Most strategic asset allocation strategies have produced negative returns over the last two years. A 60/40 allocation of Vanguard Total Stock and Vanguard Total Bond is down over 6%. John Bogle’s 3-fund portfolio, a global approach that includes an allocation to Vanguard Total International is down nearly 9%. Morningstar has a diversified portfolio that includes 11 different ETFs and it’s down about 7%. Our strategic allocations with 20 and 30% bonds, which have historical volatility slightly less than the 60/40 portfolio, are down a little less than and a little more than 5% respectively. You could have done a little better by using high dividend or value stocks for the equity portion of your portfolio but you’d still be down. It has not been a pleasant couple of years.

It is a vast understatement to say that investors are a bit frustrated right now. And when they scan the markets, the economy, and the political climate, they probably find it hard to see how things are going to get better any time soon. We’ve got an impending government shutdown (well, maybe and I’m not sure it would be a bad thing anyway), an aggressive Federal Reserve that has pushed interest rates to 16-year highs, major stock indexes that are expensive by any historical standard, an economy that everyone expects to be in recession sometime soon, and a Presidential election next year between two candidates a majority of Americans think shouldn’t even run (which is about the only thing a majority of our citizens can seem to agree on these days).

With T-bills yielding over 5%, it is tempting to just hang up on your long-term strategy and go to cash. If you’re in some portfolio that has performed something like the ones above, the cost doesn’t even seem that dear. This isn’t like 2008 when portfolios like those were down 15-25% and going to cash meant years to catch back up to where you started. And of course, T-bills are risk-free and don’t fluctuate so you won’t have any of those down quarters like the one we just had.

It seems so easy, so tempting, but is it? Is it really as risk-free as it seems? I suppose that depends on your goals but unless the timeline on all of them is less than a year, T-bills are a lousy choice for funding them. If you’re trying to fund a retirement that is 20 years in the future or to live a retirement that you hope runs at least 20 years and hopefully a lot longer, or trying to fund an education for your grade school grandkids, or any of the long list of long-term goals people are actually investing to achieve, then you’re not going to get there with T-bills. T-bills offer stability in the short term but they don’t produce sufficient real returns over the long term to achieve those goals. For that, you’re going to need some longer-duration assets, i.e. stocks, bonds, real estate.

Now, I know what you’re thinking. This little side trip to T-bills is temporary and you’ll get back in the market when all these uncertainties are resolved, right? There is just one minor problem with that – markets anticipate so if you wait for the all-clear – which never really comes since there are always things to worry about – the market will have moved on without you. Then you’ll have to figure out how to get back into a market that is higher than it is today. Most investors know that of course, so what they tell themselves is that during the next recession, when stocks are down 25 or 30 or 40% or maybe even 50%, then they’ll get back in at the bottom. Uh huh. Sure.

And what if the recession everyone expects doesn’t happen? I know, I know. The yield curve is inverted and so it has to soon, right? Yeah, sorry, there are no sure things in this game and in case you didn’t know, inverted yield curves don’t work everywhere, all the time to predict recessions. The track record outside the US is spotty at best and no one knows why. In fact, no one really knows why it has worked here in the US so consistently over the last 70 years or so. All the common sense explanations – banks won’t lend with an inverted yield curve – turn out to lack much in the way of actual evidence. So, no, we don’t have to have a recession right now.

And even if we have a recession soon, we don’t have to have another bear market. We’ve had bear markets without recessions – just last year! – and we’ve had recessions without bear markets (1945, 1953, 1961 & 1990). Some of those had bear markets before or after but I don’t think close counts in this case. Maybe the bear market in proximity to this upcoming recession has already happened. Or what if the recession is mild and markets just look ahead to the recovery? What will our T-bill investor do then?

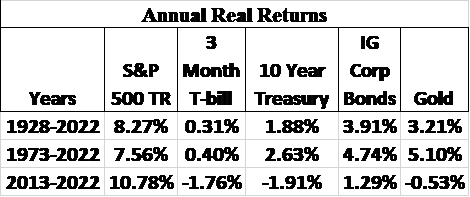

Cash investments like T-bills are paying well right now but historically, today’s rates are just a little above average. Since 1973, the average annual nominal return on T-bills has been 4.3%. The problem is that the average annual real return is just 0.4%. That isn’t bad for a short-term, risk-free investment but it pales in comparison to other, riskier assets.

T-bills are a great idea for your cash holdings, for short-term needs over the next year to 18 months. The amount you are holding in cash equivalents should be based on your short-term cash needs and/or potential emergency needs, not your long-term investment needs. If you’re holding more than that, it’s just market timing, and your chances of success, of getting out and back in, in a way that produces a better after-tax, risk-adjusted return, are very low. The range of potential outcomes, for the economy and markets, is almost infinite and impossible to predict. I spent the first 10 years of my career in this business being constantly surprised that things that had never happened, that weren’t supposed to happen, kept happening.

It is hard to look past the current potential worries for investors but you can’t just survey the negative side of the ledger. Remember those worries I mentioned above? Well, we’ve shut down the government for some length of time 20 times in the last 50 years. Do you remember any of them? The Fed? They’ve tightened policy before and most of the time they do too much and cause (or get the blame for) a recession. But recessions don’t have to be disasters like 2008 and most of them don’t involve a 50% stock market crash. And yes, the S&P 500 and NASDAQ are certainly expensive but value, small cap, and international stocks are a lot cheaper. Value, in particular, is as cheap as it has ever been relative to growth.

Politics? Well, I don’t talk about that much in these commentaries because I don’t find it useful for investors. I don’t know who the next President will be but I guarantee you he or she won’t have nearly as much impact on the economy as either party claims. Our economy is massive and markets work around government policies. Politicians are mostly just self-aggrandizing way out of proportion to reality. And just for the record I don’t like any of them and I don’t belong to a political party.

There are always things to worry about and frankly, for someone who’s been doing this a long time, today doesn’t even seem that remarkable. In fact, in some ways, today is just boringly normal. I looked back to find a time when real interest rates – which are what really matter for the economy and investors – were about the same as today and found 2003. The 10-year TIPS yield was 2.2% in January of that year, exactly the same as today. Think things are bad now? The 2-year return of the 60/40 portfolio was almost twice as bad then as now. Here are some headlines from 2002:

- Worldcom filed for bankruptcy over improper accounting. Dennis Kozlowski of Tyco resigned over questionable stock deals and exorbitant corporate perks (remember the $6000 shower curtain?). He ultimately went to prison for his misdoings. The founders of Adelphia were indicted and accused of looting the cable company for $2.3 billion. Healthsouth was discovered to be a massive fraud and Richard Scrushy, the long-time CEO ended up in prison.

- The recession was over but unemployment was 6%, the Fed had cut rates all the way down to 1.25% and President Bush was extending unemployment benefits.

- The search for weapons of mass destruction in Iraq seemed to be yielding results and war seemed – and was – inevitable.

- Arthur Andersen was charged with obstruction of justice in the Enron case and was ultimately given the death sentence.

- The S&P 500 had just finished its third consecutive down year. The NASDAQ was down 80% from its 2000 high.

- US Airways and United Airlines both filed for bankruptcy

- Kmart filed for bankruptcy

- Brokerage firms were accused of touting stocks to gain investment banking business, which was obviously true, and Sarbanes Oxley was passed in response.

- Martha Stewart was accused of insider trading and went to prison.

- West Coast ports were shut down in a labor dispute.

- McDonald’s reported its first-ever quarterly loss.

There was not a lot of optimism at the beginning of 2003. Consumer sentiment was at 80, down from 112 three years earlier and Consumer Confidence was at a nine-year low. But over the next four years, that 60/40 portfolio returned 50%, the S&P 500 rose 72% and the NASDAQ rose 80%. The strategic allocation we today call Fortress, with a 30% bond allocation, returned almost as much as the S&P 500 and far outperformed the 60/40. T-bills, on the other hand, returned 10.6% over those 4 years and that is total, not annualized.

It is not easy being a true long-term investor. You get periods like this when it hardly seems worth it. But patience has always paid in the past and I expect it to again.

Environment

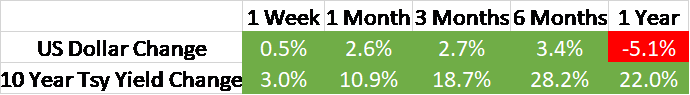

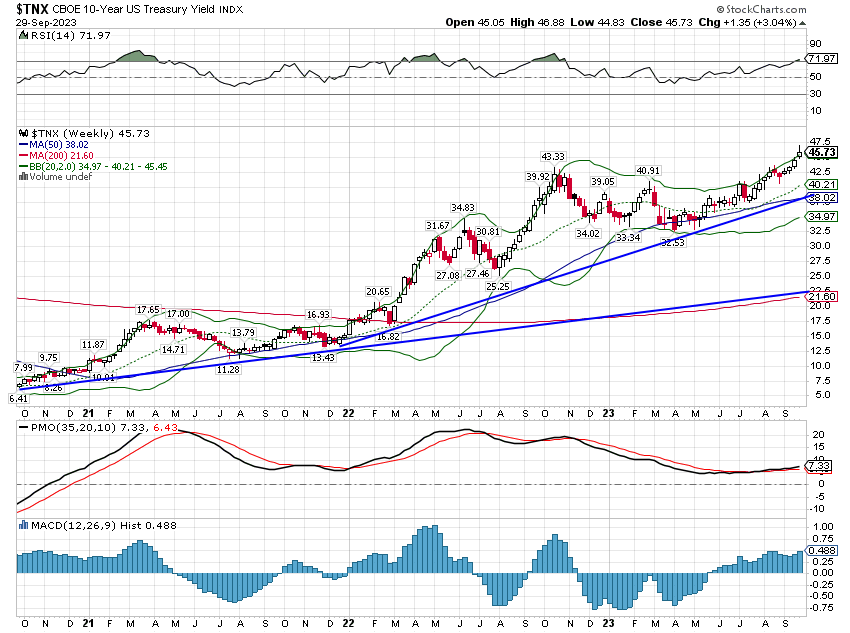

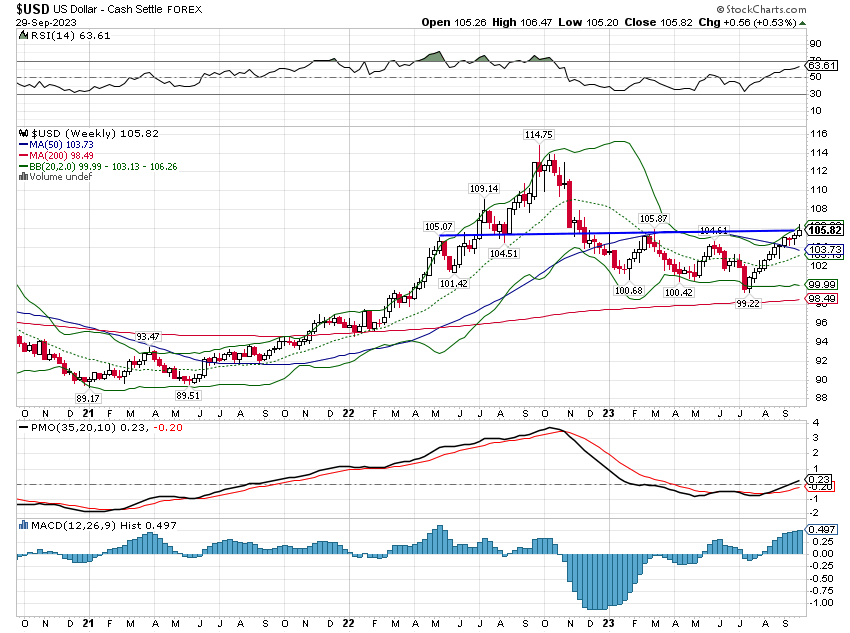

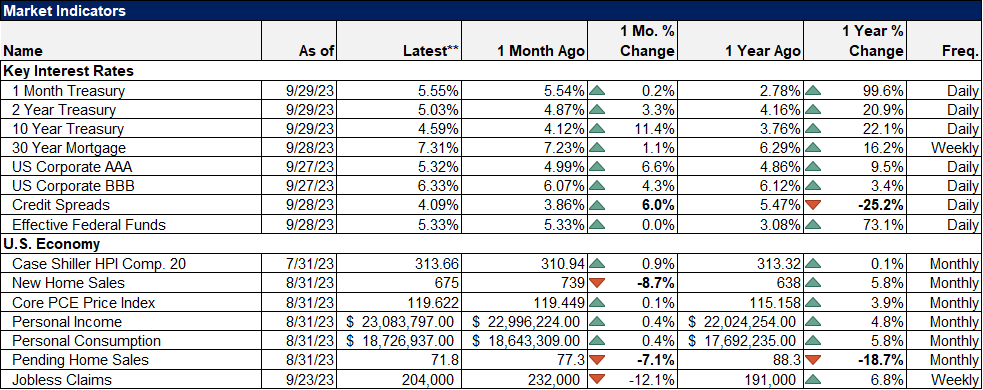

Both the 10-year Treasury yield and the dollar rose last week but only the yield is in a confirmed intermediate-term uptrend. Even the 10-year yield pulled back on Friday on some good core PCE inflation news and with everyone now calling for much higher rates, I suspect we may be near a peak. But the trend is what it is and until it changes we should invest expecting it to continue.

The 10-year rate is up about 130 basis points since the spring banking “crisis” and that’s what most people are focused on, but it’s only up about 25 basis points over the last year. Yep, a whole quarter of a percent. I would say that both the 4.33% peak last October and the 3.25% low in March were both overreactions which are all too common these days, a function of modern communications in my opinion. I would also say that if you are running a bank and you’ve been sitting around for the last 6 months not doing anything about your balance sheet, you deserve to fail.

The interest rate fear out there is palpable – oh my God did you see that Jamie Dimon thinks rates are going to 7%!!!! – and investors would likely be well advised to ignore it. Rates have taken two years to get back to the long-term average but we’re there now. The time to worry about rising rates was when the 10-year was yielding 0.5%, not now.

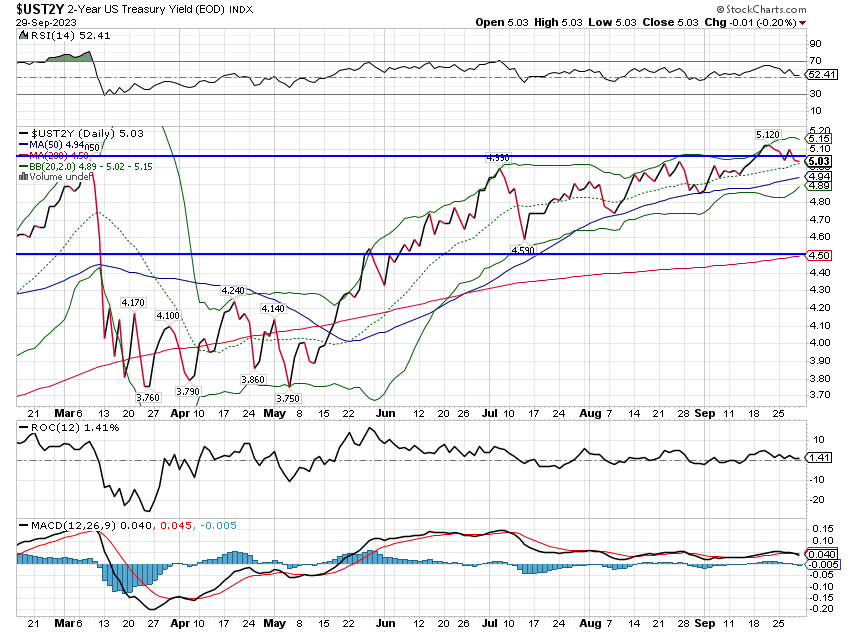

Short-term rates did not follow the long end higher last week either so the yield curve continues to steepen with the 10-year/2-year up 22 basis points just last week to -44 bps. No, this isn’t the steepening we usually see just prior to recession but that could change so we’re watching this very closely. When we do get to recession I’d take the under on severity – mostly because everyone else seems convinced the next recession will be Armageddon, the Sequel – until something convinces me otherwise.

As for the dollar, I find it interesting that the narrative is that the dollar is “surging” according to numerous articles I read last week. You’d think the dollar index was back to the old high of 115 instead of down 5% over the last year. Again, like with rates, there is a fear here that seems unwarranted. Yes, a rapidly changing currency can certainly cause problems – up or down by the way – but that isn’t what we have.

Frankly, I think the most interesting thing is that it isn’t higher. The dollar has some seemingly major advantages over the Yen and Euro and yet it remains stuck around the 106 level. This is the third time we’ve been at or near this level just this year. It just isn’t anything I can get alarmed about. And you probably shouldn’t either.

The economic environment hasn’t changed much this year. Interest rates, nominal and real, are rising. That means long-term growth expectations are rising. Just so we’re clear, that isn’t a bad thing. The dollar is in a short-term uptrend but not an especially strong one. The intermediate-term trend, which is the one we pay the most attention to for tactical purposes, is neutral. The long-term trend back to 2011 is up. The really, really long-term trend, back to 1987 is also neutral. None of those are bad things.

In fact, we don’t classify the trend of the dollar as “good” or “bad”. Historically – and very generally – a rising intermediate-term trend for the dollar just means you should favor dollar-based investments and minimize real assets. A falling intermediate-term trend means the opposite. The dollar trend certainly impacts asset class returns but it isn’t “good” or “bad”. It just is.

Markets

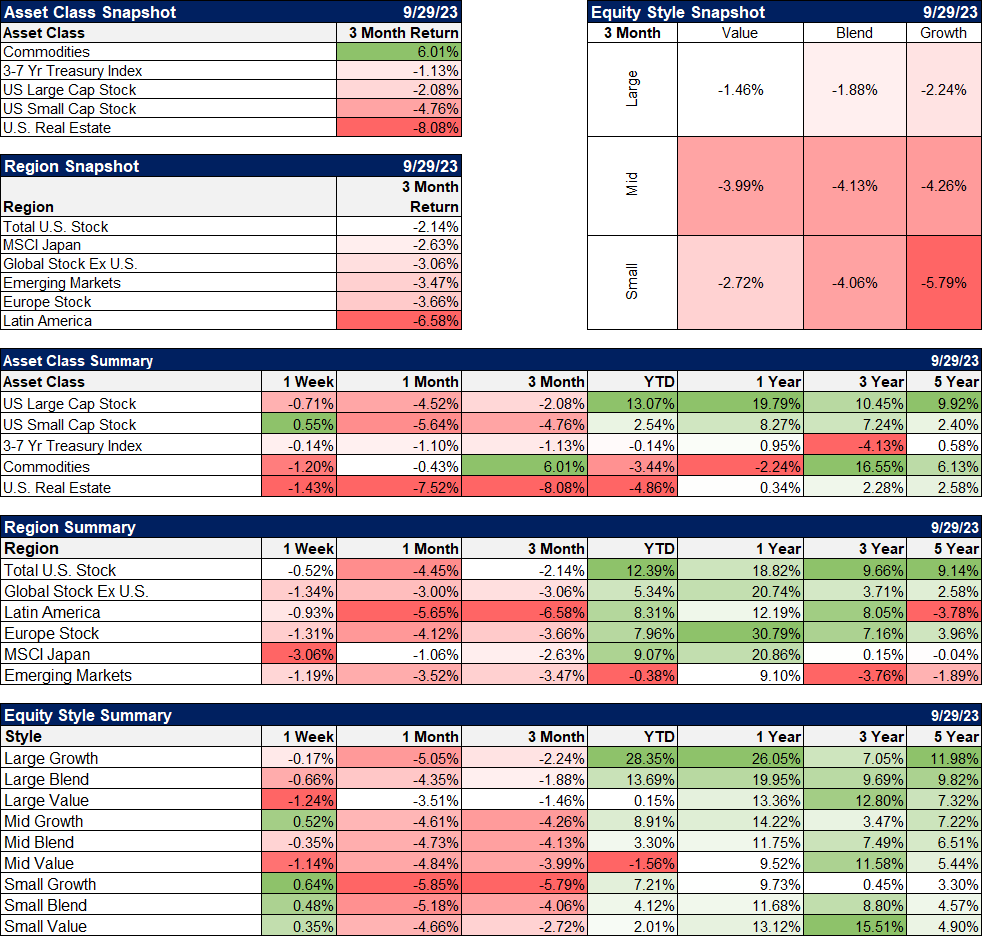

The 3rd quarter is in the books and it wasn’t a great one for investors. The only major asset class higher for the three months was commodities. Everything else was down with REITs bringing up the rear. Value resumed its outperformance in Q3 after losing big to growth in the first half of the year. International markets were also lower for the quarter with Latin America the worst performer. The US and Japan were the best performers.

Last week was also a down week for everything but small-cap stocks. That may be an indication this correction is about over but it’s only one week so give it some time.

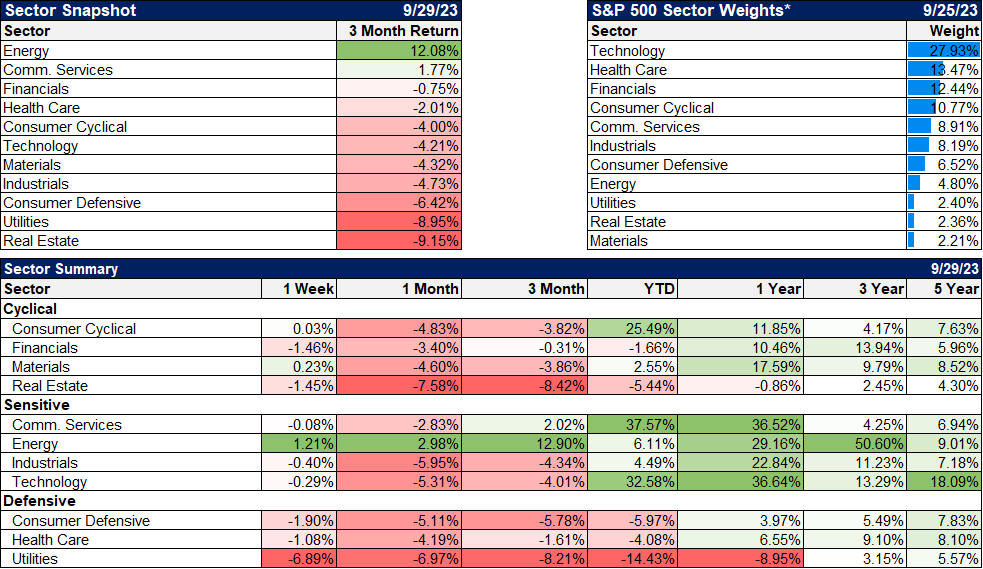

Energy was the big winner for the 3rd quarter, up over 12%. The only other sector higher was Communication Services, which is dominated by META and GOOGL. CHTR was also up big for the quarter.

Utilities were down big last week but that was really just about one stock, NextEra nee FPL. NEE has been a darling because it is the biggest producer of renewable energy in the country. Last week the partnership that holds those assets cut its growth expectations in half and NEE stock felt the pain, down 15%. The stock has been under pressure all year, down about 30%. FYI, Alhambra has a lot of clients who have owned this stock for a very long time (decades in some cases) and we have not sold any. We are not buyers yet but it is certainly back on our radar.

Economics/Market Indicators

The economic data last week was, again, about as expected. Real estate continues to struggle with higher mortgage rates. Incomes and consumption continue to grow but after inflation figures are not as good. Real disposable personal income was down 0.2% in August from July but it is still up 3.7% year-over-year. Still, I don’t like the short-term trend.

Core PCE inflation was up just 0.1% in August and the trend toward the Fed’s target continues. The core rate is up just 0.5% over the last 3 months. In February, the 3-month change was 1.26% so it has come down rapidly this year. The headline number is being driven by energy prices and that may not matter to the Fed but it surely does to the average person. Consumer sentiment was down for the third month in a row – but still way above the low last year – and even though the 5-year inflation expectation component fell below 3%, I can’t imagine filling up the tank is putting people in a good mood. Nevertheless, the core is basically at the target. Let’s see if it can stay there.

There are always reasons to not invest, always potential problems on the horizon, always a recession in our future. That’s a reason to diversify and think long term, not to withdraw and seek safety. Short-term investments are for short-term goals. Long-term investments are for long-term goals. Develop a plan that incorporates investments that allow you to achieve both. And don’t let the headlines knock you off course.

You can have the predictability and stability of T-bills but it comes at a cost – low real returns. A diversified portfolio, on the other hand, provides you with great long-term returns but with no short-term predictability or stability. That’s the tradeoff you have to accept to be an investor.

Joe Calhoun

Stay In Touch