It appears as if most reactions to today’s April 2022 payroll were quite positive, maybe enthusiastic when they should not have been. Though the Establishment Survey – the CES headline number most people pay attention to – gained 428,000 over March’s tally, it was the “other” one which crashed down like last week’s negative GDP thud.

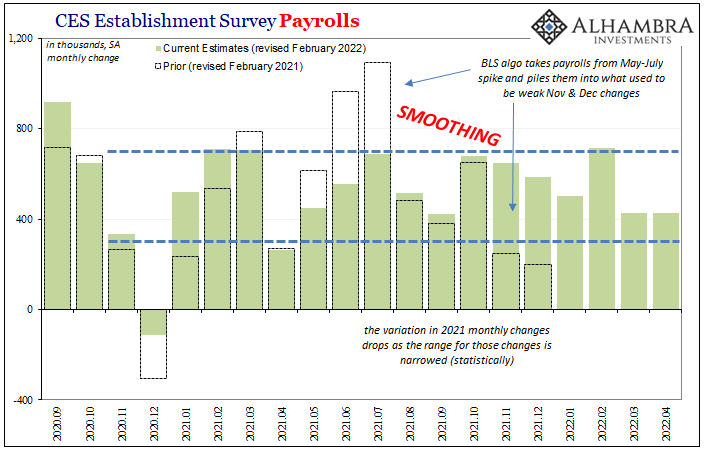

From the CES view, you can understand the optimism. Not only +428,000 for the second month in a row, this also marked the twelfth consecutive month of better than +400,000 for payrolls…even if only because last year’s benchmark revisions smoothed away the prior lows (and highs).

The past couple of months for the Establishment Survey have, predictably, fallen right within that statistically-enforced range, though at the lower end of it.

Take out February’s sore thumb of (revised lower) +714,000 and there’s a slight slowdown evident even here where the employment situation is designed to be at its most charitable.

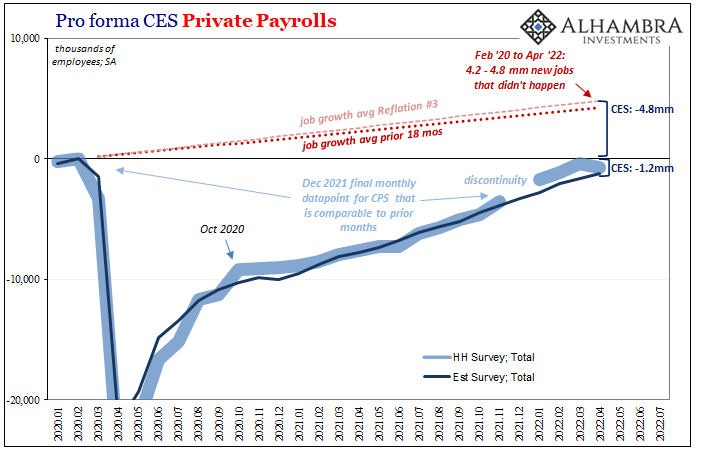

More importantly, though, even averaging better than 400,000 per month for an entire year, the overall level of employment remains way, way off track. The Establishment Survey for last month was still 1.2 million payrolls less than from February 2020, now twenty-six months in the past. Add to that the 4.5 to 5.0 million jobs that would’ve happened, and really should have if actual recovery, the employment situation by the best count is something like 6 million off.

Full employment?

That’s more of a big picture question of what might be, or might not be, in the background. The more immediate concerns, and where the April 2022 employment figures really went off the rails, this thundered from over in the CPS, or Household Survey.

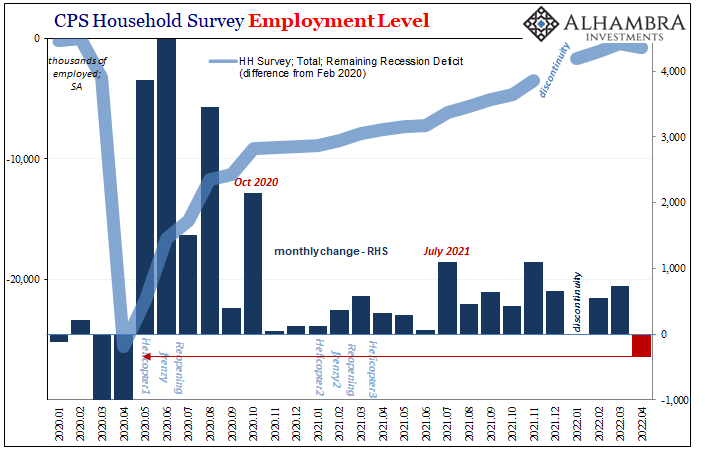

Caveats first: you never want to put too much stock in a single monthly estimate, let alone a single month of employment data, and even more caution and care when that employment data is the Household Survey. It is notoriously volatile and noisy, even when compared to other high frequency accounts that aren’t so smoothed like the Establishment Survey’s pre-planned near-straight lines.

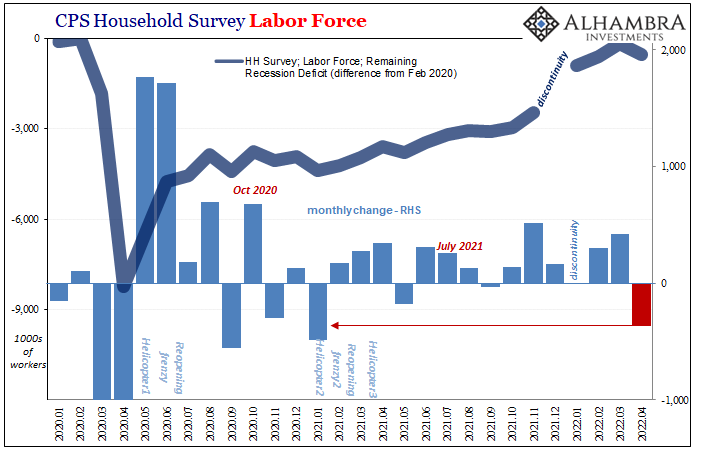

Yet, HH went negative. Big time minus. The monthly change was a sobering -353,000, meaning that there’s a very good chance that actual like calculated employment really did drop during April; a deep enough decline the statistical chances it wasn’t really minus are very low nor simple random variation.

This was corroborated to an extent, as much of an extent as another CPS data point might be able, by the Labor Force estimate. Also a minus, and also a big one: -363,000.

While noisy series both, neither of them had posted a negative in quite some time. The HH Survey hadn’t declined since April 2020. That’s significant in a different way because, while prone to big monthly changes, this data hadn’t changed that big to become so negative the entire rebound thus far.

There’s a substantial chance something happened that is different from what had been happening.

The Labor Force’s setback was its first going back to May 2021, and it hadn’t reversed to April’s degree since January last year. So, again; different?

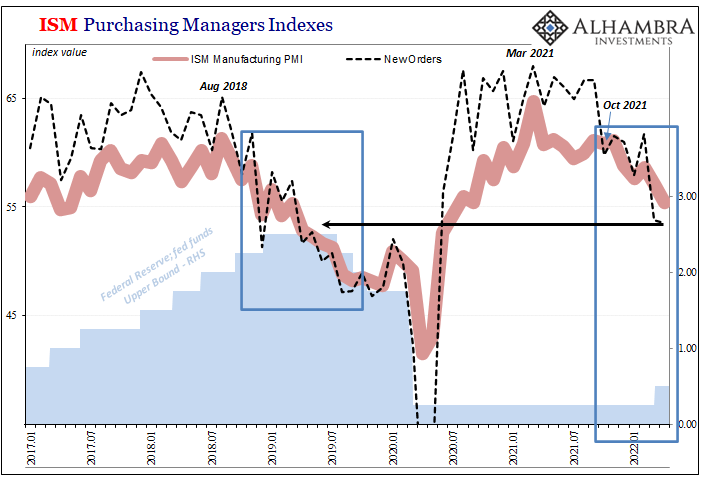

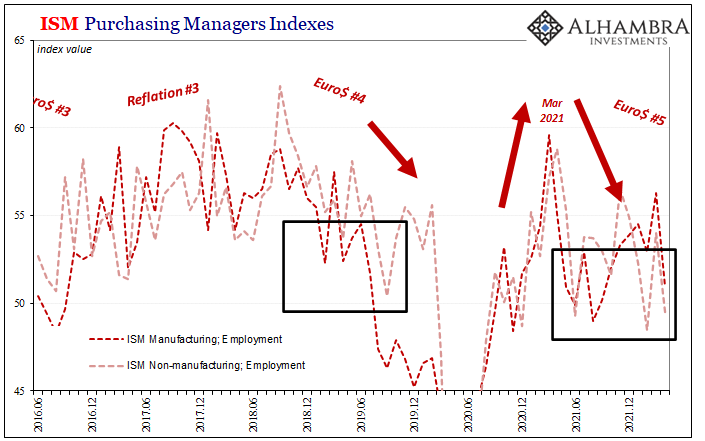

At the very least, the Household Survey does nothing to dispel the notion that the US economy is fragile, perhaps weak, and more like Q1 GDP (or recent other data, like ISMs including their employment indices) than not. This was a clear stumble.

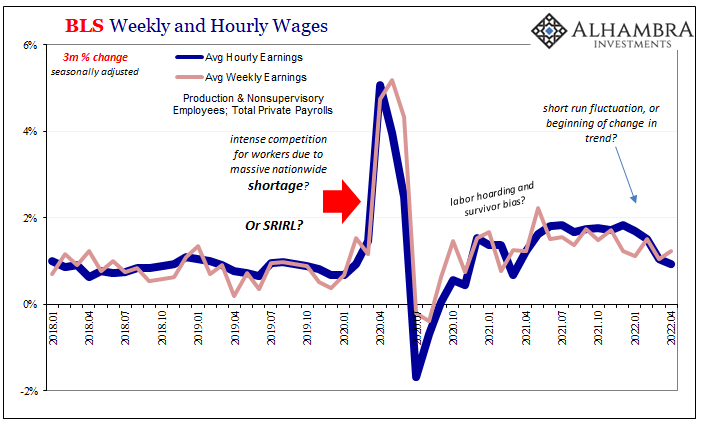

On the other end of the spectrum, the Establishment Survey didn’t do much to back Jay Powell, either. Even if you think it the more representative set, therefore rapidly approaching so-called full employment, then wages and earnings should be wildly accelerating as labor tightness forced competition for scarce workers.

Since we’ve heard constantly about a “labor shortage” for a long time already, you’d think as that shortage reached its climactic phase the pressure on wages would only intensify; but, no. Instead, wage and earnings estimates are decelerating, slowing down for what is now the fourth (hourly) or fifth (weekly) month in a row.

In the end, the April 2022 payroll data is pretty much the same as how I had described the full set of GDP estimates.

Frankly, the chances of a recession aren’t what we see in the current figures, rather the current figures are consistent with a recession trajectory and trend long since plotted out by the marketplace. These don’t prove one has arrived, yet do add a lot more to the confidence and chances one could.

Continuously weak economy riddled with imbalances and inconsistencies, yep. I mean, really, these are the results you’d expect to see from a system at the very least moving in the direction of a serious contraction.

The HH Survey stumble, like the same for Q1 GDP, is just the most noticeable along those lines. There’s more here at least tilted in that direction than not, and I’d include the Establishment Survey in that category, too (recognizing the statistical manipulation embedded within it).

None of this will matter to Mr. Powell and his FOMC, of course. To eventually stop the rate hike theater, it will require absolute and obvious proof the economy has turned its devious corner. The April 2022 employment numbers, for all their myriad faults, as of now they only hint at it.

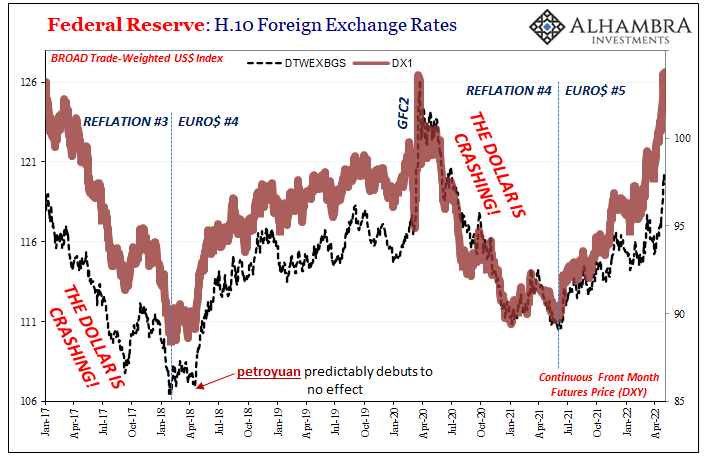

Far from the wonderful release it has been described, the employment situation’s insinuations should be taken more seriously given everything from stocks to the dollar.

And, yes, Euro$ #5.

Stay In Touch