It was chaos. Rumors of not one but two large European banks being pushed to the brink. Money market funds worried about breaking the buck rapidly pulling cash out from under any global name. The FOMC debating what would’ve been a repo-like bailout, even though $1.6 trillion of bank reserves had been “added” to the system.

What was most damaging about Euro$ #2 when it showed up in the middle of 2011 was probably how it took place so close to Euro$ #1. Ben Bernanke, most of all, had performed disastrously during GFC1 (also Euro$ #1) and yet the world had been eager to give the man a second chance. And he was blowing it.

The bench was short and his name had been all there was available. For the vast majority, he came up with what sounded like it could work. Quantitative and easing, most willing to wait and see how this QE thing worked out. Didn’t take long for an answer.

Financial markets (real markets, not the NYSE) following GFC1 were never that placated. There had been some wishing it might be real, a minor lift in credit and balance sheets that didn’t quite make it to the level required for recovery. Then 2010 and suddenly QE2.

By 2011 and full-blown Euro$ #2, banks had seen enough.

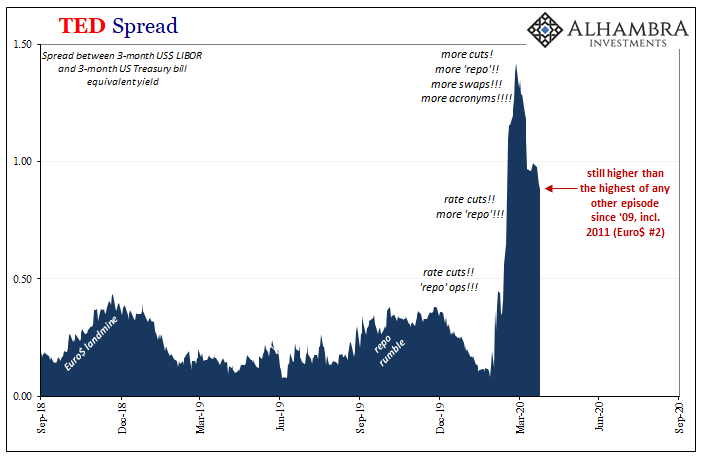

During this fatal blow, an unqualified global crisis, the TED spread blew out all over again. Though it would never reach proportions like those 2007-09, it was more than enough to create broad disorder despite QE’s byproduct of bank reserves. Related to money market funds but not exclusive of their liquidity-draining behavior, 3-month LIBOR surged and awakened the system to the prospects of unzipped ZIRP.

The Fed said $1.6 trillion in bank reserves was money printing floods of liquidity, while LIBOR rose into the wider, obvious Euro$ #2 crisis, together they showed how that wasn’t anything other than myth. On the other side of things, especially repo, T-bill rates sank down to just about zero.

Since the TED spread is the difference between those two rates, 3-month LIBOR and the 3-month T-bill yield, with those rates diverging it jumped as a consequence. By the end of the year, the beginning of 2012, TED had reached a spread near 60 bps, a high enough level to startle Ben Bernanke, Mario Draghi, and the rest of the world – at least the parts of it paying attention (meaning those outside the central bank cult still fixated on QE’s massive pile of inert, ultimately useless bank reserves).

For all that chaos and trouble, for all that it made central bankers do in response, as nasty as it came to be, at no point during Euro$ #2 did TED get past 60 bps. Settling in the 50s was more than enough of a shock.

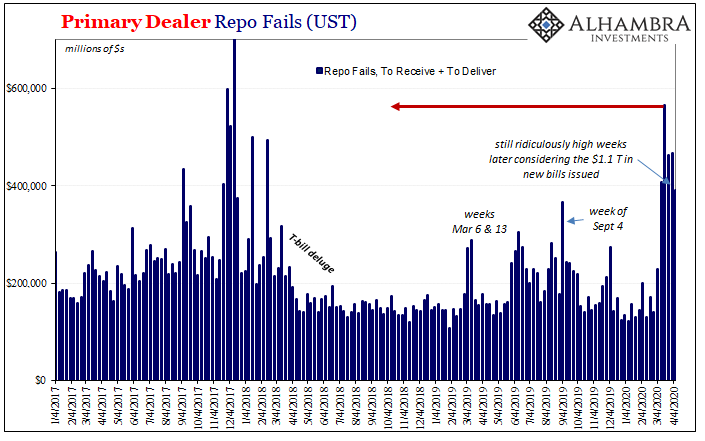

Yesterday, there were celebrations, of sorts, over how 3-month LIBOR has come back down below 1% for the first time since March 16. Getting as high as 1.45%, this is being interpreted as some kind of milestone, proof positive that the Fed’s latest “flood” of “liquidity” is working. Thank God for Jay Powell!

With only a little bit of math, and knowing where the 3-month T-bill currently yields, an obscenely low 11 bp despite a month of issuance for the record books, that leaves the TED spread at 88 bps – far and away still higher than any other time since GFC1.

Rather than being encouraged, even enthusiastically optimistic over how LIBOR is declining, you should be seriously unnerved by its conspicuously deliberate pace. Think about it, for a month with the greatest “money printing” program ever conceived, this is all you got?

Uh oh.

I write that because LIBOR’s behavior over the past few weeks is out of place for normal times, as well as those abnormal times when central banks are being effective. This slow-moving minor reduction is, however, perfectly at home for those periods accurately described as a global crisis beyond all reach of the current central bank model.

Such as GFC1.

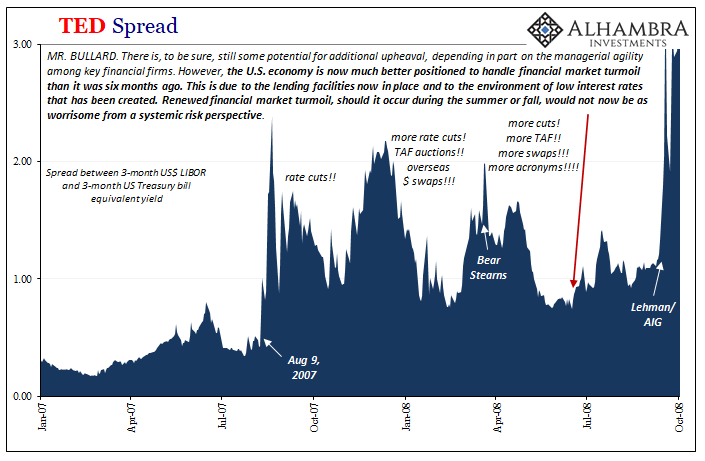

There were three large swings in LIBOR rates during just the first half of GFC1 (above). Following each, Ben Bernanke’s Fed was wildly celebrated in the media (while congratulating itself) for successfully intervening with what was, and always is, described as a flood of new accommodation and liquidity. There’s no limit to the Fed’s power, apparently, just don’t expect for it to translate into actual results.

Each of those “floods” were easily overwhelmed and quickly forgotten. Up went TED, sparking new fears and leading to more action, and then down it went uncorking champagne bottles and near euphoria alike. Only to rise up yet again a few months or even just weeks later.

Thus, what needs to stand out for you on the chart above – as it did in the crisis perceptions of these deep monetary participants (that’s what LIBOR is, the banking system responsible for the monetary system telling you what it thinks about what’s really going on in the monetary system as it relates to everything else) – is that TED, from LIBOR, never normalized; the spread receded a bit at times, but it never made its way back down to pre-crisis.

It never had the chance. That’s the thing; while it may have seemed like the Fed was being effective at these intervals when TED like LIBOR was coming down, it was mere appearance; other factors being attributed to the myth. Underneath, still smoldering were all the same misgivings and irregularities about a system constantly under pressure.

That pressure never went away; it would flare up and then calm back down, the zig zag, ebb and flow of every major crisis in history – never once dissipated fully or even substantially. It was a fragile system put on display for everyone to see just in TED and LIBOR. The Fed and its “floods” of “accommodation” and “liquidity” were nothing more than a puppet show attributed magical properties it never possessed.

This was the key, not the central bank. FRAGILE. In the eurodollar system, there’s just nothing any central banker can do to coax or force it out of that state. They only pretend to be able…for a while.

Eventually, as we all know, September 2008 erased Ben Bernanke’s prior kudos. He hadn’t managed to fix a single thing, the entire global monetary system continued in its weak and frail state right up to March 2009 no matter what any of them would try, no matter what large numbers assigned along the way. Abundant reserves, they even said.

And now we have a similar pattern playing out before our very eyes, a GFC2, starting with all those lining up to shake Jay Powell’s hand while telling him what a wonderful job he’s done – never mind all that stuff in the first half of March. As if this thing is all over with, and Ben Bernanke’s horrific 2008 experience and track record never happened.

Yes, LIBOR is falling but that so doesn’t mean what you are led to believe it means. TED’s not dead, he’s just taking his usual break while Jay tries to figure out how not to be Ben.

And that’s just where this ongoing saga gets going…

Stay In Touch