Nvidia reported earnings last week and they were, to be sober about it, incredible. Total revenue rose to $22.1 billion for the quarter, up 22% from last quarter and 265% year-over-year. Data center revenue, which is what investors really ought to be watching with this company, was up 27% from last quarter and a whopping 409% year-over-year. Gross margins run to 75%, operating margins of 54%, net margins of nearly 50%, and return on equity of 99%. It is a truly stunning performance and the stock has responded by rising 60% since the beginning of the year and nearly 240% over the last year.

Nvidia has been a pretty good chip company for a while, specializing in graphics processing units, which have traditionally been used primarily in gaming. They have also been used over the last few years in cryptocurrency mining. We looked at the company a couple of years ago and didn’t invest – wrongly as it turns out – for a number of reasons. We were particularly concerned that the crypto business surge in 2020/21 was unsustainable and we think we were right to stay away as total revenue was flat in 2023 while earnings fell 25%. What we didn’t see coming was the AI surge that has pushed the company to incredible growth over the last year. Even those who saw AI as an important technology would probably admit, if they were honest with themselves, that they didn’t foresee the tsunami of cash that would be thrown at anything that could be credibly – or incredibly – connected to AI.

The question for anyone who owns the stock or is considering owning it, is not what did it do in the past but, rather, what might it do in the future. And we’d point to that surge in crypto revenue that wasn’t sustained as a potential model. I spent quite a bit of time this last week working with the various LLMs out there and I was both amazed and underwhelmed at the same time. It is true that some mundane tasks can be automated with these AI models but it is still fairly crude and requires – for anyone interested in accuracy – a lot of human intervention. Will they improve? I’m certain they will but no one should be fooled into thinking that Artificial Intelligence involves any actual intelligence. It is a powerful tool but a sledgehammer when a small mallet might do, all the better to pound all those round pegs into square AI holes.

With margins like those above, one thing I feel certain about is that Nvidia’s dominance of the hardware side of the emerging AI field will not continue indefinitely. You don’t have to be an economist or finance whiz to figure out that margins like that will be attacked. Intel, Broadcom, and Qualcomm, among others, are not run by dumb people and they will catch up; the question is when not if. But right now, Nvidia is almost the only game in town and they are enjoying their temporary monopoly to the fullest. I sure wouldn’t be looking to short the thing even though I’ve been doing this long enough to know that vertical moves like we’ve seen in Nvidia’s stock are not sustainable; there will be a large correction at some point even if they maintain their dominance for a while longer. And look out if – when – those fat margins start fading.

Nvidia’s stock is not cheap of course, trading at 95 times trailing earnings, 90 times cash flow, and roughly (very roughly) 40 times next year’s guess at earnings. Despite that, I would not, as so many have in recent articles, put Nvidia’s rise in the same category as the dot com boom of the late 90s. Nvidia’s stock is expensive but it isn’t late 90s Sun Microsystems or Cisco expensive. And it shouldn’t even be mentioned in the same breath as a lot of the junk dot com stocks from back then that were trading based on nothing but hopes and prayers because that’s all they really ever had. Nvidia is a real company, with real revenues and fat margins that got really, really lucky that their gaming chips turned out to be perfect for AI. Did they plan it? I can’t say for sure but they were talking about AI in quarterly conference calls in 2022 so they weren’t ignorant of the possibilities. Did they expect this? I don’t think so but I don’t know. And congratulations to any investor in Nvidia who held their positions despite a nearly 70% drop in the stock price from late 2021 to late 2022. If you did that you were either on an extended vacation, stubborn to the point of obstinance, or blessed with second sight.

What concerns me more are the other stocks in the AI orbit that don’t have anything unique like Nvidia and whose stocks have also gone vertical. Companies like Super Micro Computer which makes servers and is growing pretty rapidly. SMCI’s stock, which was around $250 just last August, has been on a moon shot, rising to over $1000 in mid-February. Unlike NVDA, SMCI already has considerable competition, and its margins, in the mid to high teens, reflect that. It was a good buy at a teens P/E when we bought it but the current price is completely disconnected from its actual reality. And that doesn’t even touch on the various problems that have kept the stock cheap until just recently (see here for some background). If you’re looking for reasonably priced growth stocks you often have to ignore a few warts and we did. But we couldn’t ignore valuations this absurd.

SMCI isn’t the only stock being affected by AI mania. Fabrinet (FN), another stock we have owned for nearly two years, has also been tagged as “an AI” stock by some. It’s a company that operates complex manufacturing facilities for OEMs, primarily in the optical communications segment. It was founded in 2000 by one of the co-founders of Seagate Technology and has enjoyed steady growth over a number of years. It is typical of the kind of company we look for, with limited competition in a growth market (17% annualized revenue growth over the last 3 years), reasonable and sustainable margins (low to mid-teens gross margins), good growth (30% annualized operating income growth over the last three years) and a pristine balance sheet (no debt). It was first mentioned as an AI play after Q1 24 earnings were released in November 23 and the stock rose about 40% before a recent pullback. Any connection to AI is tangential at best but that doesn’t matter in a market like this.

We haven’t sold FN because the stock is still fairly reasonably priced and we are actually hoping to buy more on a pullback. We are investors and try to hold things for years rather than weeks or months. But when circumstances hand you years of returns in a few months, as happened with SMCI, you have to take what the market gives. We didn’t catch the top on SMCI but you rarely do in these situations. We’re happy to take our gains and look for something else. There are plenty of areas of the market that aren’t acting crazy right now and offer good value for investor’s dollars.

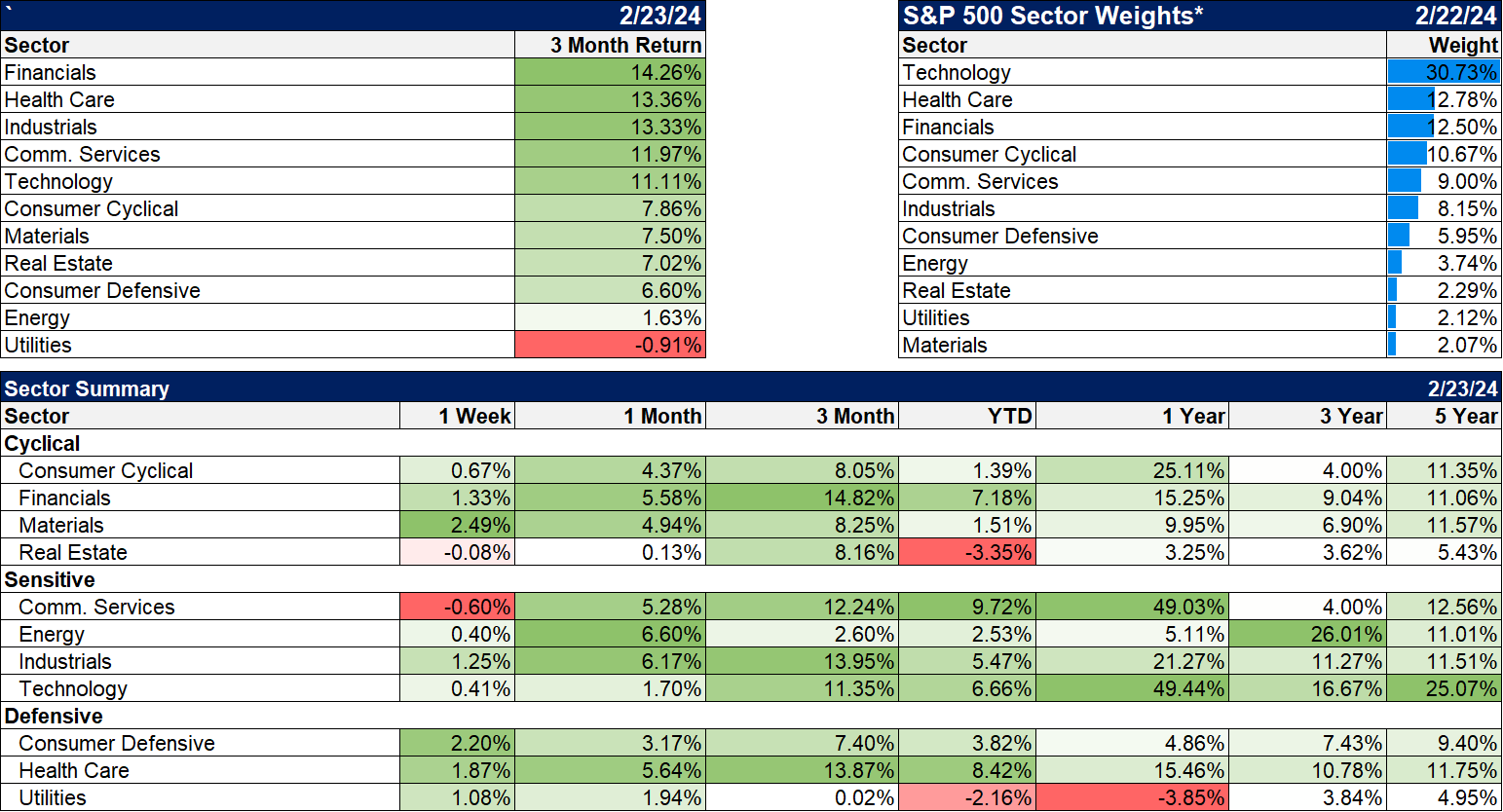

As an example, I saw an article last week showing that Nvidia’s market cap is greater than the entire US energy sector despite the fact that the energy sector’s net income was $147 billion versus just $19 billion for Nvidia. Unlike companies like SMCI, which announced a new convertible bond last week that will dilute shareholders, the energy companies are busy buying back stock and raising dividends – at a time when oil prices are not outrageous at roughly $80/barrel and, as I pointed out last week, appear poised to rise. The energy sector is less than 4% of the S&P 500 but will contribute nearly 7% of the index’s earnings. Technology, meanwhile is 30% of the index but will contribute just about 23% of the index’s earnings. The last time we saw such a disparity was at the peak of the late 90s tech boom and the reason for it seems obvious. Technology sector earnings are expected to grow at nearly 17%/year over the next five years while energy’s are expected to grow at 3%.

Of course, that assumes the analysts who pull those growth rate guesses out of their nether regions have a clue what they are talking about. They had high hopes in 2000 as well and yet energy stocks outperformed technology stocks over the next five years +45.5% to -59.7%, a spread of 105.2%. If you extend that period to the peak in crude oil prices in the summer of 2008, the spread goes to 269.7% to -55.2%, a historic miscalculation of about 325%. History does not look kindly on Wall Street’s soothsayers.

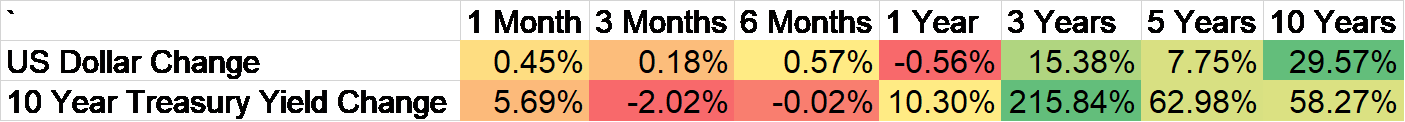

Another area that continues to look attractive is the small and mid-cap parts of the market, which are considerably cheaper than large-cap stocks. Small and midcaps are more domestically oriented and should then benefit from an environment where the US economy is outperforming the rest of the world – as it is now. An environment of positive US growth, especially relative to the rest of the world, should be one where the dollar and interest rates remain firm and they are. Since 1971, in years that interest rates and the dollar both rose, small and mid-cap stocks outperformed large caps by 2.5% to 3% per year (depending on what indexes you use). While the dollar and rates aren’t rising strongly right now, both are in intermediate to long-term uptrends.

Another group that performs well in that environment is value stocks, large and small. Since 1971, in years where the dollar rose, small-cap value stocks produced double the return of years when the dollar fell (18.5% vs 9%). Large-cap value stocks also outperform in a strong dollar environment (14.2% vs 9.8%).

Technological breakthroughs take time to impact productivity and economic growth. Oftentimes we see markets impacted first, a sector or market takes off in anticipation of the impact of some big change. When reality inevitably comes up short of the hype, markets, as they say, adjust. We saw it in the early 90s in biotech when everything with Bio in its name went vertical, only for most of the companies to disappoint. We got some great companies out of that boom – Amgen, Genentech, etc. – but a lot of them never fulfilled their promise and ultimately the sector crashed. We saw the same thing with internet companies in the late 90s. The current AI boom seems likely to follow a similar path of boom on hope and bust on reality. It is after the bust that we’ll find out which companies are going to really reap the benefits long term.

Amazon offers a lesson from the last big tech boom and bust. An investor who bought Amazon at its IPO in May of 1997 made a lot of money to its top in December 1999 (about 7500%) but only if he sold. The stock fell 94% from December 10, 1999 to September 28, 2001. Few people could stomach that but if you did the real benefit came after the bust; the stock is up 58,000% since that 2001 low. Bust survivors are robust.

The AI boom has pushed the stock market into one of its periodic flights of fancy, when the future seems certain and imminent. It isn’t of course because it never is but that won’t keep the gullible from buying into the frenzy for a while longer. The great thing about AI, according to the hype, is that while companies like Nvidia benefit first, all companies will benefit in the end from its application. AI is like a technological snake oil that will cure anything from low productivity to labor shortages. Yeah, probably not but it’s fun to dream. Sobering up before the party really gets going might make you a party pooper but it also means no hangover. Please put down the lampshade.

Joe Calhoun

*We first bought SMCI for some aggressive accounts last August at around $250. We sold in mid-February at prices ranging from $650 to $675. The stock rose further to over $1000 before pulling back and closing last Friday at $860.

Environment

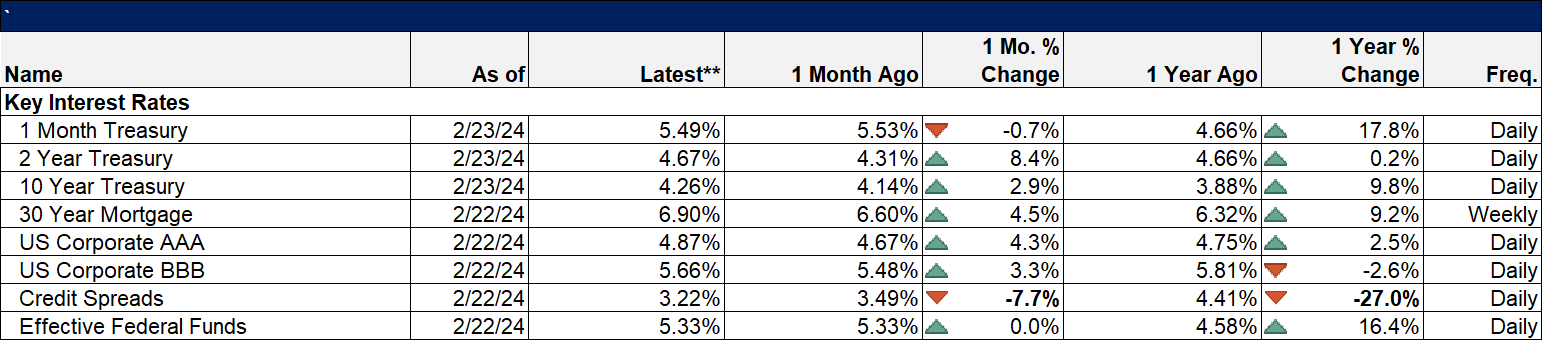

There’s no change in the trend of interest rates or the dollar.

Markets

If I told you before the long weekend that Nvidia would report gangbuster earnings the following week you probably would have chosen US technology stocks to outperform. And you would have been wrong since international stocks were actually the best performers last week. As you’ll see below, technology wasn’t the best sector of the week either. That’s how hard it is to predict future market movements; it’s hard even if you know what’s going to happen.

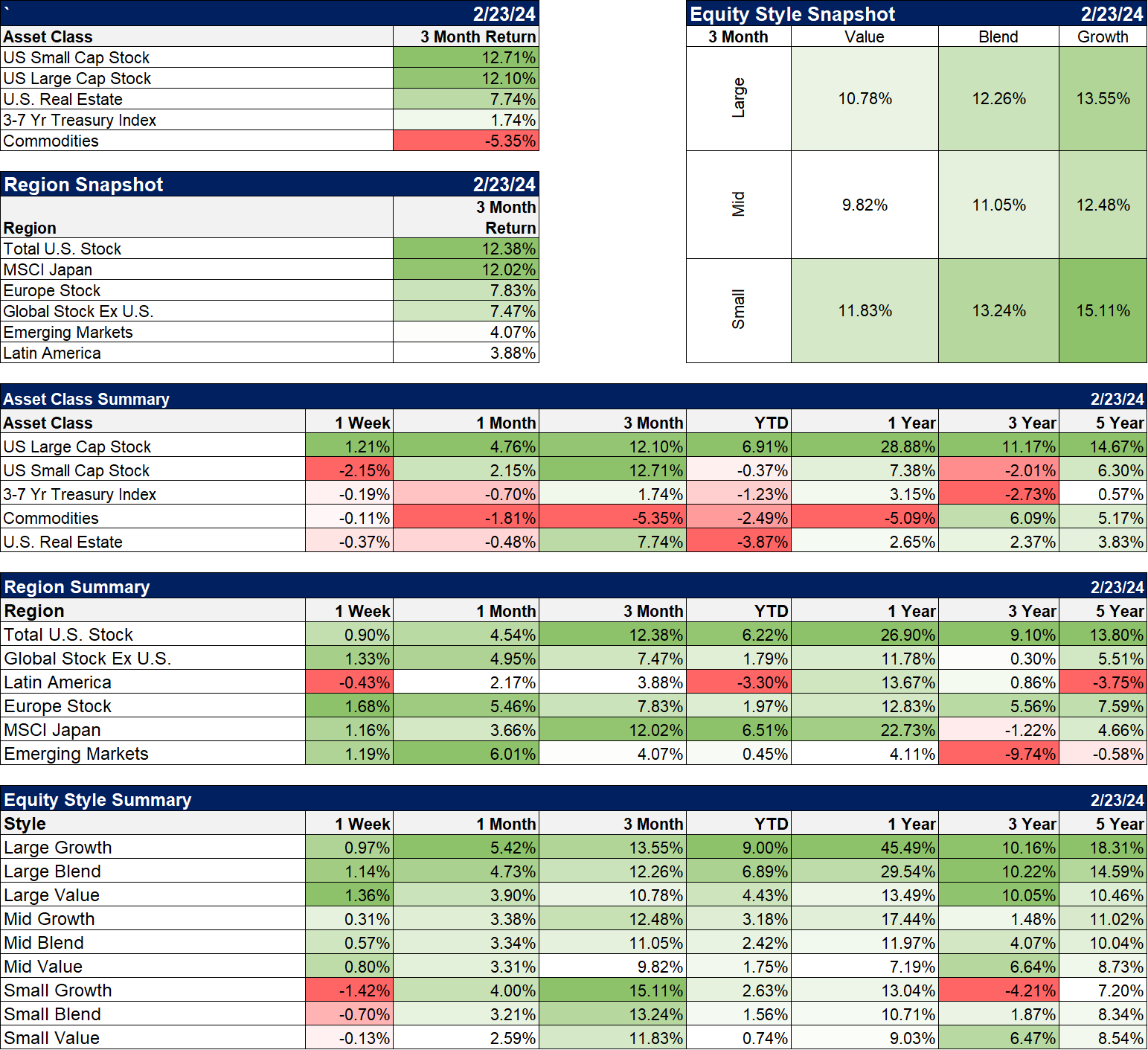

One thing to note in the chart below is that Large Cap growth has overtaken Large Cap Value in the three-year time frame. Value has had a tough go of it in the last year but as I said above, history still favors value in a strong dollar, rising rate environment. We are maintaining a value tilt because the odds favor that outcome but it sure hasn’t been easy the last 18 months or so to wear the value cap. Some consolation can be had by looking at small and midcaps where value has outperformed but those lag large cap by a wide margin so it isn’t much.

Sectors

I think if you asked 10 random investors to name the best-performing sector over the last three months, at least 7 of them – and possibly all 10 – would say technology. And yet, it only ranks fifth behind Financials, Health care, Industrials, and Communication Services. In fairness, Communications Services is largely tech but still that would only make it fourth. There’s a lot more going on in the market than just tech stocks.

Market/Economic Indicators

There wasn’t a lot of economic data last week and most of it was not surprising. Existing home sales did surprise to the upside at 4 million units but that is still way lower than the 6.5 million peak in 2021 and the over 7 million peak in 2006.

The S&P global manufacturing PMI rose again and is confirming the recovery in that part of the economy. The services version fell though it stayed above the 50 level indicating expansion.

Stay In Touch