Jerome Powell delivered his long-anticipated speech at Jackson Hole last week. Well actually, I have no idea if he was actually in Jackson Hole since the speech was delivered electronically, another victim of the delta variant. The virus itself rated barely a mention in Mr. Powell’s remarks and I think that is probably as it should be. There has been some economic impact from the recent virus surge but nothing like previous versions. COVID may not be over, but we are learning to live with it as we probably will for some time to come. As for Mr. Powell’s speech, I’d rate it as pretty boring based on my soporific reaction to it. Powell is an attorney and he proved it last Friday.

The market reaction to the speech was fairly muted but with a decidedly bullish tilt as most things are these days. Investors, or what passes for that today, apparently heard what they wanted to hear, namely that the Fed is not going to stop buying bonds yet. Maybe this year but only if they make more progress on their employment goal, Powell basically saying their inflation goals have been met. That seems to imply that the employment goal is now ascendant, the inflation goal now subservient to the employment mandate, a pretty significant deviation from their historical mission, in my opinion. Of course, the Fed is dominated by economists – and attorneys – who believe that too many people working is what causes inflation, a theory that just won’t go away regardless of the real-world evidence to the contrary, so I’m sure they don’t see it that way. I didn’t hear any mention of the Fed’s progress on climate change or any of the other items on the ever-lengthening list of things they or others think they can control.

Over the years since the economic crisis of 2008, there has developed a sense, a confidence that the Fed is in control of the economy, that first Bernanke, then Yellen, and now Powell have the ability and the tools to affect a wide range of economic variables. I understand the desire of the public to believe that there is someone in charge, that we have some control over our economic fate. What baffles me is that the economists at the Fed and elsewhere continue to believe in the Fed’s control over such a wide range of real variables in the economy. With interest rates near zero and bank lending conspicuous mostly by its absence, it doesn’t appear that interest rates are a barrier to private sector economic activity, although government activity might be a different story. And QE is merely a swap of a useful asset (Treasury) for an inert one (reserves) so the real economic effect is, I believe, negative, although the impact on the psychology of speculators is decidedly not. If the unemployment rate is too high for the Fed’s mandate, I would suggest that ending QE might be more effective at solving that problem than continuing it but I doubt stocks would like it and that seems to matter to the Fed today.

Liquidity in the US economy is certainly not a problem as evidenced by the rampant speculation in financial assets. Yes, stocks are expensive but that is only the tip of the iceberg. Someone just paid $1.3 million for a picture of rock for God’s sake. Actually, it wasn’t even a good picture of a rock but some crude digital representation of a rock whose monetary value is obviously independent of its esthetic value (which is I think zero). I’m not sure how much more evidence we need that something is drastically wrong with our economy. If your economy is somehow rewarding people handsomely for wasting resources on imaginary goods, something is wrong that goes well beyond monetary policy. Maybe it is the interaction of monetary and fiscal policy or maybe it is a cultural failing. Whatever the causes, it seems likely that monetary policy is the only thing that can end it. And Jerome Powell seems oblivious to the speculation all around him; asset prices were not mentioned even once in his speech.

The economy is a multi-faceted, global beast which is controlled by no one. It can be distorted by faulty policies as has been proved repeatedly throughout history and is being proven again today in my opinion. The zeitgeist of today is characterized by two acronyms: YOLO and FOMO. You only live once should mean that one should not waste this opportunity to live life to its fullest because you only get one shot at this. Instead, today it has turned into an excuse to pursue riches indiscriminately, without remorse at the methods or who might get hurt while you do it. Robinhood has convinced a generation that greed and speculation are a virtue, that getting rich is more satisfying if it is done at someone else’s expense. Fear of missing out on this bonanza has pushed people into taking risks they can ill afford with consequences that may last a lifetime. It will end of its own accord at some point but by then the economic consequences could be catastrophic. It would be better for the Fed to end it now, even if it requires a recession, than to allow it to continue to some ultimate, destructive Minsky moment.

—————————————————————————————————————————————————————————————————————————————————————————————————————————

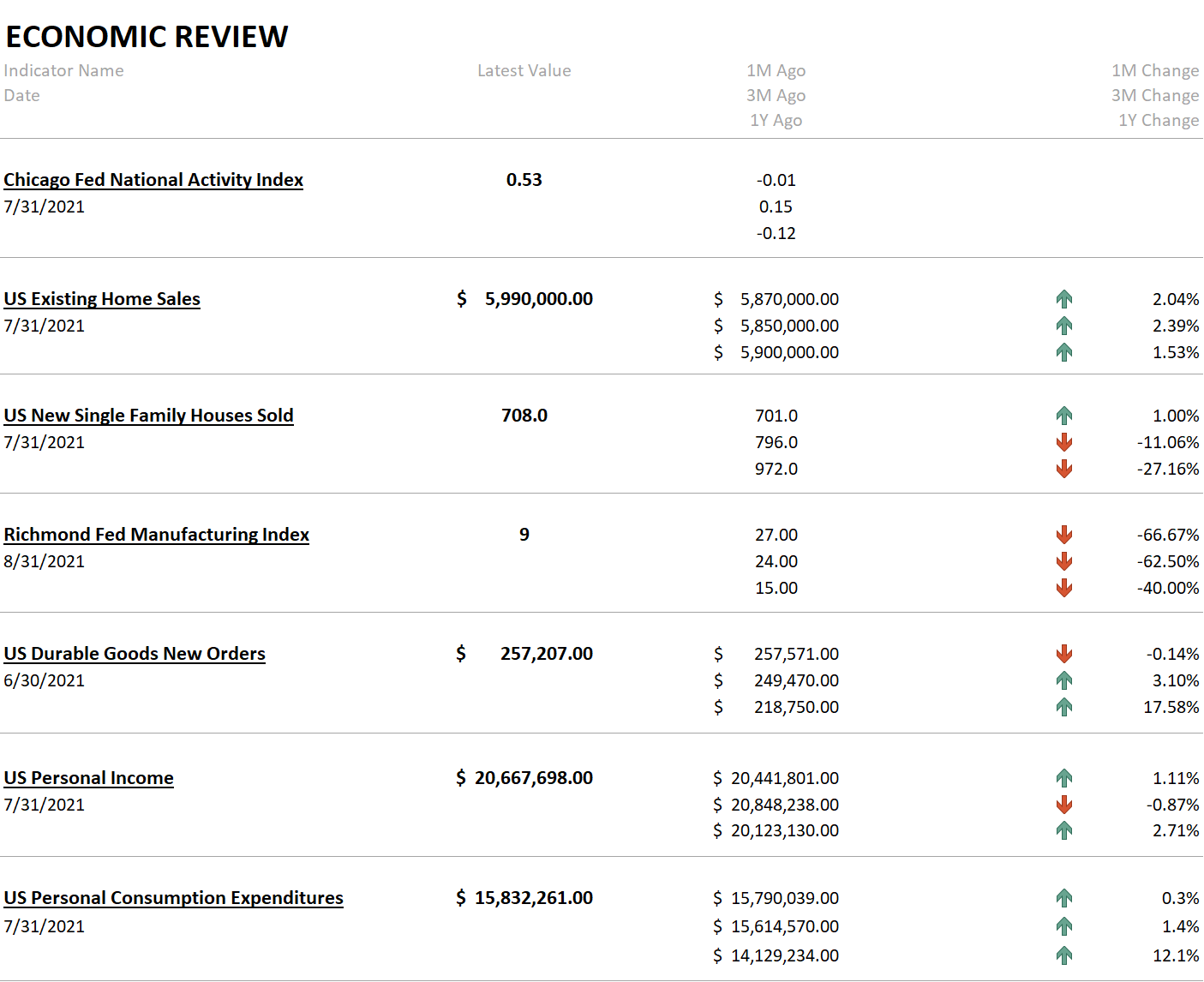

Back in the real world, the economic data continues to show an economy that is growing a bit above trend even if the peak rate of change is in the past. The CFNAI, released last week, did not turn negative as I feared but instead came in a bit better than expected at 0.53 (with 0.0 being trend growth). The 3-month average is now 0.23 and nowhere near recession territory. News on housing was encouraging with both existing and new home sales ticking up a tad. Durable goods orders were down a blip (-0.14%) but ex-transportation were up 0.7%. Core capital goods orders were up a rounding error extending the gains to six months in a row. This continued expansion in capital goods orders is one I’m watching very closely. If trend growth is going to shift to a higher level it will come through productivity gains and investment is how we’ll get there. There are a lot of trends that intersect at US investment from the ongoing shifts in the labor market to the so far only nascent trend of deglobalization. The long-term impact of COVID on growth and inflation may well prove positive but we’re a long way from knowing that for sure.

Personal income rose more than expected in July, up 1.1% which was widely attributed to the acceleration of the child tax credit. That really doesn’t have an impact on income but only the timing of its receipt so if that were the entire story I’d say it was nothing. But private wages and salaries were up 1% and only slightly less in dollars than social spending. What wasn’t up much was consumption which was up 0.3% but down in real terms. That may well be the delta effect as we’ve seen a downtick in air travel, hotel, and restaurant reservations.

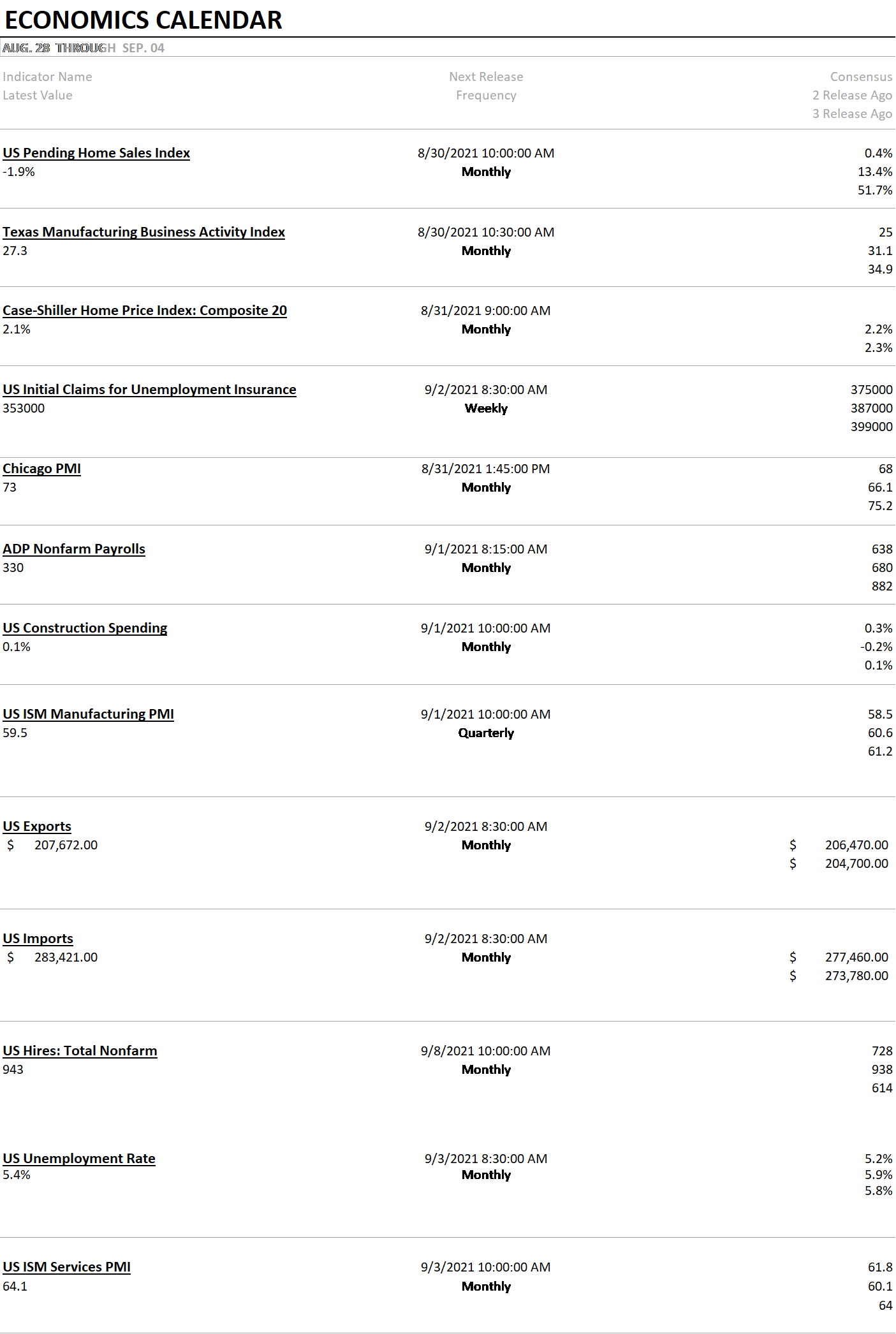

This will be a busy week for data culminating with the employment report on Friday. Expectations are for around 700k jobs. With the impending end of extended unemployment benefits in September, that may well be a low estimate but these numbers are very volatile so who knows? We also get ISM reports which will probably show continued expansion but at a slower pace.

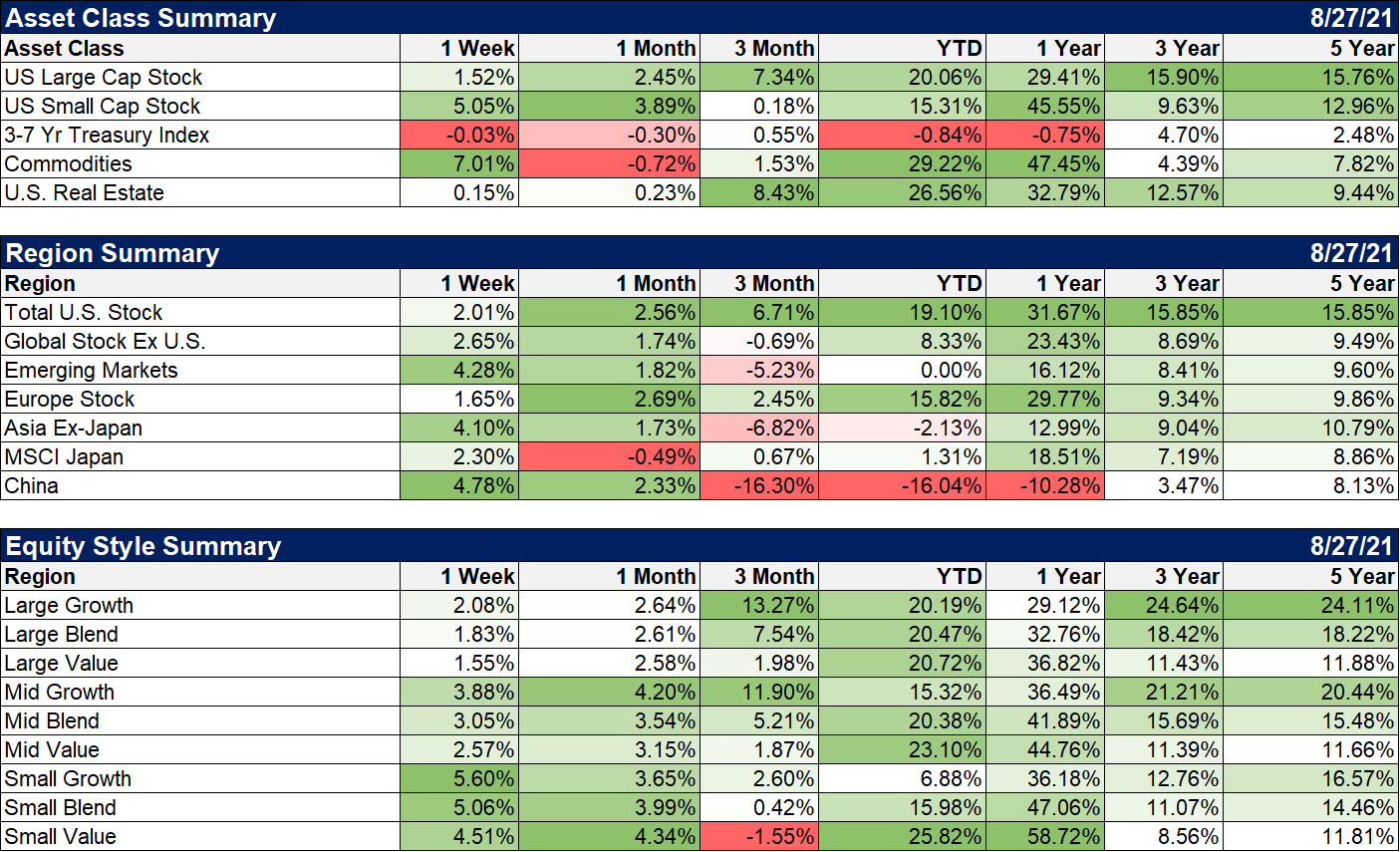

Markets definitely shifted to a more positive cyclical view last week. Small-cap stocks outperformed strongly as did commodities and emerging markets. Growth stocks won the week but value was coming on at the end of the week after the Jackson Hole speech.

The dollar fell slightly which isn’t surprising since I declared just last week that it was in a short-term uptrend. To my credit, I did say it might be a short-term trend but I didn’t mean that short. And the short-term trend, for the record, is still up for now.

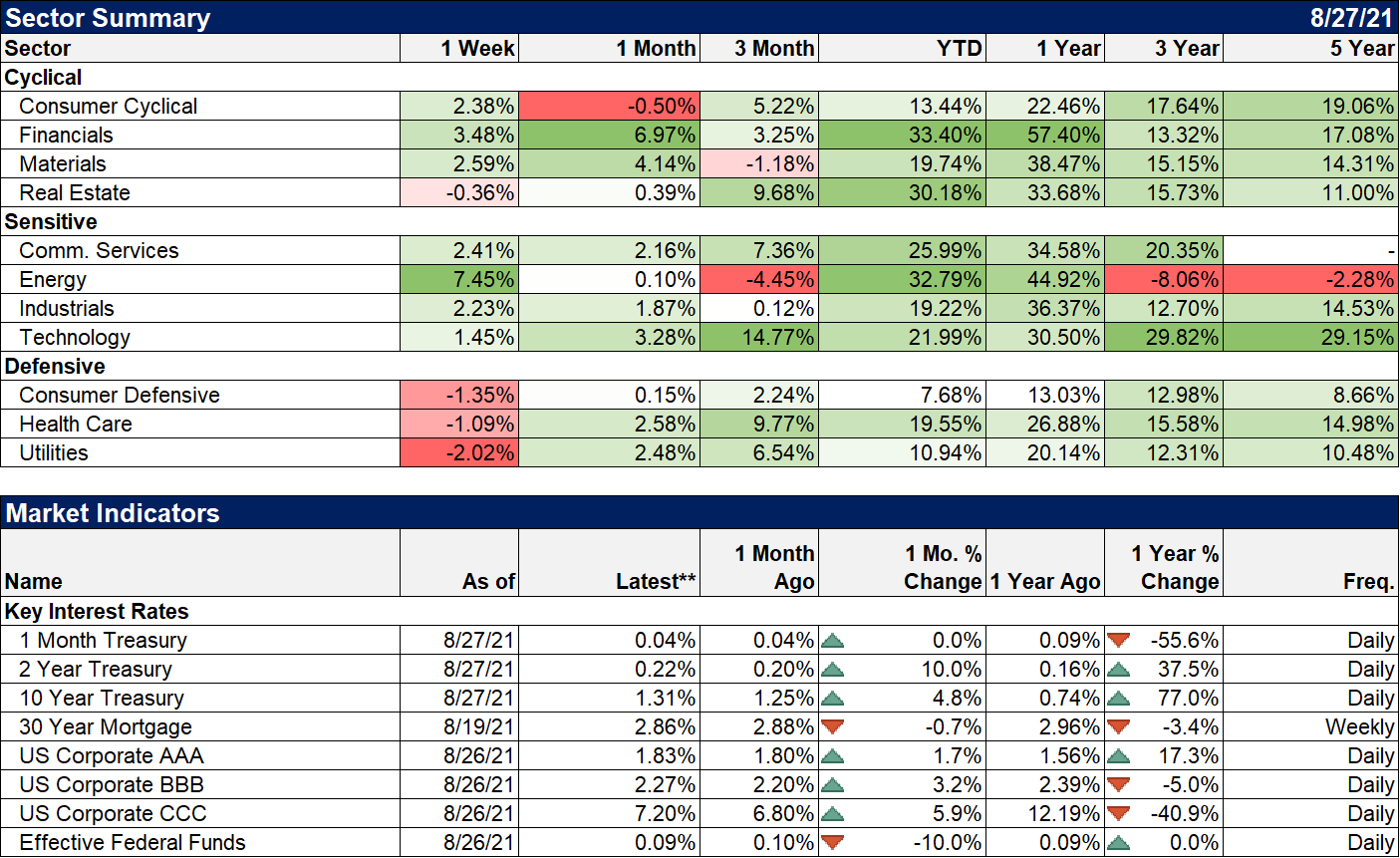

You can see the shift to economically sensitive issues in the sector report as well. Financials and materials did well but energy was the big mover. Energy stocks were coming out of a deep hole though so I’m not sure that means much just yet.

The 10-year Treasury yield fell some on Friday after Powell’s “dovish” speech but was higher on the week. Real rates were higher as well and credit spreads also narrowed.

It is a strange world we live in today when the economy is considered weak enough by the Fed to warrant “stimulation” but there is so much liquidity over a year after the recession ended that NFTs and stocks appear to have the same fundamental appeal, namely that they seem stuck in a Groundhog Day-like loop where the price does the same today as it did yesterday – go up. The godfather of the modern Federal Reserve, William McChesney Martin, once said that it was the Fed’s job to “take away the punch bowl just as the party gets going”. Jerome Powell isn’t even at the party yet. And I’m pretty sure he’s drinking alone.

Joe Calhoun

Stay In Touch