All eyes on Europe today where ECB Governor Christine Lagarde tried very hard to avoid committing to either rate hikes or the timing of them. Always conditional, she says. However, everyone knows different. With her counterparts at the Federal Reserve already committed to panicking over CPI rates, the latest HICP inflation numbers in Europe are not going to take any pressure off European policymakers.

They brought this on themselves, after all, so blatantly switching between transitory and not.

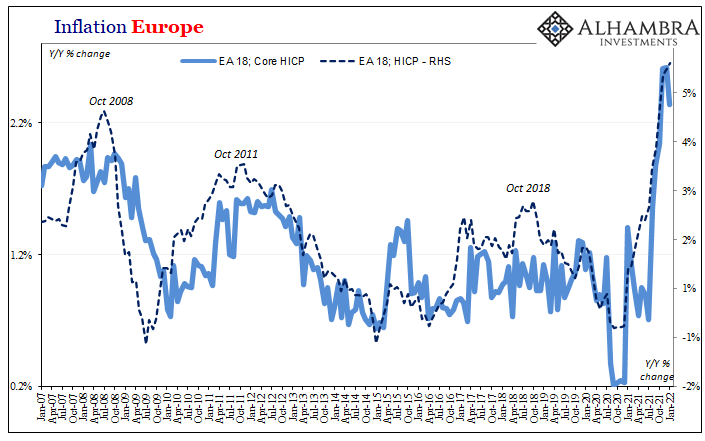

While everyone is glued to the historically high annual rate, the inflation data for January 2022 outside of that one figure leaned heavily toward Team Transitory. The preliminary or flash estimate for the EA18 as a whole put the consumer price index 5.1% higher last month than it had been January 2021. This was more than expected and also another record level.

It is the constant news reports of record high rates that policymakers actually fear. Turning toward expectations policy rather than monetary sufficiency (let alone oversupply), the actual tendency of consumer prices lately makes little difference to the theoretical basis behind the ECB’s “will they/won’t they/they are” rate hikes.

With regard to the details, even the headline came down toward transitory. The monthly change, seasonally adjusted, from December 2021 was 0.3%. More than expected, yet also the lowest since July (the current month, like the prior, no doubt will be blamed on whichever coronavirus variant).

Europe’s pattern of inflation, no matter a totally different geography as well as set of calculations, is immediately recognizable: three camel humps, or two humps and a head, with the third of whatever piece of anatomy clearly visible again concurrent to whatever had tapped the global economy in October.

While the headline HICP rate went upward, the core rate did not. On an annual basis, this was 2.3% more than the prior year, decelerating from a 2.6% pace both November and December.

Month-over-month, the core inflation estimate sank by a rather large 0.8%, which turns out to be the biggest decline since January 2020.

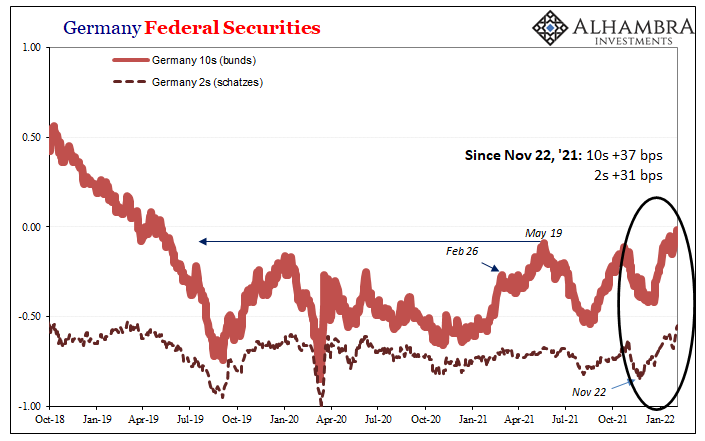

Again, these details won’t factor in Europe’s rate hikes which is why bond yields are now gaining so much attention. Germany’s benchmark 10-year bund, for example, has been said to be above zero for the first time in a long time because this crucial segment of the global bond market has finally climbed aboard inflation’s increasingly crowded Team Not-transitory.

To clarify: while some pricing services put the 10s on the plus side, the German Bundesbank’s calculations (remember, there is no single 10-year bond we can look directly at; the yield is a mish-mash of securities whose leftover maturity is about 10 years) do not. As of today’s trading, that central bank believes the representative 10-year rate is just barely negative, -0.02%.

I’ve always used these yield estimates.

Though whether slightly positive or slightly less than zero, it doesn’t really matter.

And, surprising no one, I disagree as to the interpretation of these moves for the same reasons as we find in the US Treasury market; the “good” curve steepening had been done up to May 2021 when last the 10-year had reached a multi-year high (when the 2s didn’t budge). Rates modestly higher this time around not because of inflation or growth expectations, rather due to Christine Lagarde’s selective consumer price considerations (the 2s are rising nearly in tandem).

In other words, what’s in the bond market is on the expectation of rate hikes, seeing this as central bank “inflation” fears instead of the beginning toward real inflation.

Since November 22, Germany’s 10s have gained 37 bps while the far-less-likely-to-make-a-big-move 2-year Schatz has added 31 bps. Does that additional 6 bps for the 10s represent record high inflation and potential for so much more, or just a market fluctuation given the stickiness of the 2s?

The central bank rate hike panic has gone global and it no longer matters the relative and actual inflation situation. The term “record” has been used too much in Europe, just as “multi-decade high” has been over here. These are being priced accordingly, the near-term bias in all rates is higher.

Stay In Touch