How many little pieces of conventional wisdom never hold up to scrutiny? Things get repeated over and over until they are so common that no one ever stops and thinks about them. It isn’t really nefarious like the Big Lie, more just shorthand that may have made perfect sense at one time but has become anachronistically handicapped as the world changes and changes again.

One prime example is that banks can’t make money without volatility; at least in the shadow version of a bank. A real depository institution needs nothing of the sort, of course, preferring instead its opposite. But the modern dealer bank has blended into the traditional so that the blurred distinctions have left behind the rhetoric about how one works. What a dealer is today is nothing like what one may have been long ago when this idea first manifested.

JP Morgan, for example, put up dismal numbers for Q1 2016. That wasn’t at all unusual, as all the shadow banks did. Despite massive volatility in all markets, even stocks, there wasn’t a marginal FICC nickel to be found on the Street.

“We expect investment banking revenues to be weak this quarter, mainly due to continued market volatility that froze capital markets activity—particularly in equity capital markets (ECM) where initial public offering (IPO) volumes declined more than 67% year-over-year (Y/Y),” [Frederick] Cannon [of KBW Securities] said.

In fact, JPM’s Corporate & Investment Banking (CIB) segment posted revenues of just $8.13 billion for the quarter compared to $9.58 billion in Q1 2015 (-15.1%). Volatility can mean different things, of course, but what most people mean in this context is that market spreads rise during market events making it more profitable for dealers to be dealers. The idea of such a matched book paradigm is an academic one, not fit for how banks actually operate.

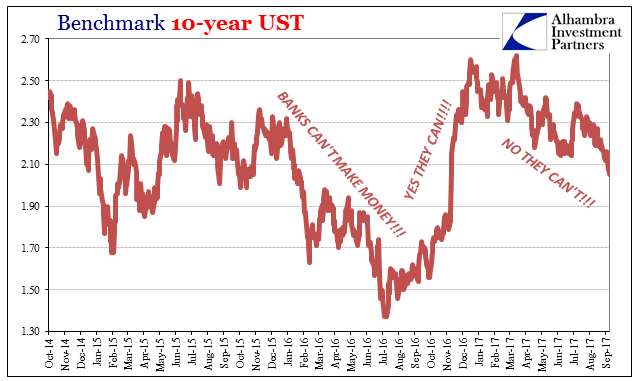

So it is now after a brief rebound and “reflation” that banks like JPM are for the middle of 2017 warning about their results again. Speaking at an industry conference today, CEO Jamie Dimon predicted that trading results would be down 20% year-over-year following what was already a bad quarter in Q2.

At the same conference yesterday, Citigroup CFO John Gerspach made a similar pronouncement with a more pointed reasoning. In forecasting a 15% drop in “markets” revenue for his bank, the executive tried to explain that the current quarter, “is lacking the volatility that pushed revenue higher in third quarter of 2016.”

That is certainly true, as there is little comparison between the more placid times of today and those often rapidly changing circumstances one year ago. But what stands out even more is the direction of things, volatility or not. In other words, like JPM, Citi made more revenue and profit under “reflation” than without it. The key variable is not volatility but markets that conform to what we are supposed to believe is the coming normal.

As I wrote last year in April:

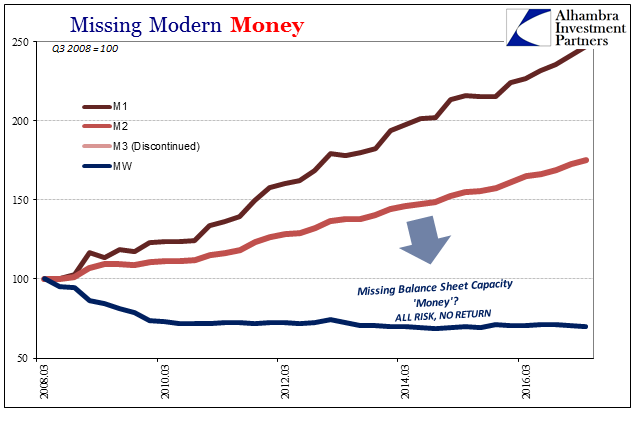

In “low volatility” environments investment banks get smaller; in “high volatile” environments investment banks get smaller. You might just get the impression that investment banks reduce themselves regardless of the volatility environment, and thus are projecting some other concern or structural tendencies.

JP Morgan is the perfect example of this fantasy position. Its London Whale as an extreme one was begun, after all, by management in its CIO office wanting in late 2011 to take advantage of the surefire successes of QE2 in the US and the ECB’s suddenly massive presence in Europe. Like that latter central bank, JP Morgan was buying what economists’ views on monetary policy were selling.

The London Whale was really nothing more than the clumsy and ill-conceived effort to turn the bank’s synthetic credit portfolio from short in terms of general risk to long the recovery because they thought central banks got it right. Specific episodes at the various eurodollar banks in the years since don’t make such great stories and headlines, but the premise and result have undoubtedly been repeated far too many times.

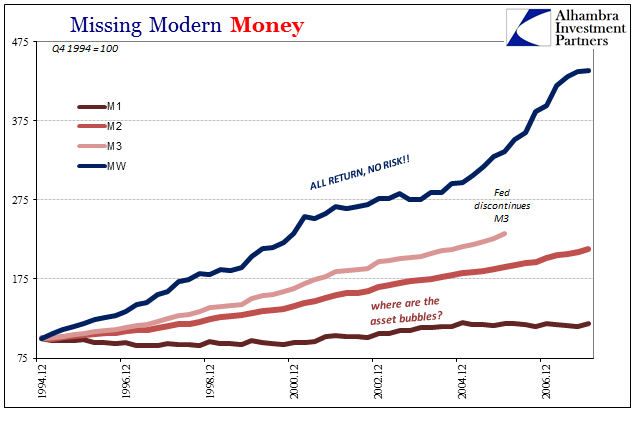

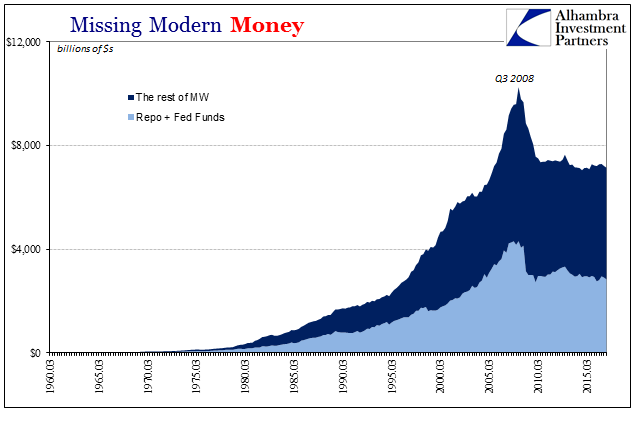

And so it appears to be the case once again 2016 to 2017. Under “reflation” the world makes sense to these people because they are of the orthodox; and it leads to raging dissonance. Many people are left to ask how can these banks who only (mostly) shrink buy a recovery story while they do so? It is a case of mistaking what the Fed does as money instead of recognizing that what dealers do actually is.

This is the difference of a credit-based money system, where even the components (shadow banks) of it aren’t required to be aware of what they are (thanks to Economics) and how what they do matters much more than what others (Fed, ECB, etc.) do. How else could it have gotten so far out of hand before August 2007? All around systemic ignorance, to put it mildly.

Therefore, they react to mainstream forecasts for how successful monetary policy in particular will be, only to find that when it isn’t they have to pull back their own activities that much more and ensuring both the next wave of central bank “stimulus” as well as its ultimate failure.

All we’ve heard about this year is “globally synchronized growth” that for the first time since 2007 was supposed to make all the difference. After preaching how interest rates have nowhere to go but up because of that, why would anyone be surprised that banks aren’t doing well? The error isn’t so much interest rates, but sticking to a worldview that is as outdated as the so-called conventional wisdom related to it.

Stay In Touch