62.2 Best Market Fed Always Ignores: Eurodollar Futures

———Part 2 Summary———

If there was A SILVER BULLET, if there was ONE RING TO RULE THEM ALL – if there was ONE MARKET TO FOLLOW to track the health of the global monetary order and world economy – it would be the Eurodollar Futures market. Incredibly, the Federal Reserve has a very low opinion of it.

———Episode 62 Intro———

“I glanced at the list, running over names (probably misspelled) that meant nothing to me, with my hand on the butt of my righthand gun. That one now contained a very special load. According to Vannay, there was only one sure way to kill a skin-man: with a piercing object of the holy metal. I had paid the blacksmith in gold, but the bullet he’d made me – the one that would roll under the hammer at first cock – was pure silver.” The scene is from The Wind Through the Keyhole, a 2012 Stephen King gunslinger novel. It’s not unheard of for the horror/fantasy-master’s characters to call on silver to battle something from the dark and murky gray.

From his 1986 novel, IT: “But that, of course, is only a joke, and not a very good one; there is only one story left, at least one he remembers, and that is the story of the silver slugs – how they were made in Zack Denbrough’s workshop on the night of July 23rd and how they were used on the 25th.” A great yarn, to be sure, but as members of an advanced civilization we KNOW there’s nothing in the shadows with blood-red eyes and tentacles. Then again… that’s precisely why Count Dracula moved to cosmopolitan London in Bram Stoker’s 1897 classic.

You see, the superstitious peasants of Transylvania knew the preternatural was real. Not so post-Enlightenment England where mucus-oozing pores and frightful claws were disclaimed. And what better place to hide disgusting aberrations, but in the shadows of denial and willfully forgotten knowledge?

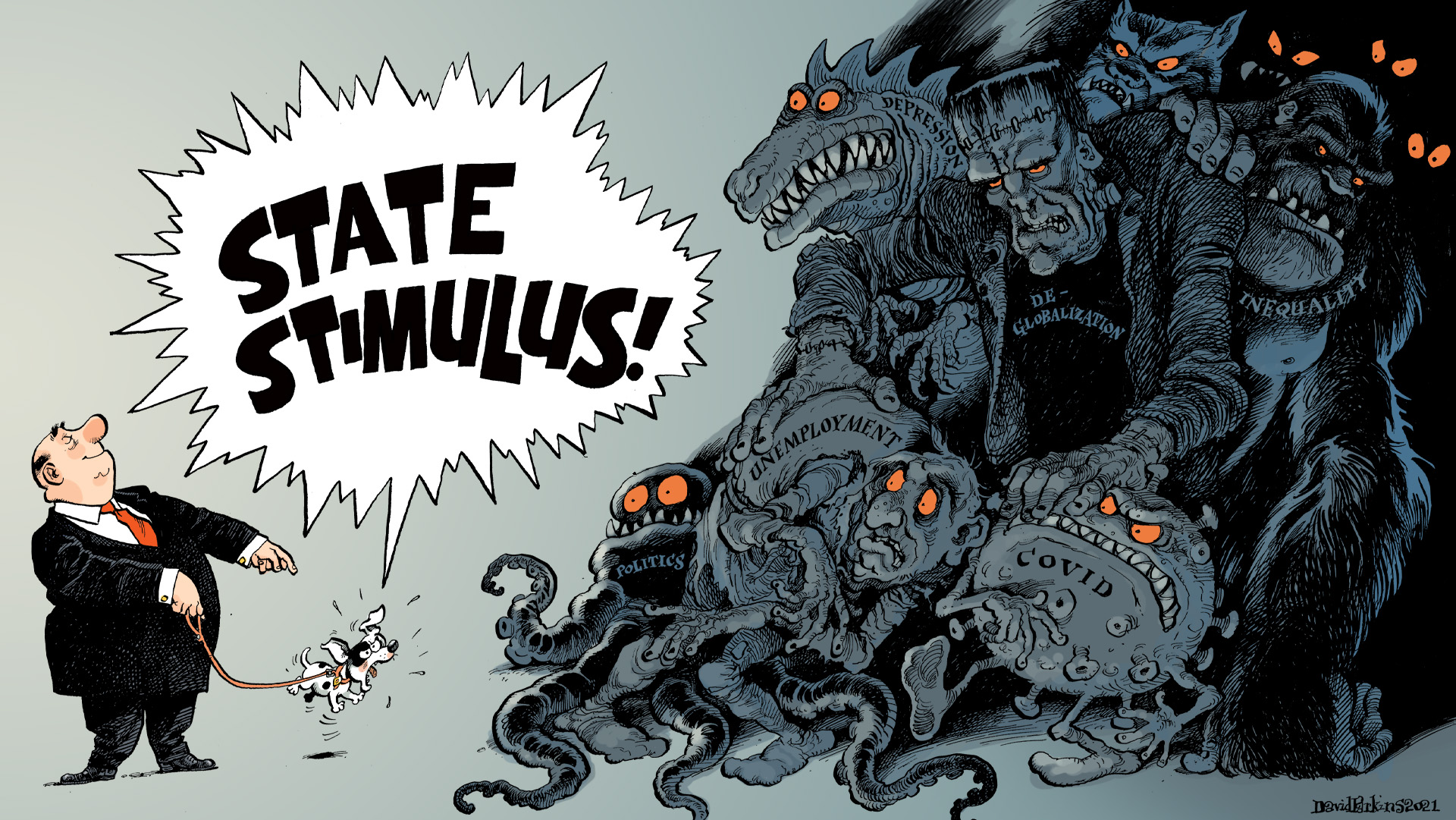

Today, enlightened monetary-scientists placate us with soothing expectation policies that the banking shadows harbor no ill-proportioned beasts. But supposing there were. Is there a silver bullet we could roll under the hammer? In Part 2 of this, the 62nd Episode of Making Sense, Jeff Snider discusses one candidate: the Eurodollar Futures market. But first, two researchers for the Federal Reserve uncover the horror of quantitative easing. Then we conclude with the fantasy of government stimulus.

———SEE IT———–

Twitter: https://twitter.com/

Twitter: https://twitter.com/

Alhambra YouTube: https://bit.ly/2Xp3roy

Emil YouTube: https://bit.ly/310yisL

Art: https://davidparkins.com/

———Hear It———

Vurbl: https://bit.ly/3rq4dPn

Apple: https://apple.co/3czMcWN

Deezer: https://bit.ly/3ndoVPE

iHeart: https://ihr.fm/31jq7cI

TuneIn: http://tun.in/pjT2Z

Castro: https://bit.ly/30DMYza

Google: https://bit.ly/3e2Z48M

Spotify: https://spoti.fi/3arP8mY

Pandora: https://pdora.co/2GQL3Qg

Breaker: https://bit.ly/2CpHAFO

Castbox: https://bit.ly/3fJR5xQ

Podbean: https://bit.ly/2QpaDgh

Stitcher: https://bit.ly/2C1M1GB

PlayerFM: https://bit.ly/3piLtjV

Podchaser: https://bit.ly/3oFCrwN

PocketCast: https://pca.st/encarkdt

SoundCloud: https://bit.ly/3l0yFfK

ListenNotes: https://bit.ly/38xY7pb

AmazonMusic: https://amzn.to/2UpEk2P

PodcastAddict: https://bit.ly/2V39Xjr

———Ep 62.2 Topics———

00:05 LIBOR and Eurodollar Futures are unwelcome by the Fed but very useful money barometers.

03:24 LIBOR and Eurodollar Futures should be very close to Fed policy, but 2008 changed things.

06:12 In 2013, E$ futures inflected down: 6 to 9 months before the third dollar shortage began.

08:41 In 2016-18, E$ futures never achieved sufficient height to indicate economic recovery.

12:01 Today E$ futures are rising (good!) but meekly, relative to previous reflations (bad!).

15:09 Today’s E$ futures, compared to the last 20 years is… PATHETIC.

———Ep 62.2 References———

How Does Reflation Look From The Point of View of the One Market That Gets It: https://bit.ly/3cKZKlb

Yes, Curves Have Been Forced To Speak Japanese: https://bit.ly/3uhsWWW

Alhambra Investments Blog: https://bit.ly/2VIC2wW

RealClear Markets Essays: https://bit.ly/38tL5a7

———WHO———

Jeff Snider, Head of Global Investment Research for Alhambra Investments and Emil Kalinowski. Art by David Parkins. Podcast intro/outro is “Shadow of a Gunman” by Sight of Wonders and “Night Remains” by Farrell Wooten at Epidemic Sound.

Stay In Touch