It’s a behavioral shift, one we’ve seen before. Misunderstood because of idiocy like QE, even those who’ve undergone the change fail to appreciate the deeper meaning behind it. Not just at the firm-level, more so systemically. GFC1 had left everyone, even the best of businesses, essentially stranded fighting for their lives. Lost revenue was secondary to daily survival.

Liquidity.

Among the grandest of victims caught up in the debacle was Warren Buffett’s Berkshire Hathaway. He learned from the first time we did this how the Fed’s alleged backstop is no dependable source:

Charlie and I never will operate Berkshire in a manner that depends on the kindness of strangers – or even that of friends who may be facing liquidity problems of their own. During the 2008-2009 crisis, we liked having Treasury Bills – loads of Treasury Bills – that protected us from having to rely on funding sources such as bank lines or commercial paper. We have intentionally constructed Berkshire in a manner that will allow it to comfortably withstand economic discontinuities, including such extremes as extended market closures.

Buffett was hardly alone, though he may have been the most honest. It wasn’t just banks who built fortress balance sheets, companies up and down the line did so, too. A surplus of liquid assets forever forward and the downgrade of risk-taking that would require. Above all, it meant a harmful focus on controlling costs to the detriment of the labor market and economy.

Nice going, Bernanke.

Ironically, it was Buffett who in 2011 had been among the more vocal bond bears. Not realizing the implications of what he himself had done with his business, and misunderstanding what the Fed hadn’t actually accomplished with their monkey business, the Oracle of Omaha strayed too far out his equity comfort zone.

I would recommend against buying long-term fixed-dollar investments. If you ask me if the U.S. dollar is going to hold its purchasing power fully at the level of 2011, 5 years, 10 years or 20 years from now, I would tell you it will not.

Nearly ten years after his prediction, the dollar’s not dead instead zoomed into a much higher part of the stratosphere while record high prices for all those safety instruments Warren still loves to use. All these things are connected; a high level of liquidity preferences, the low level even lack of economic growth to provide opportunity, and therefore the seemingly unstoppable rise of the dollar and Treasuries (prices). But you can’t see it if you think the Fed is a(n effective) central bank.

Really, all various facets of the same thing courtesy of Ben Bernanke’s fiction that was accepted across the mainstream media despite all this evidence, and surplus of anecdotes, otherwise. It’s understandable in a way; I mean, even Warren Buffett can’t put all the pieces together (and he’s no simpleton grandpa like he’s often portrayed, instead one of the sharkiest financial sharks of all time).

That’s how bad a job Economics has done for the public, leaving for most people a high degree of illiteracy. There’s no workable let alone reasonable frame of reference for people to interpret what they actually see. Instead, Alan Greenspan and his absurd series of one-year forwards still rules the conventional view when it should’ve been DOA.

At the same time, however, rising dollar, rising Treasuries and the ultimate question remains: how much of a self-insured liquidity cushion is enough? This is no static answer; for if you, as a corporate CFO, might’ve been OK with your position in, say, late February 2020, how about now?

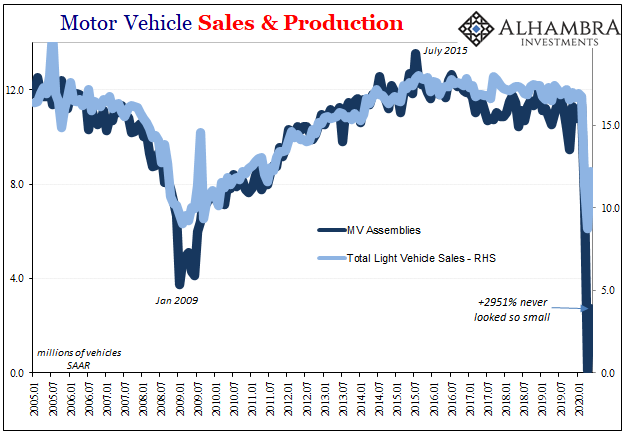

I can’t help but see the auto industry’s plight in attempting to deliver part of this answer. Auto production, worldwide, is still near to zero. Sales are very low, but they aren’t that low.

The answer, I think, comes down to cash and liquidity most of all.

There’s more than just COVID-19 in these numbers, especially autos where especially liquidity and cash for working capital is crucial. Inventory + lack of liquidity = going out of business fire sales. Preserve cash at all costs, even if it means shutting everything down in every manufacturing location. Temporarily, of course.

The Big “D.”

According to the Federal Reserve’s updated figures on Industrial Production, Motor Vehicle Assemblies were up 2951% in May 2020 from April. The most gigantic positive yet. Part of it was due to a further downward revision to the prior month, the level was actually cut by half, but mostly because after the revision assemblies in April had been down by 98.8% from March.

Two thousand nine hundred and fifty-one never looked so minuscule.

As with Mexico, Brazil, and many others, the question is, why? Inventory is definitely a huge consideration but so might be the anti-flood implications behind the ongoing high-level use of the Fed’s central bank liquidity swap lines (among other things).

To put it as succinctly as I can: what flood? Only one of those below can be right. Don’t listen to what Jay Powell or even Warren Buffett says, it’s what they all actually do.

Stay In Touch