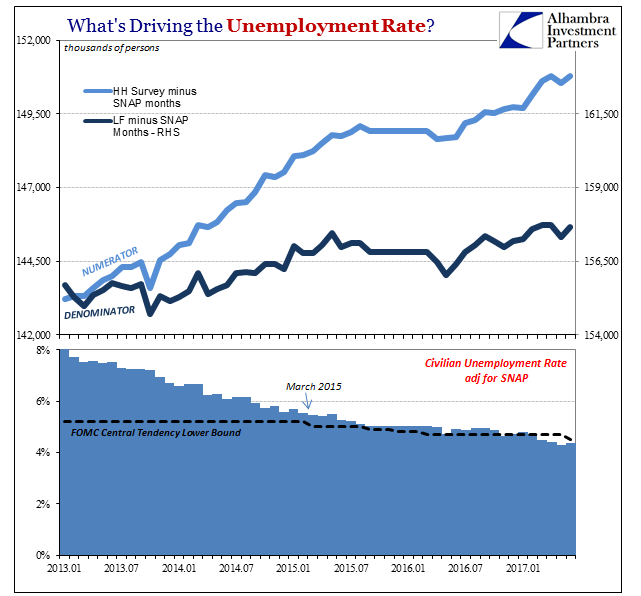

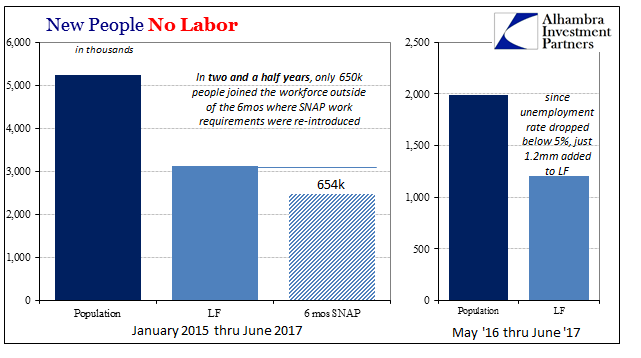

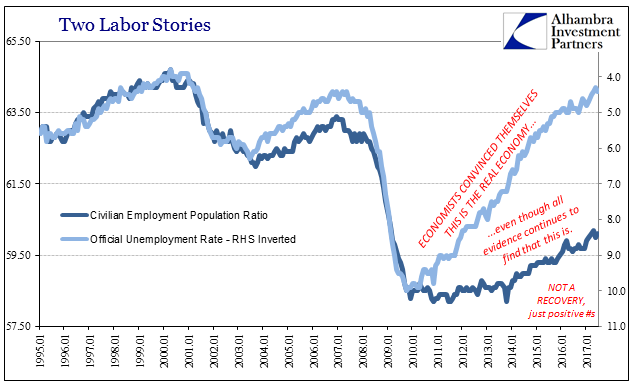

The unemployment rate suggests, strongly, that it should be otherwise. A high rate of utilization at least with regard to potential “slack” would be a significantly strong draw of people back into the labor force. Yet, going back to the start of 2015 when the unemployment rate dropped to what the FOMC at the time considered “full employment”, just 3.1 million Americans have entered the labor force. Of those, 2.5 million did so all in the six months where many state governments resumed work requirements for food aid. Of the other 24 months, only 654k have participated.

Since the unemployment rate fell below 5% in May last year, the Civilian Non-institutional Population has grown by just less than 2 million. The labor force expanded by only 1.2 million, projecting only a 60% participation rate during that time, slightly less than the overall Civilian Labor Force Participation rate (62.8%) but really and unfortunately consistent with it. In other words, even though the unemployment rate has dropped below every definition of full employment, the participation problem remains as ever unmoved.

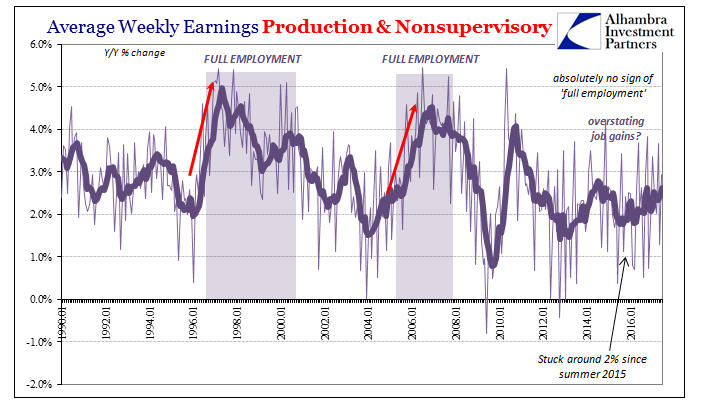

Therefore, even with the slight improvement in hours it doesn’t translate much into earnings. Weekly earnings in nominal terms continue on stuck around 2.5% growth, far, far less wage growth than would be if the economy were in actuality operating at or near full employment.

To try to account for what is truly another embarrassing disparity, the FOMC in its last set of economic projections (June 2017) was forced yet again to reduce its estimates for what counts as full employment. The latest lower bound for the central tendency is now 4.5% unemployment, still in June 2017 above the currently calculated unemployment rate (up slightly from May to 4.4%). The reason for this continuous adjustment is the lack of wage acceleration cited above, leaving inflation to meander around on oil price base effects alone.

If the unemployment rate actually applied to the real economy in a meaningful sense, meaning accounting for the participation problem, wages would have years ago accelerated to somewhere around 4% or more in weekly earnings. That would then have pushed up consumer prices, in the aggregate, leading to the Fed’s exit under more normal circumstances. Instead, the FOMC is “raising rates” largely because none of that is happening, having finally come to the conclusion, forced upon them by reality, that it is as likely never going to happen.

It is for once a payroll report more like the actual economy. It may be improving after having spent several years slowing, but it does so at so far an incredibly lethargic pace. Thus, the overall economy is left off worse for having undergone the slowdown in the first place, as the cost in time only increases while stuck in this condition.

What I mean is the incredible lack of momentum and acceleration. Even where and when negative pressures abate, that is the only positive force seemingly at work – the lack of further decline, or in the case of labor slowing. It is an odd state unlike anything else, where the only two conditions are either negative or not negative. The idea of actual growth is foreign. To my mind that is the essence of what would be a depression, but most people are conditioned to believe that word applies only to something like 1929.

Whatever the technical or colloquial term, the substance of it clearly remains to be repeated back and forth, slowing and not slowing. Growth and expansion are at 4.4% unemployment still absent.

Stay In Touch