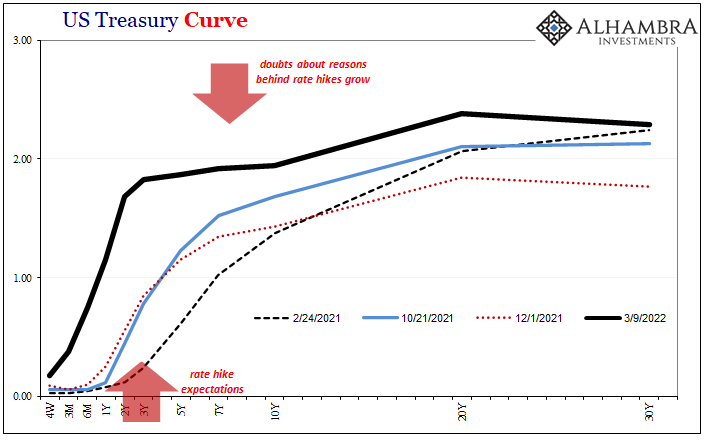

This is a truly weird shape for the US Treasury curve to find for itself. Really steep up front, seriously upward sloping consistent with the Fed’s stated rate hike intentions (which influence short-term rates most directly up to around the 2-year note). From there on down, though, it’s flat. As in pancake, almost.

I can’t recall a time when the curve was this oddly drawn. The yield curve really does behave like two different curves (because it sort of is) at most times, this is taking things to another level.

These are unique times, but when aren’t they? Though history rhymes, it never repeats exactly. Wrinkles are to be expected even in those special cases where the verses are near carbon copies. In other words, flat is flat.

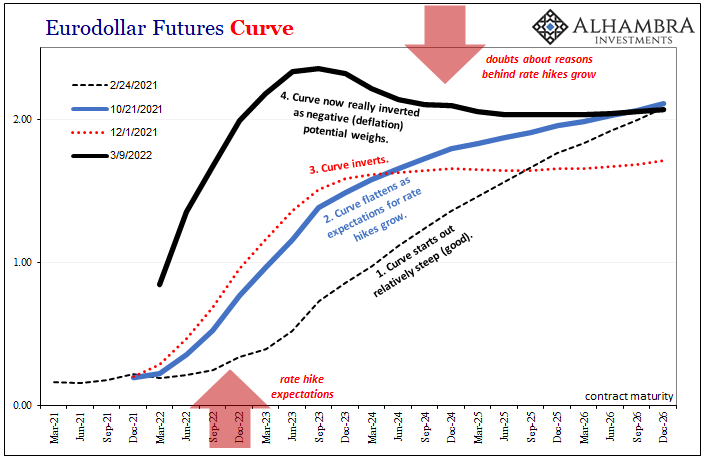

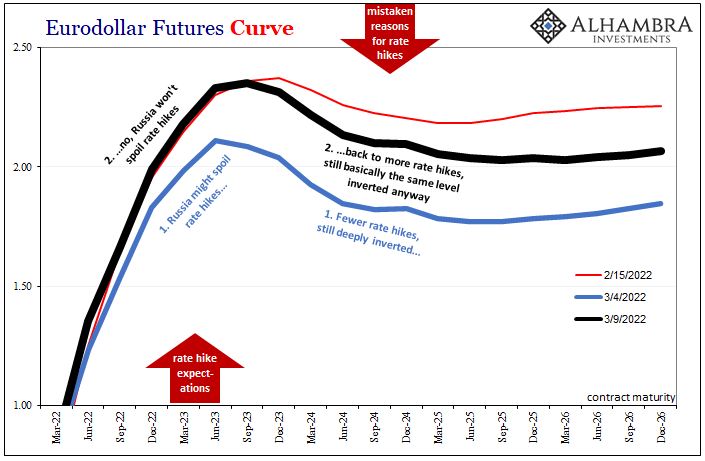

And so is inverted. Taking this a step further into the upside-down world of inverted curves, eurodollar futures have again repeated their own format. Markets grow worried about immediate threats from spillover out of Ukraine; front end contracts (like UST yields) decline somewhat as the potential for the Fed getting its rate hike plans interrupted by particularly sky-high oil price higher.

The back end, however, doesn’t move. The farther out contracts (or yields) maintain their shape even as the front prices probabilities for fewer rate hikes.

Then, as is so often the case, the market throws such caution to the wind and reflates in the short run, thinking less of Ukraine and more of Powell. The rate hikes come roaring (slight hyperbole) back into the picture, the curves’ pictures, yet the farther-out flatness in Treasuries like the inversion in eurodollar futures remains anyway.

Rate hikes on, rate hikes off, the utterly peculiar yield curve sticks no matter; the eurodollar futures inversion for all the ups and downs of late up front has actually deepened for each short run tendency.

What’s bothering – therefore distorting and transforming – financial and money curves isn’t really Russia nor is it next week’s Fed. These are concerns that run far deeper, to the point that oil prices where they are merely add perhaps too much more to what serious weakness must be underlying all this time.

I thoroughly enjoyed our conversation, @Fedguy12 , absolutely look forward to doing it again and keeping it going.

— Jeffrey P. Snider (@JeffSnider_AIP) March 9, 2022

Thanks to @JackFarley96 for hosting, and @Blockworks_ , looks like we could be reconvening in the near future.

For anyone who missed, there will be a replay. https://t.co/9blZaSpZuY

After all, as I pointed out yesterday talking with Jack Farley and FedGuy Joseph Wang, the market is hedging for something, not your run-of-the-mill everyday apprehension, either. So big this something that the other side of the market, those who might otherwise like to bet on Jay Powell and his view, they are not doing so.

In fact, the more inverted the eurodollar futures curve gets by the week or by the day, it means more in this deep, liquid, and sophisticated market are switching sides to the opposite, joining and betting with the prior disruptors who are actually betting against the Fed’s rate hike trajectory.

Demand destruction due to crude prices (and grocery; see: wheat) is one possible maybe likely outcome which could explain some of the market behavior. And if that potential demand destruction gets piled on top of a global slowdown, one that predates all these more recent disturbances, these together would indeed account for these shapes which in this context really wouldn’t be all that odd.

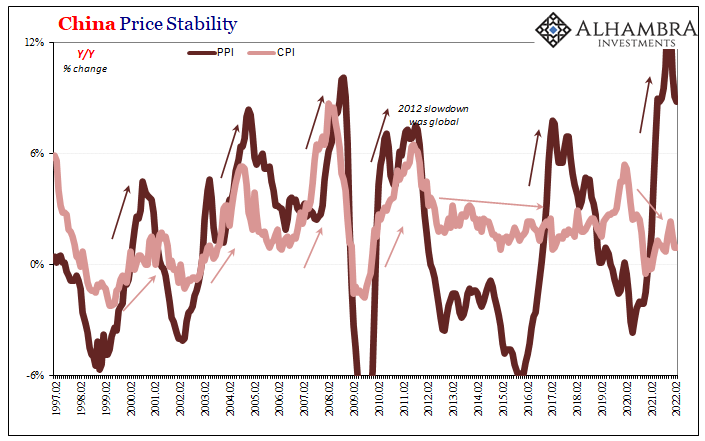

For this other possibility, any clues lie with another of Russia’s neighbors besides Ukraine, in this economic instance China. If we factor the Chinese economy as leading the world’s general and eventual direction, downturn potential already apparent there would have long before become a huge factor in upsetting Treasury yields and eurodollar futures prices.

Recent data has done little or nothing to dispel any gross financial hedging demand arising from the indicated trajectory.

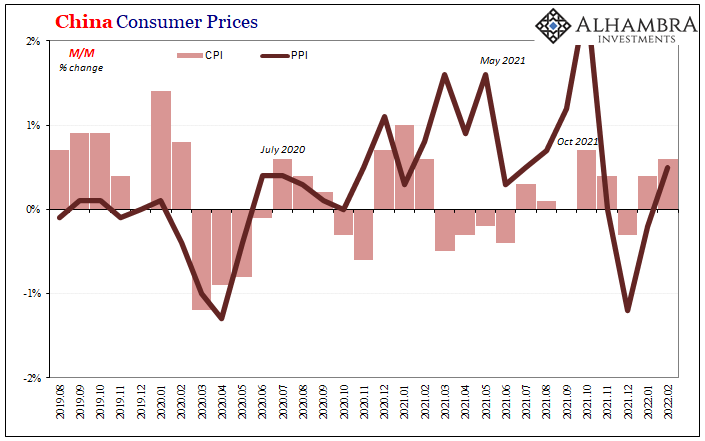

This week, China released February 2022 figures for both consumer and producer prices. For the former, the annual rate of change was 0.9% for the second month in a row, despite oil prices, and nothing like radical consumer price acceleration posted in the US or even Europe.

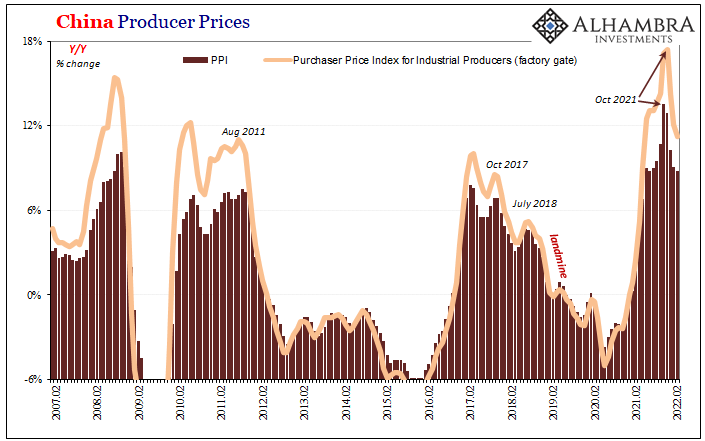

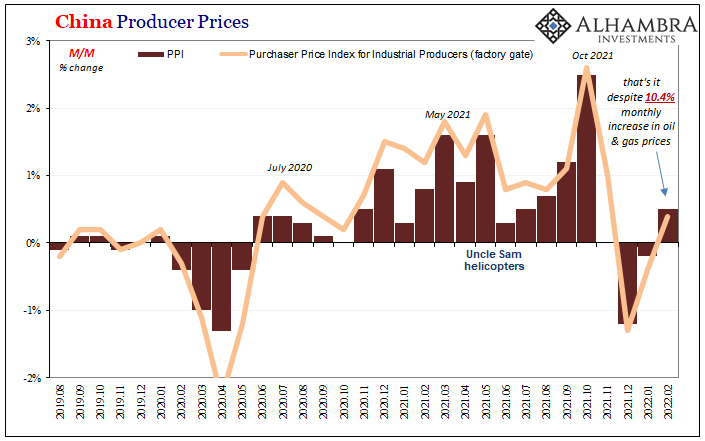

In terms of the Chinese PPI, proven to have been a relatively useful forward indicator, the annual rate declined for the fourth straight month, dropping to 8.8% year-over-year and down from a peak of 13.5% back in October (factory gate prices also slowed, increasing by a still-painful 11.2% in February, well below November’s high of 17.4%).

On a monthly basis, in spite of oil and gas prices rebounding by 10.4% in February from January, and overall raw materials costs increasing by 1.9% on the month, the PPI only gained 0.5% as the price of processed (closer to user demand) materials and goods were nearly flat (+0.1% m/m).

These much lower numbers have been attributed – as usual – to the stepped-up efforts by China’s Communists to control costs. The more likely reason for the downside to their “inflation” is what seems to have grabbed full control of flat and inverted in global markets like Treasuries and eurodollar futures.

Maybe even stocks, if you can get past the Fed’s punchbowl myth.

Stay In Touch