———WHERE———

AlhambraTube: https://bit.ly/

Apple: https://apple.co/

Deezer: https://bit.ly/3ndoVPE

iHeart: https://ihr.fm/31jq7cI

TuneIn: http://tun.in/pjT2Z

Castro: https://bit.ly/30DMYza

Google: https://bit.ly/3e2Z48M

Spotify: https://spoti.fi/

Pandora: https://pdora.co/

Breaker: https://bit.ly/

Castbox: https://bit.ly/

Podbean: https://bit.ly/

Stitcher: https://bit.ly/

Overcast: https://bit.ly/

PlayerFM: https://bit.ly/

PocketCast: https://pca.st/

SoundCloud: https://bit.ly/

ListenNotes: https://bit.ly/

AmazonMusic: https://amzn.to/

PodcastAddict: https://bit.ly/

———WHO———

Twitter: https://twitter.com/

Twitter: https://twitter.com/

Art: https://davidparkins.com/

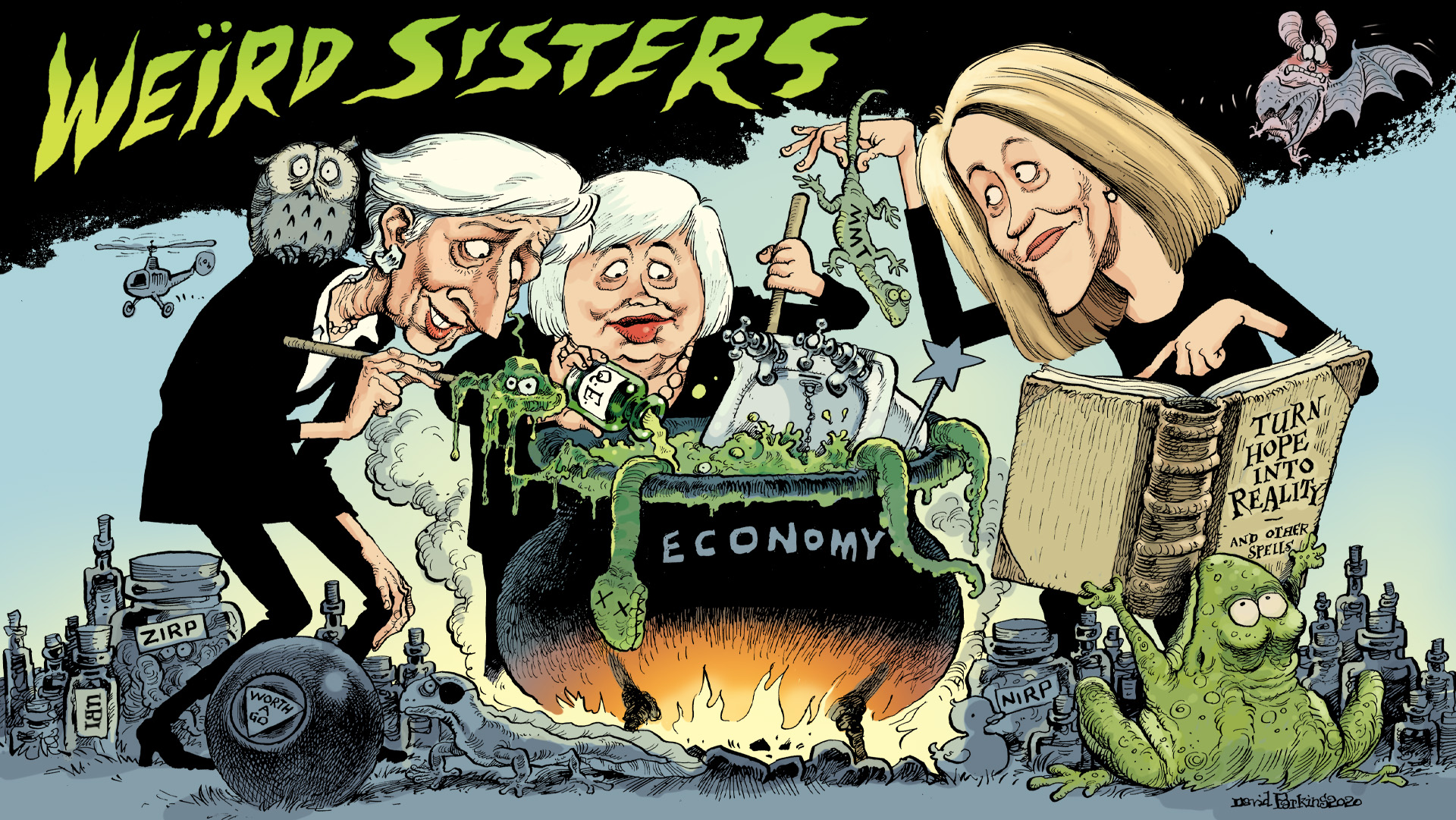

Jeff Snider, Head of Global Investment Research for Alhambra Investments with Emil Kalinowski, tongue-tied by the Atlantic Ocean. Artwork by David “Banquo” Parkins.

———WHY———

38.2 Christine Lagarde: Shaping Pure Wind into Solids

Christine Lagarde, head of the European Central Bank, promises to employ trillions in euro carrots (large-scale asset purchase programs) and sticks (negative interest rates). Seems solid! But modern-day monetary policy, “is designed to… give an appearance of solidity to pure wind.”

[Emil’s Summary] Christine Lagarde, Janet Yellen and Stephanie Kelton are among the world’s best known political-economists. Lagarde, was France’s Minister of Finance, Managing Director of the International Monetary Fund, and is President of the European Central Bank – all firsts for a lady. Yellen, was America’s Chair of the Federal Reserve and is presumptive nominee for US Secretary of the Treasury – each a first for a lady. Kelton, was advisor to the Bernie Sanders 2016 presidential campaign, is a best-selling author, and is the most famous evangelist for modern monetary theory (MMT).

And now these remarkable three are in positions of power and influence to guide the world out of socioeconomic depression. It echoes the 1999 cover of Time Magazine featuring three men — Robert Rubin, Alan Greenspan, and Larry Summers — with the agitated headline “The Committee to Save the World”. Alas, this 38th episode of Making Sense continues the long tradition of unease found in the Western canon regarding the female triumvirate.

Yes, of course The Graces — Aglaea, Euphrosyne, and Thalia — were lovely… but there was the rumor about them spending so much time in the underworld. No need to comment on the Harpies – a triad of vengeful, winged sisters. And who can forget The Witches of Eastwick: Susan Sarandon, Michelle Pfeiffer and Cher? They put your podcaster off cherries for the rest of the 80s. But it is Shakespeare who provides us the incomparable trio: the Weird Sisters. Better understood today as ‘weyward’ or ‘weyard’, they were the Anglo-Saxon Fates responsible for divination and predictions – what we call “economics” in modern day. Don’t take this podcaster’s word for it – listen to the Bard:

<<Macbeth, Act 4, Scene 1:>>

Round about the cauldron go;

In the poison’d policies throw.

Media, that report narrative

Days and nights as quantitative

Sweat inflation running hot

Boil thou first i’ the charmed pot.

Double, double toil and trouble;

Fire burn, and cauldron bubble.

Soul of financial journalist

In the cauldron boil and mist;

UBI of newt and bank reserves,

Wool of bat and control of curves,

Adder’s fork and Janet’s QE,

Lizard’s leg and Kelton’s MMT,

For a charm of powerful trouble,

Like a hell-broth boil and bubble.

Zirp, nirp toil and trouble;

Economy burn, and markets bubble.

———WHEN———

00:05 Christine Lagarde helms the good ship ECB Lollipop with trillions in euro stimulus?

01:59 In September 2019 the ECB had to perform an embarrassing, monetary volte-face: back to QE.

04:31 How does the ECB employ the “current” and “deposit” accounts to carry out monetary policy?

07:52 QE and LSAP are effectively the same; but the former is used as part of a narrative game.

09:08 Ostensibly the ECB conducts a targeted, scientific and data-driven monetary policy…

11:24 The OECD believes that in a best-case scenario the global economy will not return to trend

14:04 Expectations Policy is designed to… give an appearance of solidity to pure wind

17:57 All money is equal, but ECB bank reserves are more equal than other monies.

———WHAT———

Saving Jobs Won’t Save Us From Jaws: https://bit.ly/3mUTGcc

(OECD): Continued fiscal support and public health action needed to make hope of recovery a reality: https://bit.ly/

Alhambra Investments Blog: https://bit.ly/2VIC2wW

RealClear Markets Essays: https://bit.ly/38tL5a7

Stay In Touch