The Treasury Department released its broad TIC data today for the month of December 2022. Omicron fears, bond yields dropping despite the Fed’s rate hikes and an accelerating US CPI. Sure enough, more than a few segments of TIC consistent with those general outlines.

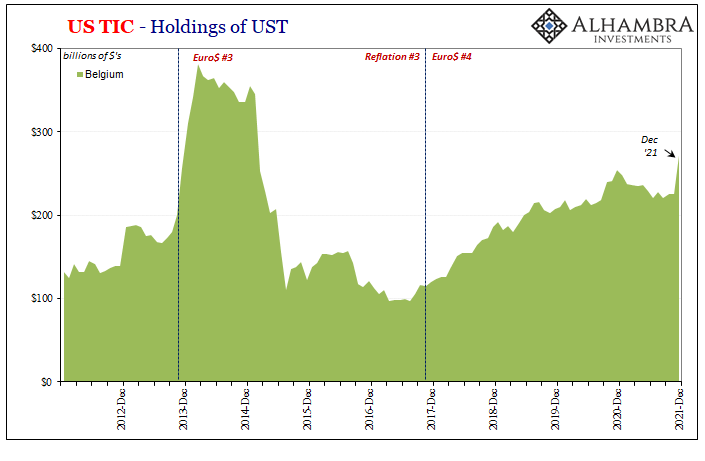

Let’s begin with one of those which doesn’t have an immediate explanation; or, put another way, can’t be directly tied into some other part of the statistics. I’m talking about the balance of US Treasuries held within the country of Belgium. Out of “nowhere”, the reported level surged by $46.8 billion in December alone.

This sounds like a it should be a positive development; when more Treasuries show up in data somewhere else this typically means more dollars out their in the eurodollar’s world. Except, when it comes to Belgium specifically, it’s not like it would be for other countries.

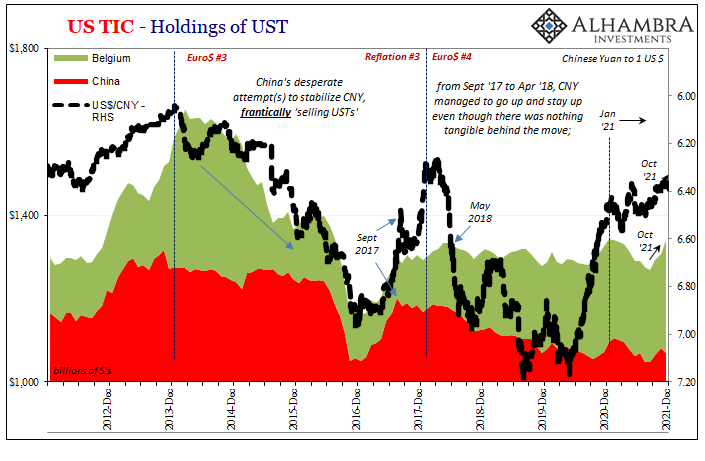

The Belgians aren’t being the beneficiaries of increased or renewed “hot money” financial flows like we might associate with, say, the Chinese holding more UST’s (fewer again in December). Instead, Belgium is the home of Euroclear which means UST’s going in (or coming out) for unidentified global financial reasons on behalf of global financial counterparties.

Including demands for collateral in repo or more likely derivatives (including currency swaps).

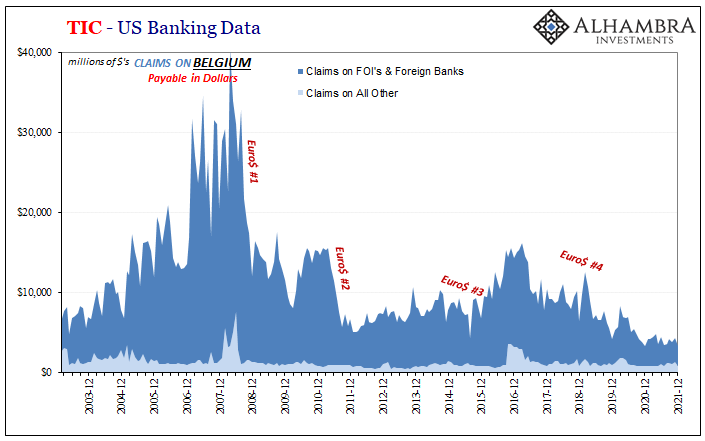

For comparison’s sake, here’s the US bank claims on Belgium which have nothing to do with the Euroclear business; these levels are drops in the global bucket (though there is a very clear Euro$ pattern to them). As of December 2021, American banks report total claims of less than $3.3 billion.

So, yeah, this is totally Euroclear. Given total UST’s reported in the clearinghouse’s home country of now $271.7 billion, spiking 20% in just one month, someone from somewhere just plunked down about half a hundred billion in UST’s (unless this is a data discontinuity; but there was no accompanying note indicating as much) for reasons equally unknown.

Collateral call?

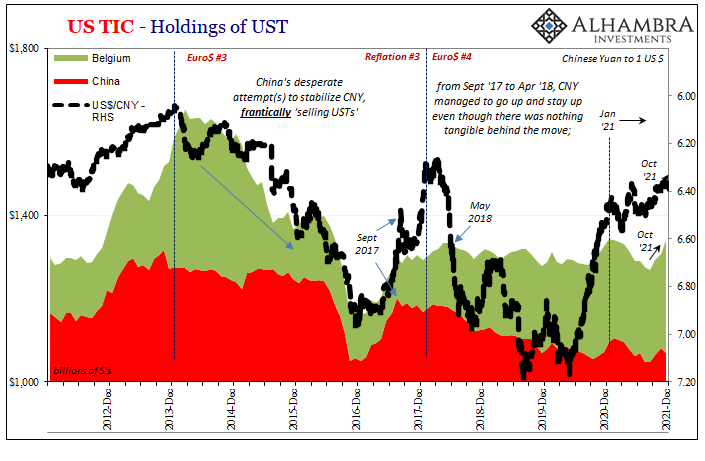

The Belgium/Euroclear connection has been associated in the past with China and its (euro)dollar funding conditions for almost a decade – and for these same reasons. The last time we saw this big of a single-month UST deposit into Belgium, it was December 2013 and January 2014.

The very painful start to Euro$ #3, someone, probably China, did indeed get a collateral call from the Belgians running Euroclear.  With no immediate answers, only suspicions, it will be interesting to see if this plays out in the same way(s) as that prior episode – yield curve flattening and eurodollar futures curve inversion are already betting on something very much like it.

With no immediate answers, only suspicions, it will be interesting to see if this plays out in the same way(s) as that prior episode – yield curve flattening and eurodollar futures curve inversion are already betting on something very much like it.

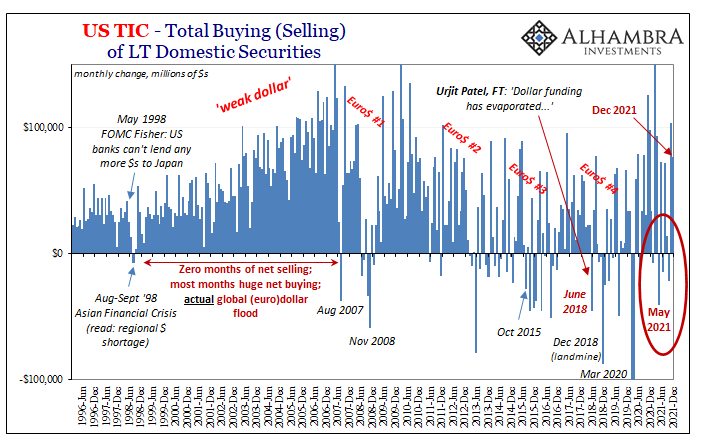

Despite these swirling questions, the overall TIC headline (net purchases or sales of US$ assets by foreigners) managed a second straight big positive. As noted last month, however, this isn’t unusual as the figures in terms of changes from month to month, or even several months, tends to be noisy and volatile. See for yourself:

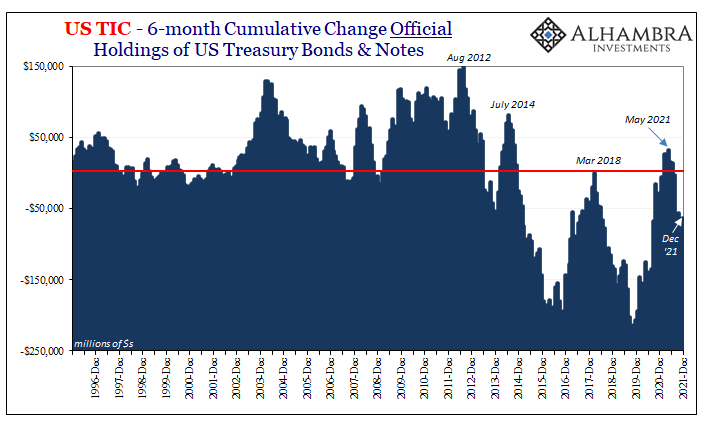

While foreigners in the private sector were buying up US$ assets again in December, more importantly (for December) foreign officials (central banks and Finance Ministries) were still selling specifically UST’s (even as their price went up). The net change wasn’t huge, -$9.7 billion net, following November’s much larger net decline it was a consistent dollar shortage number.

More importantly, the trend here which goes back to mid-year last year (like a whole lot of everything else):

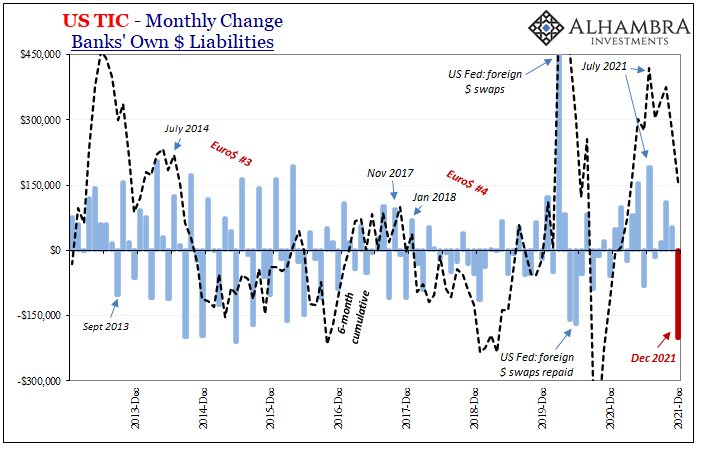

Primary among the “everything else”: US banks reported a huge decline in net liabilities to foreigners (of all types) in December, a whopping -$200.9 billion. I don’t want to make too much of it given the even more extreme noise in the month-to-month changes in this series (immediately above), but that’s more of a negative than late 2020 when Fed “overseas” dollar swaps were being repaid, and about the same as a couple of Euro$ #3 months (September & December 2014, as well as June 2015).

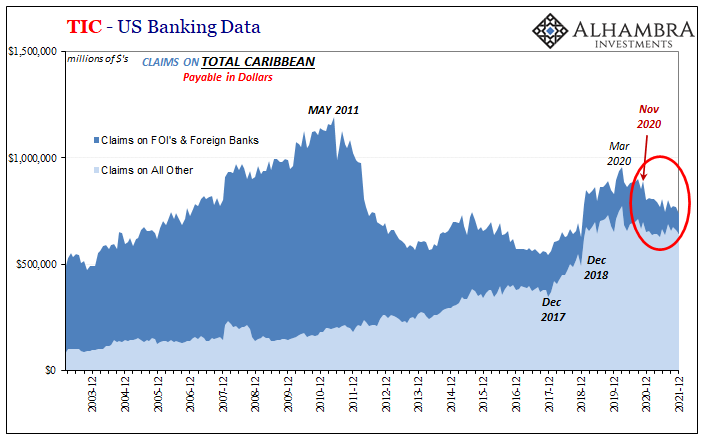

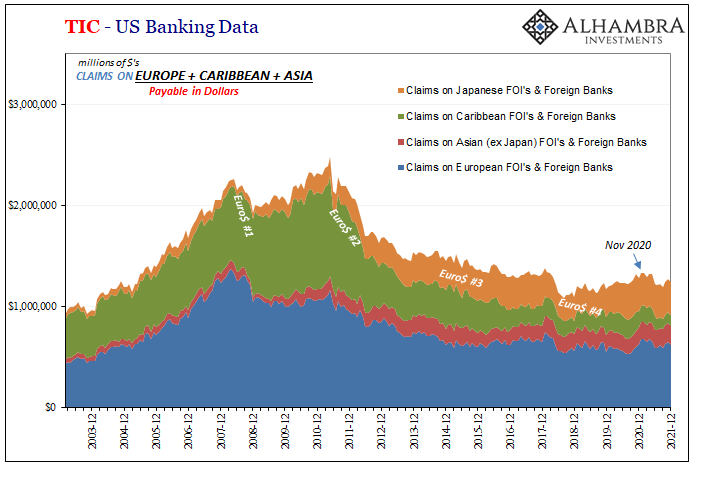

There is some indication that this December bank disturbance might have been located in/with European counterparties; or maybe those in the Cayman Islands (Mr. Emil is never above suspicion where it comes to global eurodollar flows!) The TIC data by country shows that US banks reported much fewer claims on financials (the above data is bank liabilities) in either of those locations (-$70.5 billion less claimed on firms in Europe, while -$29.7 billion less claimed on firms across the entire Caribbean).

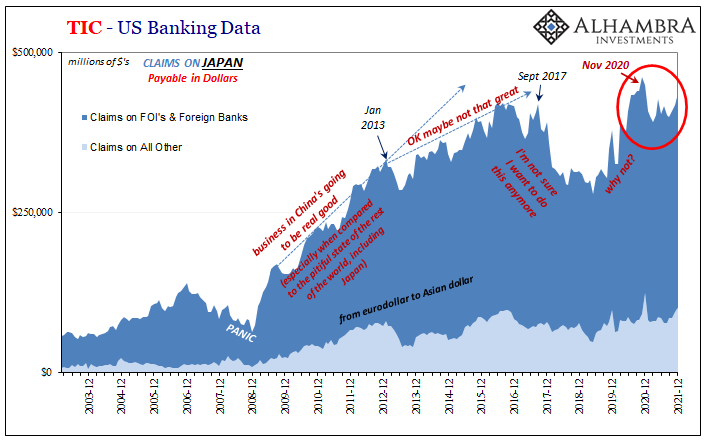

That cumulative drop was offset slightly by an increase in US bank claims on the Japanese (+$17.9 billion). Good for China?

If it was, then just which country was it who needed to plunk down $47 billion in UST’s in Brussels? It could still be China, maybe getting the eurodollar squeeze from Emil on Grand Cayman rather the usual Tokyo drop-off. Global reserve redistribution isn’t easily put together.

Unfortunately, the data isn’t one-to-one nor are these flows, changes, and results easily tracked and cross-matched across various datapoints.

1. What we do know is that any big Treasuries leap from Belgium doesn’t correlate with good eurodollar flows and funding, and that happened in December.

2. Foreign officials are still selling UST’s, including December, an historically-substantiated dollar shortage warning sign that began at mid-year last year.

3. US banks are claiming fewer dollars from the rest of the world also since last July, and reported a big decline in liabilities in December, even if we can’t directly identify where there are now fewer borrowed domestic dollars (Europe the most likely suspect) or from where fewer domestically borrowed offshore dollars.

In other words, the “what” of TIC remains as unambiguous in December as it had been the rest of 2021. While “who” isn’t unimportant, and there are several clues, the TIC data just isn’t that granular – because it was never meant to be a data proxy for a global monetary reserve system that doesn’t officially exist.

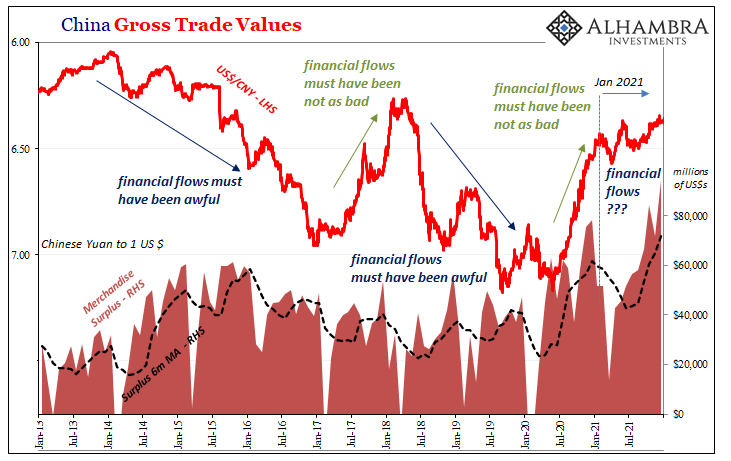

Whatever ultimately is going on, the indicated financial flows are as consistent with Chinese trade; as in, merchandise flows or the “export of dollars” don’t tell you anywhere close to the whole money story. Instead, financial flows always dominate (sadly) and TIC like markets has nothing inflationary to say about those.

Stay In Touch