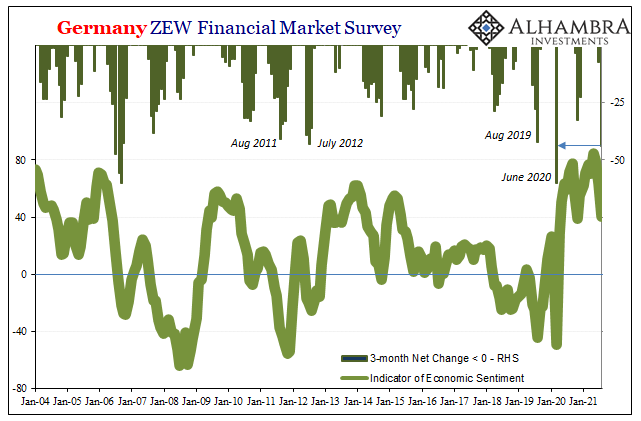

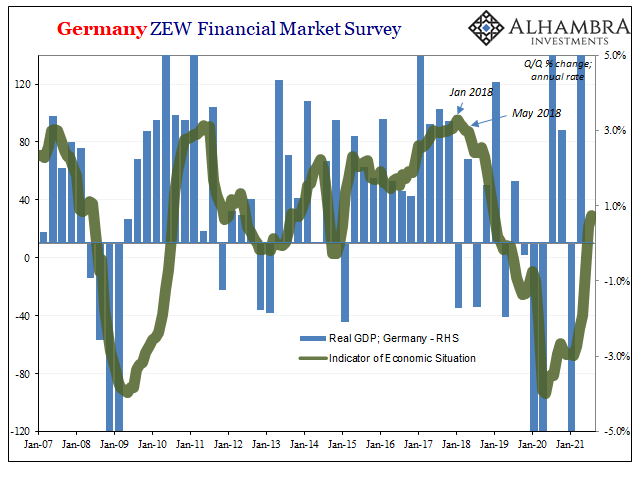

It has taken nearly two years for Germany’s ZEW to finally close its gap. The index for sentiment had popped all the way back in September 2019 buoyed by the ECB restarting QE; these peculiar German businesspersons who make up this particular survey panel do love their “stimulus” announcements no matter how many times the actual policy fails to stimulate Germany’s economy. This had meant a prolonged discrepancy between rising optimism and the uglier truth of the current situation as told to the ZEW by the same peculiar businesspersons.

That is until recently. This other situation index tabulated by the ZEW has poked back above zero, rising nearly to 30 in the latest reading for August 2021. And it’s just in time for sentiment to drop sharply again as if the middle of 2019 all over.

While this latest decline began from the highest sentiment level in almost two decades, the three months since have produced the sharpest reversal since last year’s recession, almost exactly the same as the three months before August 2019 leading to the ECB’s action. Before those, you have to go back to July 2012 or August 2011 for equivalent-sized deterioration in German sentiment, both associated with Europe’s 2011-12 re-recession.

The ZEW itself didn’t sugarcoat it, at least not at first:

This indicates increasing risks for the German economy, such as a possible fourth Covid wave from autumn or a slowdown in growth in China.

There are considerable reasons for the former, COVID fears, to manifest in sentiment but in terms of realistic economic analysis it is the latter, China, which likely represents the greatest risks; both to Germany as well as how China’s struggling economy epitomizes the actual underlying state of the global rebound.

Not all that good and more likely to be heading in the wrong direction.

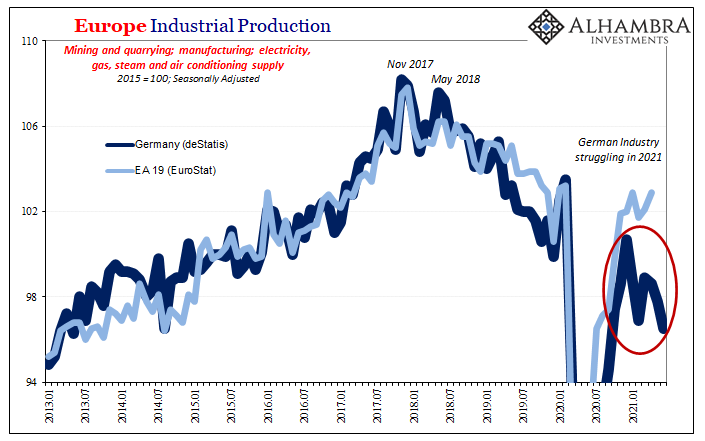

Additional data earlier this week already demonstrated as much; German Industrial Production slid again for the third month in a row in June 2021, and is down an alarming 4.2% just since last December (which just so happens to coincide with the top before this current Chinese slide). This isn’t all supply problems (though it is to some degree).

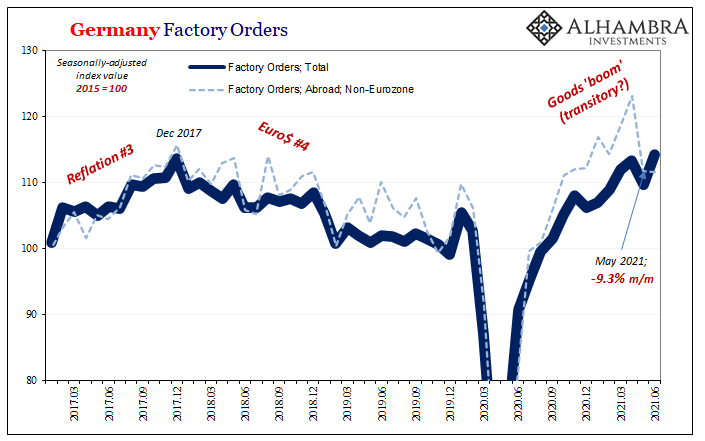

Finally, as noted last month, factory orders had plunged for German manufacturers during May. The primary reason had been a huge (revised) 9.3% collapse (month-over-month) in orders from outside both Germany and the Eurozone (though orders from within the EZ but outside of Germany dropped sharply, too).

The latest estimates from deStatis for June 2021 show that while overall orders rebounded this was a rise in orders placed from within Europe, mainly from inside Germany. Factory demand from outside the EZ declined yet again, albeit at a small rate, which means there was no rebound even after May’s huge drop.

Put all these pieces together (along with bond yields) and you arrive in perhaps too close proximity to “growth scare” very quickly before even getting to those corona fears. As noted several times this week, Germany’s condition and even sentiment isn’t strictly about, or of interest for, Germany:

The US economy, its labor market in particular, might appear to be going gangbusters, but if such proves to be an isolated case, uncorroborated by similar proportions elsewhere, in the end it won’t matter the best jobs market in decades – and not just about the predicted inflationary bump which never arrives.

Global factors. These don’t just refer to what’s going on outside and overseas, rather they represent the entire system and all in it; American economy included. Therefore, any discrepancy, as there had been in 2014 (like 2018) was about timing instead of condition or direction.

US CPI, PPI, etc., all up (though cooling down a noticeable touch) as is headline payroll data leading some to speculate, including policymakers, about a need for tapering QE (not that tapering QE means anything meaningful) if only because the US economy in their collected imagination is at greater risk of becoming too good. Same old story.

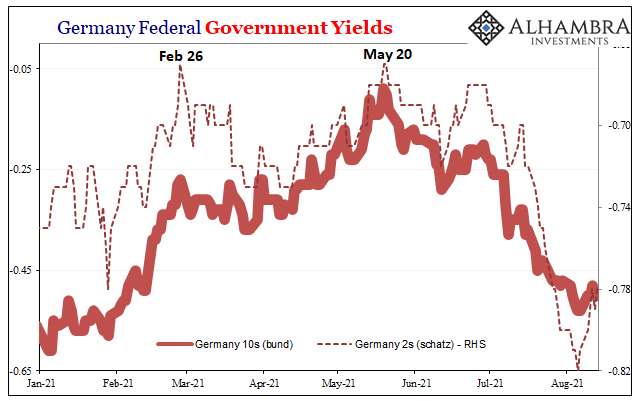

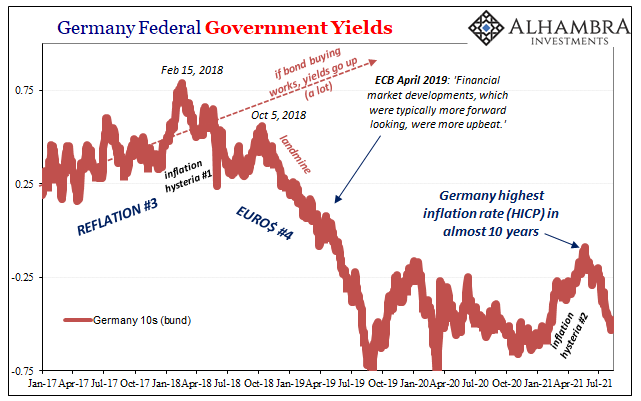

Bond yields indicate – more and more demand – otherwise because it’s not just Treasuries or bunds, rather global factors.

Stay In Touch