You have to go back four years for some honesty. The FOMC in January 2014 could be more forthright simply because the committee’s members believed they wouldn’t ever have to explain themselves. They voted to taper QE at the end of 2013 with the expectation that the economy would perform as their econometric models laid out. Thus, they could say:

The Committee recognizes that inflation persistently below its 2 percent objective could pose risks to economic performance, and it is monitoring inflation developments carefully for evidence that inflation will move back toward its objective over the medium term.

Inflation hasn’t over the intervening four years, but that hasn’t stopped them from continually referencing the same expectations year after year. In January 2015:

Inflation is anticipated to decline further in the near term, but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of lower energy prices and other factors dissipate.

In January 2016:

Inflation is expected to remain low in the near term, in part because of the further declines in energy prices, but to rise to 2 percent over the medium term as the transitory effects of declines in energy and import prices dissipate and the labor market strengthens further.

February 2017:

The Committee expects that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace, labor market conditions will strengthen somewhat further, and inflation will rise to 2 percent over the medium term.

And now Yellen’s swan song, January 2018:

The Committee expects that, with further gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market conditions will remain strong. Inflation on a 12-month basis is expected to move up this year and to stabilize around the Committee’s 2 percent objective over the medium term.

That’s five straight January’s (actually four and a February) all referencing achieving the same explicit 2% inflation target in the future tense.

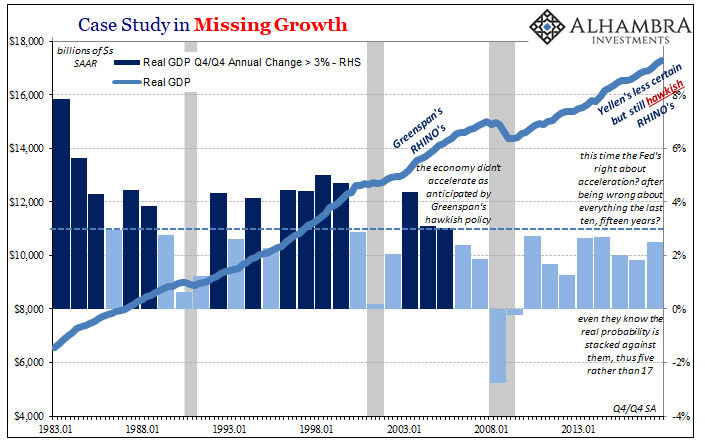

The results, or lack of, are considered for a lot more than embarrassing Economists. These things really matter, as noted earlier today, a great deal. One way to show how is by further historical comparison.

This latest FOMC meeting concluded with an affirmative vote for keeping the Fed’s policy rates (IOER & RRP) where they are. Even though policymakers did nothing, the outcome is already being widely described as “hawkish.” It’s as if the whole world has gone insane.

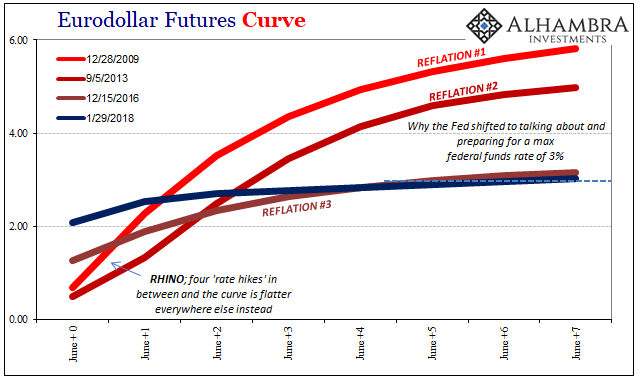

That’s not really what has happened, though, instead it’s merely the fact of life in the 2010’s; that actual economic growth is so far removed no one knows what it looks like, or what to look for. Hawkish in a meaningful policy sense is where you do what you say, and you say what you do. There is a world of difference where you claim to maybe consider a few moves here or there perhaps if transitory is beaten too far to death.

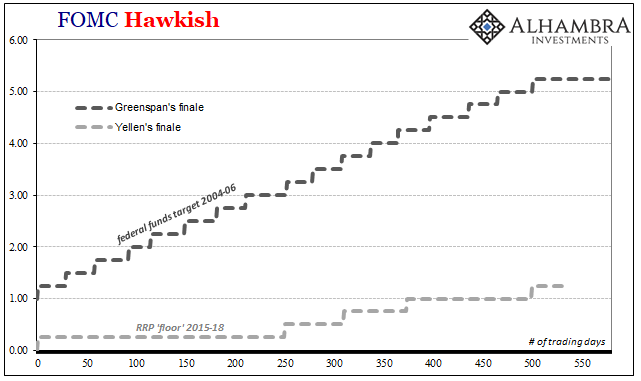

From June 2004 to June 2006, Alan Greenspan’s Fed raised rates 17 times. They brought the then federal funds target up from 1% (which was considered at the time ultra-low) all the way to 5.25%. And they did so in the same amount of time as Yellen’s Fed has meandered around closer to zero than not.

The word hawkish simply doesn’t apply, unless it is being used in isolation relative only to 2008 forward. There’s some truth to that, but that’s not how monetary policy is being described. They are trying to call this a boom, for cryin out loud, based almost entirely on what the Fed is doing!

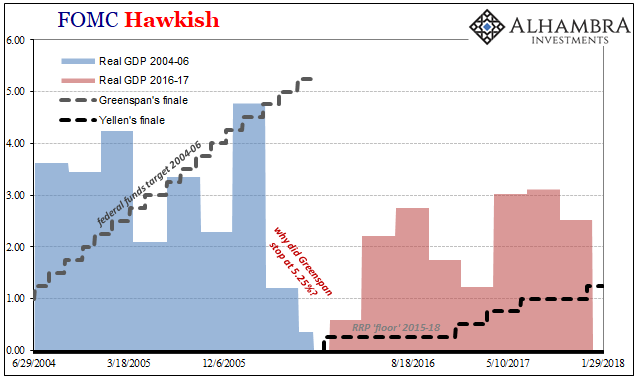

One measure of important difference is in the background for each:

Why might have Greenspan’s FOMC been more confident in actually, consistently voting for “rate hikes?” Why is inflation always referred to in the future tense nowadays?

And 2004-06 wasn’t even all that robust to begin with. Greenspan’s Fed very much like Yellen’s was ignoring the warning from the yield curve telling him that economic risks were weighted more downward than upward. The maestro was using moderate growth as if it meant robust growth was just over the horizon.

Yellen’s Fed is doing something similar, but starting so much further behind. She is using not even decent growth (better than atrocious) as if it indicates moderate growth is all but certain in the future (the point where 2% inflation happens). It’s a much more uncertain proposition, which is why you get five “hikes” in the same space as 17 before.

What the Fed is doing now isn’t hawkish one bit. They are still confused and nervous, confounded by always the “transitory” disturbances. The last downturn is two full years in the rear view, and yet they still have no confidence to act in an upfront and determined manner. That’s on top of ten years since the initial emergency began.Time is the ultimate arbiter.

The reason they hesitate is 2%. Inflation matters because it signals to policymakers that there is a more than trivial chance they are wrong, and that the economy hasn’t shifted out of its uneven, no-growth paradigm. The FOMC, I believe, knows it, too. They are using once more their patented fingers crossed strategy, the one where its members just hope for the best because you never know, the world could strike upon nothing more than random good luck (which is the term I hear instead whenever someone says “globally synchronized growth”).

That’s what “hawkish” means in 2018. Like the economy itself, the very idea is appropriately shrunken.

Stay In Touch