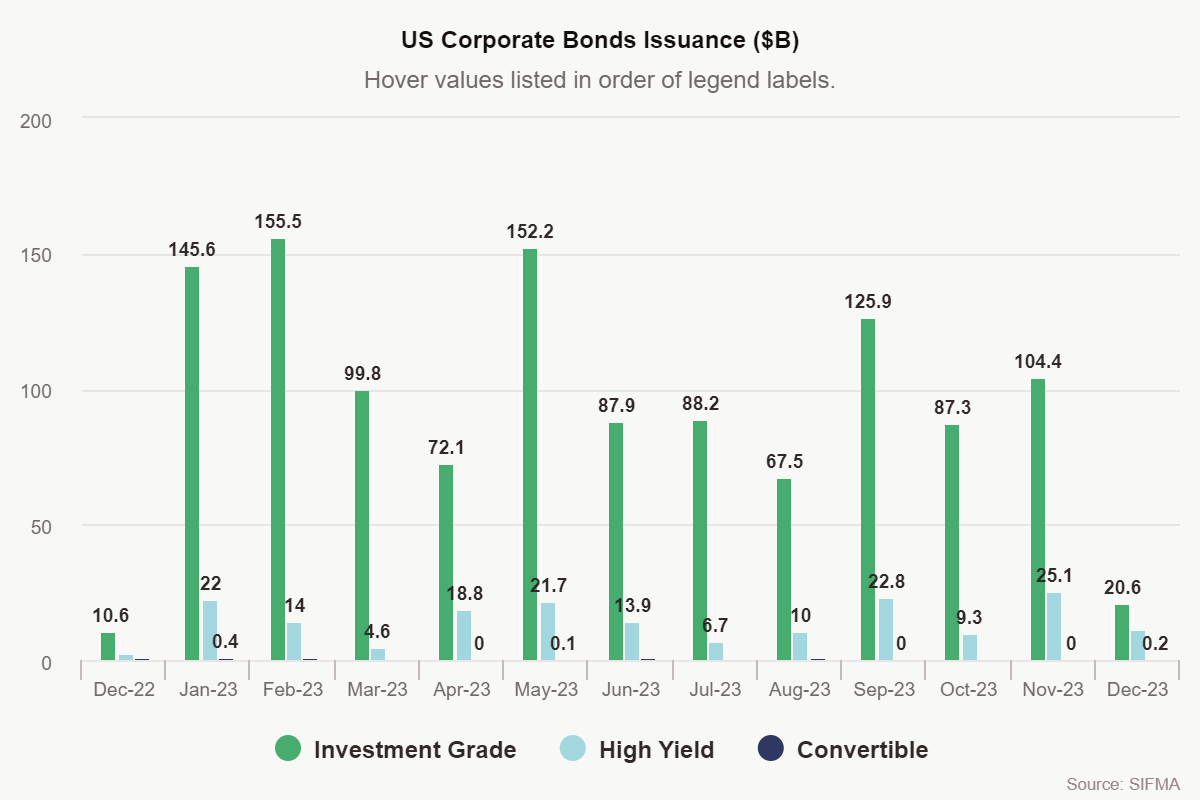

Corporate bond issuance in January is at $176 billion with a few days to go. That’s an all-time record for January and higher than any month last year. Last year’s issuance was up 5.5% over the previous year.

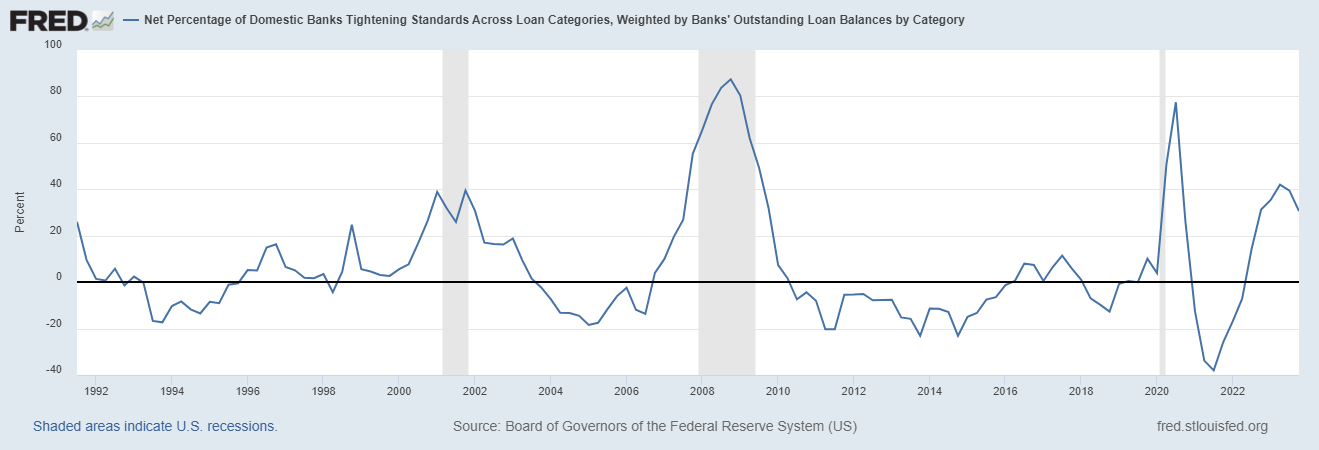

Net percentage of banks tightening lending standards appears to have peaked and rolled over. As I’ve noted about a few other items, this looks a lot like what happens after a recession, not before.

There are still a few areas where lending standards are not falling:

1. Auto loans – flat

2. Consumer loans ex – auto and credit cards – still rising

3. CRE secured by multi-family real estate – flat to rising

Stay In Touch