In late January 2012, the FOMC released an official statement confirming to the world what had long been expected. The official goal of monetary policy, or at least one of them, was to achieve price stability being clearly defined as 2% inflation (PCE Deflator). It was part of the ultimate transformation of Federal Reserve policy, from the hidden, intentionally opaque world of fedspeak under Greenspan toward a more transparent future. This new statement wasn’t a change in policy, but public confirmation.

It may have seemed uncontroversial at the time, after all, again, everyone knew that was the definition since the nineties. There was some major debate, however, internally. Only some of that discussion has since emerged, pieces of it written out in the FOMC’s policy transcripts (those for CY 2012 just released earlier this month).

The overriding concern was clarity. Chairman Bernanke didn’t want the public to hold the slightest doubt as to what it was the Federal Reserve was trying to achieve. They may argue and wonder about how the Fed carried out its goals, but Bernanke wanted no confusion about what those actually were.

CHAIRMAN BERNANKE At the same time, this document is explicit in saying that in the short run, the inflation and employment objectives can conflict, which is evidenced by our many recent debates around the table about whether further actions to promote employment create risks of higher inflation. In those situations, as the document says, we take a balanced approach that is informed by our knowledge of the economy’s dynamics, the outlook, and the size and expected persistence of the deviations of our objectives from their desired levels.

This is no small matter. Central bank credibility is as much the issue as price stability. To put it into the framework of the FOMC’s earlier and similar June 2003 discussion, monetary policy works better (at all?) when the public believes the Fed can do what it says. If the public doesn’t know what the Fed wishes to achieve, it’s more difficult to make the case for that. If instead the central bank declares sustained 2% inflation as its definition of price stability and then gets it, as everyone at the meeting believed, it makes everything with monetary policy more effective.

So much of modern monetary policy is pop psychology of this sort, owing to forced interpretations of rational expectations. It’s almost circular in its reasoning at the expense of technical competence (more on that later); monetary policy works because people believe monetary policy works, and people believe monetary policy works because monetary policy works. This is the essence of the (disproved) Greenspan put.

Janet Yellen was given head of the subcommittee determined to write this new explicit inflation statement. The timing of its vote and release could not have been more perfect, or embarrassing from her perspective. As she told the other Committee members in January 2012 before the vote:

MS. YELLEN …this statement has been designed as an overarching set of principles that is intended to withstand the test of time.

As we all know, so far it has – as a joke. Within three months of her defining these principles, the PCE Deflator dropped below 2% and outside of two months earlier last year it hasn’t been back. That’s just about six years of failing on this very important account; six years that are not transitory but “the test of time.”

The only FOMC member with the nerve to dissent was Daniel Tarullo.

MR. TARULLO You [Bernanke] seem to indicate that it was basically setting down as best we could what we think we currently do within this Committee… I should state for the record why I can’t support the document, and because it comes down to the same thing I’ve said before, I won’t say it at great length. I think the document has made vagueness a virtue to an excessive degree, and there’s a nontrivial risk that what comes out of this will actually be more of a cacophony than a clarification. [emphasis added]

It’s that actual position policymakers have found themselves wrestling with the past few (six?) years. In other words, what does happen if you say 2% but then never get 2%?

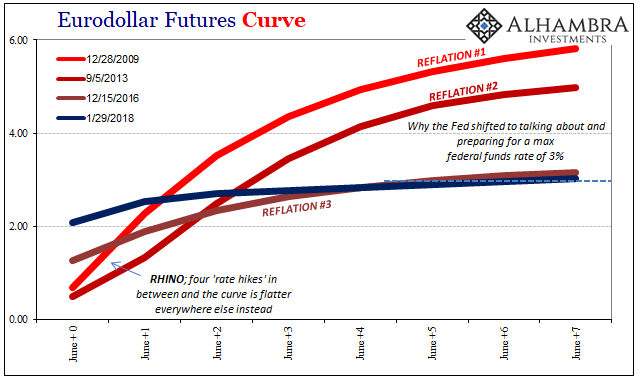

Explicitly targeting 2% inflation was supposed to help the public believe more completely in monetary policy so that monetary policy could be more effective (in its psychological manipulation). In the policy vernacular, well anchored expectations are a sort of holy grail. Instead, missing 2% year after year (after year) has had the effect of fostering a cacophony of doubt, even among the once faithful (UST’s and eurodollar futures).

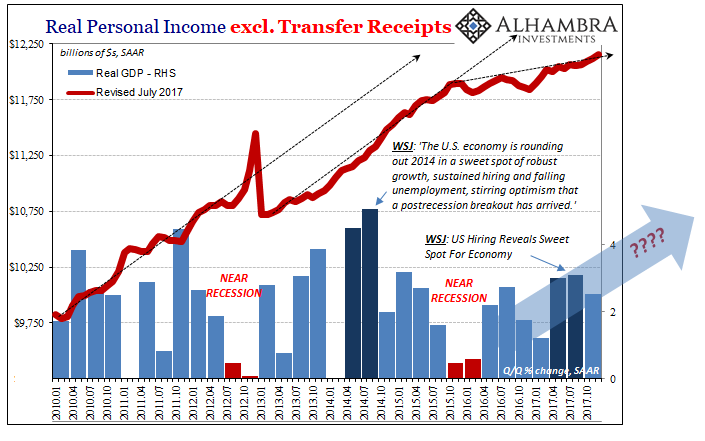

Part of the reason, too, is the dual mandate. The Fed has a duty toward low unemployment as well as price stability. If they can’t do the one, what happens with the other? Furthermore, if they appear to have achieved the other, a low unemployment rate, what does it say about monetary policy that in doing so they can’t get to both?

More questions than answers, which is the exact position Yellen finds for herself at the end of her tenure as Chairman. For her, this policy exit strategy is what she intended to define her term. It is the argument central banks have made since time immemorial, or at least since there have been central banks. Being transparent is only a virtue if you can live up to the hype.

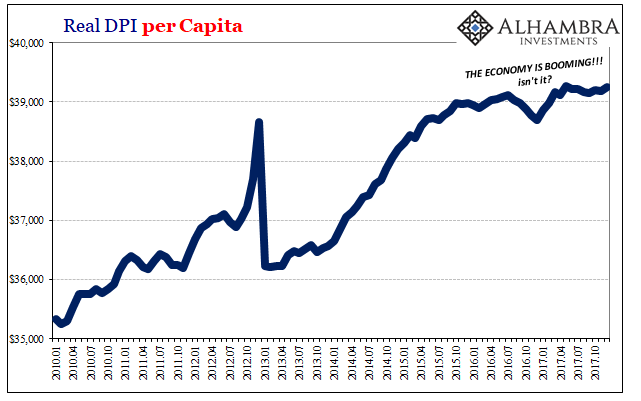

Inflation is no trivial matter, though it is often characterized that way. After all, are consumers and businesses suffering unduly with a 1.4% PCE Deflator rather than 2%? It seems at most small issue.

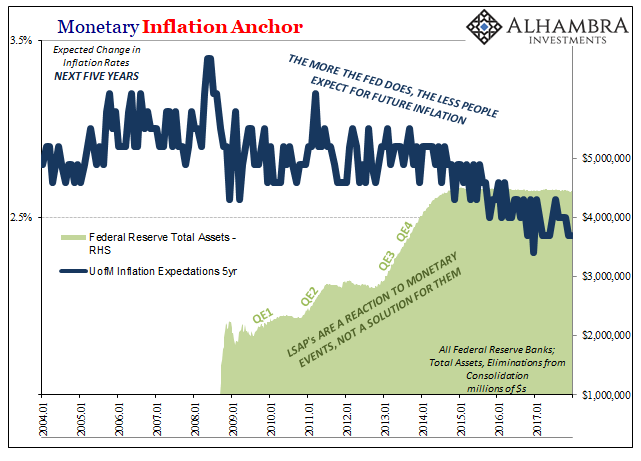

The inflation problem, though, has undermined a great deal more than the remnants of the Greenspan put. To put it another way, if the Fed has shown it can’t achieve its goals with four QE’s and years of “accommodative” interest rates, what does that say about our overall economic and monetary condition?

Monetary policy in the future doesn’t just become harder and less routine, the more immediate problem is what we find in the curves; massive and hardening, or fully hardened, economic/monetary doubt. If the Fed can’t fix it, can anything?

In a speech given at the IMF last September, Bank of England Governor Mark Carney warned, “The combination of the growing contestability of markets and prolonged synchronized weak demand may be restraining wage expectations.” In other words, there are very real consequences to the world not behaving as monetary policy would shape it. Janet Yellen in that same month put if far simpler:

My colleagues and I may have misjudged the strength of the labor market, the degree to which longer-run inflation expectations are consistent with our inflation objective, or even the fundamental forces driving inflation.

As the Fed now seeks a public consensus for its “rate hikes”, more so they want everyone to believe what they believe about inflation, Yellen’s final acts as Chairman have devolved into that disastrous cacophony Tarullo warned her about six years ago. Even now, as the dollar falls and UST yields rise, they do so against this tide (which is why rates aren’t exploding higher), not with the one the January 2012 statement envisioned. It is a direct consequence, producing lower curves and slower commodity rebounds, less business investment and therefore low and even zero labor income growth.

In other words, how easy might it be for the current “reflation” to turn right around again? A robust recovery, one that leads to a genuine boom, is one predicated on solid ground, belief that is itself robust. Established and proven monetary policy fortifies those beliefs in ways we can’t model or detail (which is one reason why Economists have spent far more time on expectations as opposed to money). A robust economic trend can withstand things going wrong in important markets. Believing the Fed can intervene and fix them makes it that much more so.

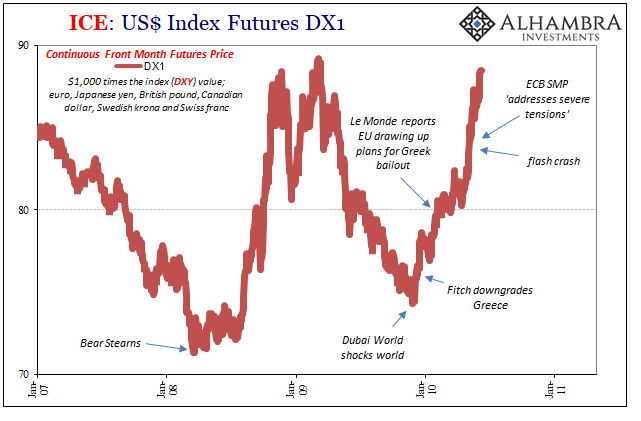

Being uncertain because by virtue of an explicit 2% inflation target the central bank can’t meet after six years and constant intervention, or a panic that officials once claimed was impossible and contained, tends to make one skittish and hesitant, prone to flight at the first small (like Dubai World in 2009) sign of risk that you know deep down the Fed can do nothing about. Even when things go right, as they appear to now, you’re never that sure they will stay right. It always comes back to risk.

The FOMC voted in January 2012 not for simply an inflation target, but quite unintentionally to prove that risks are much greater and more lasting than most people thought. That’s ultimately what the undershoot of inflation works out to. An ineffective central bank leaves as a matter of effective policy a far riskier world. A risky world is a depressed one, expectations and all.

Stay In Touch