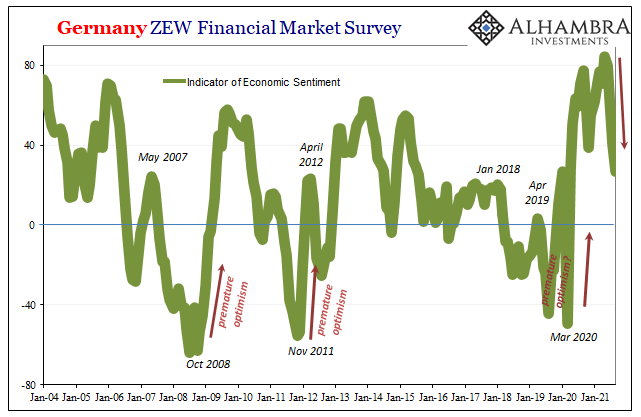

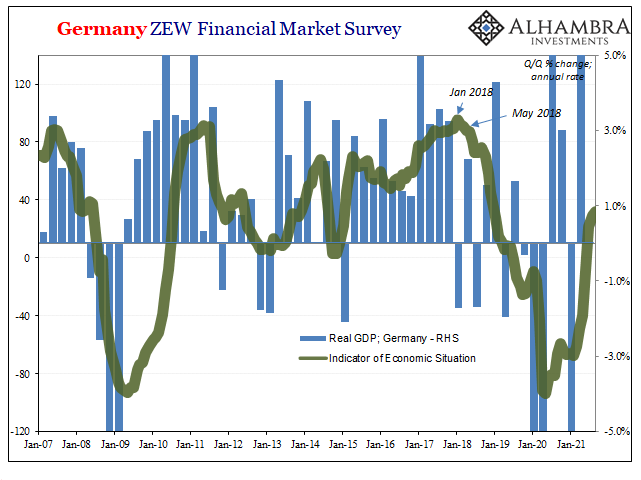

By the summer of 2018, there were already any number of economic warning signs over globally synchronized growth fading fast. Many if not most of them market-based, of course, but not all. In the realm of sentiment, for example, the Germans in particular had put their finger on the pulse of the global economy and found it suspiciously feeble, economic pressure dropping far faster than you’d have thought at the time (given constant upbeat assessments no matter data).

I wrote about Germany’s closely-watched ZEW in July 2018, back when everyone was still convinced about the “surefire” inflationary upside every country’s central bankers were projecting. No. The global economy was quite steadily rolling itself over:

In the latest value for July 201[8], reported today, the index has dropped to -24.7, down from -16.1 in June and -8.2 in May. It’s the lowest since 2012, not a particularly auspicious comparison. To begin this year, the value was +20.4.

That means over the subsequent six months, this specific half year that has followed noteworthy, serious worldwide market liquidations, the index has tanked by an alarming 45.1 points.

This signal, like all the rest, was quickly dismissed as some quirk of the Orange Man and his “trade wars.” COVID, by contrast, at least sounds equal in seriousness to the fade in sentiment. Back then:

Taken by itself, it’s another soft economic warning that we should take serious the prospects beyond just the latest false dawn (globally synchronized growth). Like the narrow upswing of the ZEW index itself, what’s suggested is that whatever little growth there might have been during Reflation #3 it may have since disappeared; the unpleasant scenario of the global economy having already started rolling over.

Yep. False down which within a mere matter of months had quickly (and “unexpectedly” for all those blaming “trade wars”) unraveled such that globally synchronized growth had become a globally synchronized downturn in the US, too, like Germany and elsewhere.

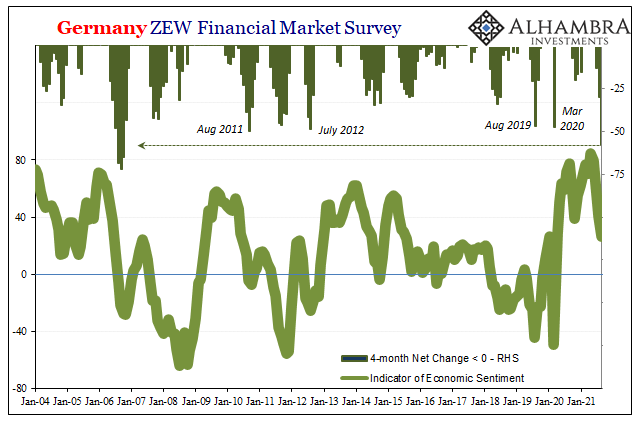

Today, early September 2021, the ZEW sentiment dropped again. Since hitting a more-than-decade high back in early May, this index has sunk like a rock. Not just four consecutive monthly declines since that lofty apex, the total drop within the quartet is an astonishing 57.9 points. This makes the largest 4-month contraction since 2006 – the end of the global eurodollar mania heading downward toward eventual oblivion.

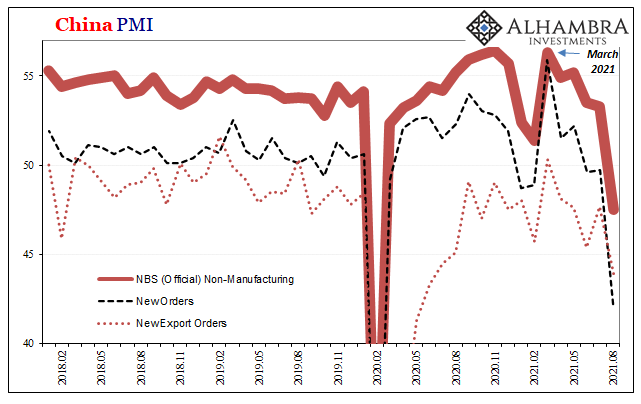

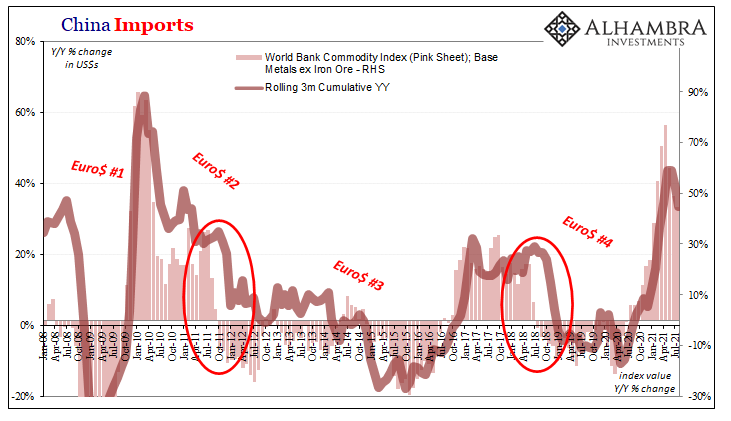

Germany, as you know, has close economic and trade ties with China. China, as you also know, is the economy which is always claimed to be on top of its game; necessary because if anything short of that the inflationary, global recovery narrative can’t sustain itself in much the same way the actual economy won’t, either.

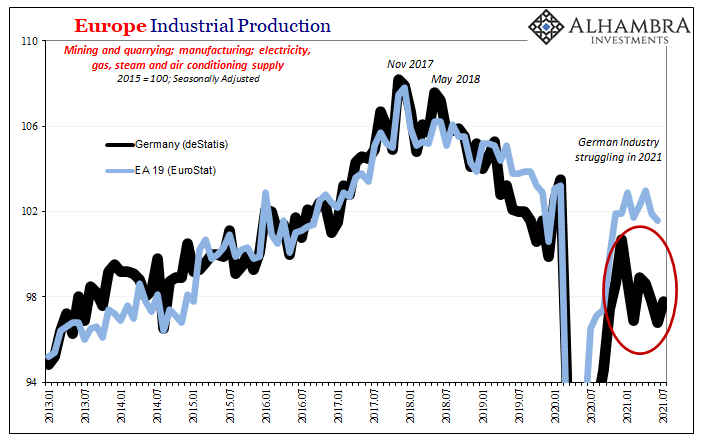

As it is, actual output as seen from both the ZEW Current Situation Index as well as something like deStatis’s estimates for Industrial Production in the country demonstrate only a struggling economy (below).

Whereas 2018 only had the one excuse – trade wars – in 2021 there are several; from COVID and political over-eagerness to the worldwide shortage of both chips (not Doritos, thankfully) as well as workers.

By itself, the ZEW wouldn’t have been overly compelling in 2018. That was the thing, though, it was one indicator which was only contrary to the common interpretation thrown around in the financial media like there was real weight behind it. There never once was.

In terms of data and evidence, including a whole bunch about China, it was the narrative which proved to be contrary to the unfolding situation.

Here we are all over again. Inflation, etc. Yet, against that rhetorical backdrop the warning signs are gathering in much the same way, for many of the same reasons, and with similar rationalizing.

Stay In Touch