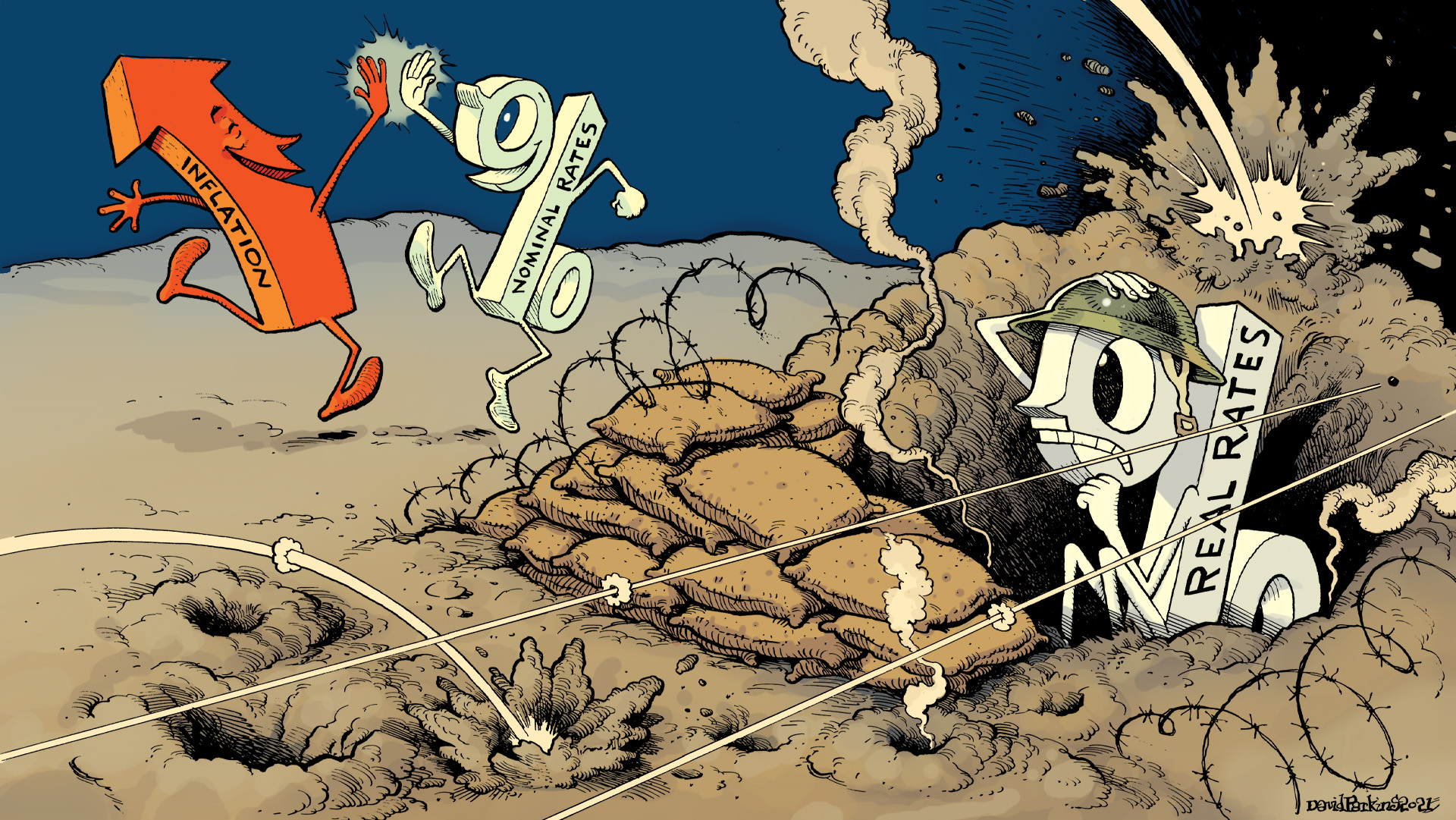

42.1 WSJ Columnist asks Fed: ‘What the…?’

Wall Street Journal columnist Andy Kessler recently spoke with Jeff Snider about central banks and monetary policy. He ended a recent column with, “The least the Fed can do is get out of the way. End QE now”.

[Emil’s Summary] A recent Hidden Forces podcast with Demetri Kofinas featured professor Kevin Vallier and his new book “Trust in a Polarized Age”. Vallier notes that Americans are less trusting than at any point since at least the 1960s. The timing is no surprise to any that read William Strauss and Neil Howe’s The Fourth Turning. The “American High” – a period of confidence during which the society felt it could accomplish anything – ended with President Kennedy’s assassination.

That phenomenon – that lack of trust, that lack of confidence – can be observed even in the University of Michigan survey of consumers. During the 1950s expectations about the future always ran ahead of the contemporary condition; an optimism, whether the present was good or bad, that it would be even better soon. But, by the end of the 1960s, and ever since, expectations are always worse than the present. If we use confidence in democracy as a proxy for trust, that phenomenon is not solely American. A University of Cambridge project that includes 4 million people, covering 154 countries and combines over 25 international surveys showed 2019 to have been “the highest level of democratic discontent on record”. Surely 2020 will rank even worse when results are finally published.

A more granular survey by Gallup has been conducted in the United States since the early 1970s and focuses on public and private institutions. Citizens are asked how much confidence they have in: organized religion, the Supreme Court, Congress, organized labor, big business, public schools, newspapers, the military, etc. Almost at the very bottom are news organizations. The only institution in which the public consistently has less confidence in is Congress, which they recently attempted to burn down.

The financial media is no exception, as Jeff Snider often makes clear in his writings. But just as Vallier expressed hope with Kofinas that trust can be rebuilt and just as Strauss and Howe conveyed confidence that institutional strength is cyclical and will return, so here, in Episode 42, does Snider note that the minority of financial press attempting to be bring truth to power is growing.

———WHO———

Twitter: https://twitter.com/

Twitter: https://twitter.com/

Art: https://davidparkins.com/

Jeff Snider, Head of Global Investment Research for Alhambra Investments with Emil Kalinowski, anonymous. Artwork by David Parkins.

———WHERE———

AlhambraTube: https://bit.ly/2Xp3roy

Vurbl: https://bit.ly/3rq4dPn

Apple: https://apple.co/3czMcWN

Deezer: https://bit.ly/3ndoVPE

iHeart: https://ihr.fm/31jq7cI

TuneIn: http://tun.in/pjT2Z

Castro: https://bit.ly/30DMYza

Google: https://bit.ly/3e2Z48M

Spotify: https://spoti.fi/3arP8mY

Pandora: https://pdora.co/2GQL3Qg

Breaker: https://bit.ly/2CpHAFO

Castbox: https://bit.ly/3fJR5xQ

Podbean: https://bit.ly/2QpaDgh

Stitcher: https://bit.ly/2C1M1GB

Overcast: https://bit.ly/2YyDsLa

PlayerFM: https://bit.ly/3piLtjV

Podchaser: https://bit.ly/3oFCrwN

PocketCast: https://pca.st/encarkdt

SoundCloud: https://bit.ly/3l0yFfK

ListenNotes: https://bit.ly/38xY7pb

AmazonMusic: https://amzn.to/2UpEk2P

PodcastAddict: https://bit.ly/2V39Xjr

———WHEN———

00:51 Some members of the mainstream media are interested in questioning the Federal Reserve.

02:33 Why did Wall Street Journal opinion columnist Andy Kessler reach out to Jeff?

05:41 Is “traditional banking” the same as “deposit intermediation”?

08:23 Collateral rehypothecation takes place 6 to 8 times per asset, according to the Fed

11:01 Singh estimates 6-to-8 turns are reported at quarter end; what about intraquarter?!

14:29 Singh, despite his position and status, struggles to bring light to the monetary shadows

15:19 What happens when you remove a credit card (UST) and replace it with coins (bank reserves)

18:49 Have other central banks stripped their systems of premium collateral (sovereign bonds)?

20:24 Has a central bank stated it will leave on-the-run and short-term securities alone?

21:54 Mr. Kessler draws attention to Jeff’s tone of amazement regarding the Fed’s actions

23:22 Mr. Kessler demands the Federal Reserve “end QE now”!

———WHAT———

How the Fed Stifles Lending: https://on.wsj.com/3bBrqc7

RealVision Caitlin Long Interviews Manmohan Singh: https://bit.ly/2XEx6JW

Alhambra Investments Blog: https://bit.ly/2VIC2wW

RealClear Markets Essays: https://bit.ly/38tL5a7

Stay In Touch