The yearlong wireless data plan nightmare is officially over. For the second month in a row, the CPI for Wireless Telephone Services, which includes any unlimited data at fixed prices, was more stable in its annual comparison. In April 2018, the index was nearly flat to April 2017; down by less than 1%.

It was, for once, transitory. What that was supposed to have meant, however, has yet to materialize. Central bank officials like Janet Yellen and to a lesser extent Jerome Powell (who seems to be almost in hiding of late) said that once these temporary drags (specifically mentioning wireless telephone services numerous times) fell off the indices inflation would accelerate as one final indication of full employment and economic recovery.

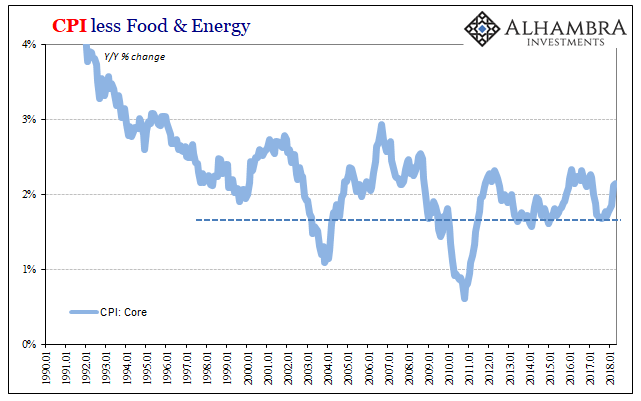

Not only that, several key policymakers kept referencing their preference for “symmetry” in inflation. This meant they would tolerate sustained above-target (referencing the PCE Deflator) inflation for several months or even much longer to try and make up all this lost ground from the last five nearly six years. It’s an important concept that begins to address the huge costs of lost economic growth going back to 2007, though couched within the context of the CPI it can only ever be distracting.

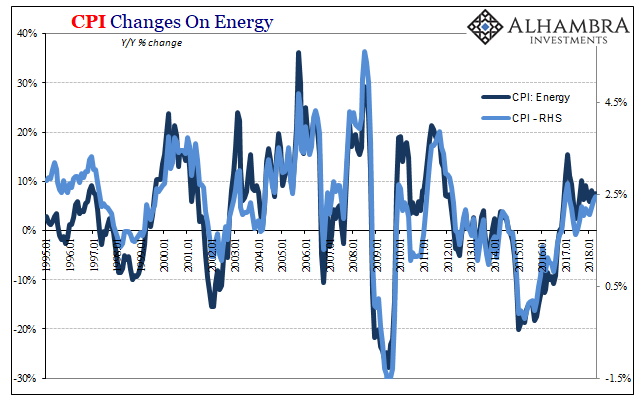

Two months now removed from removing Verizon’s unwelcome distortion (from the FOMC’s point of view), the only thing moving the CPI like the PCE Deflator is oil prices. That doesn’t mean that it is artificially high in that sense, the CPI is what it is. Rather, the issue before symmetry is whether or not it can stay up at all.

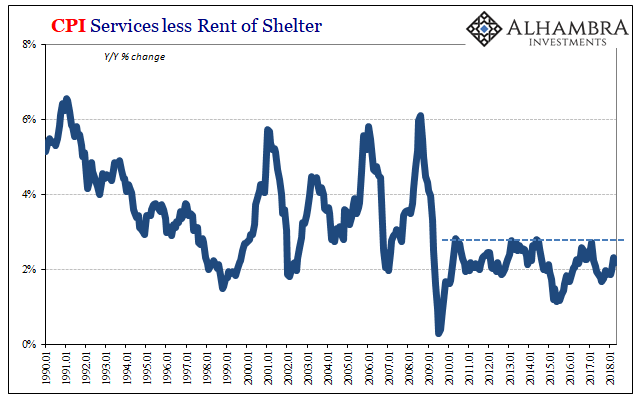

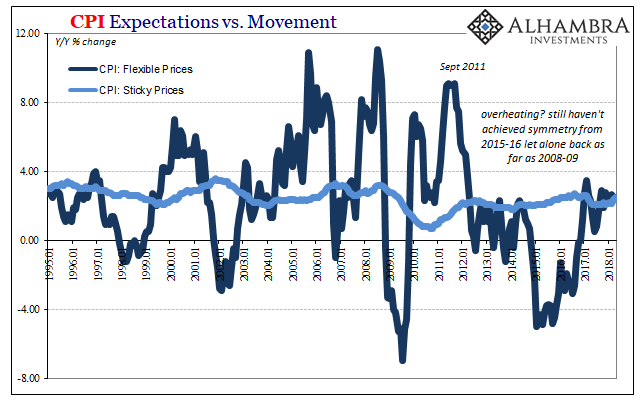

In other words, to get to overheating requires more consistency than WTI. Core inflation rates, for example, register the Wireless Telephone intrusion in an almost perfect “U” shape. The core rate in March 2018 was 2.12% year-over-year and in April 2.14%. CPI Services less Rent of Shelter advanced 2.33% in March, but only 2.19% last month. Even the so-called flexible prices index, which is where acceleration would register, decelerated for the second month in a row (sticky prices moved up instead, again as the base effect of wireless fell off).

That’s not how it was supposed to go, at least so far as inflation hysteria saw it. The crux of the issue, particularly as it pertained to the looming, biblical BOND ROUT!!!!, was that inflation was about to be such a big problem the Fed would be forced, gleefully, to raise rates far faster than any of the infamous dot plots. Instead, there is nothing here other than WTI.

Maybe that’s why despite rising oil prices, which a year ago (or less) would have been received like a thundering warning, markets have largely shrugged, resisted even (both the UST curve as well as the IRS curve). Maybe they won’t in the coming months, but for now like Wireless Telephone Services the hysteria is gone. The boom has yet to boom.

Stay In Touch