The idea behind post-Georgia reflation is that globally fiscal-led “stimulus” will be enough to fix what’s still wrong. The economy broke down, by choice, last year but with sufficient zeroes behind governments spending around the world, from DC to Brussels and a bunch in between, whatever costs and consequences remaining due from 2020 aren’t going to be unmanageable for 2021.

There’ll be some pain, a little, not much worth getting worried about. That’s the latest reflation narrative.

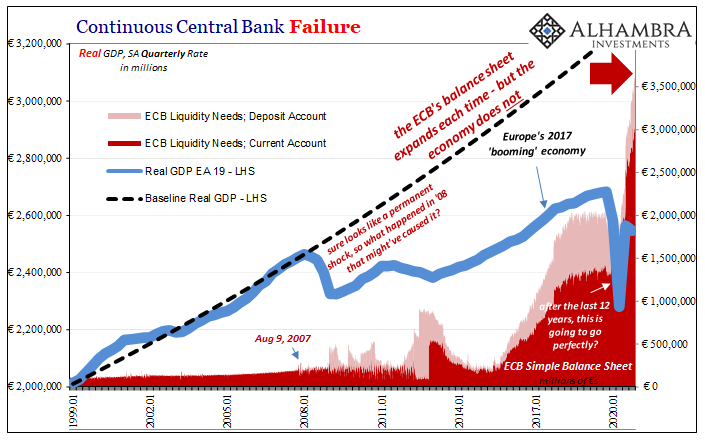

The previous narrative, you might remember, was also “stimulus”-led only that one had come to figure nearly the same number of zeroes should have led to full and complete recovery long before now such that there wouldn’t have to be any pain at all.

That’s what “V’s” can accomplish, except as last ended it was painfully clear the governments couldn’t manage a “V.”

Now it becomes more a matter of time. On the one hand, the longer it takes to mount more than the reopening rebound (as reopening sinks further and further back into ancient history) the more pain will have to absorbed by someone or something somewhere. On the other, reflation says “give it all more time” before rebounding accelerates again.

This time, it’ll work.

It isn’t the first time, though. It’s always left for “next” time because recovery never follows. They say it does, but a roaring real recovery is unambiguous and the global system has been plagued by positive ambiguity ever since 2009. By 2010, even “they” were calling it a “new normal” for a reason.

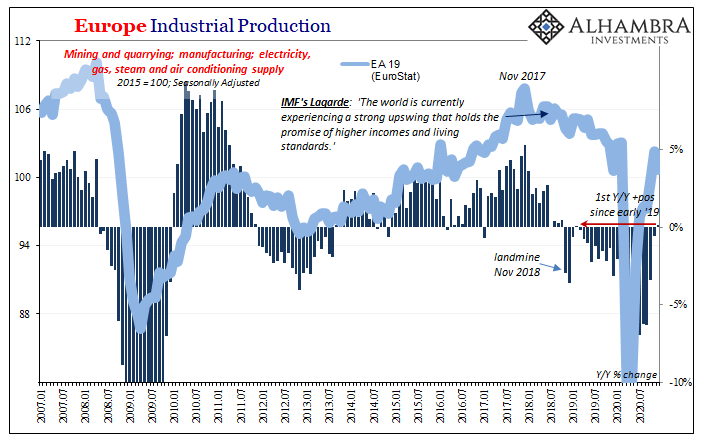

When we examine Europe, it’s easy to see all these things merely repeating. European Industrial Production, for example, during December 2020 managed its first annual rise in almost two years according to yesterday’s Eurostat update from. Matching February 2019’s +0.1%, even a barely positive number to end 2020 makes it seem like the European economy is moving solidly in the right direction.

Give it enough time, and the “stimulus” will find its magic; maybe even a little “too” much if the economy’s this apparently “robust” (that’s the inflation rather than strictly reflation narrative).

But being 0.1% better in December 2020 than overall production had been in December 2019 is instead an example of just how twisted these views have become. To begin with, after the huge decline earlier last year, why hasn’t production come roaring back to make up for those lost months due to the presumably non-economic (pandemic restrictions) imposition?

More so, though, Europe’s economy began the COVID era already stuck in reverse. There had been just over two years of slumping and contracting activity before disease factors. If at the end of 2020 European industry can barely match the end of 2019, that really means being nowhere near the end of 2017, the actual prior peak, let alone threatening to rapidly overtake it in a matter of a few more months. Reflation in the economy of right now doesn’t really come into it; forget inflation entirely.

Just give it another six months?

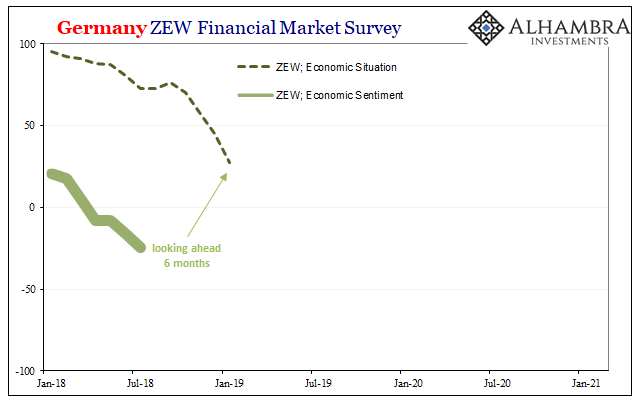

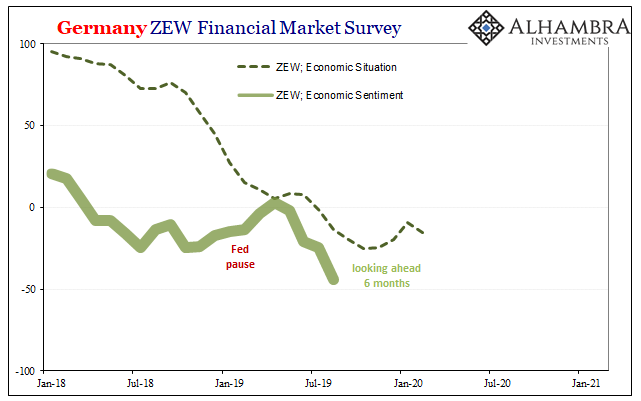

Germany’s Zentrum für Europäische Wirtschaftsforschung (ZEW), as we’ve pointed out many times before, actually measures just this in terms of its “sentiment” index. The survey asks panelists to tell researchers what they believe the relative condition of the German economy (as a proxy for Europe as a whole) will be six months from today.

A separate set of questions, feeding the ZEW’s “situation” index, assesses what the same panelists are thinking about the economy right now. In that way, we might be able to at least get a sense of conventional thinking about future conditions merely by comparing the sentiment index to the situation index half a year further on.

Going back to the beginning of Euro$ #4 (long before “trade wars” entered the deep pool of mainstream excuses), German ZEW sentiment managed to catch the flip out of Reflation #3, correctly predicting at first a downturn that wasn’t just captured in the ZEW situation index 6 months forward, it was also corroborated by a whole range of additional statistics including GDP estimates which today show a “shocking” negative number for Q1 2018 and then only questionable “growth” therefrom.

This sentiment indicator, however, began to “lose” the narrative early in 2019; the ZEW index picked up as central banks around the world, the Fed and Jay Powell’s “pause” most notable among these, rushed to fortify an inflationary liftoff they still claimed was happening – if falling noticeably behind their timetables.

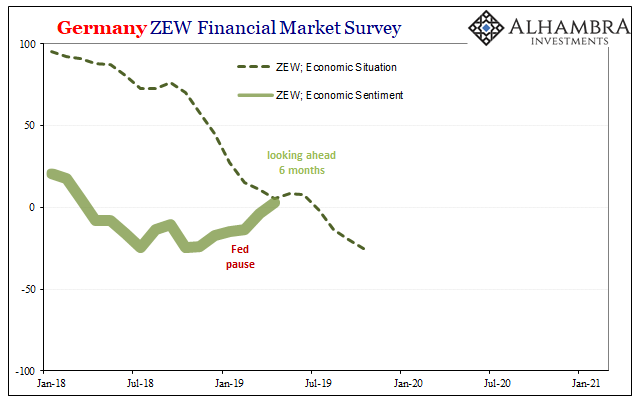

The situation index two quarters beyond showed that wasn’t going to be the case. As Summer 2019 wore on, the global situation had only worsened – in some places, including parts of Europe like Germany, an outright recession had already begun (where GDP had peaked back in Q1 2019).

The sentiment index sank again by August 2019, forecast the German economy being unresponsive to early 2019 central bank “stimulus” (like the Fed’s pause becoming actual rate cuts by the end of that July) and falling into full contraction by 2019’s end.

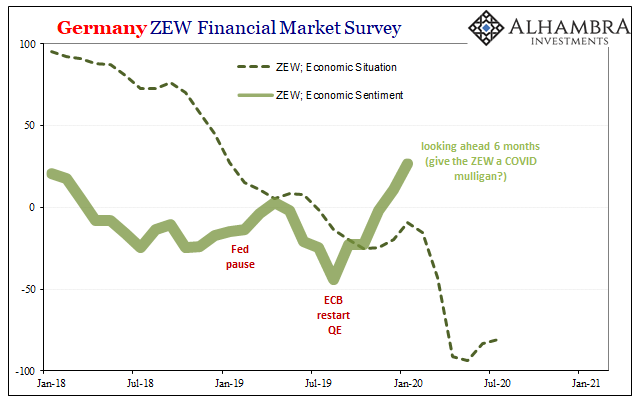

While that was ongoing, the ECB had restarted QE in September 2019 while the world dismissed US$ repo rumbling despite a lack of coherent story or even idea about what it had been, and so far as German (and mainstream) sentiment it grew even more positive for the half-year period beyond the recession forward into early months of 2020 when QE’s influence was expected to have been at full impact.

Obviously, six months forward from the sentiment peak in January 2020 there was no chance. We might forgive the ZEW for not suspecting COVID, give these Germans a pandemic mulligan, though we’d also have to put aside Germany’s recession and the potential it wouldn’t have been solved by QE before the March overreaction to the pandemic.

Once the shutdowns materialized in March 2020, sentiment sank, as it should have, peering ahead six months at a situation that was going to be in bad shape.

Then even more QE, the biggest yet. And if you thought Germans (and the media) had loved 2019’s restart of the PSPP, they double and triple loved the massively upsized PEPP “stimulus” originally begun to ensure the low-pain “V” recovery would near easily take form.

By August 2020, the ZEW sentiment index was into the 70s, surpassing each of the prior highpoints set in 2014 and 2009. It was the most optimistic the panelists had been since 2004!

What were they looking forward to, though? With the latest update for February 2021, released today, the ZEW’s situation figure looks quite a lot like Euro Area and Germany IP (and GDP) as they illustrate the serious struggle actually gripping Europe’s economy. In other words, six months into the future from last August it should have been reaching normal, a clear, realistic pathway plotted and significantly moved forward toward it, yet the Germans like the Europeans continue to be nowhere near anything like that.

The question, therefore, is what had caused sentiment to miss so badly. Most will say it was the second (or third) wave of COVID, therefore an end to the pandemic that will open things up for normalcy and then recovery.

Sure enough, ZEW sentiment grew extremely positive again with more “stimulus” announced back during November along with the introduction of vaccines. As of the latest data for February 2021, this index is back into the 70s again even as the situation continues to be stuck nowhere near rebound let alone reflation.

Is this just the coronavirus?

Only accounting for the last eleven months in isolation, even then it’s not a sure thing the only thing wrong are these non-economic factors related to “imperfect” disease management. All of these numbers, including ZEW sentiment, are a lesson about “stimulus” as well as the tendency for the real economy to always undershoot (for “some” other reasons).

If COVID’s the only problem for Europe, or the rest of the global economy, then sentiment could be onto something for what things could look like 6 months from now. That hasn’t been the case in years, so, looking ahead another six months after the last six months didn’t achieve it, what are the realistic chances for relatively pain-free 2021 because everything goes perfectly this time? How many more mulligans does Europe and the ECB really get?

Stay In Touch