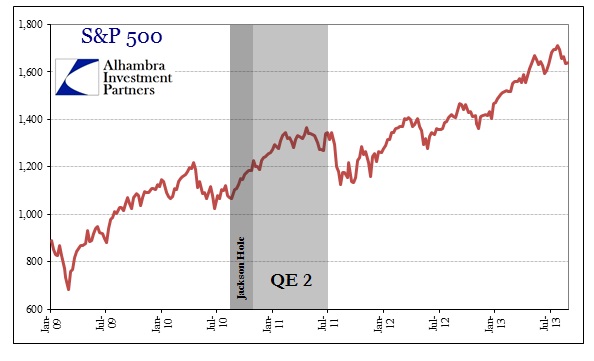

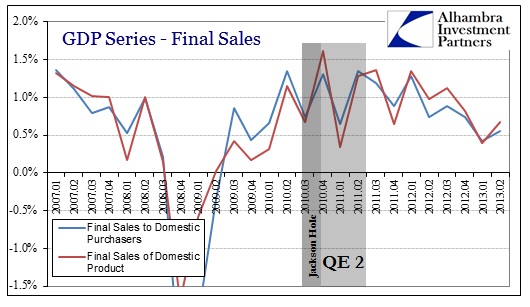

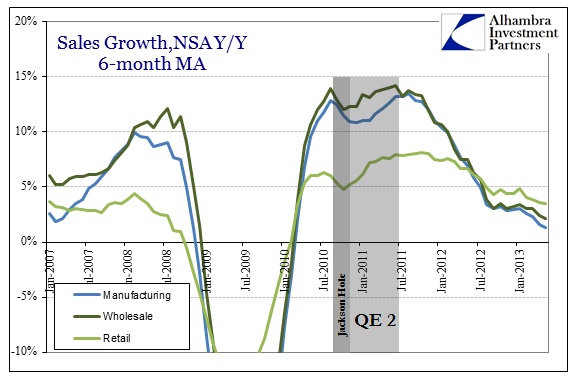

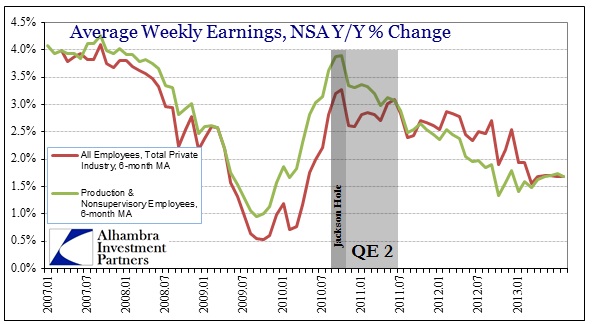

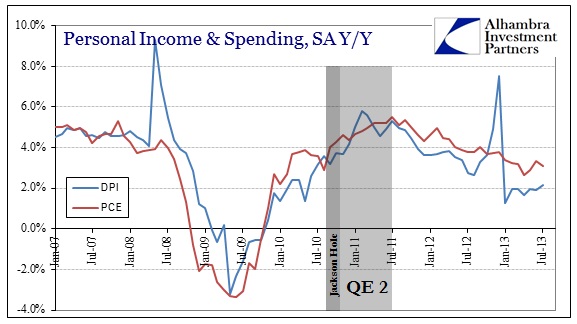

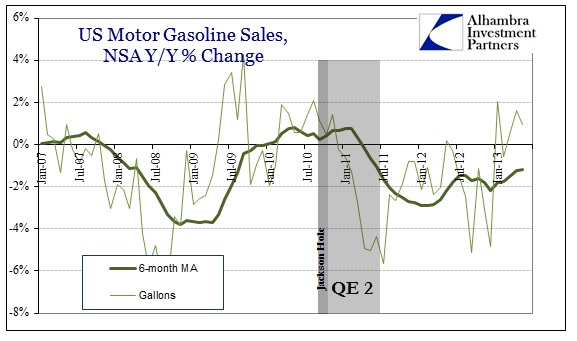

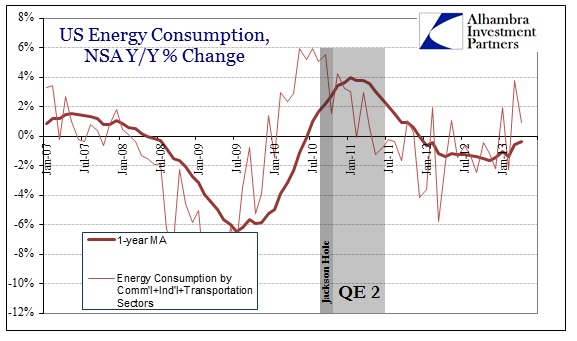

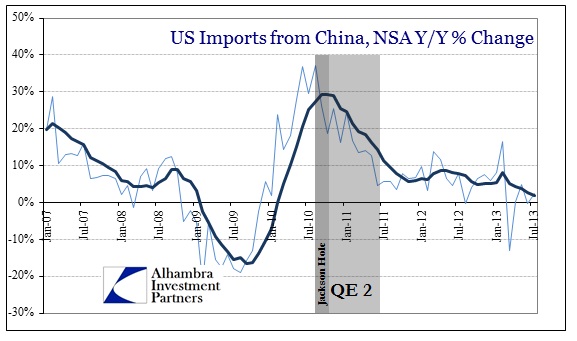

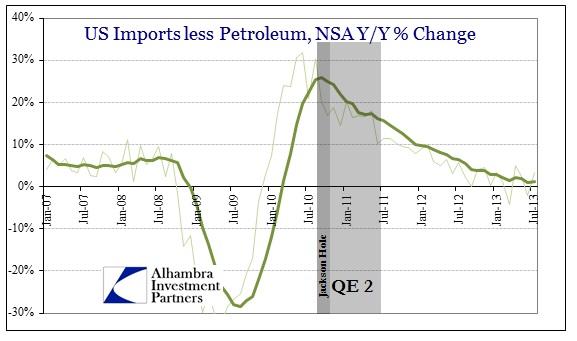

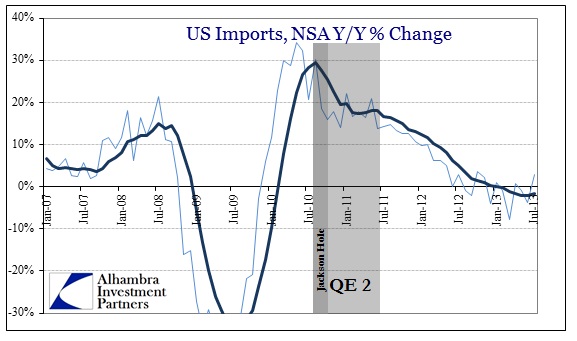

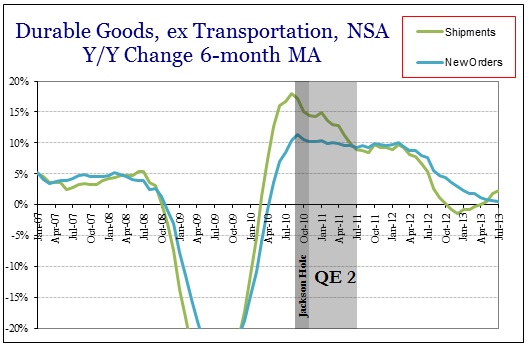

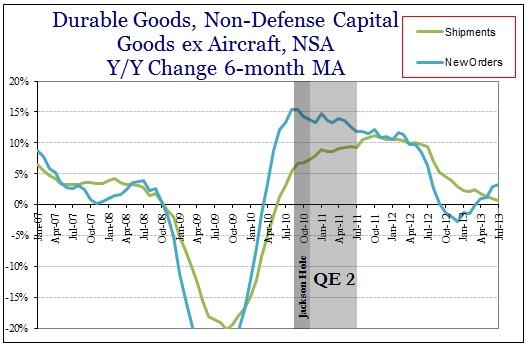

Not much commentary is needed here.

For:

A broad range of views and data points reduces the possibility of randomness in trying to infer causation. However, at some point you just have to look at all this and see the obvious relationships.

At best: there is no correlation, the economy moved outside of QE’s influence. The implication is that QE had/has no impact whatsoever.

At worst: there is correlation, meaning the economy only responded negatively to “stimulus”. Outside of the move in stock prices, economists would call this a negative multiplier.

Those are the only two choices.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: [email protected]

Stay In Touch