52.3 US Oil Market Update + Texas Power Credit Crisis?

What does the oil market (production, demand, inventory) in the USA tell us about the economic recovery in early 2021? Also, is a power market credit crisis in Texas causing a national run on banking-system collateral?

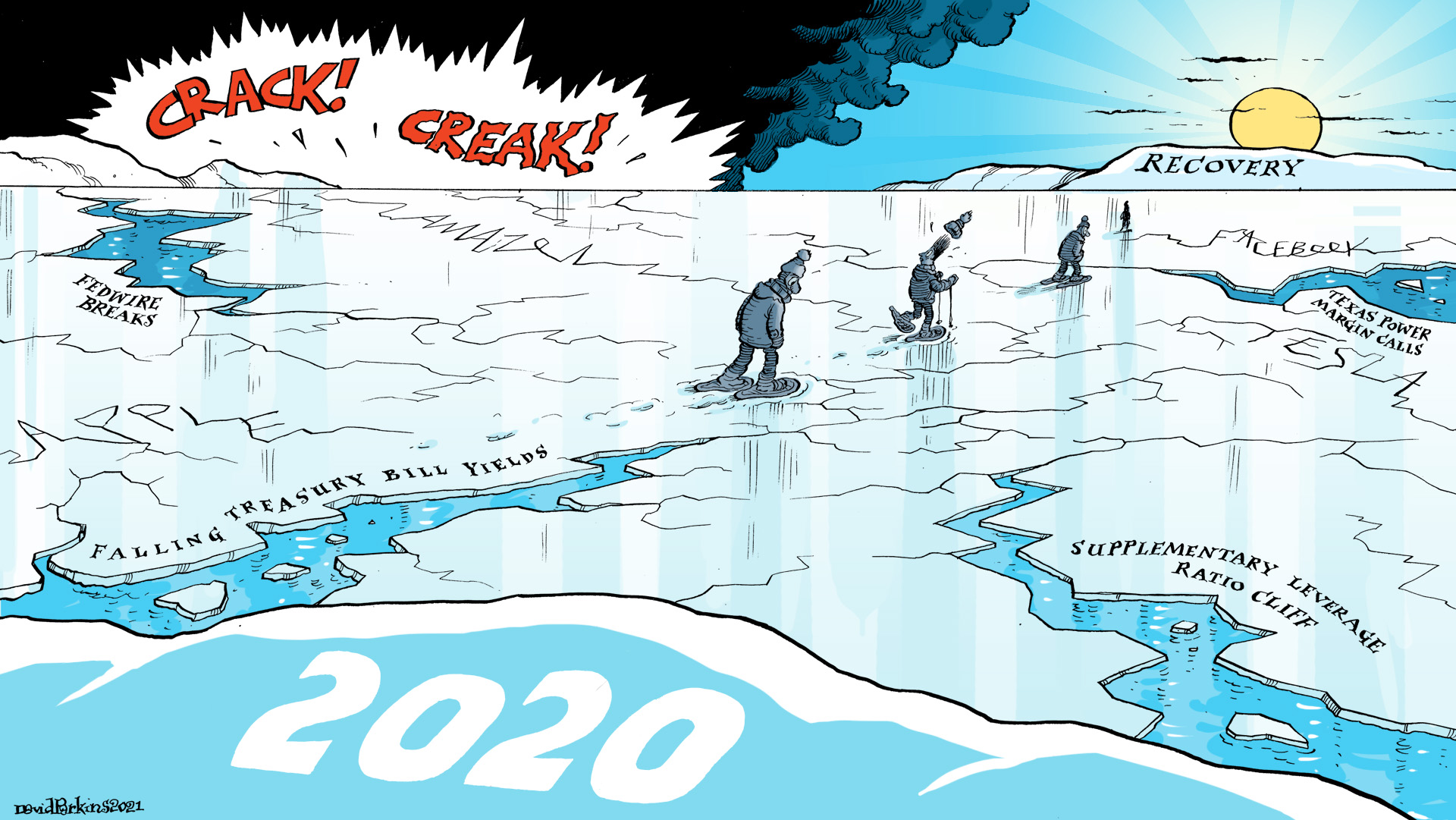

[Emil’s Summary] The theme of Making Sense Episode 52 is how an environment reacts to an anomaly. Resilient systems keep these aberrations constrained. But fragile ones can retroactively redefine what had earlier been labeled as an “irregularity”, “oddity” or “operational error” to something altogether more unsettling: “cause”, “spark”, “trigger”.

In part one Jeff Snider continues his multi-week review of breaks to the smooth functioning of interbank payment and messaging systems. This time a look at a sequence that led to a week-long disorder to Fedwire in August 1990. Part two, also a continuation of a multi-week review, ponders what may be causing the disquieting twist in the US Treasury yield curve. Is the demand for short-term collateral a disqualification of reflation, as was the case during 2013’s so-called Taper Tantrum? Lastly, some words on oil and the developing Texas power market credit crisis, in which electric retailers failed to make $2.1 billion in required payments and put the largest power generation and transmission cooperative in Texas into bankruptcy.

Fedwire “operational error[s]”. Unsettling demand for Bills. Texas margin calls. An approaching quarter-end seasonal low point in liquidity. A looming regulation-mandated US Treasury cliff on April Fools’ Day. All anomalies… in a resilient system.

———WHO———

Twitter: https://twitter.com/

Twitter: https://twitter.com/

Art: https://davidparkins.com/

Jeff Snider, Head of Global Investment Research for Alhambra Investments with Emil Kalinowski, anomaly. Art by Winterfell resident, David Parkins. Podcast intro/outro is “Some Thing” by Rambutan at Epidemic Sound.

———WHERE———

AlhambraTube: https://bit.ly/

Vurbl: https://bit.ly/3rq4dPn

Apple: https://apple.co/3czMcWN

Deezer: https://bit.ly/3ndoVPE

iHeart: https://ihr.fm/31jq7cI

TuneIn: http://tun.in/pjT2Z

Castro: https://bit.ly/30DMYza

Google: https://bit.ly/3e2Z48M

Spotify: https://spoti.fi/3arP8mY

Pandora: https://pdora.co/2GQL3Qg

Breaker: https://bit.ly/2CpHAFO

Castbox: https://bit.ly/3fJR5xQ

Podbean: https://bit.ly/2QpaDgh

Stitcher: https://bit.ly/2C1M1GB

PlayerFM: https://bit.ly/3piLtjV

Podchaser: https://bit.ly/3oFCrwN

PocketCast: https://pca.st/encarkdt

SoundCloud: https://bit.ly/3l0yFfK

ListenNotes: https://bit.ly/38xY7pb

AmazonMusic: https://amzn.to/2UpEk2P

PodcastAddict: https://bit.ly/2V39Xjr

———WHEN———

00:05 What does the oil market (supply, demand, inventory) in the US tell us about the recovery?

03:31 What do oil and gasoline stocks tell us about the recovery’s progress?

04:13 Are oil producers / refineries producing oil products at a normal pace in 2021?

09:07 Power market credit crisis looms as Texas bills come due

14:24 Why do some anomalies become triggers for systemic shocks while others remain anomalies?

———WHAT———

Hot Oil, Cold Weather, Uncle Sam’s Green: https://bit.ly/3sxGJb0

Power market credit crisis looms as Texas bills come due: https://on.ft.com/3dOWoOY

Alhambra Investments Blog: https://bit.ly/2VIC2wW

RealClear Markets Essays: https://bit.ly/38tL5a7

Stay In Touch