Stocks rose last week, a breathtaking, nearly 20% run off the recent lows before a pullback Friday trimmed the gain for the week to about 11%. That was certainly helpful but investors would be well-advised not to get too excited. This is what bear market rallies look like. They come out of nowhere, they run much further than anyone thinks they should and, more than anything, they engender hope; hope that the bear is finally over, that policymakers have finally pulled the right lever to right the ailing economy. False dawns are the norm, not the exception.

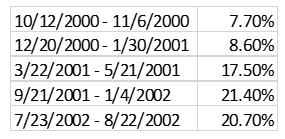

In the last two bear markets, there were numerous, breathtaking stock market rallies that ultimately proved to be nothing more than selling opportunities before new lows. In the 2001 – 2002 bear market, there were three rallies of more than 15% and two others that ran to nearly 10%:

The S&P 500 didn’t make its final bear market low until October 9th, 2002 at 776.76. And even then, it required a retest in early 2003 that got within just a few percent of the October low. That bear market spanned over 2 years and by the end, nobody wanted stocks.

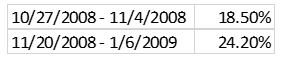

In the 2008/09 bear market there were two big rallies similar to last week’s:

We didn’t make the final low until March 9th, 2009. That bear market was fairly short compared to the 2001/2 bear and I think the memory of that one is influencing how investors are thinking of this one. We won’t know until the future arrives but I think it makes a lot more sense to start thinking in terms of the 2001/2 bear. This is not going to end quickly and it is going to be painful.

The impetus for last week’s stock market rally was the massive policy response from the Fed and from Congress. In last week’s note I said I wanted to see some kind of normalcy in the bond market and the Fed provided it, basically agreeing to buy, well, almost everything. Corporate bonds and municipal bonds were added to the buy list and both rallied smartly on the week. It took nearly unlimited buying by the Fed – their balance sheet hit $5 trillion last week – but bonds found a bottom and while stocks got all the attention this was the much more important development. We aren’t out of the woods yet by any stretch of the imagination but it might buy us some calm for a while. Or maybe not; there is still a lot of stress out there.

This week also marks the end of the first quarter and there could be implications across multiple markets. Previous quarter ends have been times of stress in money markets but with the Fed basically giving them all forbearance on normal regulatory requirements – for now – we might get through this one with little disruption although big moves in currency markets are worrisome. (More on that below.)

I’ve also been hearing a lot of people say that stocks could rally this week as pension funds rebalance their portfolios. With stocks down a lot and bonds up a lot, that would mean selling bonds to buy stocks. I have my doubts though. Things everyone knows about – and this was discussed frequently last week on the financial news channels – rarely move markets. But, as I said a couple of weeks ago, hope springs eternal.

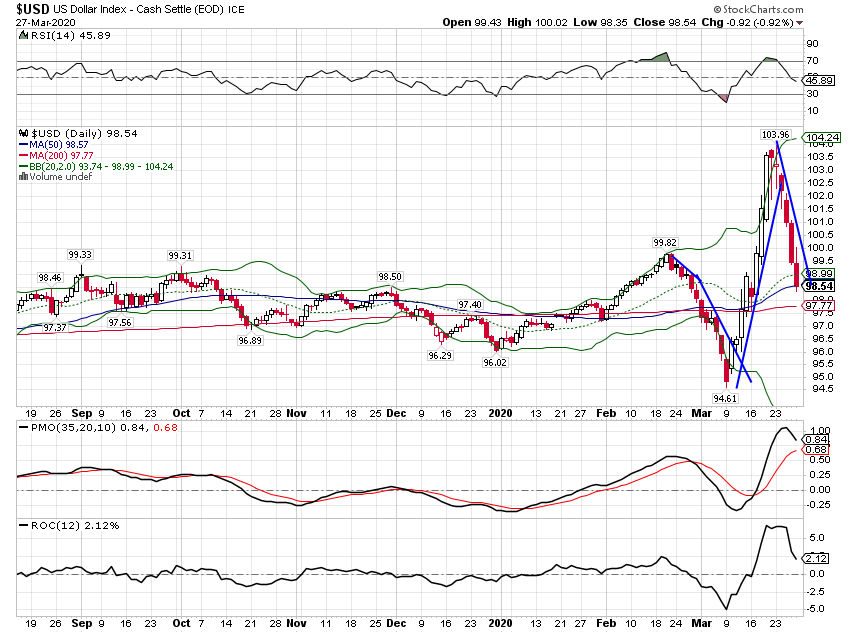

The other big movers last week, that most people probably didn’t even notice, were currencies. The dollar took a beating all week and it was generally attributed to the size of the fiscal stimulus package and the Fed’s interventions. I’m not much for simple explanations and this one doesn’t make a lot of sense in my opinion. Fiscal stimulus will not be confined to the US and the world’s central banks have turned on the printing presses and left the building (Or at least that is the popular perception).

The movements of the dollar recently have been large and fast, the source of the changes hidden somewhere deep in the shadow banking system our Jeff Snider writes about so much. Moves of this size over such a short period of time are almost unheard of.

From the 21st of February to the 9th of March, the dollar index fell 9 out of 12 days, a total of over 5%. The move was driven by the Yen and Euro, up 11% and 6.5% respectively. The Swiss Franc moved in a similar pattern, up 6.5%, in line with the Euro. Emerging market currencies and the commodity currencies, A$ and C$, continued to fall during this time.

Over the next 10 days, the dollar reversed course and rose 9.9%. The Euro, Yen and Swiss Franc all fell, moving in lockstep. This was the most intense part of the crisis – to date – when stocks were moving in 5% increments and bond bids were as scarce as honest politicians.

Now, they’ve turned again, the Euro this time taking the lead, up about 5% with the Yen up 4% and the Swissy matching that gain. The only difference this time is that other currencies joined the rally against the dollar with the A$, C$ and even the EM currencies rallying off their lows. That could just be coincidence as these currencies were down a lot and due for a bounce. Or it could be something else.

A weaker dollar would certainly be welcome – to some degree – in large parts of the world with heavy dollar debts. Whether it is in our best interests is another question but the current occupant of the Oval Office has frequently expressed his desire for such an outcome so you’d likely get no resistance from our Treasury. I have my doubts whether something like the Plaza Accord could work today but that doesn’t mean it won’t be tried.

The last time we saw volatility like this in these major currencies was, as you might guess, in 2008 in the teeth of the last crisis. Back then though these types of moves happened over months while this time it has been crammed all into one. From August to November 2008 the dollar index rallied over 18%, fell 9% in December and made its high for that move at the same time the stock market hit bottom in March of 2009.

I don’t know the exact source of the extreme volatility in the major currencies except to say that the world’s major banks were involved. Whether it was on their own behalf or a customer I don’t know and frankly, it doesn’t matter. It has become basically impossible to separate the risks of the banks and the leveraged customers they serve. The source of the problem is leverage and we will continue to have these crises as long as banking remains the complicated mess it has become. After this is over, we need to have a serious discussion about what we want and will allow our banks to do. They occupy a privileged position in our economy and they have abused it. The goal should be to make banking boring again. Please.

President Trump announced tonight that the federal guidelines on containing the virus will remain in effect until April 30th so we have at least another month of basically being shut down and I would not be surprised if that proves a date too soon. If Italy peaks and starts to make headway soon, I might change my mind, but absent an effective treatment our news is likely to get worse from here. For May 1st to be realistic as a return to some activity, we’d need to see a peak in the next two weeks. Based on Italy’s experience that seems a lot to ask.

Meanwhile, the economy continues to deteriorate at a rapid pace. One thing we should all learn from this is how interconnected our economy is. Thinking you can shut it down and restart it without significant, lasting damage is fanciful. A restaurant closes and its cooks and servers lose their jobs. The credit card processer and food suppliers lose a customer. Landlords don’t get paid rent and banks, in turn, don’t get mortgage payments, municipalities don’t get their property and sales taxes. The mortgage payments don’t flow through to the pension fund holding the mortgage-backed security. Multiply that by thousands or millions of small businesses and a rapid restart of the economy starts to look ridiculous.

The bill passed by Congress does make a large pool of capital available to small businesses in the form of loans that might – or might not – be forgiven at some point in the future. How exactly this money will be disbursed and who will qualify is not yet known although Treasury Secretary Mnuchin says the program will be up and running this week. No, I have no idea what he’s smoking.

The loans are to be made so companies can make payroll and pay their basic expenses, the idea being that they will just idle their business and wait to reopen. But how many business owners will take up the government’s offer is unknown and a lot of companies have already laid off all or a significant portion of their workers. It may make more sense for them to reject the money and just start over. Even if they make it through the quarantine, there is no guarantee their business will just go right back to where it was before the virus arrived.

We cannot – and neither can the politicians – know in advance what kind of behavioral changes this pandemic will induce. It seems obvious that people would spend less and save more – assuming they have a job – and a lot of retail stores may never recover. Just to mention two, I will be shocked if Macy’s or JC Penney survive this. Now that isn’t necessarily a bad thing and these once well-regarded names have been on the brink for some time. But if those names don’t make it, what chance does a small retailer have? These loans the Treasury and Fed are doling out via the banks are going to be more than a little risky.

What other changes will we see? Will people be willing to jam themselves into arenas to watch pro basketball? Will they attend as many concerts? What about schools? How many parents will decide that homeschooling actually worked pretty well, especially if one of the spouses has lost a job? What will companies do with their supply chains? Will they bring more manufacturing back to the US? What kind of investments will that require and where will the capital come from?

The point is that the recovery on the other side of this, whenever that is, looks very messy at best. It will take time to rebuild whatever doesn’t make it and adjust to new patterns of investment and consumption. The economy two or three years down the road may look a lot different than it did at the beginning of this year. And markets haven’t even begun to digest those changes.

For now, I am concentrating on the trends in the markets as they are. I think a lot of people are still clinging to the idea that this is just a correction – a really deep one but still – and that things will go back to “normal”. Let’s be clear about the stock market. The short-term trend is down. The intermediate-term trend is down. And the long-term trend is still up but tenuous at best. At the lows last week, the S&P 500 had given up all its gains back to 2016. If this market falls as much as the last two bear markets it will give up all gains back to 2013.

And that is a point to remember. In the last two recessions, the S&P 500 fell about 50% at the lows. This recession will be worse than either of those. Why wouldn’t we expect stocks to fall at least that far again? Will the policy response really be more effective than last time?

Right now, the only things in an uptrend are Treasuries and gold. There seems little reason to think that is about to change although both trends are extended and vulnerable to pullbacks. That would require though that we get some kind of good economic news. The Fed may have arrested the fall but interest rates – real and nominal – are still falling. That is evidence that growth expectations are still falling.

This bear market seems unlikely to end soon absent a compelling treatment or cure for COVID-19. That isn’t out of the question obviously and with every pharmaceutical company and doctor working overtime to figure it out, I’d love to be surprised. But hope isn’t a strategy and I expect this recession and bear market to be a marathon, not a sprint. Last week’s rally was nice but unlikely to signal anything other than noise.

Stay In Touch