- Has the Fed’s rate hiking campaign actually lowered inflation? Or would it have happened anyway? Jerome Powell has said that the rate hikes would involve “pain” but if that is the criteria I don’t see it. Higher rates have hit the real estate market but almost nothing else. And even there, mortgage rates are now trending back down and activity seems to be picking up again. So, was the “transitory” camp actually right?

- Could the drop in inflation be as transitory as the rise? There’s a lot of money still out there at the household, corporate and state government level. California just sent out more checks and my state (SC) just did a tax rebate at the end of the year. Income tax rates have been reduced in 10 states for 2023 and others, like SC, are doing one time rebates. With China re-opening and the potential for continued high demand in the US, will prices stay down?

- Could rising rates actually be stimulative? Interest income was up $140.6 billion in 2022 while payments were up $94.4 billion.

- Are we in a bull market? Last year when the S&P 500 fell below its 200 day moving average, there was a flood of articles about how this meant we were in a bear market. There was another flood when the 50 day moving average fell below the 200 day (the so called “death cross”). Now that the index and its 50 day MA are back above the 200 day I don’t see one article about it.

- Is the S&P 500 Value index really value? The largest holding is Microsoft and the average forward P/E of the top 10 holdings is 21.1. The entire index trades for 17.1 times forward estimates and 2.41 times sales. Does this sound like a value index?

- Now that real consumption of goods is back to trend (see This IS the Soft Landing) will they now fall below trend? Or reaccelerate? Auto sales in January up 17.7% from December and running at an annualized rate of 15.7 million would seem to argue for the latter.

- Is the inventory correction over? Retail inventory/sales ratio for retail ex-autos and parts peaked in August at 1.17.

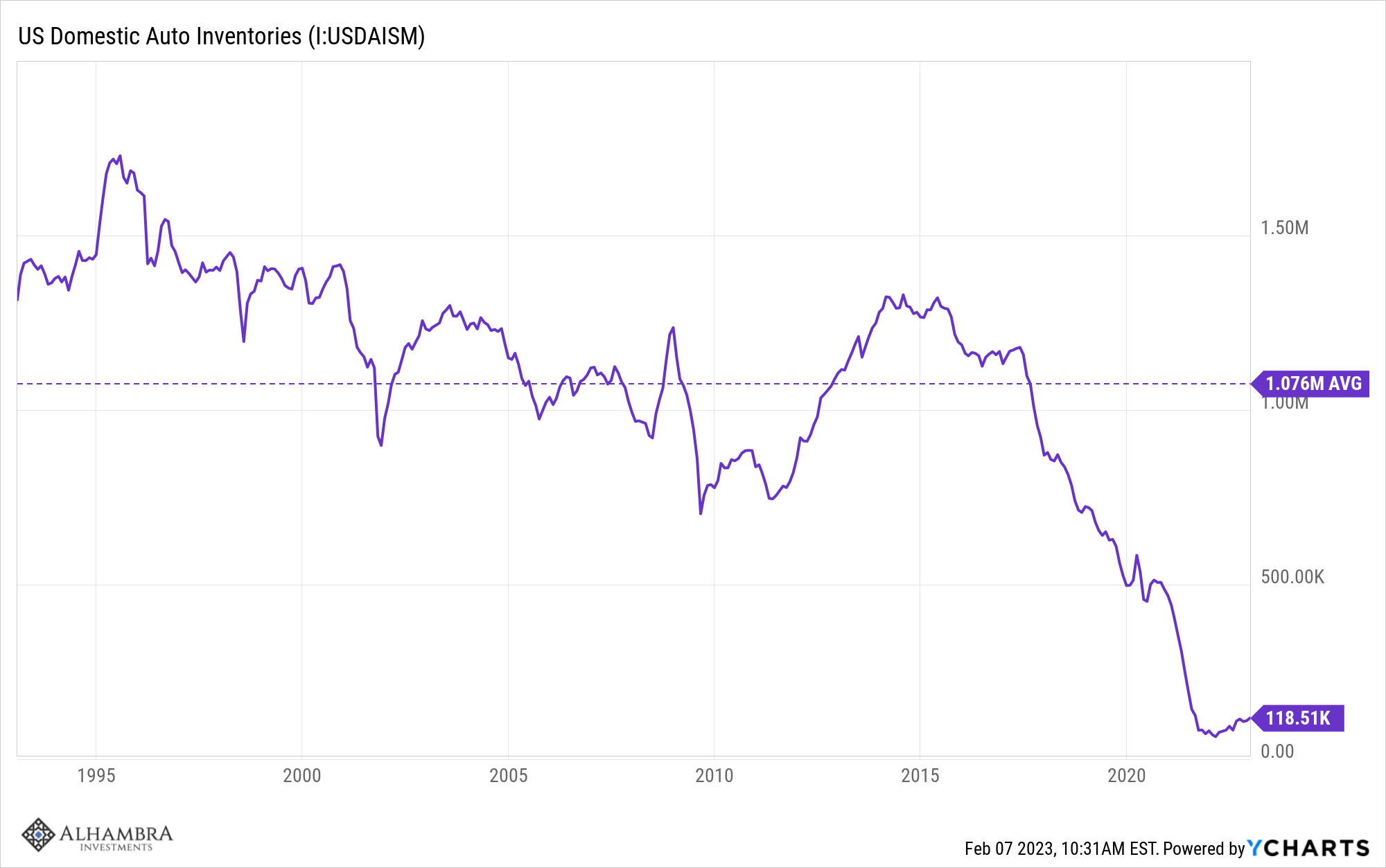

- Domestic auto inventories, on the other hand, stand at 118.5 thousand units when the long term average is over 1 million. Is this a new post-COVID normal? Or will dealers build inventory back to the old levels? What’s the impact on GDP if dealers just bring inventory back to half the old normal?

Stay In Touch