Ah, the college experience! There’s a lot of growing up that happens in those four years—finding out who you are, learning to be even more independent, and for some, learning to do their own laundry. But one thing is certain. No matter when you go to school or where, it’s going to be expensive.

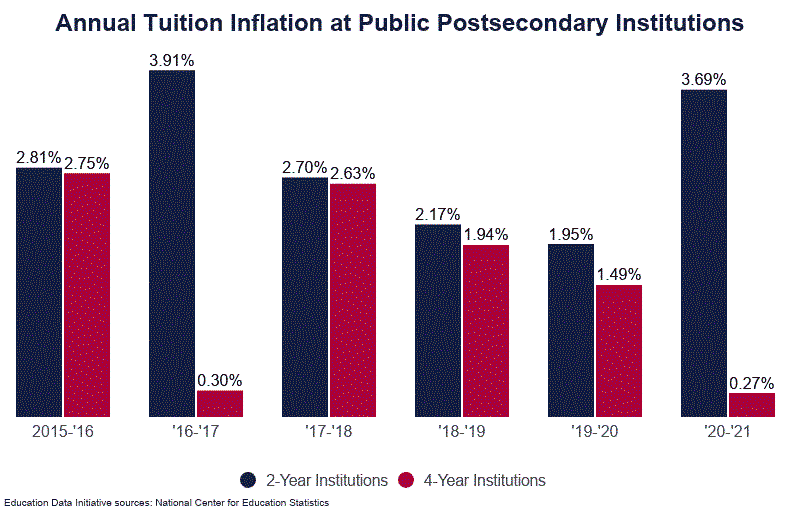

What drives the cost of college tuition? Inflation. Just as it pushes up the price of things we buy, it has the same effect on what you pay to go to school. Education Data Initiative has been gathering college tuition information for decades. Here’s what it found:

- The average annual cost of tuition at a public 4-year college is 37 times higher than tuition in 1963

- College tuition inflation averaged 4.64% annually from 2010 to 2020

- The cost of tuition at 4-year institutions increased 31.4% from 2010 to 2020

- After adjusting for currency inflation, college tuition has increased 747.8% since 1963

- The most extreme decade for tuition inflation was the 1980s, when tuition prices went up 121.4%

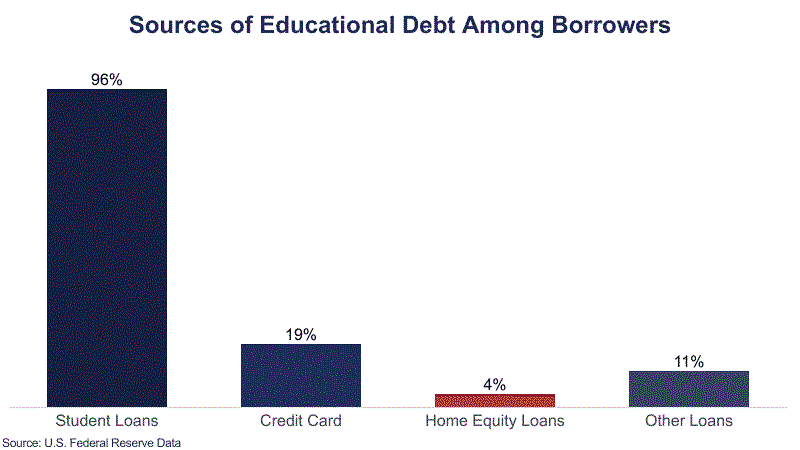

So, how do students pay for the ever-increasing cost of higher education? Sometimes mom and dad help, but few parents have enough to pay for it all. 85% of college students receive financial aid from grants, scholarships and college endowment funds. But most students have to borrow money to pay for school and the bulk of those loans are from the federal government.

In 2023

- 8 million Americans had federal student loan debt.

- 5% of students completing an under-graduate degree had federal student loans.

- 2% of those of those completing graduate school had federal student loans.

- 13% of students use some private source funding, such as banks, credits unions, credit cards and home equity for student loans.

Even though most student loans come from the federal government, they are still loans, they are still a financial commitment, and if not handled properly, they can have a long-term negative impact on credit scores.

How Student Loans Work

Student loans are a type of installment loan just like a car loan. You borrow a certain amount of money. You pay it back in regular installments and you pay interest on the amount of money you borrowed.

When students and their families apply for loans from the federal government, they begin by filling out the Free Application for Federal Student Aid (FAFSA). If approved, the U.S. Government becomes your lender.

Private financial institutions also offer student loans. Usually, the terms are not as favorable as the federal loan option which offers lower fixed interest rates, deferred payments as long as you’re enrolled as a student, and in certain situations, loan forgiveness.

Types of Student Loans

Direct Subsidized Loans are available to students who can demonstrate financial need. The government pays the interest on these loans during a predetermined grace period, usually while the student is still enrolled or recently graduated from college. During this time, borrowers are not required to make payments on the loans.

Direct Unsubsidized Loans are available to all students regardless of need. With these loans, the student is generally responsible for paying interest throughout the life of the loan. As with subsidized loans, borrowers are generally not required to make payments while they are still in school.

Direct PLUS loans are loans made available to the parents of dependent students and to students pursuing graduate or professional degrees. These loans typically have higher interest rates and fees than other types of federal student loans.

The Affect of a Student Loan on Credit Scores

Don’t be surprised if a lender, federal government or private, does a hard inquiry of your credit to see if they’ll take on the risk of lending you money. Hard inquiries tell a lender how often you’ve applied for credit, and your loan capacity or credit utilization ratio. The formula divides the amount of revolving credit you have by the total amount of your available credit. For example:

If you have a revolving credit balance of $1,000 and your credit limit is $2,000, you have a credit utilization ratio of 50%. ($1,000 / $2,000 = 50%)

If you have a revolving credit balance of $1,000 and a credit limit of $5,000, your credit utilization ratio is 20%. ($1,000 / $5,000 = 20%)

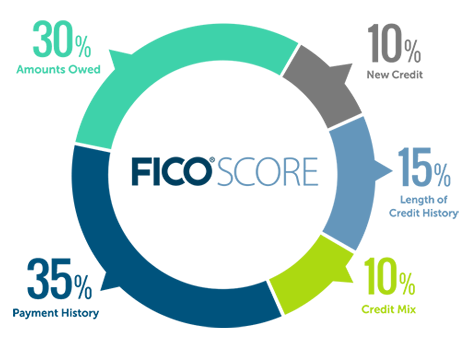

The lower the percentage the better credit risk you are. Credit utilization makes up 30% of your credit score.

Hard inquiries temporarily reduce your credit score for approximately 12 months.

Direct Subsidized Loans and Direct Unsubsidized loans are offered to students no matter what their credit history looks like. Lenders do not do hard inquiries on either of these types of loans, so there’s no hit on your credit score.

Direct PLUS loans, on the other hand, do require lending institutions to perform a hard inquiry and your credit score will be temporarily lowered.

That’s the negative. But there could be a positive effect. Having a student loan has the potential of improving your credit score by diversifying your credit mix. Lenders look at the different types of credit on your report—installment, revolving or unsecured. According to lenders, managing several types of debt at the same time shows that you’re a responsible borrower.

But the biggest factor affecting your credit score is how well you pay back what you owe. If you make the required student loan payments on time and don’t default, student loans can help establish or build your credit history. Payment history makes up 35% of your credit score.

Missing a Payment

If you miss a payment, you have 90 days before the loan is considered delinquent. After that time, missed payments appear on your credit reports and your credit scores may drop.

If you continue to miss payments, you run the risk of the loan going into default, which can further decrease your credit scores by a lot. You could also lose access to certain debt relief options, and you might be required to pay steep collection fees or have your wages garnished.

Bad Repayment History

If you are delinquent on your payments or stop paying all together, it will show up on your credit report. And it’s going to be there for a long time. For as much as seven years, any lender you try to get credit from will see that black mark on your credit report and may be reluctant to loan you money. That could be a car loan or a credit card. But it’s not just lenders that may be wary. Others who check credit reports are employers who are considering hiring you, landlords considering whether to rent to you, and insurance companies, who may charge you a higher premium because of your credit history.

Parts of a Credit Score

Good credit or bad credit, you need to be aware of the items a lender looks for when they check your credit and how much of an impact it can have on your score.

- Payment history—35%

- How much you owe—30%

- Length of credit history—15%

- How much new credit you have—10%. New credit is defined as

- New accounts

- Recent credit inquiries

- The age of your most recently opened credit account

- Credit mix—10%

Courtesy: MyFICO

Having Trouble Making Payments

If you’re struggling to pay back student loans, take action before your credit score takes a beating. Check into the possibility of lower monthly payments through an income-driven repayment plan (IDR). All IDRs share some similarities. Each caps payments between 10% and 20% of your discretionary income and forgives your remaining loan balance after 20-25 years of payments. The four plans are:

If you’re not able to make the monthly payments because of certain serious hardships, you may be able to defer the federal student loan repayment.

- Various circumstances may qualify you for deferment, including cancer treatment, economic hardship, re-enrolling in school, military service, rehabilitation training and unemployment. You will not have to make monthly payments during the deferment period, and interest typically does not accrue, though this can vary based on the type of loan you have. Be sure you know how interest is handled with your loan.

- With forbearance, you almost always have to pay the interest that accrues while you are not making monthly payments. The circumstances that qualify you for this temporary relief can include financial difficulties, medical expenses, a change in employment, AmeriCorps service, National Guard duty, some teaching services and enrollment in a medical or dental internship or residency.

Student Loan Repayment Best Practices

- Make payments during your grace period.Making payments on your loan — even during the grace period — will reduce the total amount you’ll have to pay in interest.

- Pay more than the minimum.If you can afford it, pay more than the minimum monthly payment to reduce your interest cost over time.

- Consider enrolling in autopay.Your loans may offer the option of making monthly payments automatically, which helps ensure you’re paying on time. In some cases, automatic payments can also reduce your interest rate.

- Be aware of your repayment options.If you can’t make a payment, contact your lender immediately. Make sure you know the debt relief programs that might be available to you, such as IDR plans or loan forgiveness.

For most people headed to college, a student loan is a big part of getting a quality education and preparing for your chosen profession. But before entering into a student loan agreement, know the terms and conditions of your loan, the repayment requirements, and the impact on your credit score.

Stay In Touch