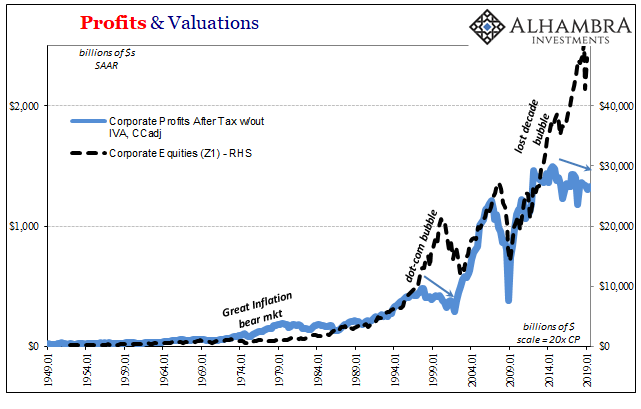

The stock market’s dichotomy grows ever wider. On the one side, record high prices which are being set by the expectations of a trade deal plus renewed worldwide “stimulus.” Sure, officials everywhere were late to see the downturn coming, but they’ve since woken up and went to work.

On the other side, though, there’s not nearly the same level confidence. Earnings are derived from several factors but chiefly the economic climate in which companies operate. Collectively, they’ve been down for years now (up slightly on a per share basis only because of so many buybacks) and despite price optimism about ending trade wars and the promise of more central bank rate cuts and QE’s there doesn’t seem to be the same outlook across the business world.

Germany’s IFO Institute for Economic Research not only conducts regular surveys of German businesses on German economic conditions and expectations, it also does the same for global businesses and how they assess the world economy. Its World Economic Climate Index is updated quarterly based on the responses of over 1,200 professionals in more than 110 countries.

And like so many other sentiment surveys and so-called soft data recently, the IFO’s Index for the current global situation reached a new low in Q4 2019.

According to the latest figures, the current quarter surpasses the previous low point set during the fourth quarter of 2011 – back when Europe was falling into a second nasty recession and the world was beset by a second global financial shock.

The IFO’s expectations index fell back, too. It had set a new cycle low in Q1 this year in the aftermath of last year’s landmine. Recovering somewhat in Q2 (“green shoots” and the constant talk of a second half rebound), expectations have been trending lower again despite the re-awakening of dumbfounded central bankers and their go-to QE or rate cut responses.

While the institute singled out emerging market economies for its most unfavorable assessments, and their most unfavorable economic prospects, among advanced economies it is the United States that is troubling its survey panel the most. In relation to the US view, the press released stated, “estimates for the coming months in particular declined.”

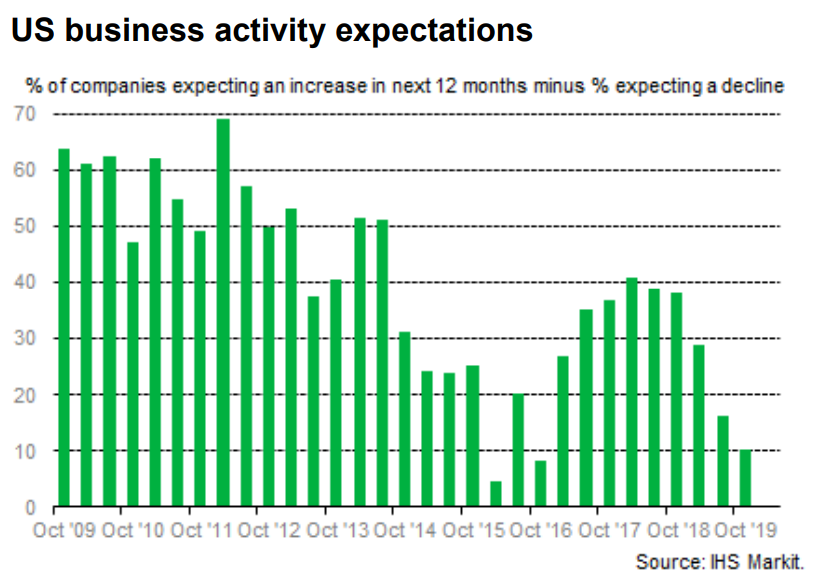

In light of that, also this week IHS Markit reports that its broad “business outlook” survey for the US (not to be confused with its PMI surveys) registered a 3-year low.

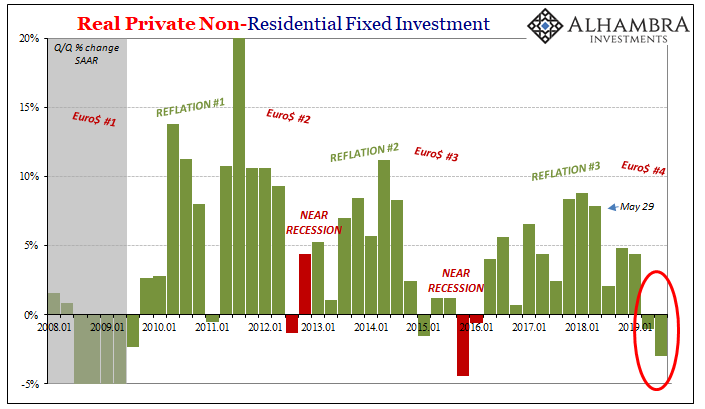

Markit’s sentiment data lines up with what we’ve been seeing in the two key areas where business perceptions directly connect with the macro factors: employment and investment. An uncertain economic climate (or worse) combined with profit pressures can lead companies to take another look at their costs and big cash outlays.

In line with weaker job creation expectations, U.S. private sector firms are also less confident of a rise in capital spending over the next year. The net balance of companies who forecast an increase in investment (+6%) fell from that seen in June (+10%) but is in line with the developed market average.

It is also in line with recent GDP data on fixed investment (capex).

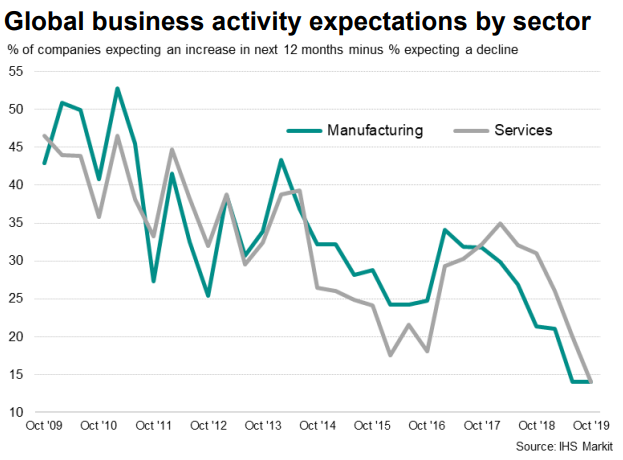

Markit’s news doesn’t get any better when looking at the global economy as a whole. Echoing the results of IFO’s World Economic Climate, the former’s Global Business Outlook survey (again, separate from the PMI’s) registered its lowest number since 2009, too.

Both service sector providers as well as manufacturers are saying that they don’t see much prospect for a turnaround for the world economy over the next year. Since the data collection took place during the month of October, all those respondents have had a chance to digest and think about the seemingly coordinated global policy response – and seem to find it lacking, or at least unconvincing in its initial phase.

Again, rate cuts all over the world and restarted QE in Europe. Trade deals on the horizon and record high share prices in many places. But amongst real economy participants, there remains much less belief and optimism.

Maybe stock investors see things from their perch high above all the rest that those down on the ground and in the trenches do not, or cannot. Then again, perhaps stock investors are rationalizing the old tropes, especially those related to the almighty stimulus of money printing and highly accommodative policies that, after a decade of seeing them over and over and over, those down in the trenches have learned aren’t either of those things.

The stock market surges with optimism reflected in prices. The business economy worldwide sinks with more pessimism reflective of serious concerns (repeatedly, the lowest since 2009) over the ability to generate earnings. Both sides looking at the fever pitch of the last few months and reaching very different conclusions.

Stay In Touch