It’s nothing more than pedigree, having little to do with actual performance. Central bankers are given a level of respect and even admiration suited only to their job title. As such, they travel the world as honored guests to fulfill the insatiable demand for their takes on essential matters no matter how far off the mark.

Only rarely is there occasion for useful information.

One of those was August 2014. Stanley Fischer who was then Vice Chairman of the Federal Reserve found himself in Sweden. Because his audience was Swedish and not American or even English-speaking perhaps he felt a freer hand at being honest. Whatever the reason he told them what he would never say here.

Year after year we have had to explain from mid-year on why the global growth rate has been lower than predicted as little as two quarters back. Indeed, research done by my colleagues at the Federal Reserve comparing previous cases of severe recessions suggests that, even conditional on the depth and duration of the Great Recession and its association with a banking and financial crisis, the recoveries in the advanced economies have been well below average.

In the aftermath of the Great “Recession” they never saw coming, the same worthless policymakers kept promising the world they’d make up for it by ensuring recovery. QE’s and whatnot, by and large populations around the globe were willing to lend officials that chance, extending a huge benefit of the doubt (given the severity of what had just happened) unearned by the crisis performance.

More than that, people stayed patient for years and that patience was repaid with overpromises and lack of transparency, indeed a controversial and thoroughly corrupt enterprise intended to hide the truth. There was no recovery; Economists had been wildly over-optimistic about the ability of “stimulus” to, well, stimulate.

Central bankers, in particular, finally figured out how to short-circuit the apology circuit Stanley Fischer rode around the world in 2014 and after: they stopped promising rapid growth.

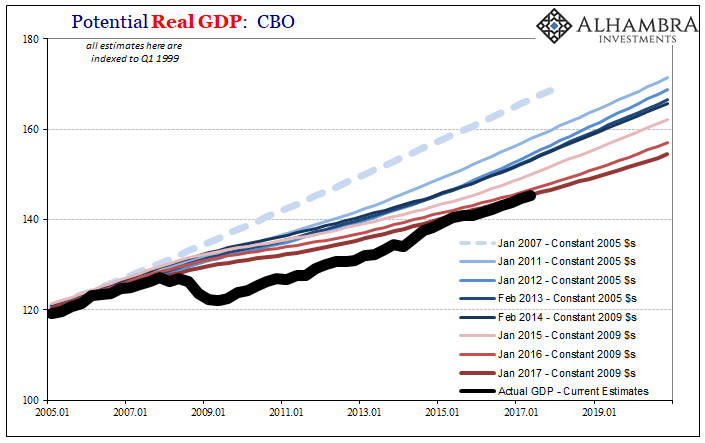

This didn’t mean, however, that they would stop pledging recovery. Quite insidious, with more than a sprinkle of disingenuousness, the world’s policymakers simply rebranded the “growth” Stanley Fischer was apologizing for as the recovery (see: above).

If you set the bar way low and claim it’s the same thing, with a bunch of regressions and math-y sounding phrases (like R*) behind the effort, who would know the difference? For a bunch of Economists, quite clever.

The need to relitigate the aftermath of the 2008-09 “recession” remains as necessary today; perhaps becoming even more essential in the wake of recent events.

Why?

Recovery. There’s a new financial crisis to replace the last one even though we’ve yet to escape from it. And like the last one, this new one threatens to alter the very course of the global economy. Stan Fischer would even admit as much in Sweden in 2014, “Its depth and breadth appear to have changed the economic environment in many ways and to have left the road ahead unclear.”

The IMF has released its first post-GFC2 batch of econometric guesses. The April 2020 World Economic Outlook (WEO) is intriguingly shortened as to its outlook. Apparently, these Economists are reluctant to look out much past next year whereas in years past they’d happily model inaccurately long into the “long run.”

You wouldn’t know it from the figures, but uncertainty is the theme. Quite the point, I imagine, since it is obviously deemed more advantageous for these Economists to project the best case in numbers and then hedge them on the downside in words and footnotes. Knowing most people will see only the charts and graphs rather than heed any caveats, the IMF like the Fed seeks only to get through the short run without as much righteous public anger.

Better to figure out who the next Stanley Fischer will be to send out and apologize to overseas audiences somewhere around 2025 or so. Admitting another major break in trend right now is being treated as official suicide.

And in that way, it is unnecessary economic suicide. For a second time.

The IMF’s 2020 estimate is sobering; for the entire global economy real GDP is now expected to decline by an unreal, 1930’s-style -3%. For the entire year, not just Q2.

Once we get out of this mess, however, for 2021 real GDP growth explodes to +5.8%. Halleluiah! All we need is some (more) patience?

As wonderful as it looks on a chart, it all unravels from there. Starting with the words:

In a baseline scenario–which assumes that the pandemic fades in the second half of 2020 and containment efforts can be gradually unwound—the global economy is projected to grow by 5.8 percent in 2021 as economic activity normalizes, helped by policy support. The risks for even more severe outcomes, however, are substantial. Effective policies are essential to forestall the possibility of worse outcomes… [emphasis added]

Yeah, OH SH$% yet again.

For this unusually rosy “baseline” scenario, it’s actually really bad. To begin with, to achieve this +5.8% rebound in 2021 the IMF models assume China is going to be gangbusters. They project Chinese real GDP growth to dip down to +1.2% for all of 2020 before rising nearly 10% in 2021.

As if China was basically fine in 2019.

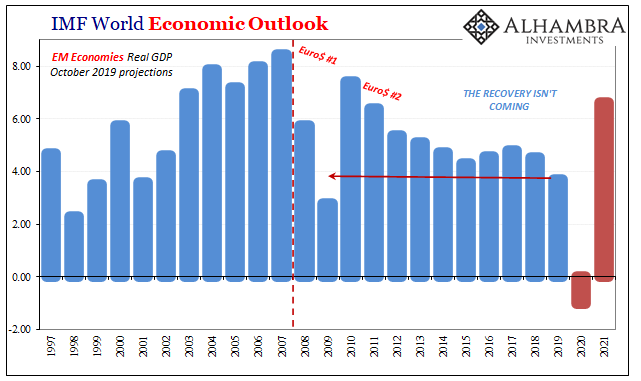

Thus, EM growth is being scheduled to drive the anticipated global recovery – just like last time.

As thin as that “baseline” scenario already is, that’s actually the only good news in the April 2020 WEO.

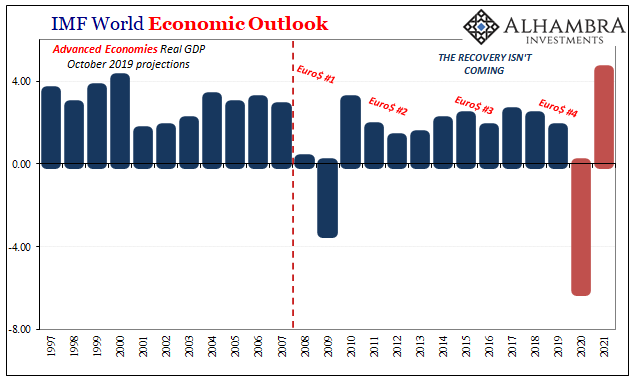

What about the developed world, the United States and Europe? Big trouble – as the optimistic case. The IMF’s simulations point to -6.1% real GDP for the calendar year 2020, besting 2009 by a substantial margin.

The real horror-show is 2021, only a partial rebound of +4.5% following the collapse.

Like China, it’s not like the US was in good shape in 2019 (some might recall Jay Powell being pressured by Euro$ #4 into three rate cuts in the middle of last year). Europe was already on the verge of recession, having been caught up in a substantial two-year downturn these same models neither saw coming nor properly identified.

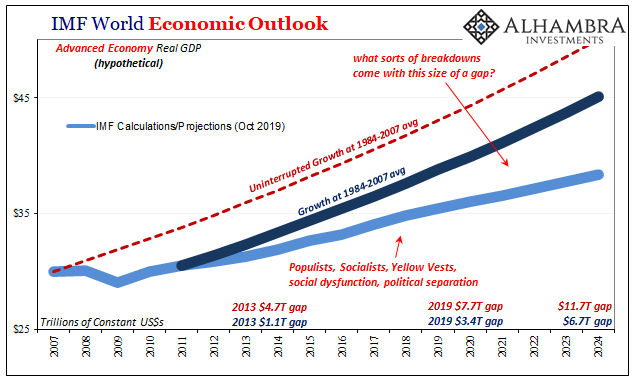

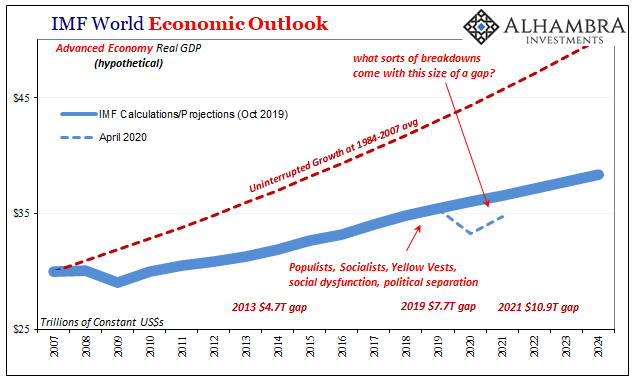

And the chart above makes it look better than it really would turn out to be. Up to this year, the global economy had fallen so far behind that the gap to healthy conditions transcended human beings’ limited ability to comprehend such massive numbers – the very stuff behind Stan Fischer’s sorry.

Throw another GFC into the mix and…

The IMF merely hoping that should everything fall perfectly into place, no more setbacks, and stimulus, for once, actually stimulating quite a lot, that by the end of next year the world’s advanced economies, the engines for global demand especially for which the emerging world still strives to produce, we are going to end up substantially further behind than we already were. More serious long run damage.

As the “baseline” case.

It actually doesn’t help that these models are constantly wrong. The mistakes are always made in only the one direction. They start by forecasting a “V” having established they’ll be apologizing for the eventual, perhaps inevitable “L.” This run of simulations, however, doesn’t even begin with a full “V.”

Maybe this time, some of the future expressions of regret will be genuine. That’s about the most we can hope for in terms of progress and recovery.

Stay In Touch