Why do the teachers unions oppose school choice? School choice and vouchers should be a positive change for teachers. They would have more choices of where to work and how to teach. They’d have more opportunities to experiment with different teaching methods. They could explore different compensation methods, potentially making more than they do now. Are the teachers unions being run only to protect their worst members? If I was a good teacher I would not be pleased.

Is the nascent commodity rally sustainable? The fall in the dollar has provided support for commodity prices recently but growth is obviously still lacking. It hasn’t been a uniform rally as the Ag commodities have lagged and even a general commodity index ETF like DBC is really still in a downtrend. But copper and crude oil in particular have been strong recently, especially relative to gold. We pay particular attention to the copper:gold ratio because of its high degree of correlation to the 10 year Treasury yield. So which market is right? Bonds? Or copper?

What does it mean to be bearish? Josh Brown had a post on his blog the other day titled What Are You Even Looking At? The gist of the post is that markets are going up and if you are bearish, you just aren’t paying attention. He says:

When I read bearish commentary about the stock market these days, I say to myself “What are you even looking at? Where the hell did these people learn to invest or trade?”There is no doubt that the bull market in the S&P 500 could stop at any time, but how could you possibly look at it now and say it’s imminent? Do you know how to read a chart? Do you understand how trends form, why they persist? Can you legitimately manage money without even that most basic of understandings?

Now I don’t know what bearish commentary he’s referring to specifically but I think most people have a more nuanced view of things than “this going up, must own it”. I’ve swapped some email with Josh and I like him but if he believes that investing is just about reading a chart I think he needs some more reforming. What does it mean to be bearish? What actions do you take with your portfolio when you are bearish?

It is no secret that I’m not a fan of this market, primarily due to valuations that are nosebleed no matter how you try to fool yourself into thinking they aren’t. But that doesn’t mean I don’t own any stocks. All it means is that my allocation to stocks is less than it would be in a market that was priced more reasonably. Does Josh believe that if the S&P 500 is going up I should have a full allocation regardless of valuation, regardless of risk? Because that’s what high valuations imply, that risk is higher than it would be at a lower valuation. If he believes that you should just own a full allocation of an asset regardless of valuation/risk then maybe he’s the one that needs to think about how he’s managing money.

Why does anyone listen to Alan Greenspan? The man failed in the private sector, his forecasting record is just awful and he’s basically senile. I saw him on CNBC this morning and he got confused about when he gave the irrational exuberance speech, saying, “…in 1986”. The fact he’s out there talking about a bond bubble and saying stocks are fine makes me want to buy bonds and sell stocks.

Is the stock market running out of buyers? One of the first things I was taught about markets was that it was the reaction to news that matters, not the news itself. So, if you have what seems to be good news and the stock or market doesn’t go up, then you need to be wary. If you have bad news and the stock doesn’t go down, it tells you something too. Which brings me to this earnings season (btw, I’m working on another big combined post with Jeff and Margie on earnings and valuations which should be up this weekend). Earnings have generally been pretty good with most companies beating estimates (as they normally do since everyone sandbags the numbers) but the response has not been positive.

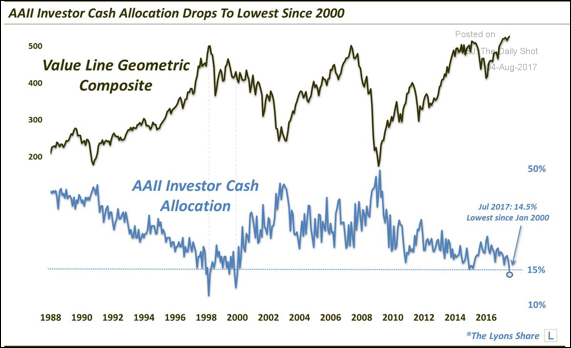

It may just be a matter of a lack of cash:

Stay In Touch