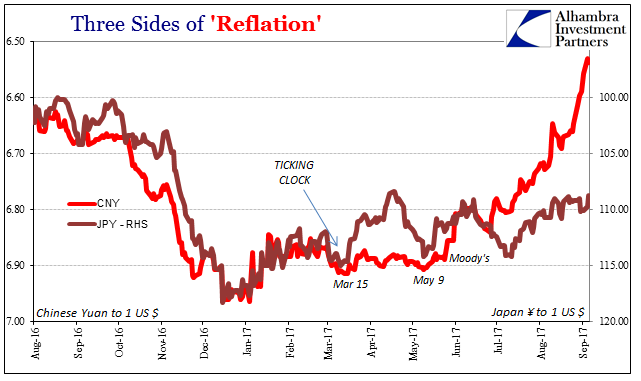

It’s hard not to put all emphasis on missile tests and other serious forms of sabre rattling. Even doing so, as the bond market may be doing right now, however, misses the underlying. Everything at the moment traces back to mid-March, which in hindsight was a very eventful month in full far away from the Korean peninsula.

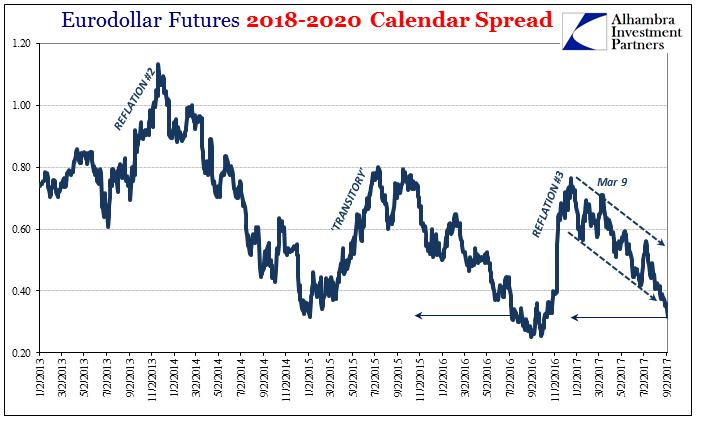

Take, for example, eurodollar futures. The curve has in the very important 2018-2020 window utterly collapsed since then. What that means in terms of market expectations is, as i wrote earlier today (subscription required):

The EDM 2018’s tell us that rates aren’t expected to go much higher from here until that contract expiration less than a year ahead.

But the hugely flattened curve from there to EDM 2020 tells us that the market further and further expects little or even nothing more in “rate hikes” thereafter. The Fed may want to get close to 3% in this cycle, but the market now doubts it gets half that far (or, alternately, it gets somewhat farther and then has to turn back around).

“Reflation” was, in a nutshell, the sudden change and introduction of an upside. These markets and the real economy had spent the several years of the “rising dollar” to that point investigating possibilities of only a downside. In late July 2016, there was this small ray of light breaking through to those utterly dark interpretations of a totally bleak future.

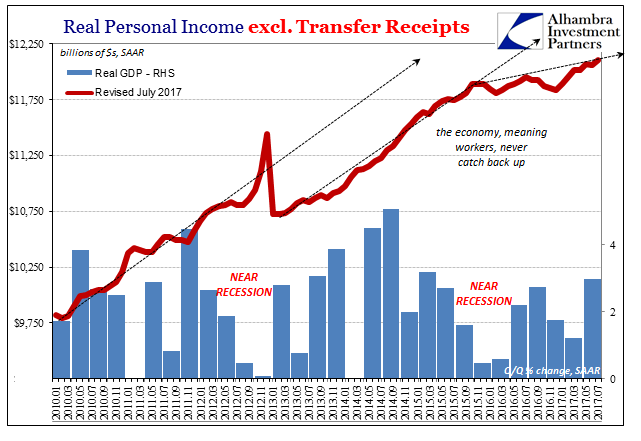

It was never much of an upside to begin with, but for a time there were some heavy considerations for what that might mean. The trend since March, however, is those markets increasingly giving up on it and going back into the bunker projections; not a nuclear bunker but still an economic one. The upside is nearly all gone now, largely because it never attained anything more than imaginary status.

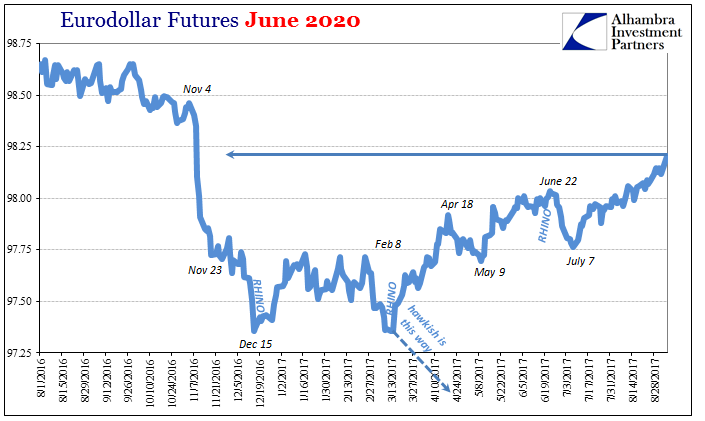

Markets wanted to believe in some small part that “rate hikes” were real, meaning they were coming our way because this was 2004 or 1994 again. Even if it was only partly 2004 that would qualify as a huge improvement over the last ten years. The RHINO in March, instead confirmed that the Fed was and is shifting policy because they are shifting policy; there is no rational reason apart from the fact that it has been a decade since that first “rate cut” in 2007 and nothing has changed. The world, the US economy with it, only ever gets weaker for these “dollar” events.

That wasn’t the only change in March, either, as several major shifts have been detected from oil to CNY. If the several “reflations” to this point were nothing more than the spaces between active “dollar” events, what might it mean that this latest one, number three in the series, is more and more disabused of any upside considerations whatsoever? It is, to start with, a repeat of 2014 but from a worse starting position. You can’t help but go back to thinking downside in this shape.

Stay In Touch