I skate to where the puck is going to be, not where it has been.

Wayne Gretzky

I took my wife to dinner Saturday night at a local, boutique hotel. The Willcox Hotel was established in the late 19th century to cater to the Winter Colony of wealthy northerners who spent their winters in South Carolina. Today it still caters to the wealthy, primarily in the horse industry. It is a great place to eat, have a drink, and pick up on all the local gossip. It’s also a great place to get a feel for what’s hot and what’s not, to listen in on the conversations of the wealthy investors who can usually be found at the bar talking about their latest triumphant trade (rarely does one hear about the trades that didn’t work out). The most common topic of conversation over the weekend – even on a weekend when we have horse races going on – was AI and its effect on the stock market. I heard glowing testimony to the virtues of Nvidia, Broadcom and Super Micro, just to name a few. I heard people (mostly men to be honest) talk confidently of the future that would be created by AI. Their knowledge didn’t extend much beyond the buzzwords though; I asked one gent what he knew about machine learning and got a blank stare. I asked another how long he thought it would be before we achieved AGI (Artificial General Intelligence) and he said I must be mixing up my acronyms because AGI stood for Adjusted Gross Income.

I’ve been doing this kind of thing for a long time, listening to the “crowd” more directly; sentiment surveys often don’t capture the mood. Most of the time there isn’t a single, common topic of conversation in these types of situations but when there is, it usually means something. It could be something economic like fears over commercial real estate or the US debt burden, both of which I also overheard mentioned during dinner. Or it could be some hot investment, in this case, the AI stocks. Whatever it is, by the time it reaches the general conversation at the Willcox bar – or your version of it – it’s already over. It’s similar to the magazine cover indicator that says if a market or economic trend makes the cover of a general interest magazine, it has already played out.

This is far from scientific and there are other ways to measure sentiment but it does give you a sense of how deeply something has penetrated the popular psyche. It doesn’t mean we should run out and short AI stocks but it does mean we should start looking for the next thing because this one, AI, at least for now, is probably near peak hype. Being invested in the popular AI stocks right now – or most of the tech sector – feels pretty good because you’ve got a lot of company, you’re doing what everyone else is doing. No, that isn’t a good thing. In one of his memos from 2006 titled Dare to Be Great, Howard Marks said:

You can’t take the same actions as everyone else and expect to outperform. The search for superior results has to lead to the unusual, perhaps the idiosyncratic…..Unusual success cannot lie in doing the obvious….Non-consensus ideas have to be lonely. By definition, non-consensus ideas that are popular, widely held or intuitively obvious are an oxymoron.

Investing is usually a matter of doing the obvious for an extended period of time. Adopt a simple but effective strategy and stick to it come hell or high water. Invest for the long term. Avoid high expenses. Have a budget and save. Set goals and implement plans (strategies) to achieve them. Everyone knows these things although, like diets, they are often hard to stick with. But there are also those idiosyncratic things, the non-consensus items, the lonely investments, that offer the opportunity to perform differently than the crowd. Now, different may not mean a higher absolute return; it could mean a higher risk-adjusted return; the same return as the average but achieved with less volatility. And sometimes investments are lonely for good reason; contrarian positions aren’t always right. These types of opportunities don’t always exist but when they do, you aren’t going to notice them if you’re down at the Willcox talking about AI stocks.

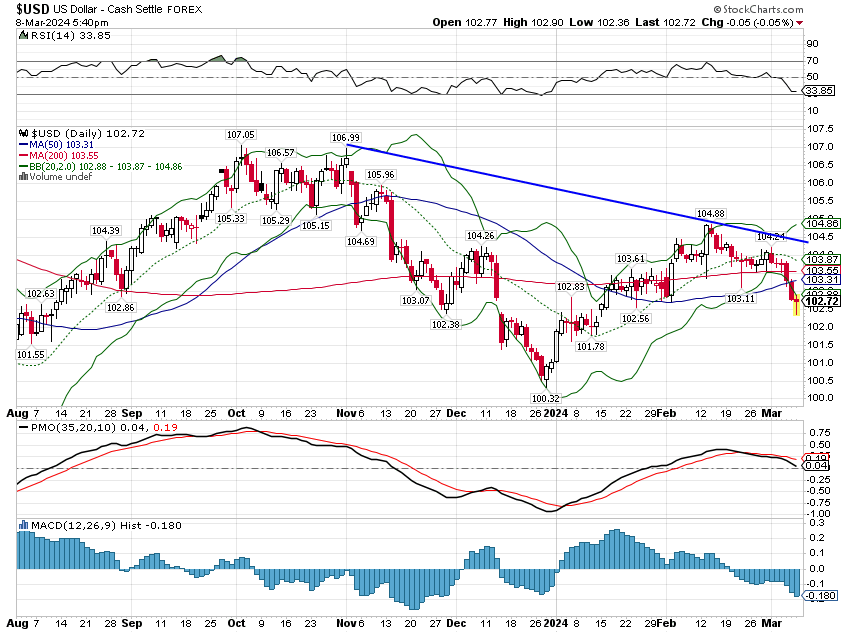

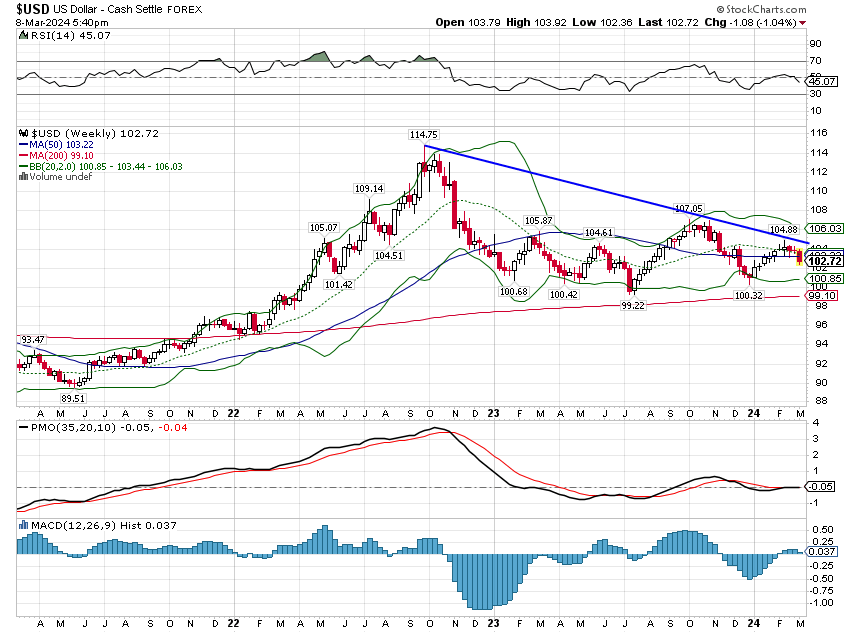

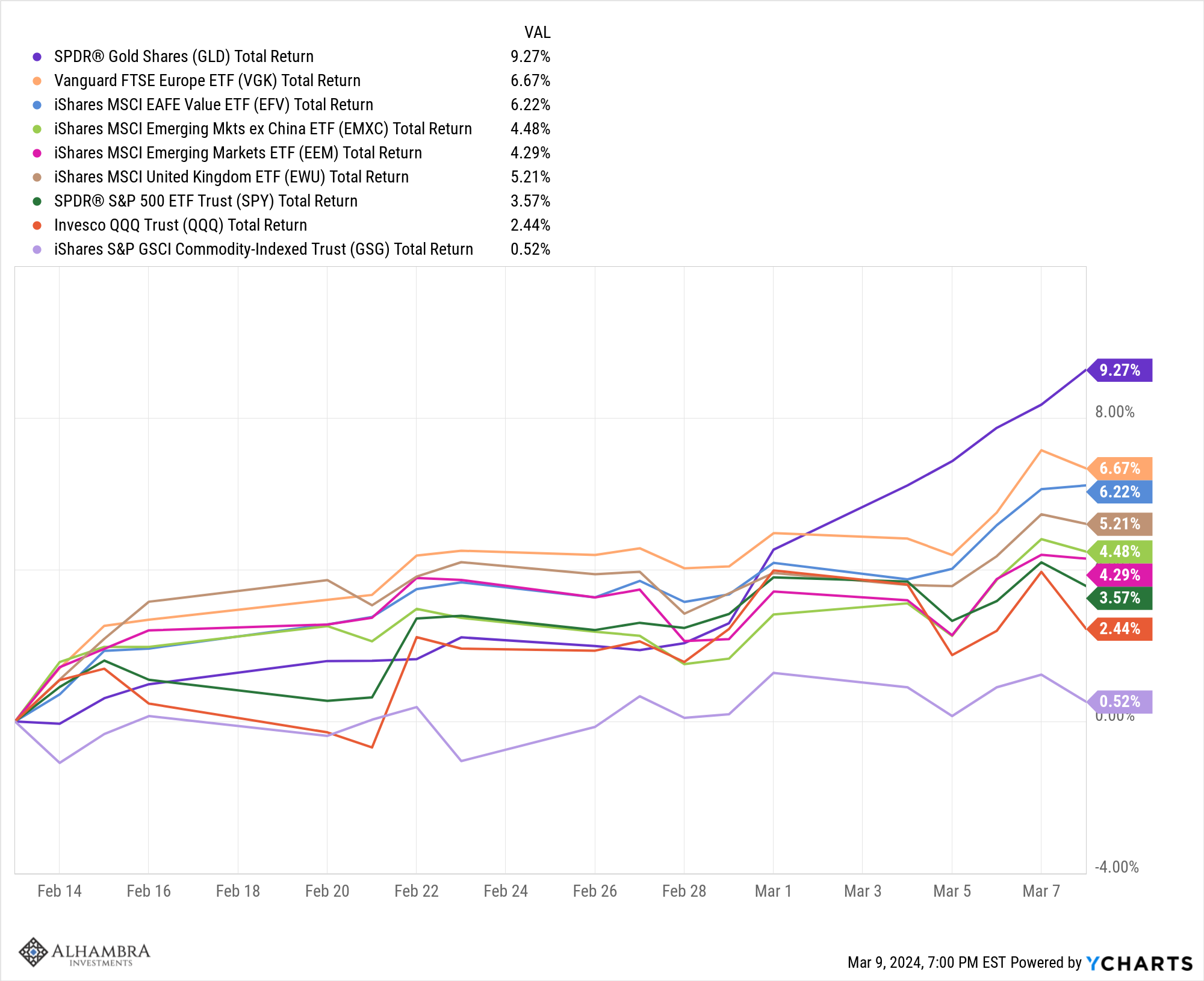

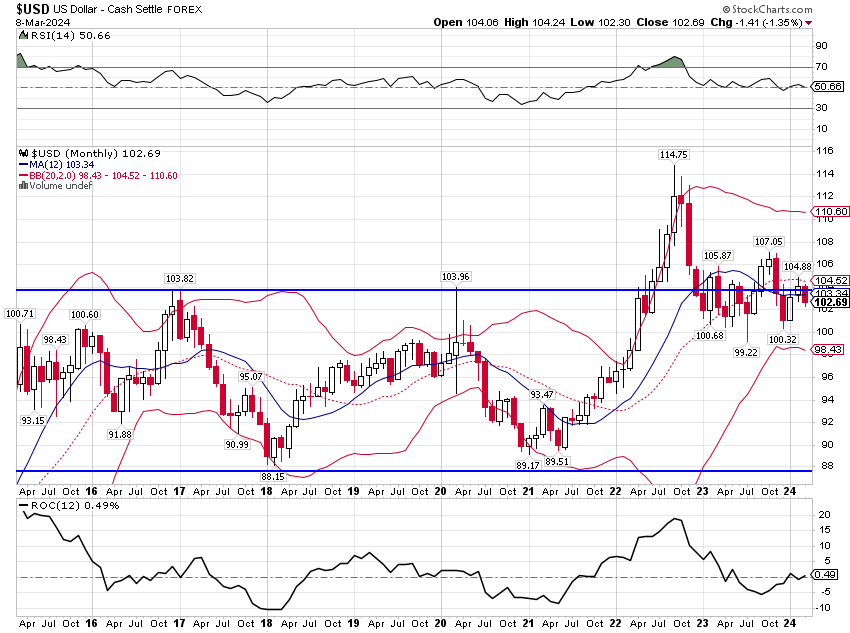

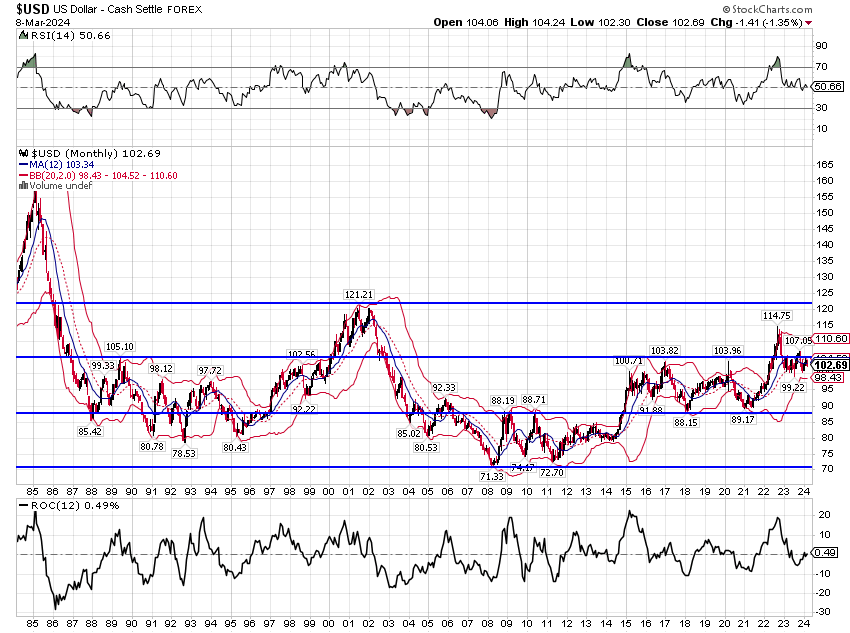

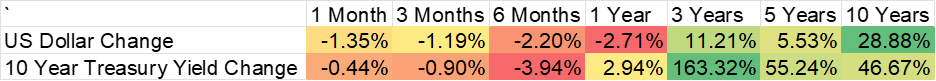

There has been a subtle shift in the markets over the last few weeks that has gone unnoticed by most investors. Consensus has been – and still is – that the US economy is doing much better than the rest of the world, a fact reflected in the relative value of the dollar. From 12/27/2023 to 2/13/2024, the US Dollar index (DXY) rose nearly 4%, a pretty big move for such a short period of time. Currencies aren’t a perfect reflection of relative growth expectations – there are other factors that move currencies – but they do reflect investors’ preferences, which obviously turned strongly to the US at the beginning of this year. Since that February peak though, the DXY has given back half that gain and appears to have resumed its downtrend. That was my expectation all along and I wrote about it back in mid-January (updated in a blog post yesterday).

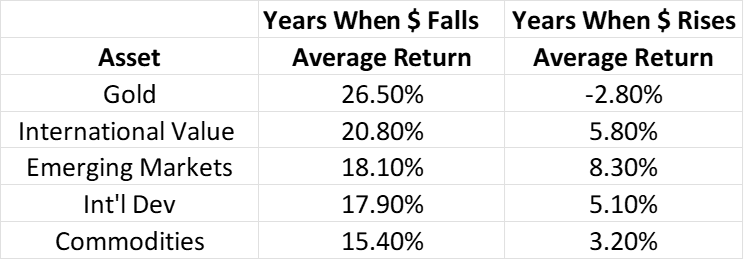

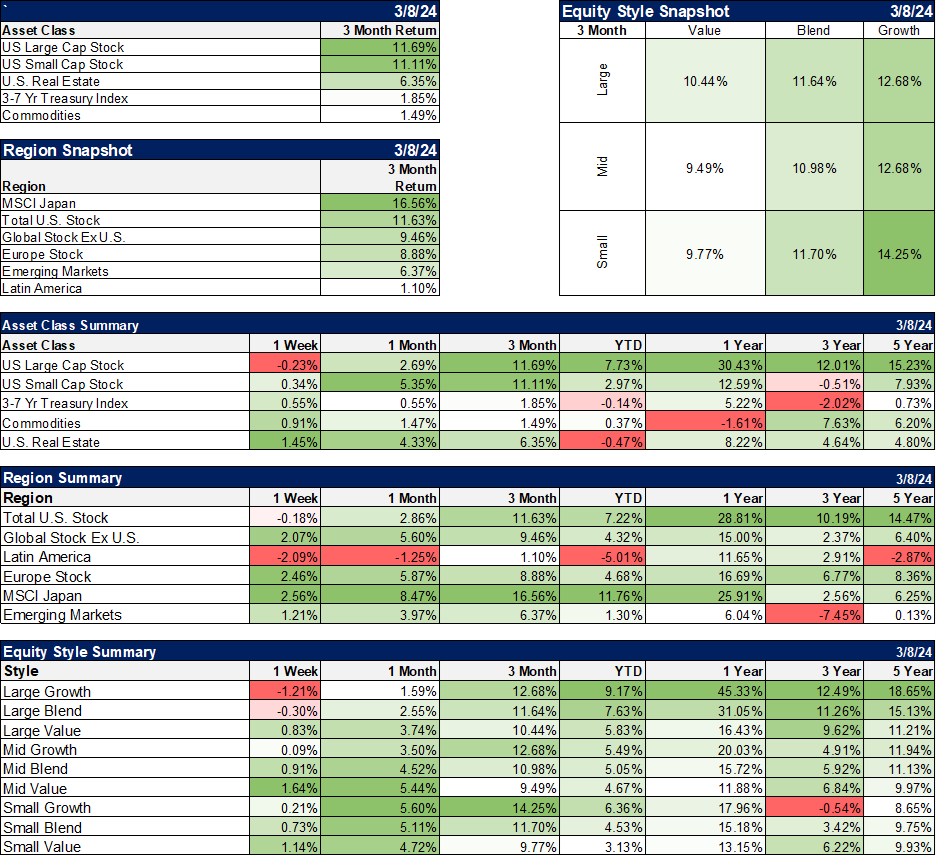

There are several asset classes whose returns are dramatically impacted by the course of the dollar (as you can see in that blog post). I don’t know how many analysts and TV talking heads I’ve heard recently express bafflement about gold’s recent rise but the reason is obvious – the dollar is down. The same is true of international value stocks, European stocks, Emerging market stocks, and even British stocks, all of which have outperformed the S&P 500 and the NASDAQ 100 since the dollar peaked.

British stocks are outperforming the S&P 500 and the NASDAQ 100 over the last three weeks? During the height of AI mania? It’s only a little more than three weeks so maybe it doesn’t mean anything but on the other hand, maybe we should revisit that consensus opinion about the US economy versus the rest of the world. There is little doubt that the US economy performed better than most of the world last year. US real GDP rose by 2.5% while the EU managed a mere 0.5% while the UK flatlined. 2022 was a different story with the EU growing 3.6% and the UK 4.3% while the US managed 1.9%. But markets don’t move based on what happened yesterday or even what is happening today but rather what is expected tomorrow. The rate of change is important too; an accelerating economy is more attractive than one that is slowing, even if it maintains positive growth. So the question for the dollar is not whether the global economy will improve in 2024 but, if it does, will the US lead the effort? If the rest of the world improves while the US slows, investors’ market preferences will shift and so will currency values.

A change in the trend of the dollar is a big deal for investors and offers one of the few opportunities to really outperform. The difference in returns for some assets based on the dollar trend is so stark that getting this one decision right can make a big difference in your overall returns. An investor who shifted to a purely domestic focus in 2014, when the dollar made its final low for the last downtrend, was massively rewarded by a strong dollar trend with the S&P 500 outperforming the EAFE 333.1% to 82.5%. Owning foreign stocks or commodities during that time only served to reduce returns. If the dollar trend changes, the benefit to the investor who recognizes it can be very large indeed. You are unlikely to catch the exact turning point but currency trends tend to be persistent so you don’t need to be precise to benefit from the trend.

The obvious question then is whether the dollar trend has really changed. For now, the long-term trend, defined as 10 years, is still up. But if we look at 9 years instead, it is easy to call the trend neutral and that may be part of an important transition.

Currency trends are not easy to change and take time as you go from rising (falling) to neutral to falling (rising). The shift from the strong dollar of the 90s to the weak dollar of the early ’00s took most of two years (2000-2002). The transition from falling to rising that followed took over 3 years (2008-2012). This shift so far only dates from October of 2022 so it may have more oscillating to do before the downtrend gets established and accepted. I’ve pointed this out before but the really long-term trend of the dollar index is neutral within three zones.

Trips to the top zone don’t generally last long because a very strong dollar creates havoc in countries with dollar debts (and there are a lot of those). With the dollar now in the middle zone, stress on dollar debtors (mostly emerging markets but others too) is relieved, another positive in favor of the rest of the world improving relative to the US. If the dollar stays in the middle zone, the global economy is probably functioning pretty well and non-US investments should perform better than they did during the period when the dollar was strong and rising. The risk/reward looks attractive at this level if you assume another rapid rise back into the upper zone so soon after the last one is unlikely. If the dollar just falls to the bottom of the middle zone, you’ll gain nearly 12% on the currency alone and you’ll be investing in countries where the economic outlook is improving. The time to capture these future gains is now, when the dollar is still relatively strong. Yes, this is anticipating a move but don’t think of it as a prediction, merely an expectation. Expectations are fine and necessary for tactical investors, just don’t get attached to them. To paraphrase John Maynard Keynes, if the facts change, change your mind. Quickly.

Wayne Gretzky said to skate where the puck is going to be, not where it has been. For a hockey player that is mostly a matter of vision and experience (mixed with some natural talent). For investors, it means you have to do the uncomfortable things, the lonely trades that buck the consensus, so it isn’t easy and certainly not intuitive. Humans are social animals and we crave the comfort and the perceived safety of the crowd. We want to fit in at the Willcox. But being comfortable isn’t going to deliver results different than the crowd. Dare to be different. And maybe great.

Joe Calhoun

Environment

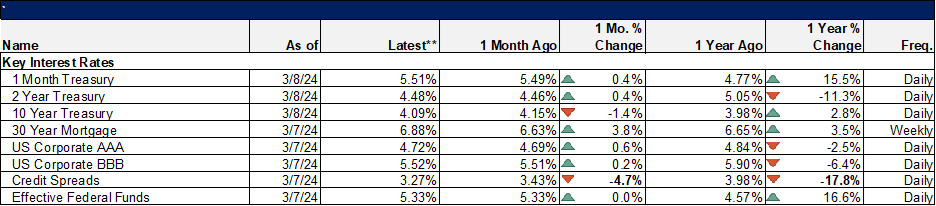

Interest rates have also come down recently but the change isn’t as obvious as with the dollar. The trend hasn’t changed but if I’m right about the dollar, rates are probably going to fall as well. Nominal and real interest rates are proxies for nominal and real growth so if growth weakens those rates are likely to fall. But we aren’t there yet.

Markets

The rally continued to broaden last week as large-cap stocks fell and most everything else rose. REITs were the big winners for the week as interest rates fell. International markets outperformed as Japan continues to make new highs. What’s interesting is that everyone is talking about Japan but no one is talking about Europe, which is also making new highs.

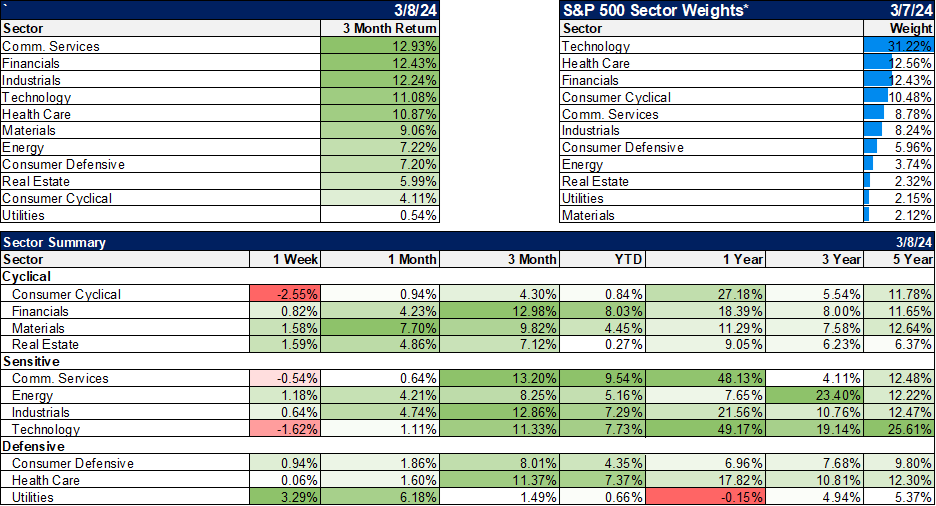

Sectors

Tech finally took a breather as rate-sensitive areas such as Utilities and REITs took the helm. The rally is broadening out within the stock market too. Financials are at all-time highs and energy is close.

Market/Economic Indicators

The economic data last week was generally positive for both growth and inflation.

- Total vehicle sales rose in February to 15.8 million from 14.9 million in January.

- US S&P Global Services and Composite indexes were solid at 52.3 and 52.5 respectively

- ISM Services fell to 52.6 but remains solidly in growth mode

- ISM Services prices index fell from 64 to 58.6

- Factory orders fell 3.8% but were down 0.8% ex-transportation

- Job openings and Quits fell but are still well above the pre-COVID levels

- Payrolls rose a more than expected 275k although revisions were negative

- Average hourly earnings rose only 0.1% month-to-month

Credit spreads are nearing cycle lows.

Stay In Touch