Government investments rarely work out the way they are supposed to. From Solyndra to California’s High Speed Rail project to the Big Dig to the UK government selling off gold at the lows at the turn of the century, governments just aren’t very good at the investment thing. The UK gold selling incident is perhaps the best example of government ineptitude. They announced publicly that they intended to sell off half their reserves when the price was at a multi-decade low which just drove the price down further. They finally sold 375 tonnes over a 3 year period at an average price of $275 an ounce. They couldn’t have done a better job of bottom ticking the market if they’d tried. By 2008 the prices was knocking on $1000 and today it stands at $2167. Great trade.

That example of government malfeasance came to mind the other day when I saw this headline:

Energy Dept. Offers $2.3 Billion Loan to Boost Lithium Production

The Energy Department is moving forward on a deal to provide a $2.3 billion loan to Lithium Americas in an effort to shore up domestic supplies of a mineral vital for the production of electric vehicles.

I guess it makes sense to subsidize the production of lithium with everyone shifting to electric cars except…

EV euphoria is dead. Automakers are scaling back or delaying their electric vehicle plans

We sold roughly 15 million light vehicles in the US last year and about 1.4 million were electric cars. GM was the first of the major US car companies to go all in on electric vehicles which should have been everyone’s first clue that this wasn’t going to work out. And guess what? GM is also an investor in the same lithium project the Energy Department is about to sink $2.3 billion of taxpayer funds.

Here’s another small problem with the government funding a new lithium mine:

Crashing lithium prices turn the industry from ‘euphoria’ to ‘despair.’ What’s next?

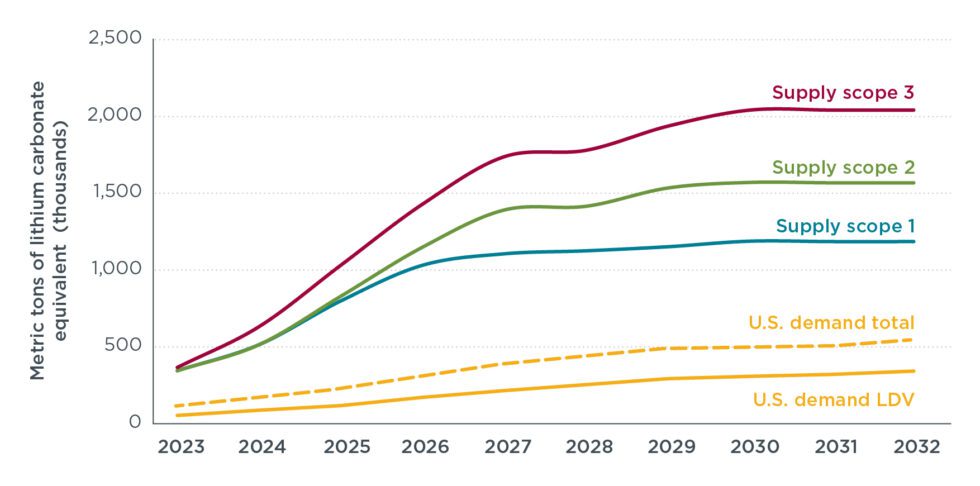

And that’s just the recent price action. Lithium prices actually peaked around $80,000 a metric ton and are now down about 80%. This isn’t just a consequence of no one really wanting electric cars. It’s also a function of supply. There’s an old saying in the commodity business that the cure for high prices is high prices, meaning that high prices will elicit new supply. And that has certainly been the case with lithium. Production has ramped up around the world with supply growing by nearly 50% in 2023 alone. And there is ample supply on the drawing board, so much that the International Council On Clean Transportation estimates the supply will far exceed US demand until at least 2032:

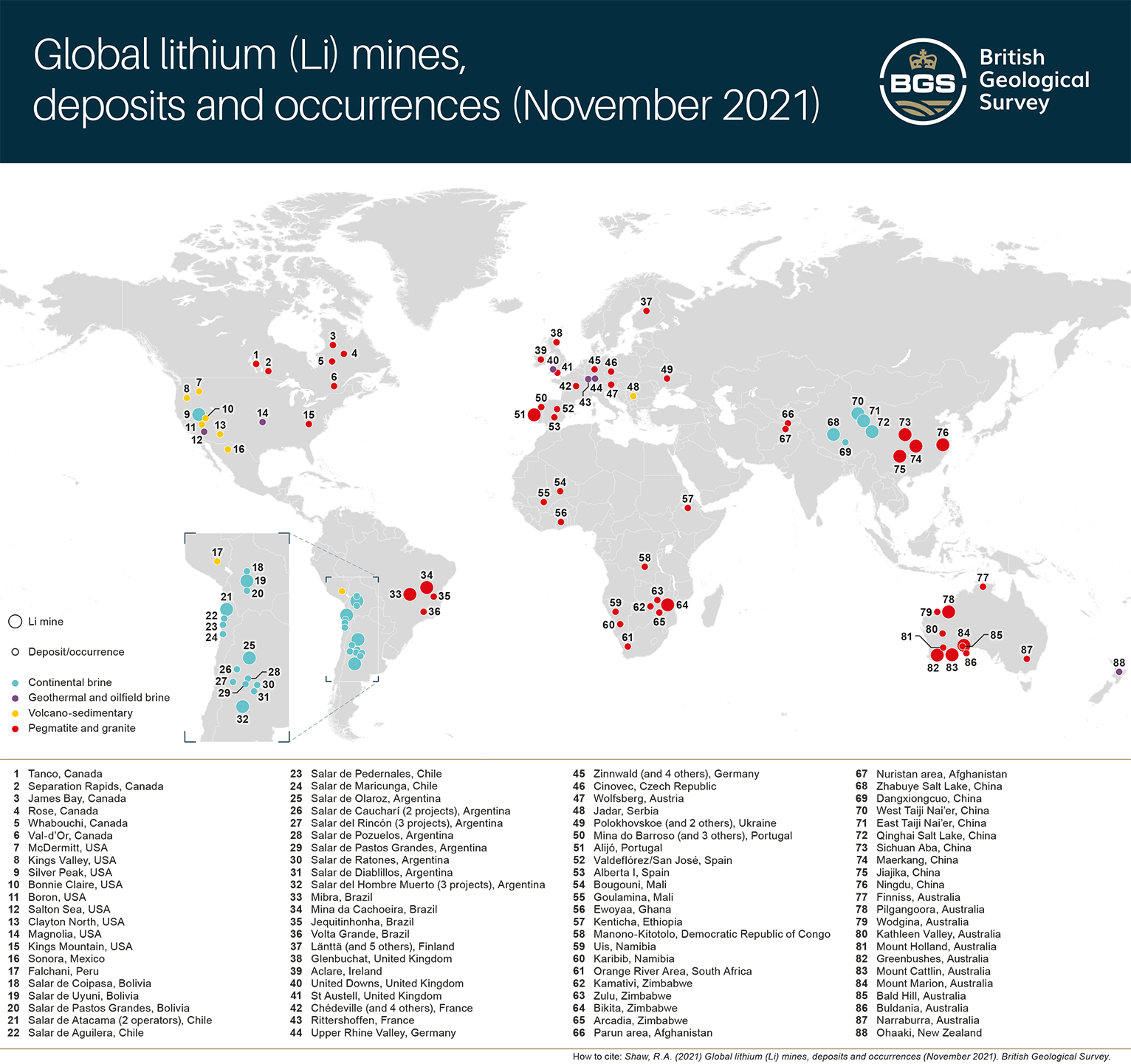

So what’s the rationale for the US government to lend taxpayer money to open a new lithium mine when the price is low and supply is ample? Well, the stated rationale is the all encompassing “national security” because a lot of the world’s lithium comes from China. The problem with that argument is that lithium isn’t exactly rare and there are plenty of existing and planned mines in countries that are friendly to the US:

Not only that but new technology is making lithium extraction from brine another source of supply. Exxon Mobil are funding a brine operation in Arkansas and Texas:

ExxonMobil drilling first lithium well in Arkansas, aims to be a leading supplier for electric vehicles by 2030

Koch Industries has a similar project in the same area.

Finally, I would just mention that battery technology is evolving and may well move beyond lithium. Solid state, sodium ion, graphene and iron air batteries are all in various stages of development.

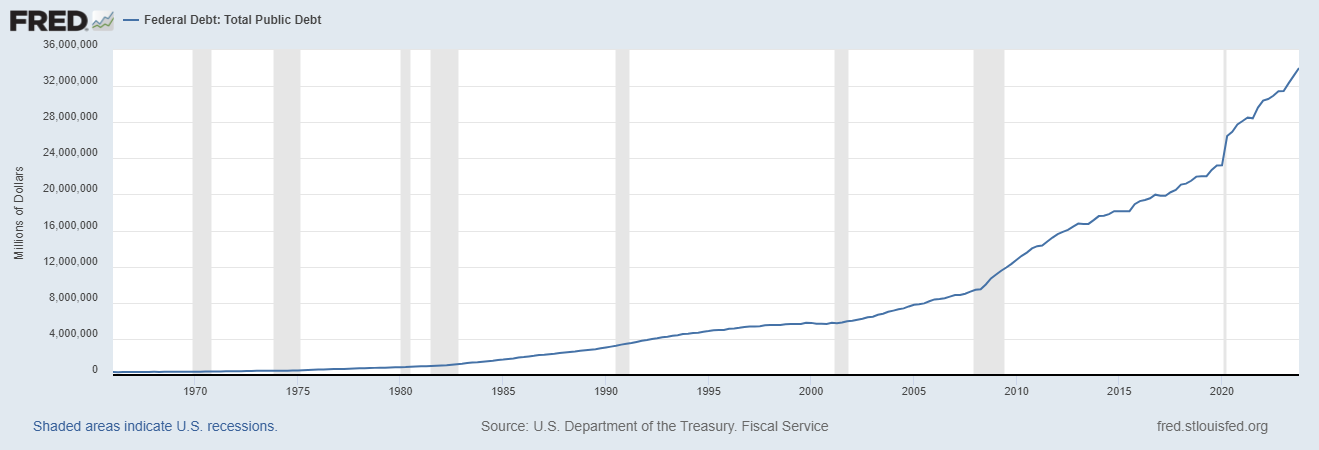

Private capital has poured into lithium production over the last couple of years so there isn’t any need for the government to get involved. Well, except for the political points to be scored. That’s what drives all government investment, not the actual fundamentals. Industrial policy is nothing more than a recipe for corruption and wasted tax payer dollars. As if we weren’t wasting enough of those already.

Government is a near perfect contrary indicator. Whatever they are doing a lot of, just plan on it to fail. You will rarely be disappointed.

Stay In Touch