Two sets of indications, each heading in opposite directions. Or mainly at odds one from the other. To the inflationary side, the BLS reports producer prices that are still rising at substantial rates. The PPI representing the final demand for finished goods was up 9.35% year-over-year in July, slightly faster than the 9.19% posted in June. The latest a new thirteen-year high just about equal to August 2008.

The commodity portion of the index also accelerated on an annual basis. Unadjusted, producer commodity prices were up 19.79% last month compared to 19.51% the month before. You have to go back to 1974 for anything approaching or above 20%.

The core PPI rates also continued to rise quickly, removing food and energy still producer prices in July finished 6.23% higher when compared to last July.

There are some base effects in all these estimates, especially commodities, but even without them price increases are above what had become typical for the 2011-20 period. In the core rate, for example, excluding base effects the year-over-year change would’ve still been around 3.4%, still the highest in its decade of data.

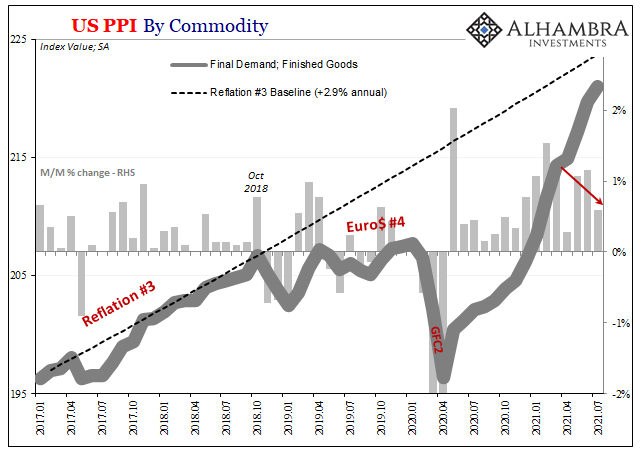

Like the more disciplined CPI figures, however, there are signs prices are slowing their upward rolling. The first PPI index mentioned above, final demand for finished goods, in the seasonally-adjusted index the peak rate was calculated all the way back in February. After a “stumble” in April, the monthly change re-accelerated May and June before dropping down again for July.

It isn’t quite the obvious downshift in some parts of the CPI, but a downshift of some magnitude nonetheless.

The reason for it, and the reason why inflation potential remains low, is what we find moving about in the other direction. While PPI final goods isn’t quite fully at odds in the inflationary way, it certainly isn’t (yet) in on the monetary indications such as Treasury yields and other measures closely correlated and corroborating their rising deflationary probabilities.

What these mean, quite simply, is that even as consumer and producer prices deviate for the time being, this deviation is being projected to dissipate at the same time deflationary problems gather alongside; in fact, the latter being one key reason why, should it turn out this way, consumer and producer price acceleration gets turned down and back again.

Not just T-bills and Treasury nominals, the ongoing disappearance of UST’s from foreign placement with FRBNY as well as a peculiar (in an early 2018 kind of way) sideways to upward bend in the dollar’s exchange value.

Inflation is more than a few months of high CPI and/or PPI; if it wasn’t, then we’d have to characterize 2008 in that way when doing so would be simply ridiculous. Quite like 2008, high rates of “inflation” when undercut by monetary conditions going the other way the balance of probabilities simply do not come out on any other side but “transitory.”

Actual inflation, “real” inflation of the monetary variety, the only usable definition, is when consumer prices speed up across a broad range of them, being maintained by “money printing” over more than the short run. Sustained, in other words.

The 2008 outbreak or price deviations, didn’t last long for many of the same factors (though not to the same degree or intensity) we already see right now.

Stay In Touch