Why, man, he doth bestride the narrow world

Like a Colossus, and we petty men

Walk under his huge legs and peep about

To find ourselves dishonorable graves.

Men at some time are masters of their fates.

The fault, dear Brutus, is not in our stars,

But in ourselves, that we are underlings.

Julius Caesar, Act I, Scene II

The fool doth think he is wise, but the wise man knows himself to be a fool.

As You Like It, Act V, Scene I

William Shakespeare

Jerome Powell gave a speech at the Jackson Hole conference last Friday. It was a masterful oration…oh, heck I can’t do it. I had the speech on in my office, as everyone else in this business did, but I had the sound down low and didn’t hear most of it. To be brutally honest, I don’t care what anyone at the Fed says anymore. They talk so much it has just become background noise to the markets.

When I first got into this business over 30 years ago, the Chairman of the Federal Reserve was Alan Greenspan, a man who epitomized the role. He was, if nothing else, inscrutable, once saying: “I know you think you understand what you thought I said but I’m not sure you realize that what you heard is not what I meant”, although that may just be what is always said about someone talking without really saying anything. In the late 90s, he was so tight-lipped about policy changes that traders used the “briefcase indicator” to try and gain insight. If Greenspan’s briefcase bulged on the way into an FOMC meeting, big changes were afoot.

Back in those days, the FOMC didn’t even tell you what they had decided in their meeting. You had to figure it out from what they did in the market afterwards. Traders would gather ’round the Quotron, scanning the Dow Jones Newswire for a news flash, of a coupon pass or some other arcane market operation out of the NY Fed. Today, the Fed spends every moment outside the meeting week trying to influence the market to adjust to what they plan to do so no one is surprised when they actually do it. They tell the market what they are going to do and then tell the market what they did and then hold a press conference to discuss the things they already did, why they did them, what they might do in the future, and what they had for lunch.

In the lead-up to Powell’s speech, there was speculation about what he might say and this theorizing by itself moved markets, with stocks dropping 1.3% on Thursday on fears about the content of his speech. The worry? Rumors had been flying around for at least a week that he would raise the estimate for R-Star. Yes, R-Star might be higher than previously thought and if that doesn’t send a chill down your spine, well, you are definitely not one of the cool kids. Me? My thoughts ran to Shakespeare. Jerome Powell, our modern-day economic Julius Caesar, bestriding the markets like a Colussus, us mere mortals, led to our financial fate by his whims.

What is R-Star? It is the “natural rate of interest”, a term invented in the late 19th century by Knut Wicksell, who if nothing else has a really cool first name. According to the NY Fed, it is “the real short-term interest rate expected to prevail when an economy is at full strength and inflation is stable”. Hope that cleared things up for you. If not, I’ll simplify it. It is a theoretical rate that the Fed can’t measure and over which it has little to no control.

The idea behind the neutral rate (which is the same as the natural rate because economists can’t help but complicate things) is that it should guide the Fed in setting short-term interest rates. If inflation is too high they will set the Fed Funds rate higher than R* and if inflation is too low they will set the rate below R*. Easy peasy, right?

Except the Fed doesn’t know what R* is at any given moment and it is always changing. Oh, and the Fed doesn’t set real interest rates, only nominal ones. Oh, and R* is also influenced by all the other things that affect economic growth that aren’t monetary and over which the Fed has no control. Oh, and R* is really about balancing the supply of savings and demand for investment and investment is more dependent on long-term rates than short term. And the Fed has almost no control over long-term rates. Other than that, it’s a fine theory.

Jerome Powell did say one thing in his speech that I agree with completely and it was also his only reference to R*:

As is often the case, we are navigating by the stars under cloudy skies.

The Fed is trying to steer the economy with 19th-century navigation equipment and a broken rudder. They shouldn’t be trying to steer at all and they have much less control over the destination than they or most people believe. The natural rate of interest is exactly that, natural. It is determined by the supply of savings and the demand for that savings to invest in the real economy. It should be the prevailing long-term real interest rate. If it isn’t, if we have too much or too little inflation it is because the Fed and all the other economic policymakers have oversteered. By trying to set the short-term interest rate, the Fed usurps the role of the market and reveals itself as the fool who doth think he is wise.

You don’t need to know what Jerome Powell is going to say or do. The wise investor knows what he doesn’t know – what he can’t know – and becomes the master of his own fate when he refuses to be an underling to a fool.

Environment

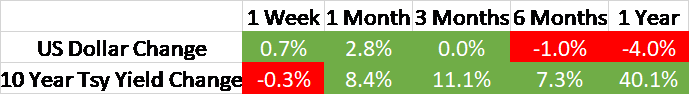

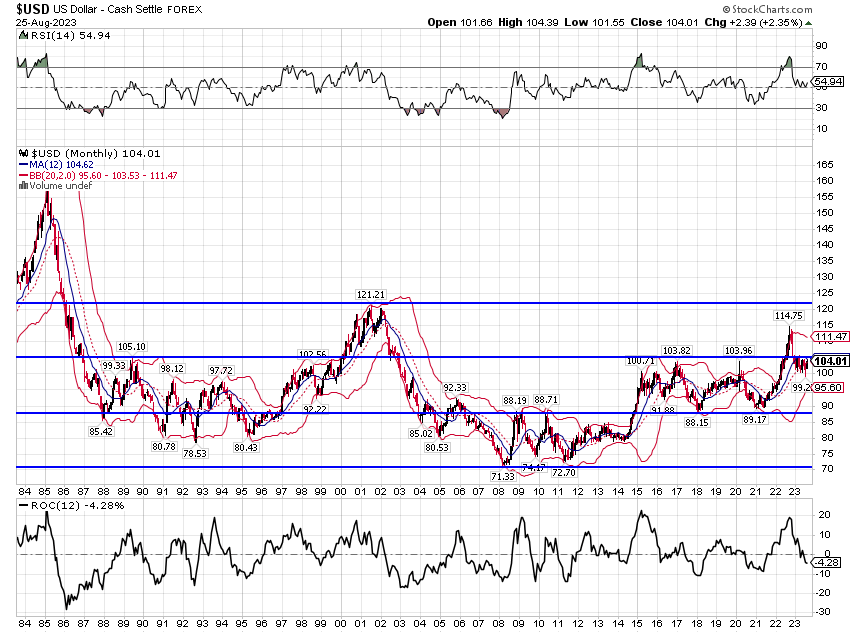

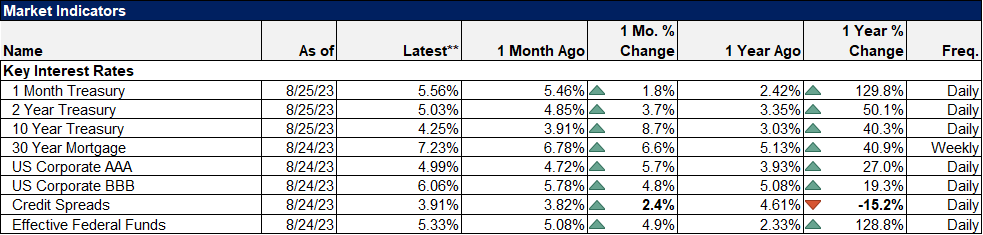

The trend for interest rates remains up, although the 10-year rate was down marginally for the week and has still not managed a weekly close above the October high. 10-year TIPS yields did hit a new high for the cycle last Monday, finally joining some other maturities at 2%. It didn’t last and like the nominal 10-year, the yield settled lower by about 2 basis points.

There may be more significance to what is going on with shorter-term rates, although the 2-year yield has not yet broken above its March high. Whether it was Jerome Powell’s speech or the generally upbeat economic news, short-term rates markets have started to price in a higher probability of another rate hike. The CME’s FedWatch Tool shows a 45% chance of another hike at the December meeting. Further, it currently shows a nearly 40% chance that rates will be unchanged through May of next year. The SOFR market shows similar odds.

In July, expectations were for rate cuts by the end of the year, and in just about a month, those expectations have flipped to a higher probability that rates will rise by the end of the year. I think there is information in the rate of change. Investors are struggling with the incoming economic data being stronger than they expected and also trying to reconcile the official inflation data with their own personal experience. The result is that expectations for future rates are just oscillating around current levels. And that outcome, that rates are essentially unchanged for an extended period, may be the most likely outcome of all.

In fact, that is exactly where we are already. The 2-year note yield is essentially unchanged for the last 5 months and the 10-year for 10 months. The result is that returns for intermediate-term Treasuries YTD are mildly positive. Investment grade bonds have done even better with 1-5 year and 5-10 year IG bonds both up over 2% YTD. It is the long end of the curve that has suffered this year with the longest-dated Treasury ETF down over 2.5%. Ironically, that’s the part of the market seeing the greatest fund inflows as the doom and gloom crowd continues to bet on recession or something worse.

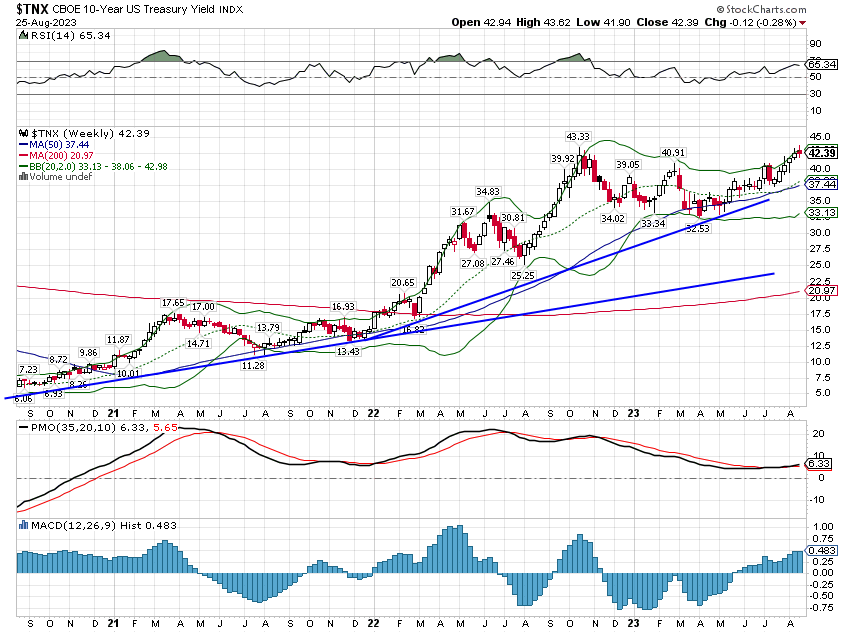

The dollar broke its short-term downtrend last week but is still neutral on an intermediate-term basis. The long-term trend is still up. As I’ve pointed out before, the dollar is in a very long-term, wide trading range and we’re nearer the top of that range. While we may have another thrust upward, I think this nearly 40-year trading range will persist. If that is true, then I would expect the dollar to revisit the bottom of the range over the next decade. That means holding more investments that benefit from a weaker dollar than you have over the last decade. But for now, the dollar trend is still neutral to rising.

Markets

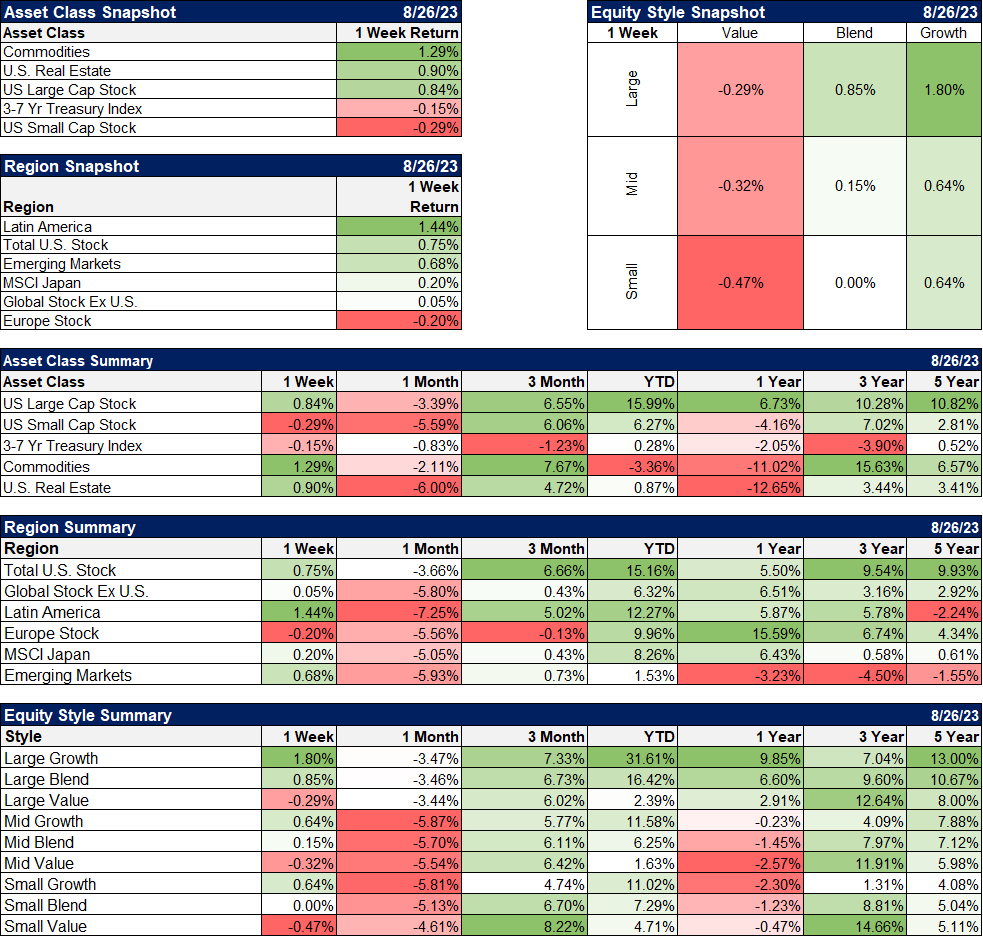

Commodities and real estate led the markets last week. That is mostly due to energy prices but copper, gold, and platinum were all up over 1.5% for the week. I think most investors would be surprised to learn that commodities and real estate are both up nicely over the last 3 months with commodities actually outperforming stocks. The gap between reality and perception is wide on both of those asset classes which often represents an opportunity.

Growth stocks outperformed last week and continue to lead YTD and over the last year. Value still has a good lead over the last 3 years. It will be hard for growth to continue to outperform if, as markets currently expect, real rates stay higher for longer. Valuations in growth stocks are still at an extreme but higher real rates should push them down over time.

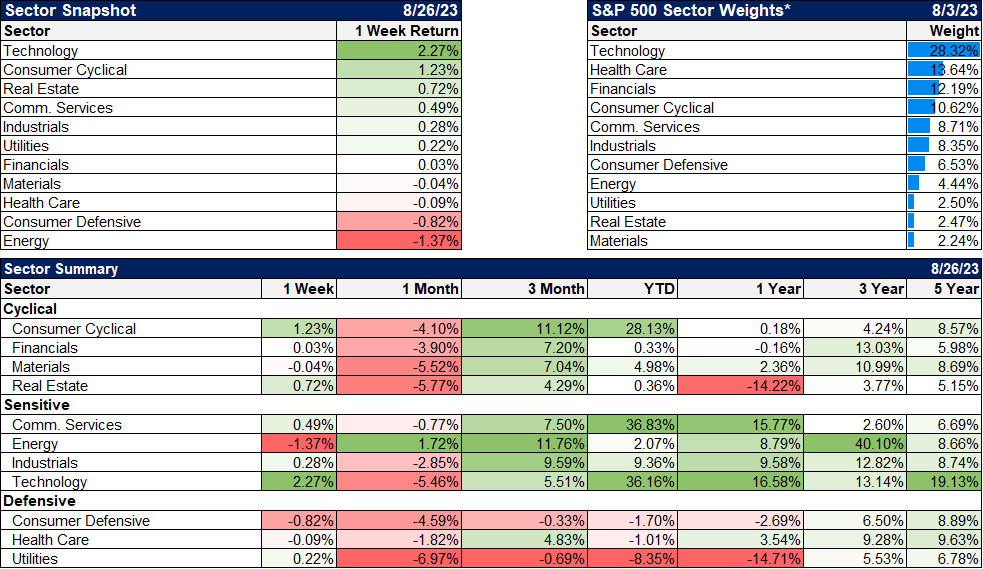

Technology is the premier growth sector so when growth outperforms, it isn’t surprising to find the sector at the top of the weekly rankings. Cyclicals also had a good week as the economy continues to surprise to the upside. Energy took a breather last week but is still the best performer over the last 3 months.

Market Indicators/Economics

Note: We had some issues with our economic data module updating so that isn’t included here this week.

The economic news continues to be pretty good but overall, I continue to see an economy growing right around trend. There has been a lot of excitement about the Atlanta Fed’s GDPNow tool showing 5.9% growth for the current quarter but it is way too early for that to be accurate. The Chicago Fed National Activity Index for July was reported last week, up from -0.33 in June to +0.16. The 3-month average rose from -0.15 to -0.13 with zero being growth at trend. The CFNAI moves slower but is probably a better indicator of current growth, right around the long-term trend of 2%.

Existing home sales were down again as they have been for 10 of the last 12 months. There’s a lot going on there with limited inventory and high mortgage rates shifting activity to new homes where sales were up 4.4%. Overall, the real estate market stands out mostly for not being worse, considering the rise in rates.

We got two regional Fed manufacturing reports last week from Richmond and KC, both of which improved from last month. The Richmond version was, however, still showing contraction. Durable goods orders ex-transportation were up more than expected though and I expect the trend on manufacturing to continue to improve.

Since fools are top of mind this week I can’t help but comment on this article:

Buyers of Bored Ape NFTs sue after digital apes turn out to be bad investment

Lawsuit: Sotheby’s $24M sale to FTX gave Bored Ape NFTs “an air of legitimacy.”

Here’s what I wrote in September of 2021 when these were auctioned:

Well, my goodness. I mean there are only 10,000 of these things so get’em while they’re hot, I guess. And you get to be in a club! That, to me, is the artistic statement of these pieces but it says a lot more about the buyers than the creators. It is the digital equivalent of Fountain by R. Mutt. Marcel Duchamp used a urinal to represent his disgust at world war – and changed the art world forever to boot – and it may be that the creators of many of these NFTs are expressing their disgust as well, maybe at inequality or materialism or systemic racism or something else. Or maybe they are just taking advantage of the situation. But it seems obvious, at least to me, that the artistic nature of the pieces lies in the buying, not the creating. And the higher the prices rise, the less likely the buyer is to get the joke. One can’t help but wonder at the supply of fools today; there are days I think it might be infinite.

This of course brings to mind another quote about fools, mainly that they will be relieved of their cash in due course. If you bought one of these for anything over a token amount, you need to admit to yourself that you made a mistake, that you mistook price for value. Sotheby’s is likely guilty of nothing more than matching supply and demand (although there are parts of the story that are a bit sketchy). You can’t learn from your mistakes – become wiser – unless you admit them.

The fool quotient today is not nearly as high as it was back then but valuations in parts of the market are certainly challenging. US large-cap growth stocks in particular seem grossly overvalued based on history but maybe the future will be brighter than currently anticipated. Ironically, if R* is higher than previously thought – and with 10-year TIPS yields back to 2% and rising it may well be – that might justify a higher multiple on faster-growing earnings. Of course, higher real rates usually mean lower valuations so the rate of change of both would be the deciding factor for the market. That being the case, the cheaper parts of the market – small and midcaps are quite reasonable with growth prospects similar or superior to large cap – seem more compelling.

Most of the things that keep investors worried amount to nothing more than a tempest in a teapot. That is especially true of monetary policy and the constant babble coming from the Fed. Economics and its arcane jargon make fools of us all at times. Our best bet to avoid such fate is to ignore the cacophony of foolish pontificating.

But God chose the foolish things of the world to shame the wise

1 Corinthians, 1:27

Joe Calhoun

Stay In Touch