The 30-year US Treasury bond yield dipped below 2% today for the first time since early February. The unsurprising nasty “surprise” in the ISM combined with more concerning data especially surrounding China released over the long American holiday weekend have added more weight to fears the global economy has reached the limits of reopening. If we’ve already seen its best days…

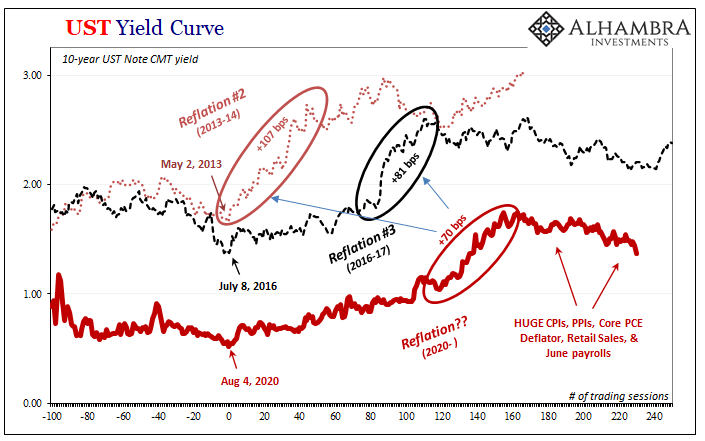

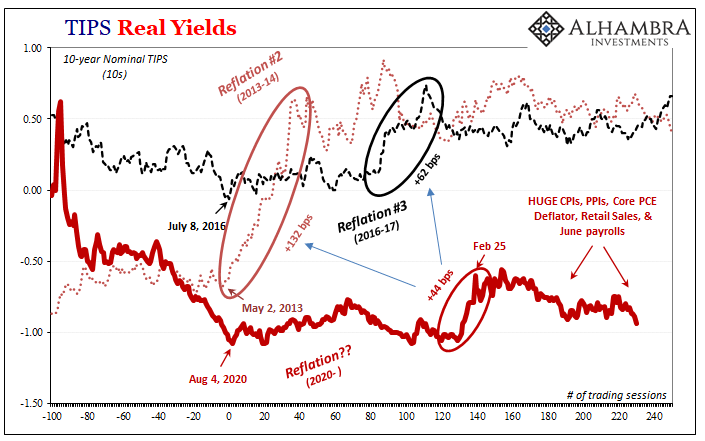

It raises the prospects of more than just failing or ailing recovery; there’s rolling over out of reflation entirely and into what would be the merely next downturn “cycle” in the more than decadelong baseline. Presuming the 2020-current period as something like Reflation #4 (which is still arguable), the movement in Treasury as well as global bond yields over the past few months (especially dating back, as it all does, to specifically Feb 24-25-26) is leaning toward what might then be Euro$ #5 (at the very least Euro$ #4b).

Are we there yet? How close?

Over the past several cycles, particularly Euro$ #3 and Euro$ #4, it has been the combination of falling yields and a rising dollar which has clinched it; the confirmation that the global dollar situation has reached whatever critical mass (shortage) so as to be able to wreak enough economic havoc rolling a synchronized mild reflationary upturn over into a mild synchronized disinflationary downturn (and then worse).

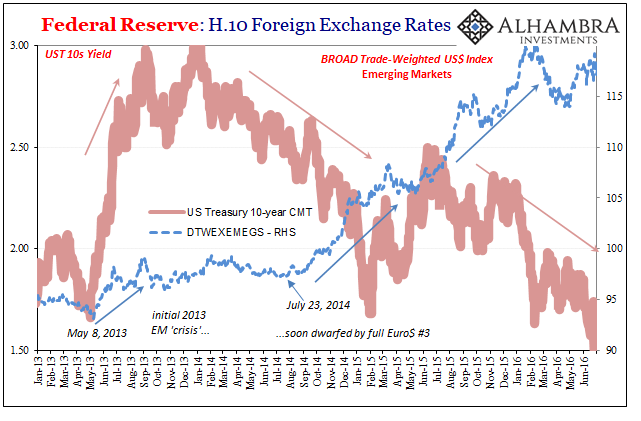

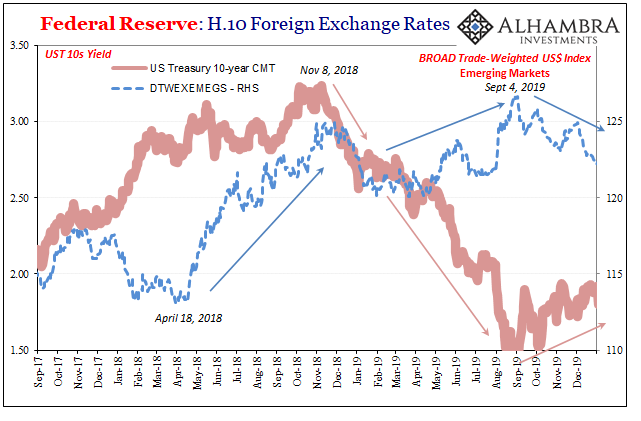

It gets a little messy in between those two points (which is where the myth of “decoupling” shows up for a little while). During Reflation #2/Euro$ #3, it was falling yields and a limited dollar up (mostly against CNY) right from the start of 2014 which had indicated the start of the process. The dollar, its fullest exchange value crosses, that sharp rise came later on in 2014 as the negatives for the eurodollar really began to pile up and then roll over (it wouldn’t fully synchronized with the US falling off until 2015).

The following cycle, Reflation #3/Euro$ #4, mostly the opposite. The dollar began to rise before Treasury yields would decline (other global yields, such as German bunds, however, were dropping coincident to, and even before, the upward dollar).

Either way it goes, the worst of it happens when both are moving – yields uniformly falling worldwide and the US dollar exchange value more uniformly rising (or having risen). When both of those two things get together, that is when you know it’s likely game over.

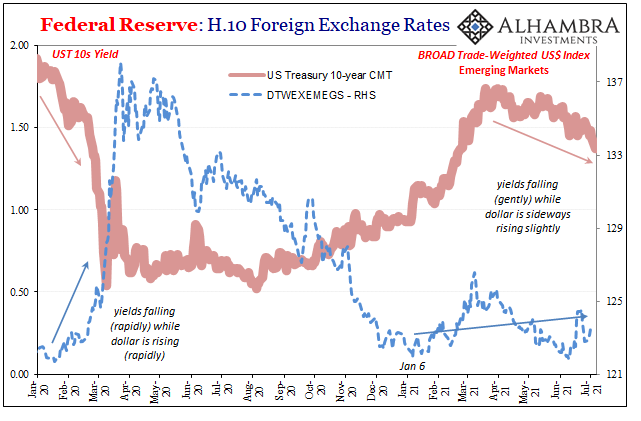

We aren’t there yet in 2021. Again, yields falling all over the place including Treasury yields now down past where the events of February 24-25 had them. But the dollar’s exchange value has yet to really make any substantial move – in either direction.

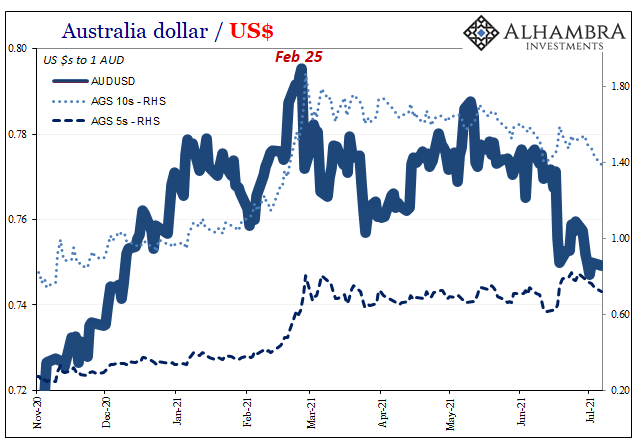

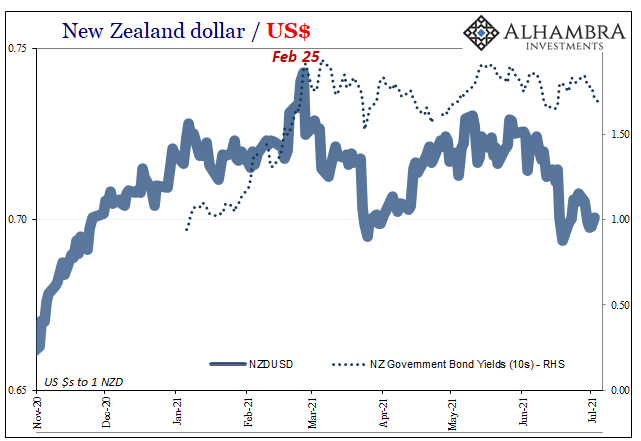

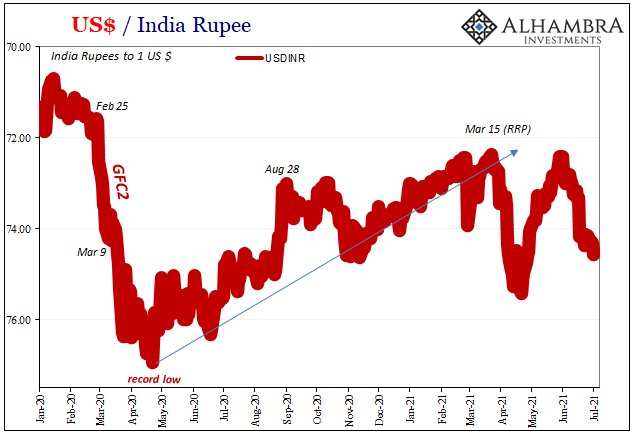

In fact, the dollar’s been mostly sideways since early January even throughout that reflationary selloff up to the middle of March (in Treasuries). There have only been a few signs of upward tendencies in a couple of key crosses like the Australian dollar (and New Zealand, both more closely connected to risks involved with eurodollars and China). India’s rupee is another one which has both become more volatile as well as broken the wrong way out of its most recent trend.

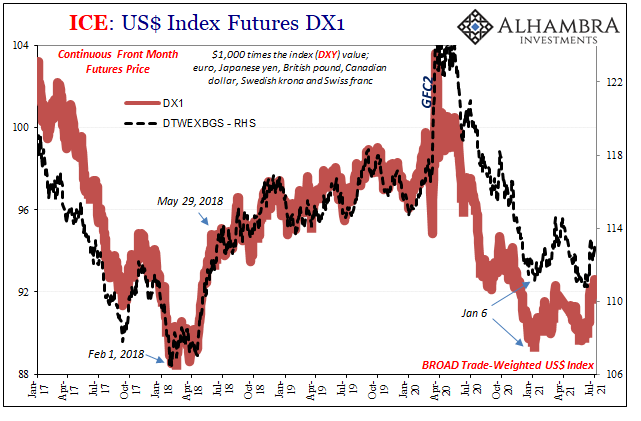

The broader dollar indices, however, have largely remained rangebound though DXY (more than others) is threatening the top of its range.

Going back to last year, the dollar has been “stronger” (meaning tighter global eurodollars) then the public might otherwise have believed (what with all the DOLLAR CRASH!!!!! rhetoric piling up). Six months without much change is already itself a huge concern and red flag (what with everything supposedly going right, including “too much money” flooding money markets since mid-March).

On the flipside, though, this stubborn dollar along with the direction of global yields completely refutes any chances for inflation. That much is clear, with both bonds and currencies in agreement about the global (yes, global) factors underlying clearly still disinflationary/deflationary tendencies.

But not yet the wrecking ball; in a sense it’s good that the dollar hasn’t moved higher more than it has. Yields are down, and maybe things turn around before the dollar joins them in repeating the rollover pattern taking everything down again.

Then again, why would that be? After everything being on the positive side for quite some time, what’s left to restart reflation before the dollar might join yields? In a sense, the clock is ticking before risk aversion (see: dealers and RRP) goes too far past the unknowable threshold into the next dollar squeeze/acute shortage phase.

If American “infrastructure” spending is all that’s left, or this fantasy about “too much money”, then certainly it is just a matter of time (Euro$ #5, or #4b, was almost certainly inevitable anyway, the issue always more about “when” than “if”). For now, we’re aren’t there just yet, only half the signal.

Stay In Touch