———WHERE———

AlhambraTube: https://bit.ly/2Xp3roy

Apple: https://apple.co/3czMcWN

iHeart: https://ihr.fm/31jq7cI

Castro: https://bit.ly/30DMYza

TuneIn: http://tun.in/pjT2Z

Google: https://bit.ly/3e2Z48M

Spotify: https://spoti.fi/3arP8mY

Breaker: https://bit.ly/2CpHAFO

Castbox: https://bit.ly/3fJR5xQ

Podbean: https://bit.ly/2QpaDgh

Stitcher: https://bit.ly/2C1M1GB

Overcast: https://bit.ly/2YyDsLa

PocketCast: https://pca.st/encarkdt

SoundCloud: https://bit.ly/3l0yFfK

PodcastAddict: https://bit.ly/2V39Xjr

Dick Costollo said, “Me-first capitalists who think you can separate society from business are going to be the first people lined up against the wall and shot in the revolution. I’ll happily provide video commentary.” Jeff Snider explains the historical context of Marxist agitation against Capitalism.

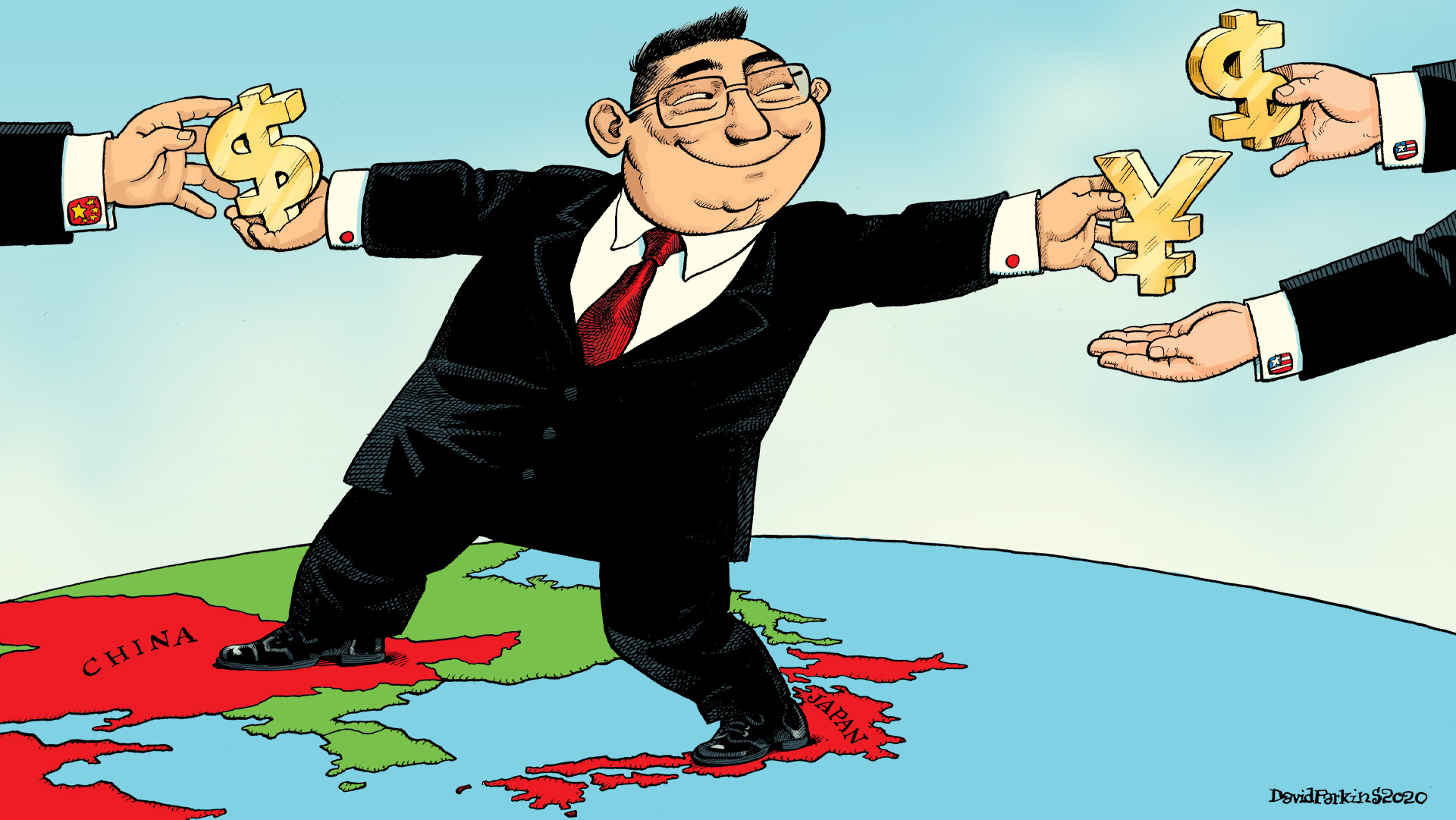

[Emil’s Summary] Advanced-economy money centers make the world go round. In the early 1800s London and Paris funded globalization cycles. Berlin and Vienna joined the exclusive club as the century waned; New York at the start of the next. Today, East Asia’s cities are members, including Singapore and Hong Kong. But the 800-pound sumo wrestler of the Pacific basin is, and has been, Tokyo.

Some speculate it was there at the beginning of the eurodollar, putting overseas dollars, held by WW2 service members, to work. The subsequent, multi-decade growth miracle established Tokyo’s financial prowess. The 1980s brought disturbance early – the LDC Crisis – and euphoria later – the baburu keiki. When the bubble burst Japan’s dollar borrowings from US banks dropped by more than three-quarters by the end of the 1990s.

Then, in 1999, the Bank of Japan implemented the first modern zero interest rate policy. In 2001, the first quantitative easing. From it’s 1999 low Japan’s dollar borrowings from US banks doubled by 2004. Then doubled again by 2009. Then doubled again by 2011.

In part three of this, the 29th episode of Making Sense, Jeff Snider explains Tokyo’s role in the rise of a synthetic dollar empire and how disturbances within it, in early-2014 and late-2017, set off the third and fourth eurodollar crises. But first, thoughts about the rising appeal of socialism and words about the modern-day monetary tension between the ideas of 18th-century Scottish philosopher David Hume and 19th-century American financier Jay Cooke.

———WHEN———

01:07 D. Costollo, ex-Twitter CEO, says when the revolution comes certain capitalists to be shot

01:44 What flavor of revolution is Costollo associating himself with?

02:45 Capitalism first. Revolution second. Socialism last. Marx believed capitalism would expire

05:58 Marxism is not uniform, it has several denominations

07:50 Can Capitalism ever run out of workers? Or might it push wages below subsistence levels?

11:28 How did Antonio Gramsci resolve Marxism’s anticipated global revolution that never came?

13:33 Gramsci appears to have been successful in his call for counter-CULTURAL revolution (first)

———WHAT———

There Have Long Been Too Many ‘Have Nots’ In the U.S.: https://bit.ly/3l4GX5F

The context behind Dick Costollo’s Tweet: https://on.ft.com/3lddCpL

Who was Antonio Gramsci: https://bit.ly/36vWcAr

Alhambra Investments Blog: https://bit.ly/2VIC2wW

RealClear Markets Essays: https://bit.ly/38tL5a7

Stay In Touch