I have often been accused over the years of being too optimistic and I will plead guilty to having a little rose-colored tint in my glasses. I am an optimist by nature and I search constantly for good things to write about. There are more than enough people out there willing to tell you the world is coming to an end, in more interesting ways than I could ever imagine. I don’t feel like I can add much to the doom and gloom canon. Besides, the sunny side of the aisle is pretty roomy right now. Come on over. Be an early adopter!

Rose-colored my glasses may be but they don’t blind me to the potential problems investors face; I am a rational, realistic optimist. The Fed is going to meet this week and the course of the stock and bond markets, at least for a while, will be determined by what is decided at the FOMC meeting. That is not how this is supposed to work but it is the reality of the situation, at least for now. We should be concentrating on making long term investments that will benefit us, and the economy, instead of worrying about what some central banker might say. But in the age of the loquacious central banker, we will instead focus our attention on Jerome Powell. Sigh.

Regardless of what Powell and the others on the FOMC do now, we should all remember that we are here, in this inflationary mess, because of their previous actions. Inflation is a monetary phenomenon and they are the folks in charge of monetary policy. They underestimated, by a wide margin, the price to be paid for financing $7 trillion in fiscal folly. Expecting them to now get things right is the triumph of hope over experience. A mistake now, to try and correct that last one, seems almost assured. The question, as with so many things in economics, is depth, how deep the gash of the economic slowdown. Parson Powell has already told us that we need to feel pain – repent, ye free spending consumers! – if we are to atone for his mistakes. The only question is how much he can inflict before the economy rolls over or the politicians call for his scalp.

I personally think that slowing nominal GDP growth is going to prove challenging. If the Fed’s goal is to kill inflation by pushing the economy into recession, they’re going to have to overcome the huge pile of cash they left behind last year. Household and corporate balance sheets are remarkably liquid. Yes, there has been some drawdown in the “excess” savings of the COVID era, but it’s only about a quarter of the total so far. At the current pace, the “excess” will be gone in just 3 short years.

The Fed may be able to scare people sufficiently with an economic slowdown to get them to pull back spending temporarily. But as soon as the economy starts to turn up, they’ll start spending again. And, since the savings rate generally rises during recession, they’ll replenish the pile of “excess” savings.

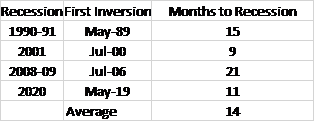

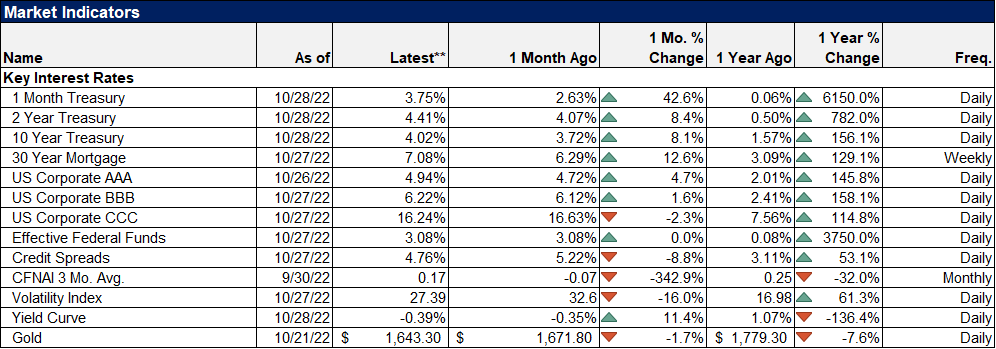

But right now, the economy is slowing and the Fed is pursuing an aggressive tightening policy. The yield curve is almost entirely flat to inverted, the 3-month T-bill rate joining the rest of the curve, from 6 months to 7 years, in rising above the 10-year rate. The inversion of the 10-year/3-month spread has, in the past, heralded a coming recession. Of course, it tells us nothing about timing; the average lead time from inversion to recession in the last four recessions is 14 months. So, yes we’re on recession watch but we will need confirming signals to take action. We have a few now – LEI down six months in a row for instance – but there are important checkboxes, such as credit spreads, that remain blank.

This isn’t a situation that demands immediate action. The trend of the dollar and interest rates is still up at this point and stocks are, despite this rally, still in a downtrend. An opportunity is likely to arise when one of those big trends changes. If it is because rates start to fall there will be an opportunity in bonds. If it is because the dollar gets in a downtrend the opportunity could be in gold or commodities. Stocks would likely benefit from stability, in rates and the dollar.

I will expect to get emails this week about how I’m a Pollyanna because I have the gall to think of the US economy as, for lack of a better word, resilient. Imagine how negative the mood is if mere resilience is the optimistic view. Frankly, I don’t know how you could view the US economy as anything but resilient. It has taken a lot of abuse over the years, from monetary and fiscal authorities, and it keeps coming back for more. The US economy isn’t resilient because of the Federal Reserve or the Congress or the President. It is in spite of them.

Environment

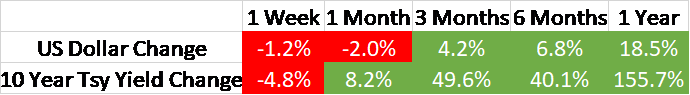

The dollar and the 10-year Treasury yield continued their correction last week. The 10-year yield fell about 20 basis points. The dollar fell to a low of 109.36 (I told you a couple of weeks ago that first downside target was 109; close enough) before recovering slightly on Friday. The dollar index is now down 3.6% from its September high of 114.75. It’s in a short-term downtrend for now but the longer-term trend is still up.

The dollar is certainly still well loved and for good and obvious reasons but it appears to be peaking on the long-term chart. I can’t give a reason for that right now but I guarantee you that when it peaks it will be obvious as hell with the benefit of hindsight. Those good and obvious reasons it is well loved are, by the way, already reflected in today’s price. For now, I’d say the next downside target is around 104.

BTW, the dollar index at 104 is still a strong dollar and would still not violate the long-term uptrend.

For rates, the most interesting development last week was the inversion of the 10-year/3-month yield curve – again. When I started writing this it was again uninverted and now it is inverted again. Oh my, what does it mean? Let me be as clear as possible. The inversion of this part of the yield curve is a traditional warning sign for recession. It does not, as best I can tell, cause a recession but it is correlated. I do not believe we have had an inversion of this part of the curve in the post-war period that didn’t eventually lead to recession.

So, the inversion means that the odds of recession sometime in the near future have risen. Does it mean recession is inevitable? No, we could have the first inversion of the post-war period that doesn’t lead to recession. I don’t think that will happen but it certainly could and it wouldn’t surprise me at all. I have said this repeatedly over the last couple of years but this post-COVID period is unique. We don’t have a precedent of recovering from a global pandemic with a massive fiscal response funded via a massive monetary response. We don’t have a precedent for what happens after governments effectively shut down the global economy and then restart it. We sure don’t have a precedent for all those things and a war in the heart of Europe.

Even in the best of circumstances, in a more “normal” economy, the lead time from inversion to recession is widely variable:

The impact on stocks is also variable. Stock market bottoms have happened as soon as 3 months from the onset of recession (1953/54) and as long as 20 months (2001). Stock markets tend to peak before recession but the lead can be as much as a year to none at all. There have been bear markets without recessions (1946, 1961, 1966, 1987) but I don’t know of an instance where we had a recession without a bear market.

What does all that history add up to? Every bear market and every recession is different, the past is merely a rough guide to the future. The only prediction I’ll make is that when we get a recession, we will almost certainly have a bear market too. And that if that recession is far enough in the future, we could have a bull market in the interim. The range of possibilities is necessarily wide.

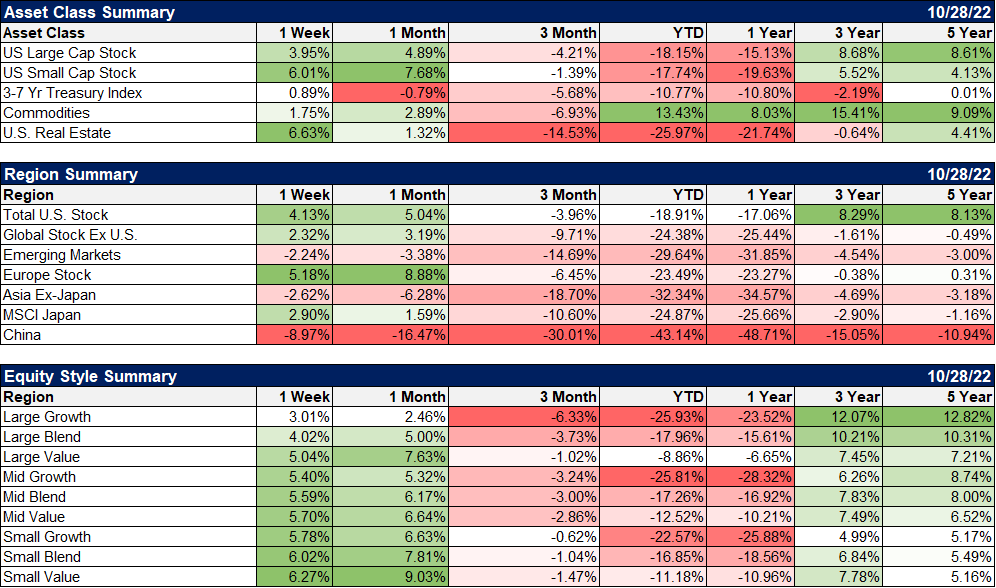

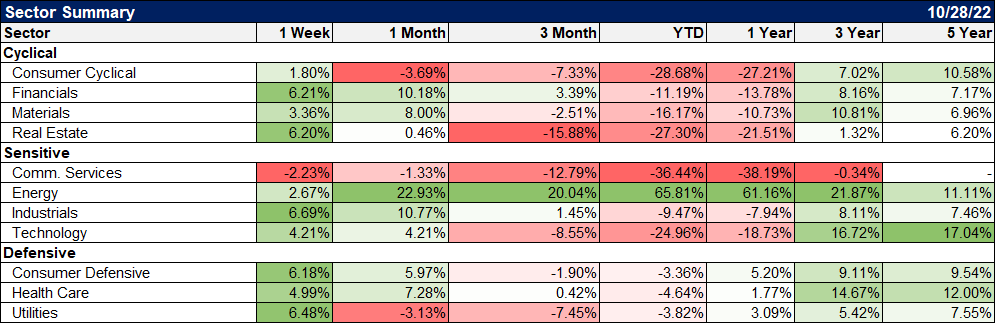

Markets

Stocks were up again last week, extending the rally that started on October 13th. From intraday low to the close last Friday, the S&P 500 has risen 11.7%. Small-cap stocks are up a little more at 12.7%. REITs have added 11.1% during this fall rally. What’s more interesting is that the rally in risk has occurred without a rally in bonds. During the summer stock market rally, the 10-year yield fell from 3.48% to 2.79% but risk has rallied this time while rates have risen.

Why have stocks put in this rally right before the Fed meeting this week? Earnings have been pretty good with some glaring exceptions like Meta and a few other tech stocks. Industrials, REITs, and financials have all performed well which might indicate this rally is more about growth than rates but given the recent yield curve inversion, that explanation also feels a bit wanting.

It could also be some investors getting a jump on the mid-term elections, assuming that Republicans will take control of Congress. I have no deep insights to offer on that score except to say that if they do, markets generally seem to like gridlock. It’s almost as if the less the politicians do the better the economy performs. Imagine that.

Whatever the explanation, I think this rally has gone way too far, way too fast. Sentiment has turned bullish very quickly and there appears to be some FOMO going on and not just at the retail level. Institutional investors are likely fretting the rally too knowing that if the market rallies into year-end and they miss it, they might be looking for a job next year. Or as Eddie Murphy once put it so pithily, they “ain’t going to have the money to buy their son the GI Joe with the kung fu grip”.

I do not expect Jerome Powell to offer any encouraging words to the bulls this week so if that’s what they’re counting on, I think they’re going to be disappointed. If you’ve been thinking of buying this rally, I’d hold off. And if you’re a trader and bought the bottom you probably want to take some chips off the table. Even if this is a rally that continues, a pullback based on Fed talk, would be healthier than just continuing to go up. I’d say the odds heavily favor at least a correction of the recent uptrend.

This has been primarily a US-based rally too and last week was no different. China continued its self-immolation after the Xi-fest, down another 9% last week. That non-US stocks still underperformed with the dollar falling last week, means they performed even worse in their own currencies. Can the US avoid recession if the rest of the world succumbs? Well, it is more likely than the reverse but hardly a sure bet.

Value outperformed growth and small stocks outperformed large, two trends that are looking more and more durable.

Financials, real estate, and industrials led the way based on good earnings. Utilities were also higher, rebounding from their September drubbing. But defensive stocks also had a good week so maybe there’s more to it than just a little downtick in rates. It is a bit strange to see defensive stocks and economically-sensitive stocks rallying together. I suspect it won’t last.

Credit spreads have fallen during the risk-on rally too and are now back below 5%. We may be headed for recession but if so, someone should alert the junk bond market.

This week’s commentary is a day late because I was out of town to attend a very special wedding. That’s what got me thinking about optimism this week. The newlyweds, Marcelo and Alexis, are young, successful, and about to start a family. They have managed somehow to be daring and conservative all at once. They are fearless in their travels and adventures but also frugal and conservative, carefully husbanding the capital they’ve worked so hard to accumulate. They are loyal to their families but open and welcoming, always making their guests feel special and included. They are what we hope our future holds.

And, importantly, Marcelo and Alexis are not alone. We are privileged to know many young people (I find that is a much more flexible term as I get older) who allow me, encourage me, inspire me to see a better future. We read a lot about how awful the millennial generation is – narcissistic, unfocused, lazy, entitled winners of participation trophies. But as Jonathan Swift wrote:

Falsehood flies and the truth comes limping after.

The truth, that our future is actually in good hands, is mundane and draws no attention because it has happened repeatedly in our history. And it appears to me that it very much remains true today. Thank you Marcelo and Alexis for doing things your own way, for proving, to me at least, that America’s best days are still ahead of her.

Joe Calhoun

Alhambra’s Resident Optimist

Stay In Touch