Trump or Biden? Will we even know tomorrow? Many purport that markets are leaning one way or the other, typically based on whichever market leaning puts whatever preferred candidate in the most favorable light. Everyone’s a winner in the run up.

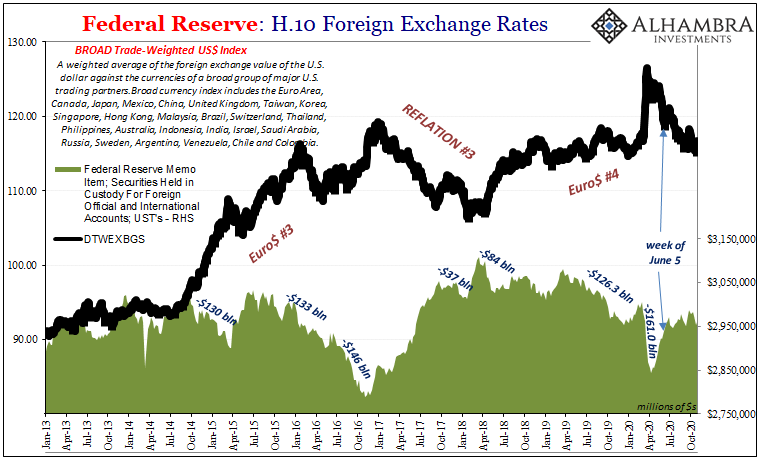

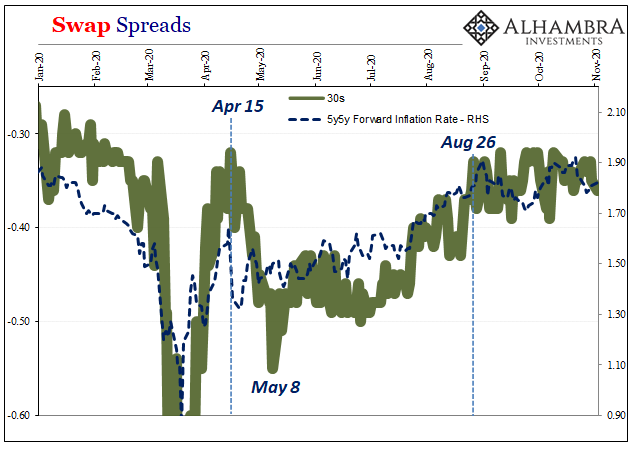

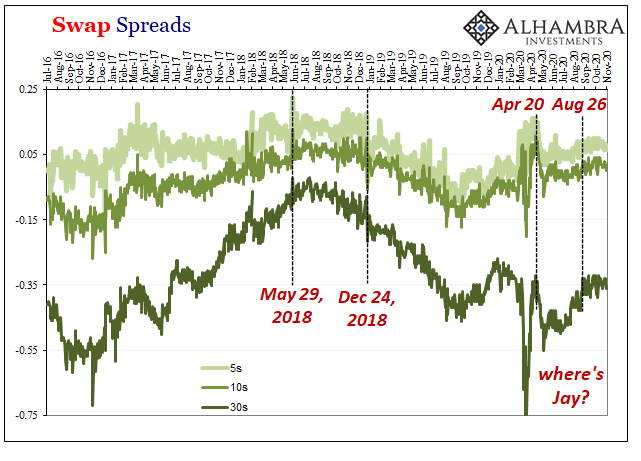

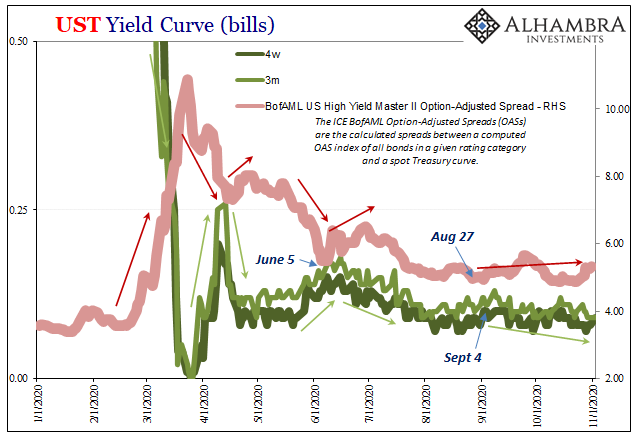

I don’t think there’s a lot of trading that goes with either candidate. As things stand right now, from what I see it’s absolutely still all about August 27 (as that followed June 5). Since then, whatever’s been leaning has been leaning toward the rising dollar “stuff”; or at least no longer in the reflationary direction.

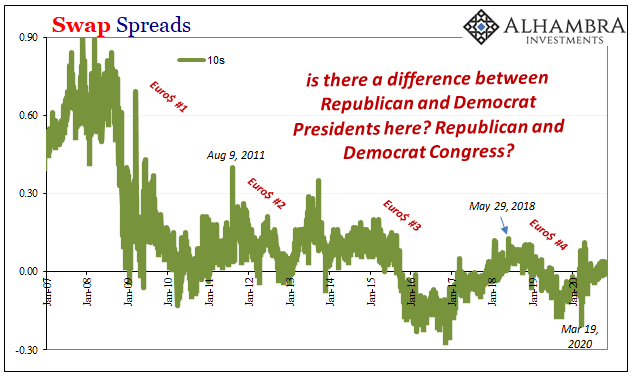

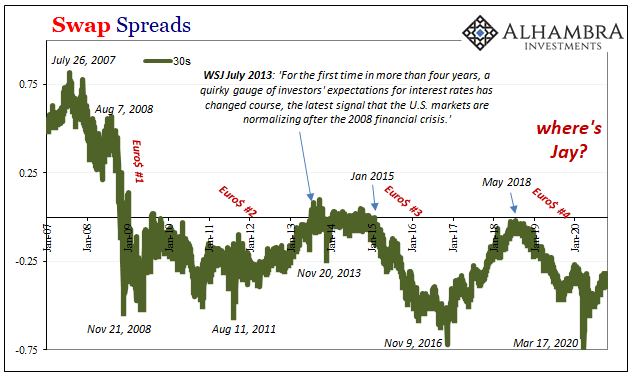

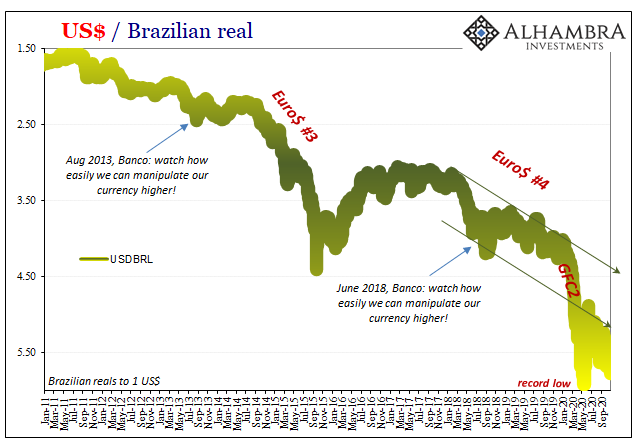

What does August 27 have to do with the Presidential election? It’s one of those dates that shows up in far, far too many places to have been something like random noise, and it doesn’t align with the bickering. This day, like May 29, 2018, sticks out for other, dollar-related reasons.

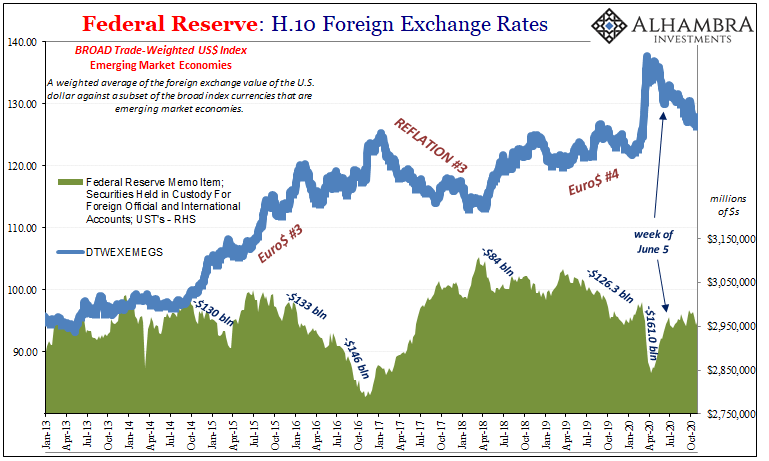

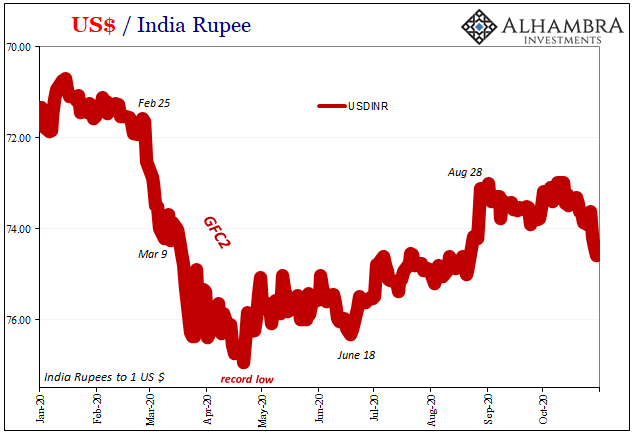

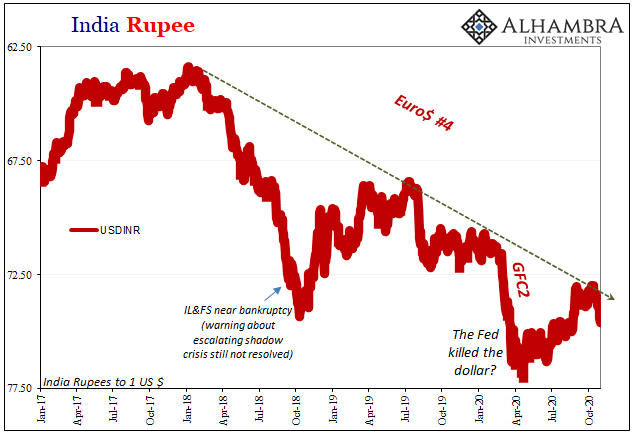

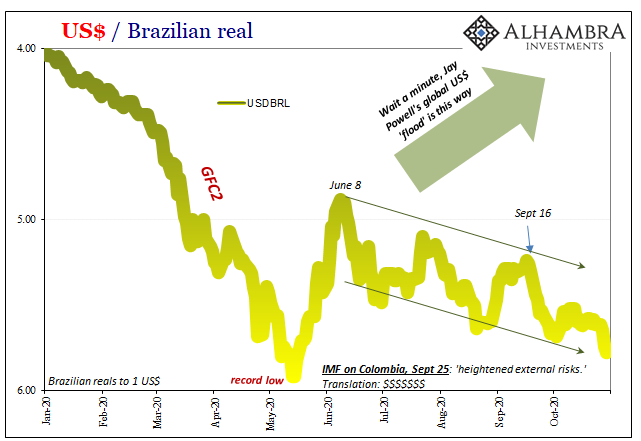

The dollar is back to being higher against what I’d consider leading currencies, Brazil’s (nearing record low) and India’s (multi-month low). Behind both of those as well as the rest of the not-dollar-crash currency exchange values is that “stuff” of illiquidity in the global eurodollar regime.

Not just the lack of “flood”, maybe some partial reverse out of reflation-y. Like CNY, there isn’t the return of UST’s into foreign hands (directly below) like we’d otherwise expect out of a real reflation pattern.

T-bills and credit spreads, swap spreads starting at the 30-year maturity and spreading inward to the 10s and even to the 5s. With UST’s in custody of the Fed continuing to be lower, disappearing into the ether of a collateral chain-type system only the Europeans seem to mildly care about it (and are taking the sweet time trying for the first time anywhere to look after), connections to bills, swaps, and other esoteric eurodollar indications.

Does the election – even if it goes smoothly – change anything here? Again, I don’t think any of this has much to do with the political contest. Either way.

That doesn’t mean it can’t nor won’t get volatile in the meantime.

When it comes to partisanship in this country (as well as others), there’s only one thing for certain. This economic and global dollar turbulence is a thoroughly, very lengthy bipartisan failure. Both sides pure suck at it equally, and both sides tell you emphatically how it’s the other’s fault while each does the same thing at alternating turns (let’s have the Federal Reserve Chairman – and only the Federal Reserve Chairman – tell us how well the Federal Reserve is taking care of the economy and the monetary system).

Detest Emperor Xi, sure, but the guy’s got a point.

Stay In Touch