———WHERE———

AlhambraTube: https://bit.ly/2Xp3roy

Apple: https://apple.co/3czMcWN

iHeart: https://ihr.fm/31jq7cI

Castro: https://bit.ly/30DMYza

TuneIn: http://tun.in/pjT2Z

Google: https://bit.ly/3e2Z48M

Spotify: https://spoti.fi/3arP8mY

Breaker: https://bit.ly/2CpHAFO

Castbox: https://bit.ly/3fJR5xQ

Podbean: https://bit.ly/2QpaDgh

Stitcher: https://bit.ly/2C1M1GB

Overcast: https://bit.ly/2YyDsLa

PocketCast: https://pca.st/encarkdt

SoundCloud: https://bit.ly/3l0yFfK

PodcastAddict: https://bit.ly/2V39Xjr

———HOW———

29.2 Copernicus, Hume, Cooke & Ice Cube ‘talk’ Money

Over the ages legendary philosophers have offered their thoughts on the nature money. This episode focuses on two – David Hume and Jay Locke – whose ideas, though diametrically opposed, are both true. Also, Antonio Gramsci, Milton Friedman, Nicholas Copernicus and Ice Cube weigh in.

———WHY———

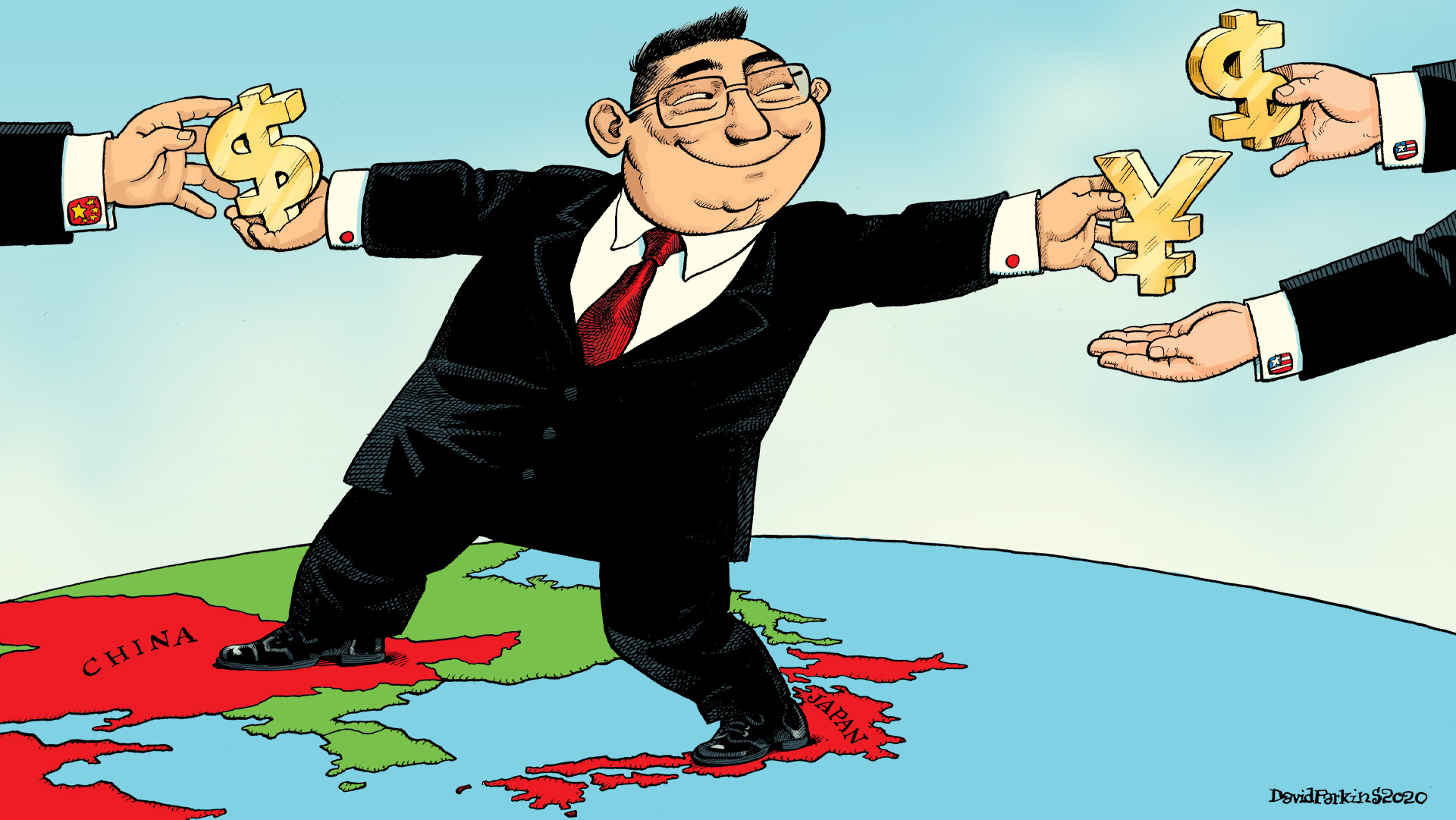

[Emil’s Summary] Advanced-economy money centers make the world go round. In the early 1800s London and Paris funded globalization cycles. Berlin and Vienna joined the exclusive club as the century waned; New York at the start of the next. Today, East Asia’s cities are members, including Singapore and Hong Kong. But the 800-pound sumo wrestler of the Pacific basin is, and has been, Tokyo.

Some speculate it was there at the beginning of the eurodollar, putting overseas dollars, held by WW2 service members, to work. The subsequent, multi-decade growth miracle established Tokyo’s financial prowess. The 1980s brought disturbance early – the LDC Crisis – and euphoria later – the baburu keiki. When the bubble burst Japan’s dollar borrowings from US banks dropped by more than three-quarters by the end of the 1990s.

Then, in 1999, the Bank of Japan implemented the first modern zero interest rate policy. In 2001, the first quantitative easing. From it’s 1999 low Japan’s dollar borrowings from US banks doubled by 2004. Then doubled again by 2009. Then doubled again by 2011.

In part three of this, the 29th episode of Making Sense, Jeff Snider explains Tokyo’s role in the rise of a synthetic dollar empire and how disturbances within it, in early-2014 and late-2017, set off the third and fourth eurodollar crises. But first, thoughts about the rising appeal of socialism and words about the modern-day monetary tension between the ideas of 18th-century Scottish philosopher David Hume and 19th-century American financier Jay Cooke.

———WHEN———

00:05 Philosophers and the nature of money.

02:07 David Hume’s essay “Of Public Credit” – encouraging government austerity

03:53 Jay Cooke’s contention that government debt added to the nation’s wealth

06:14 Both Hume and Cooke are correct – simultaneously. It depends on the circumstances.

09:32 What would Jeff Snider do to fix the monetary order?

13:03 Ice Cube states that the US created $3 trillion in money with no inflation; so keep at it

———WHAT———

Before Hume, Before Carnegie: https://bit.ly/3iqcg99

Ice Cube Tweet: https://bit.ly/2Gd9JCt

Alhambra Investments Blog: https://bit.ly/2VIC2wW

RealClear Markets Essays: https://bit.ly/38tL5a7

Stay In Touch