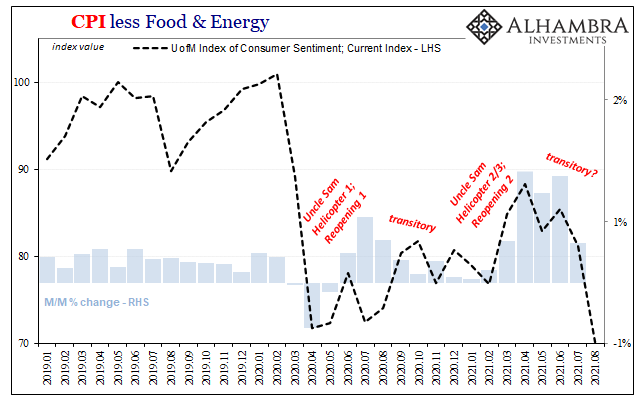

Slowdown, yes, but by how much? The inflation argument has been forced to change yet again after having been put together by expectations for a “red hot” economy to stay red hot for a prolonged period. That’s no longer in the data, as even the most robust of indications – such as sentiment – have clearly cooled off.

What’s left, therefore, is a mutation, an inflation mutation, which hopes that the uniform slowing down showing up everywhere is just the natural progression from red hot to merely just hot. Still inflationary, they say, perhaps if a touch less unambiguous in its signal.

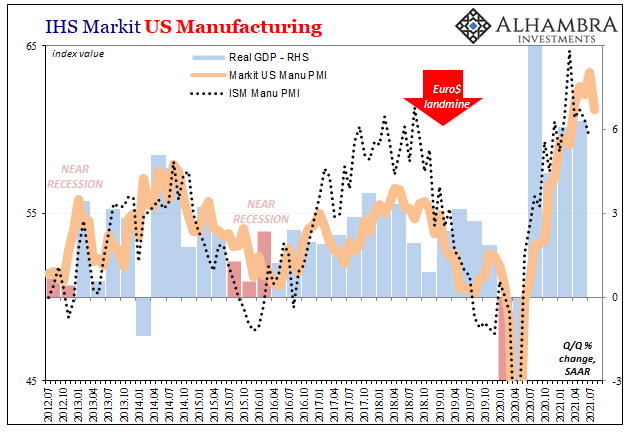

The PMI estimates from IHS Markit released today probably went a little too far in the direction of ambiguity. While commodity prices have come under pressure and forward-looking curves in the bond market are of their own explicitly non-inflationary (deflation potential), economic data is moving in that direction as each has already pre-supposed.

Specifically Markit’s PMI’s, the manufacturing version remained above 60 in the flash estimate for August. Down from last month’s high of 63.4, but at 61.2 this month though in the 60s that’s still the lowest since March. The goods sector still good, though like retail sales cooled off to some degree.

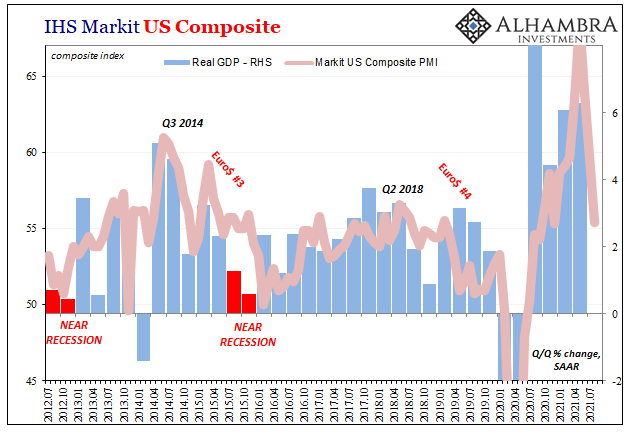

The real potential negative, however, was the more important services sentiment. Markit’s flash PMI for this sector in August dropped by nearly five points, from 59.9 in July to 55.2. Blamed on COVID, like everything will be going forward (around 2025, I can easily imagine when Euro$ #7 rolls around its negative effects will still be attributed to the upsilon variant whipping up the 15th “wave” of the coronavirus), the slowing here isn’t just the one month.

More to the point, the composite PMI – which has been a relatively decent projection of real GDP – fell to 55.4 in August from 59.7 in July only partly supported by manufacturing clinging to the 60s. The services retrenchment sends the index down into where real GDP might not even make 4% for the full Q3.

Even 3% might be a tossup depending upon what happens the rest of this month and then September’s final contribution to the third quarter overall. This would be a pretty serious step-down from what’s been figured since early this year, even late last year with vaccine and “stimulus” euphoria.

It’s not necessarily the risks of any looming recession, or re-recession, sorry NBER, it’s already the inflationary disappointment of contrary expectations. Just like Summer 2020 had originally been anticipated full of high reflationary “V”, only to see reality dwindle to big, renewed deflationary slowdown, Summer 2021 is shaping up to have been a stunning repeat performance.

And for many the same reasons.

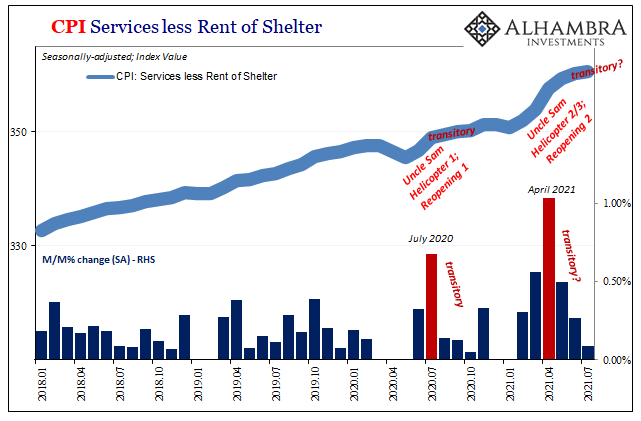

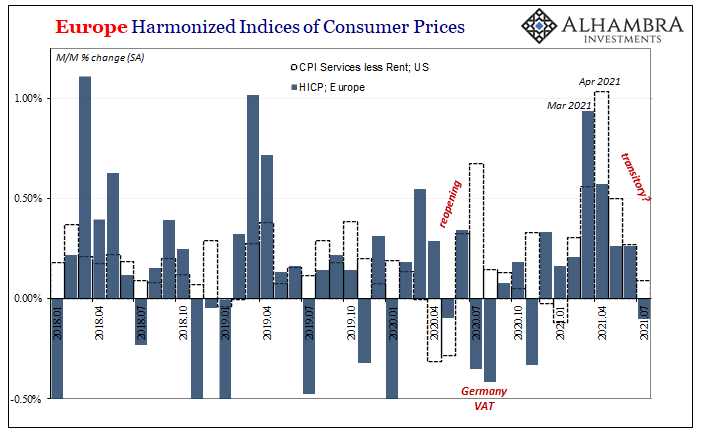

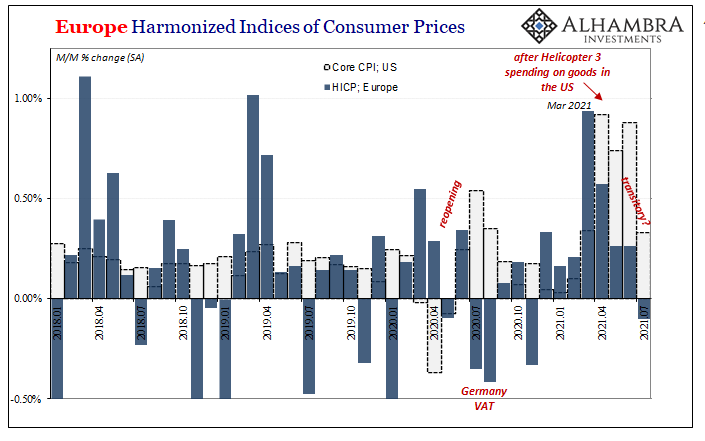

Other than the transitory effects of Helicopter Uncle Sam, there’s not much to like about the underlying state of the overall global economy – including the US contribution despite its otherwise red-hot goods segment.

This is why bond yields here and everywhere else: 1. Never got very high to begin with; 2. Began to write down already low inflation potential long before delta corona was identified.

There had been some modest upward hypothetical (reflation) from the combined end of the pandemic and the large federal government interventions at the time, but it really didn’t take much time (late February, once reminded, Fedwire, of the gross, unsolved deflationary potential of a fragile money system) for the probabilities to return to type.

Markets had already begun to reprice these downside chances months ago and now the data is predictably coming along in the way of those prices. There is a very good chance, an increasingly likely probability set, the rebound’s (not recovery’s) best days were already months ago.

And if that is the case, since they weren’t ever that great at any point, not inflation. Temporary price deviations, yes, not of the sustainable variety of the long-reported, short-on-data money flood.

Stay In Touch